Based on the following information can you answer:

4 Retirement Number (45 points)

Please show your work.

a Assume no social security or pension

b In today's dollars, they would like $108,000 (including taxes) in year 1 of retirement

How much will they need to accumulate on their retirement date to meet their spending needs?

How would this number change if they wanted to end their lives with $450,000 of investments to leave to their child?

5 Retirement Plan (20 points)

Please show your work.

Assuming they do not plan to leave anything to their child, how much will they have to save each year to achieve their Number?

6 Education (25 points)

How much will they need to save each year to achieve their goal of paying 70% of the total cost of their child's 4-year MSU education?

What other advice would you give them about paying for college?

a Annual inflation rate for college expenses = 6%

b College asset rate of return = 7%

7 Investments (20 points)

They continue to have access to their 401(k) and 403(b). Including, but not limited to these plans, in what account(s) would you recommend that they save their retirement funds? Why? Please account for all of the savings Frank and Lois will need to do.

8 Types of Investments (25 points)

What types of investments would you recommend to Frank and Lois? Why?

9 Social Security (10 points)

If they ask you to include Social Security in their retirement projections, what advice would you give them?

10 Insurance (25 points)

Comment on their insurance needs and your recommendations for Frank and Lois.

Assume in all circumstances that they would want to maintain a lifestyle similar to their current lifestyle.

Be specific as to amounts and types of insurance that you recommend.

Include comments on life, disability and long term care at a minimum.

11 Estate (10 point)

Comment on their estate planning needs assuming they do not have an estate plan today.

