Answered step by step

Verified Expert Solution

Question

1 Approved Answer

based on the first photos, fill out the income statement which is in the photo ACME Distribution, Inc. December 31, 2016 Adjusting Entries Read through

based on the first photos, fill out the income statement which is in the photo

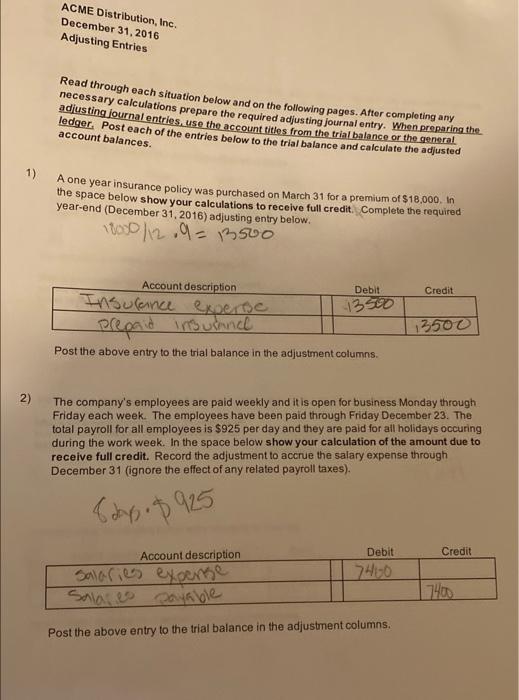

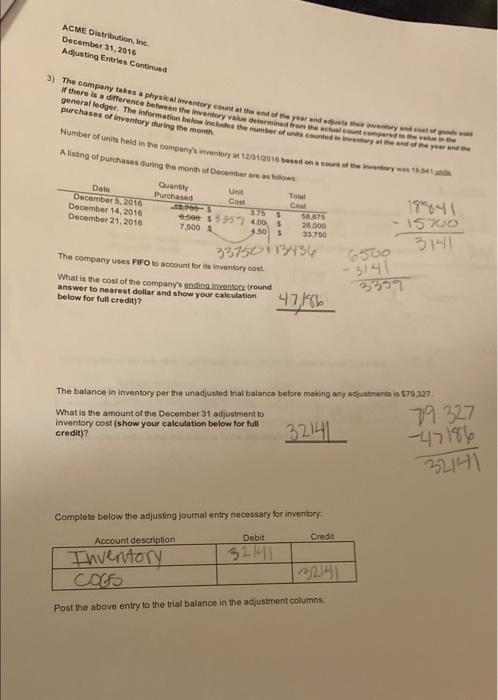

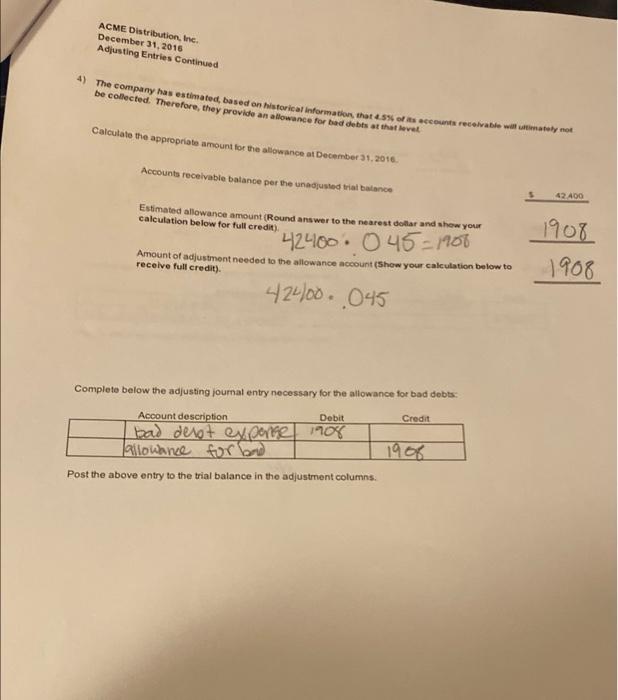

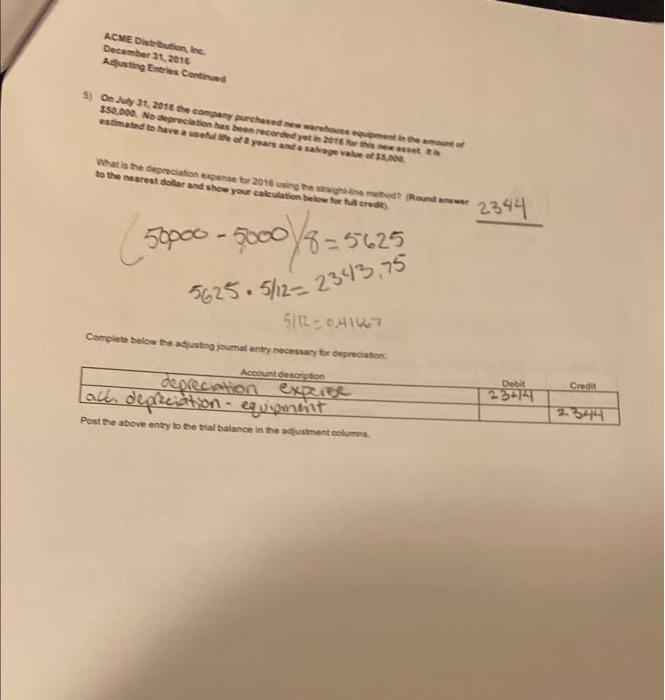

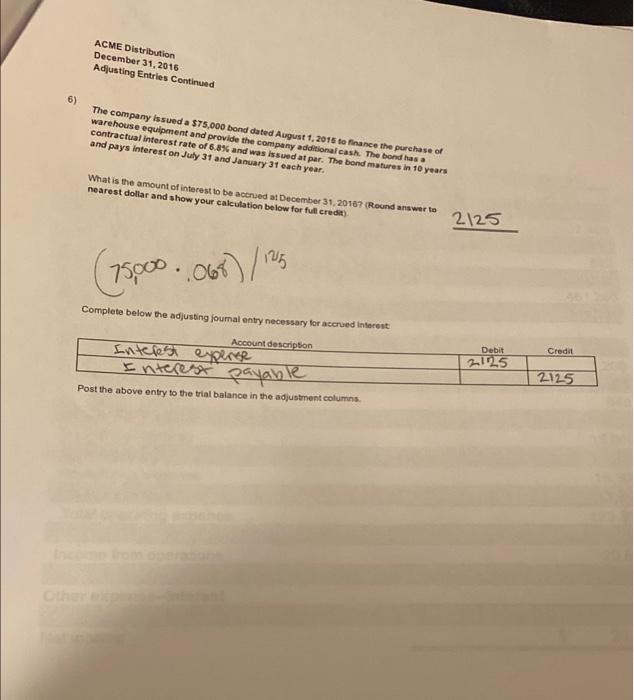

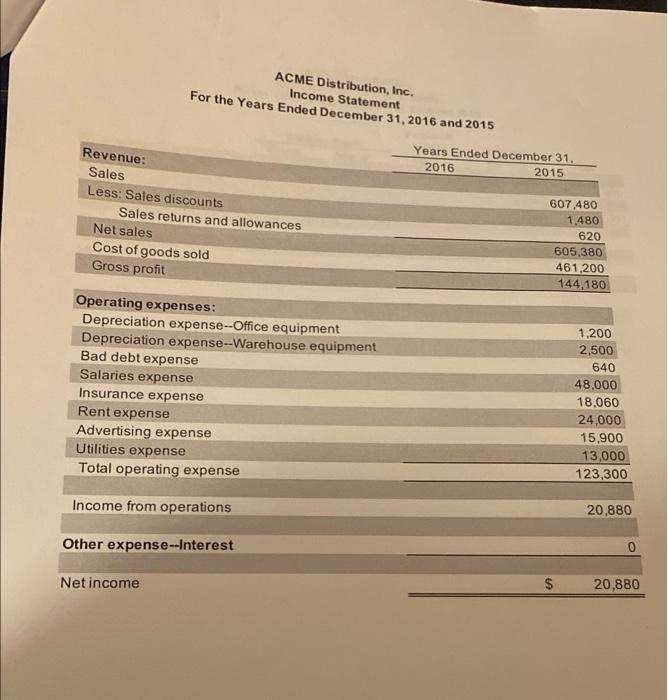

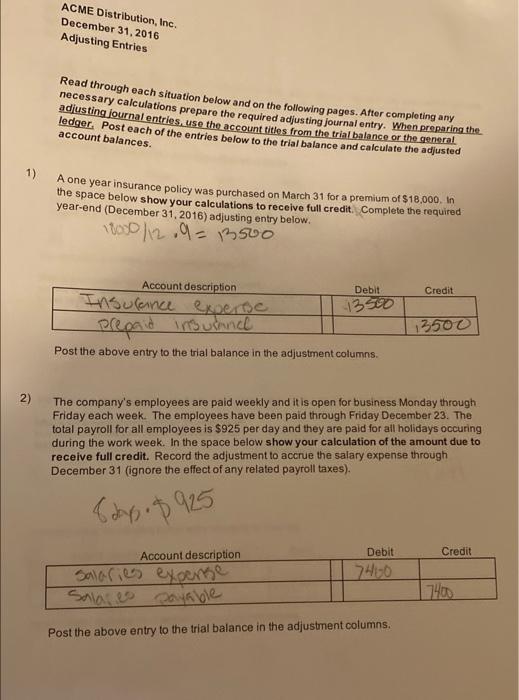

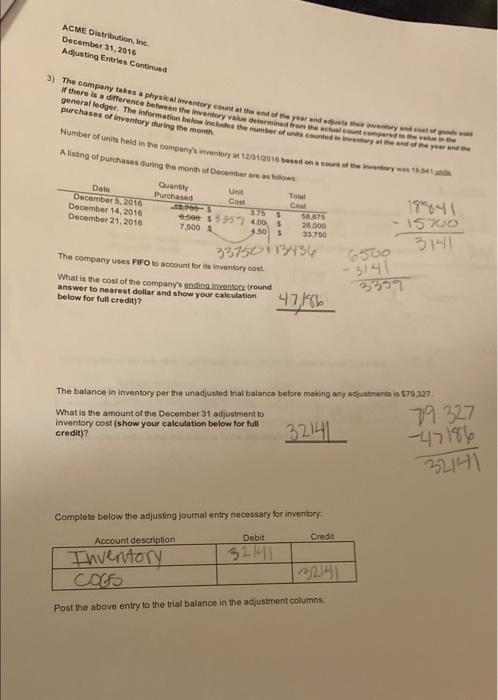

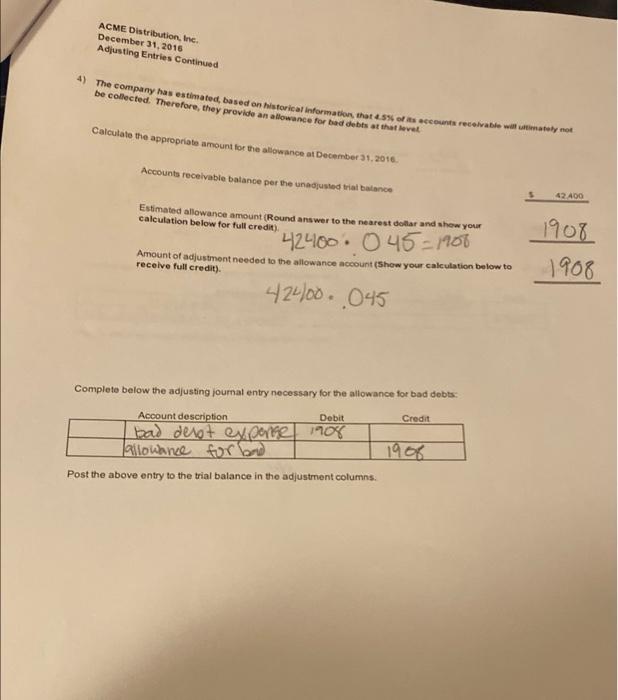

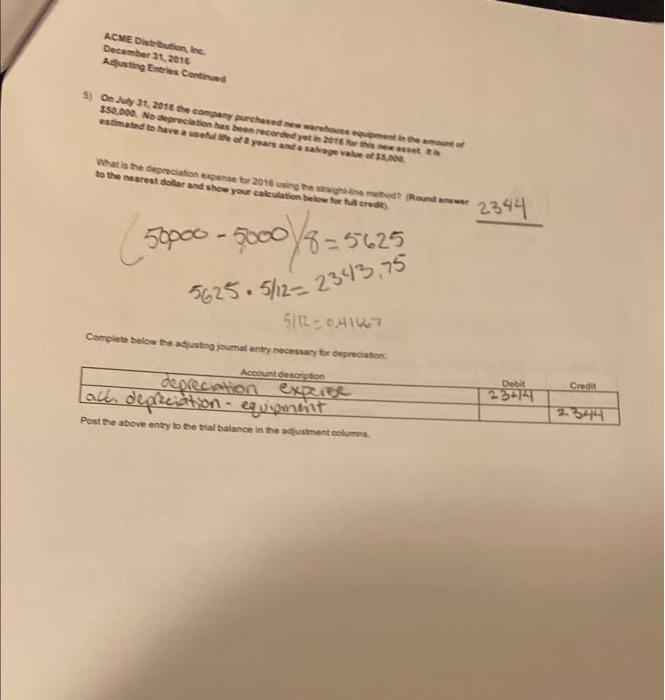

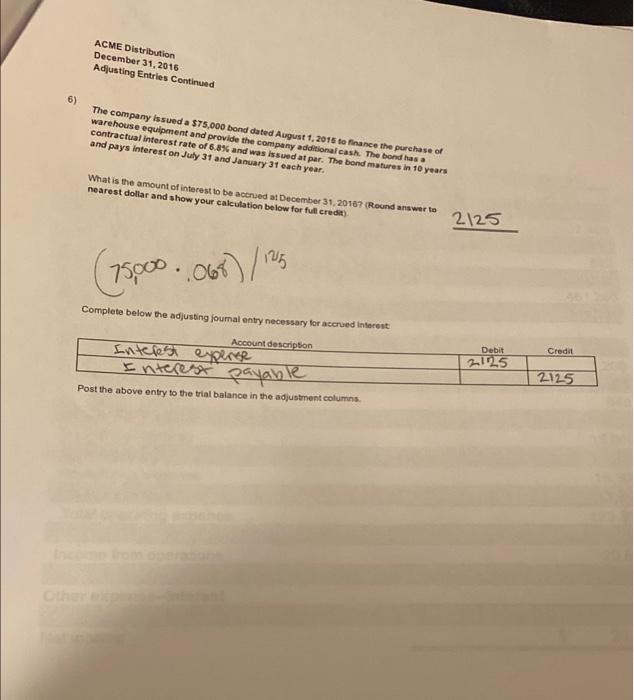

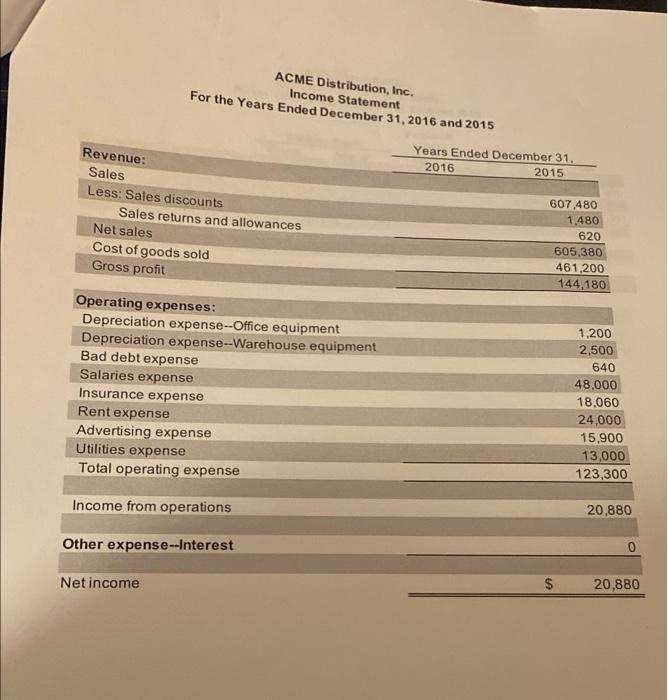

ACME Distribution, Inc. December 31, 2016 Adjusting Entries Read through each situation below and on the following pages. After completing any necessary calculations prepare the required adjusting journal entry. When preparing the adjusting journal entries use the account titles from the trial balance or the general ledger Post each of the entries below to the trial balance and calculate the adjusted account balances. 