Answered step by step

Verified Expert Solution

Question

1 Approved Answer

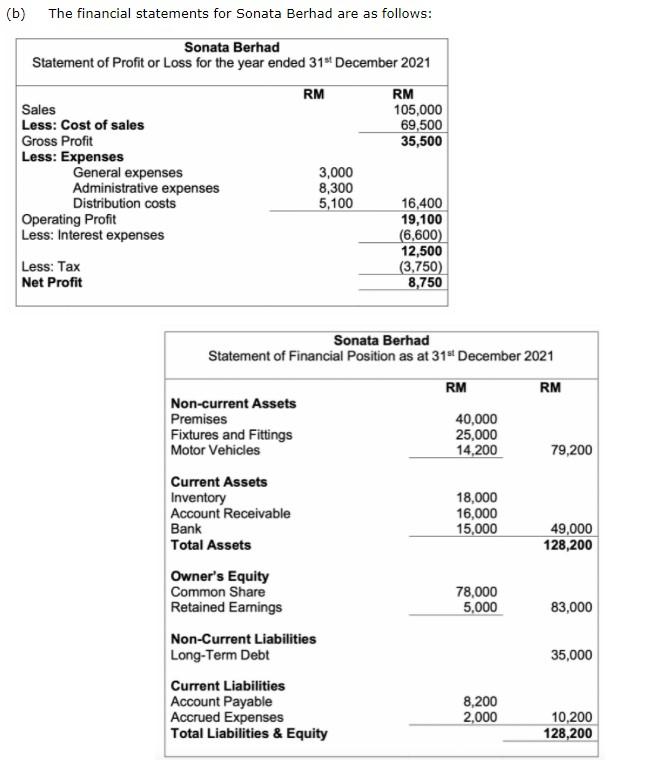

Based on the financial information above, calculate the following financial ratios: i. Current ratio. ii. Quick ratio. iii. Average collection period. iv. Inventory turnover ratio.

Based on the financial information above, calculate the following financial ratios:

i. Current ratio.

ii. Quick ratio.

iii. Average collection period.

iv. Inventory turnover ratio.

v. Total assets turnover.

vi. Gross profit margin.

vii. Net profit margin.

ix. Return on asset.

x. Return on equity.

(20 MARKS)

URGENT PLEASE ANSWER ASAPPPP!!!!!!!!!!!!!!! THANK YOUUUUUUUUUU!!!!!!!11111

(b) The financial statements for Sonata Berhad are as follows: Sonata Berhad Statement of Profit or Loss for the year ended 31st December 2021 RM RM Sales 105,000 Less: Cost of sales 69,500 Gross Profit 35,500 Less: Expenses General expenses 3,000 Administrative expenses 8,300 Distribution costs 5,100 16,400 Operating Profit 19,100 Less: Interest expenses (6,600) 12,500 Less: Tax (3,750) Net Profit 8,750 Sonata Berhad Statement of Financial Position as at 31 December 2021 RM RM 40,000 25,000 14,200 79,200 18,000 16,000 15,000 49,000 128,200 Non-current Assets Premises Fixtures and Fittings Motor Vehicles Current Assets Inventory Account Receivable Bank Total Assets Owner's Equity Common Share Retained Earnings Non-Current Liabilities Long-Term Debt Current Liabilities Account Payable Accrued Expenses Total Liabilities & Equity 78,000 5,000 83,000 35,000 8,200 2,000 10,200 128,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started