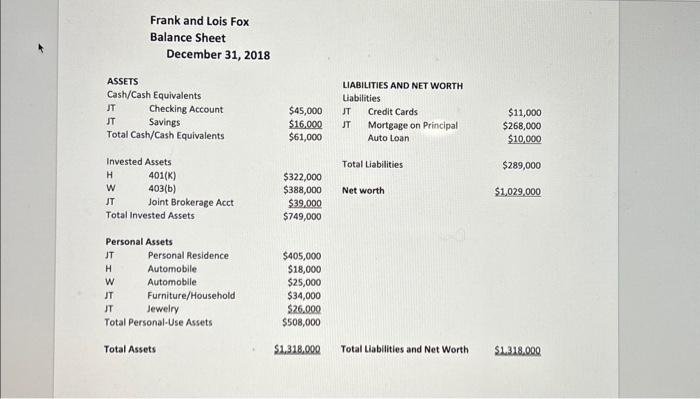

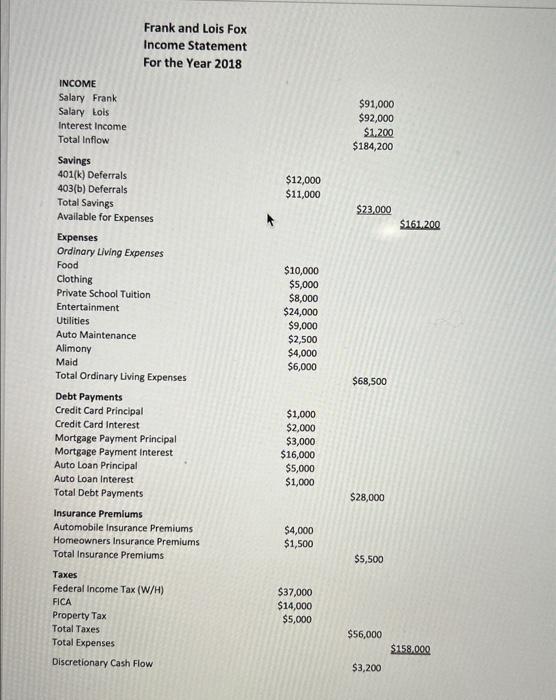

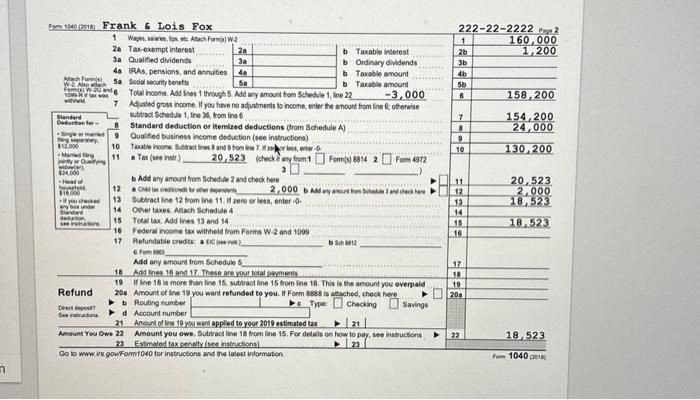

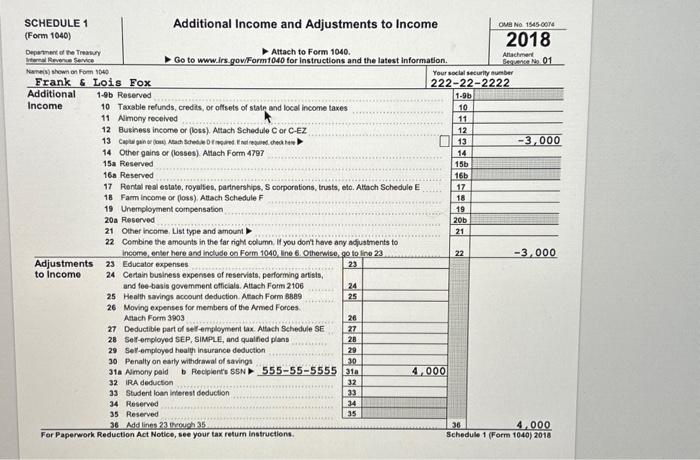

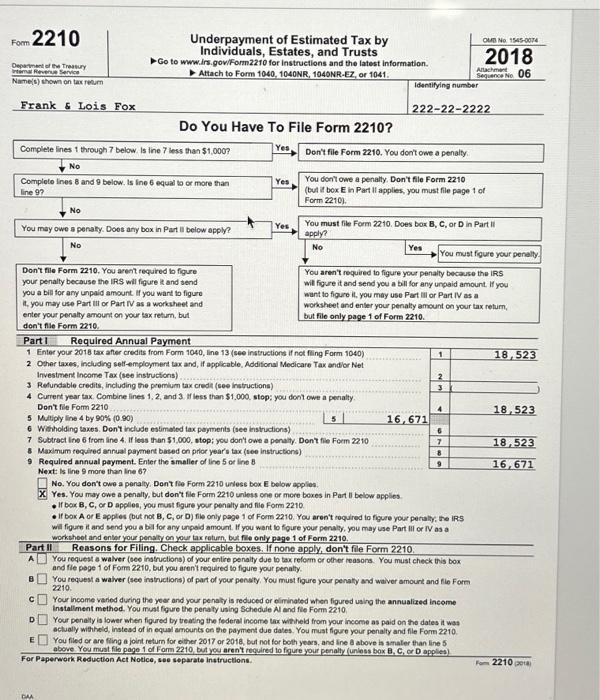

