Based on the financials for said company, please analyzed and discuss the company's potential Sales Growth, Debt ratio, Current ratio etc.

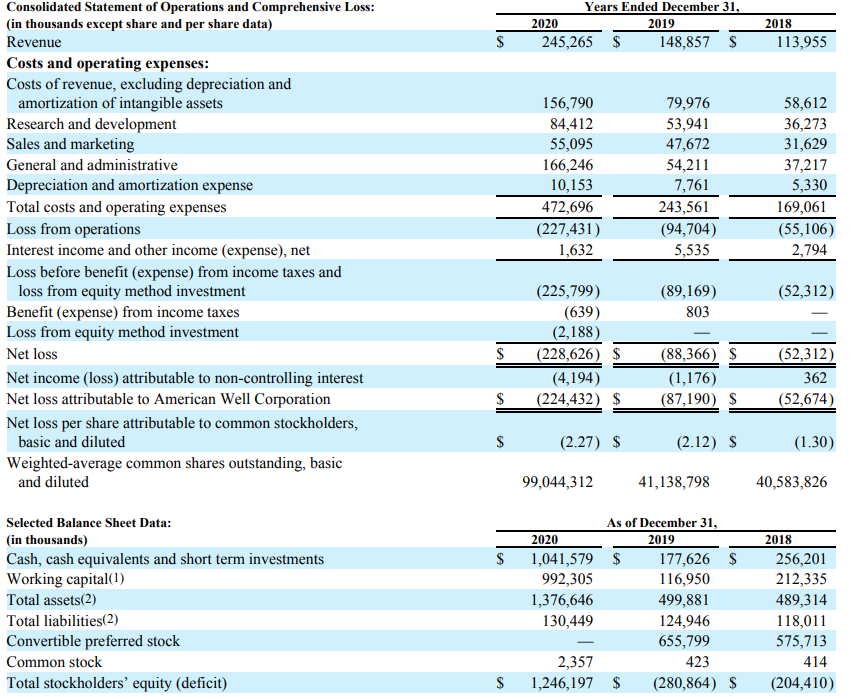

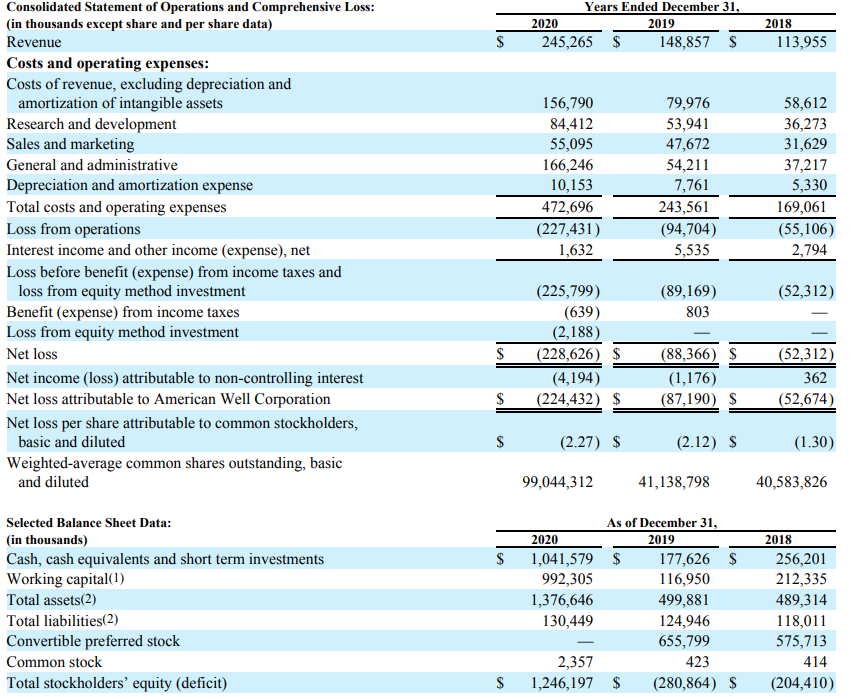

Years Ended December 31, 2020 2019 245,265 $ 148,857 $ 2018 113,955 $ Consolidated Statement of Operations and Comprehensive Loss: (in thousands except share and per share data) Revenue Costs and operating expenses: Costs of revenue, excluding depreciation and amortization of intangible assets Research and development Sales and marketing General and administrative Depreciation and amortization expense Total costs and operating expenses Loss from operations Interest income and other income (expense), net Loss before benefit (expense) from income taxes and loss from equity method investment Benefit (expense) from income taxes Loss from equity method investment Net loss Net income (loss) attributable to non-controlling interest Net loss attributable to American Well Corporation Net loss per share attributable to common stockholders, basic and diluted Weighted-average common shares outstanding, basic and diluted 156,790 84,412 55,095 166,246 10,153 472,696 (227,431) 1,632 79,976 53,941 47,672 54,211 7,761 243,561 (94,704) 5,535 58,612 36,273 31,629 37,217 5,330 169,061 (55,106) 2,794 (52,312) (89,169) 803 (225,799) (639) (2,188) (228,626) $ (4,194) (224,432) $ $ (88,366) $ (1,176) (87,190) $ (52,312) 362 (52,674) $ $ (2.27) $ (2.12) $ (1.30) 99,044,312 41,138,798 40,583,826 $ Selected Balance Sheet Data: (in thousands) Cash, cash equivalents and short term investments Working capital(1) Total assets(2) Total liabilities(2) Convertible preferred stock Common stock Total stockholders' equity (deficit) As of December 31, 2020 2019 1,041,579 $ 177,626 $ 992,305 116,950 1,376,646 499,881 130,449 124,946 655,799 2,357 423 1,246,197 $ (280,864) $ 2018 256,201 212,335 489,314 118,011 575,713 414 (204,410) $ Years Ended December 31, 2020 2019 245,265 $ 148,857 $ 2018 113,955 $ Consolidated Statement of Operations and Comprehensive Loss: (in thousands except share and per share data) Revenue Costs and operating expenses: Costs of revenue, excluding depreciation and amortization of intangible assets Research and development Sales and marketing General and administrative Depreciation and amortization expense Total costs and operating expenses Loss from operations Interest income and other income (expense), net Loss before benefit (expense) from income taxes and loss from equity method investment Benefit (expense) from income taxes Loss from equity method investment Net loss Net income (loss) attributable to non-controlling interest Net loss attributable to American Well Corporation Net loss per share attributable to common stockholders, basic and diluted Weighted-average common shares outstanding, basic and diluted 156,790 84,412 55,095 166,246 10,153 472,696 (227,431) 1,632 79,976 53,941 47,672 54,211 7,761 243,561 (94,704) 5,535 58,612 36,273 31,629 37,217 5,330 169,061 (55,106) 2,794 (52,312) (89,169) 803 (225,799) (639) (2,188) (228,626) $ (4,194) (224,432) $ $ (88,366) $ (1,176) (87,190) $ (52,312) 362 (52,674) $ $ (2.27) $ (2.12) $ (1.30) 99,044,312 41,138,798 40,583,826 $ Selected Balance Sheet Data: (in thousands) Cash, cash equivalents and short term investments Working capital(1) Total assets(2) Total liabilities(2) Convertible preferred stock Common stock Total stockholders' equity (deficit) As of December 31, 2020 2019 1,041,579 $ 177,626 $ 992,305 116,950 1,376,646 499,881 130,449 124,946 655,799 2,357 423 1,246,197 $ (280,864) $ 2018 256,201 212,335 489,314 118,011 575,713 414 (204,410) $