1) A one year insurance policy was purchased on March 31 for a premium of $18,000. In the space below show your calculations to receive full credit. Complete the required year-end (December 31, 2016) adjusting entry below. 18000/12.9=13500 Debit Credit Account description Insurance experse 43400 prepaid insurand Post the above entry to the trial balance in the adjustment columns. 13500 ) 2) The company's employees are paid weekly and it is open for business Monday through Friday each week. The employees have been paid through Friday December 23. The total payroll for all employees is $925 per day and they are paid for all holidays occuring during the work week. In the space below show your calculation of the amount due to receive full credit. Record the adjustment to accrue the salary expense through December 31 (ignore the effect of any related payroll taxes). 8days $925 . Credit Debit 7400 Account description salaries expense Salases sayable Post the above entry to the trial balance in the adjustment columns. ACME Distribution, Inc. December 31, 2016 Adjusting Entries Continued >> The.company takes a physical inventory count at the end of the year and fast med en there is a difference between the twentory value formen element compared to the general ledger. The information below the number of Uses es war wy *** purchases of inventory during the month Number of units held in the company's woventory m 12101 20 16 based on a counter try **** A listing of purchases during the month of December are as follow Ouvy To Dale Purchased December 5, 2016 December 14, 2016 - 3351 400 December 21, 2016 7.500 5 Un Cou Cow 56475 26.000 33.750 1764 15700 4.50 $ 33750 113456 The company uses FIFO to account for its inventory cost What is the cost of the company's ending van round answer to nearest dollar and show your calculation below for full credity? 1600 3141 3357 47,186 The balance in inventory per the unadjusted trial balance before making any adjustments is 579,327 What is the amount of the December 31 adjustment to inventory cost (show your calculation below for full credit) 3214L 79327 -47186 32141 Complete below the adjusting journal entry necessary for inventory Account description Debit Credit 32141 Inventory C003 Post the above entry to the trial balance in the adjustment columns ACME Distribution, Inc. December 31, 2016 Adjusting Entries Continued 4) The company has estimated, based on historical information, that 45% of its accounts receivable waltenatoly not be collected. Therefore, they provide an allowance for bad debts at that level Calculato the appropriate amount for the allowance at December 31, 2016. Accounts receivable balance per the unadjusted triat balance 42 400 Estimated allowance amount {Round answer to the nearest dollar and show your calculation below for full credit) 42400. 