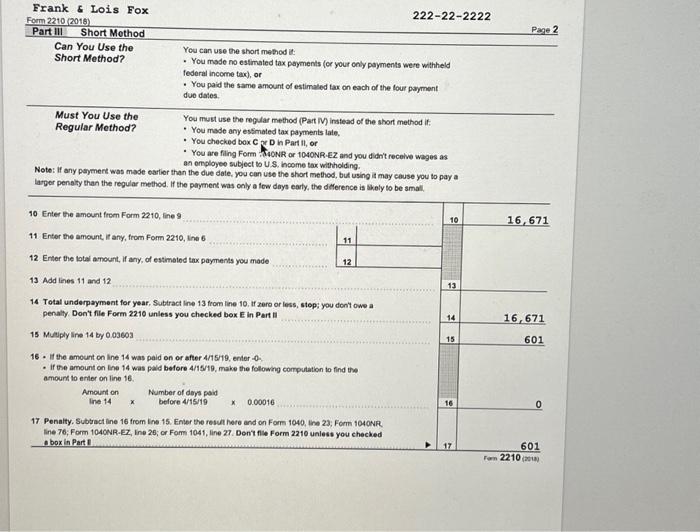

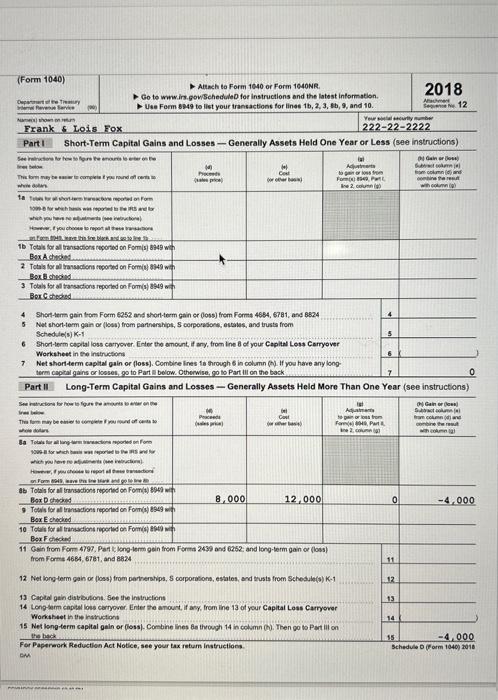

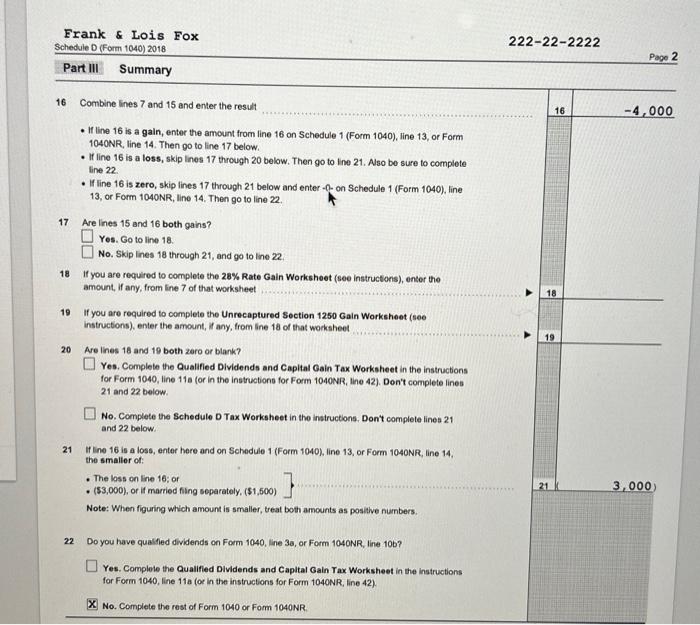

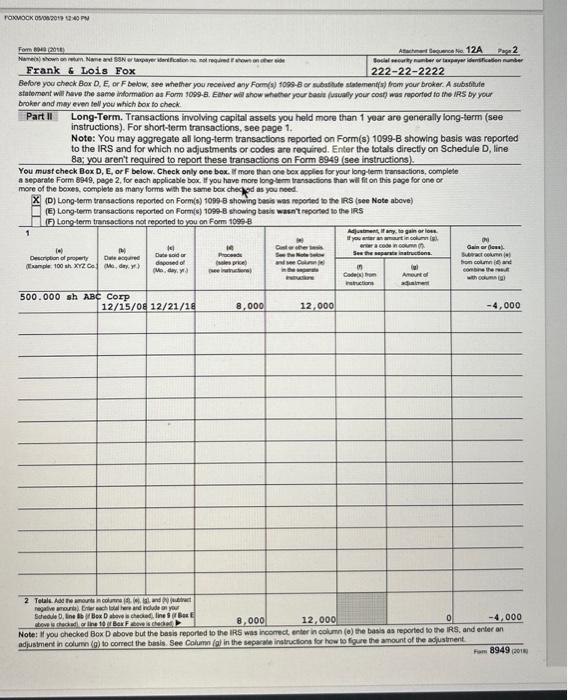