045-1906 Amount of adjustment needed to the allowance account (Show your calculation below to receive full credit). 1908 1908 42400. 045 Complete below the adjusting journal entry necessary for the allowance for bad debts: Credit Account description Debit bad dext exponce 1908 allowance for bord Post the above entry to the trial balance in the adjustment columns 1906 ACME Distribution, the December 31, 2015 Austing Entries Continued 5) On July 31, 2016 the company purchased warehouse amount of $50.000. No depreciation has been recorded yet in 2016 estimated to have a le of years and age value of 55.000 What is the depreciation expense tor 2016 using the right Round answer to the nearest dollar and show your calculation below for 2344 50poo - 5000/8=5625 5625.5/12-2343,75 51120.41667 Complete below the adjusting joumal entry necessary toe depreciation Account description depreciation experee lace depreciation equipment Cred Debit 254141 2344 Post the above entry to the trial balance in the adjustment.com ACME Distribution December 31, 2016 Adjusting Entries Continued 6) The company issued a $75,000 bond dated August 1, 2016 to finance the purchase of warehouse equipment and provide the company additional cash. The bond has a contractual interest rate of 6.8% and was issued at par. The bond matures in 10 years and pays interest on July 31 and January 31 each year. What is the amount of interest to be accrued at December 31, 20187 (Round answer to nearest dollar and show your calculation below for full credit) 2125 105 (75000. 068)/ Complete below the adjusting joumal entry necessary for accrued interest Credit Account description Interest expense Interest payable Post the above entry to the trial balance in the adjustment columns Debit 2125 2125 ACME Distribution, Inc. Income Statement For the Years Ended December 31, 2016 and 2015 Years Ended December 31. 2016 2015 Revenue: Sales Less: Sales discounts Sales returns and allowances Net sales Cost of goods sold Gross profit 607.480 1.480 620 605,380 461,200 144,180 1 Operating expenses: Depreciation expense--Office equipment Depreciation expense--Warehouse equipment Bad debt expense Salaries expense Insurance expense Rent expense Advertising expense Utilities expense Total operating expense 1,200 2,500 640 48.000 18,060 24,000 15,900 13,000 123,300 Income from operations 20,880 Other expense--Interest 0 Net income $ 20,880

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started