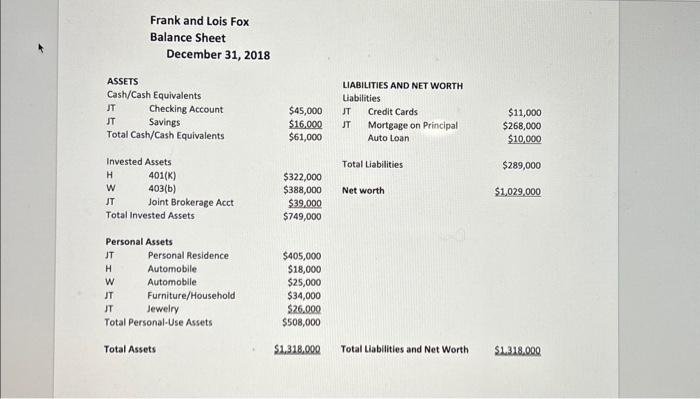

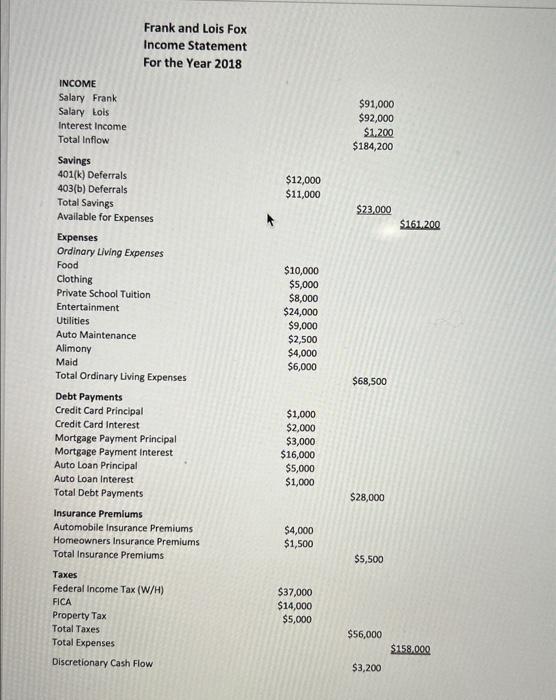

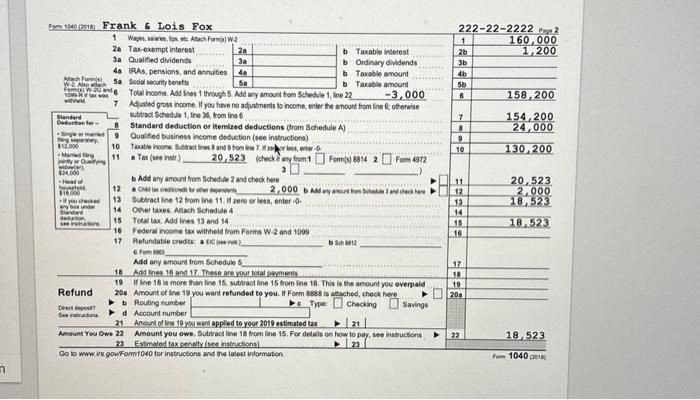

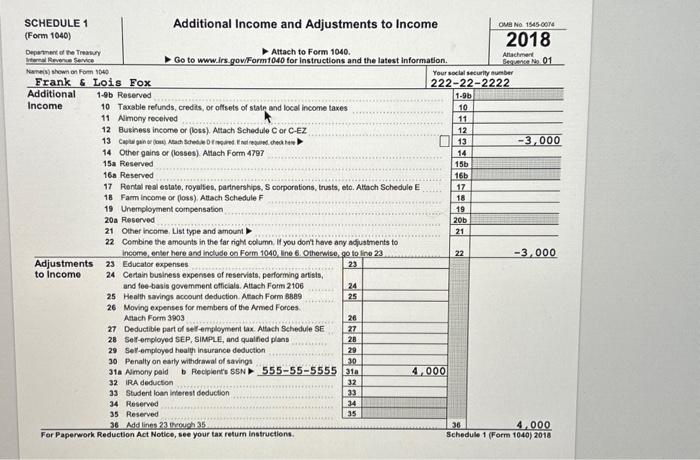

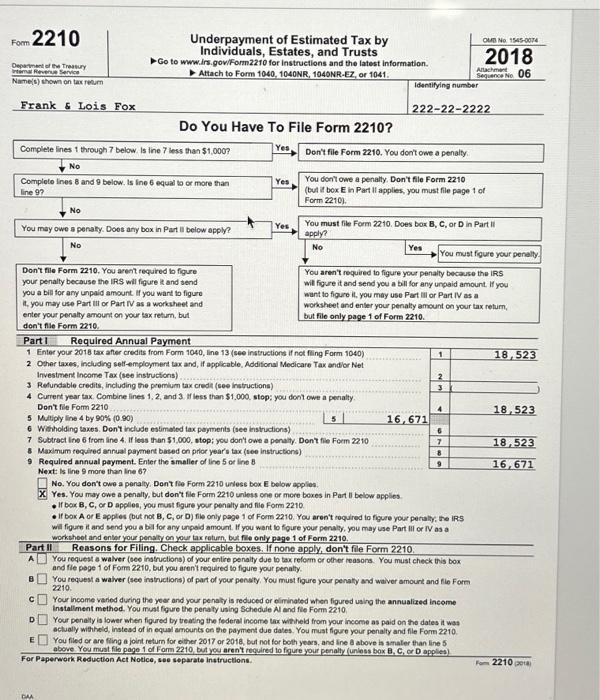

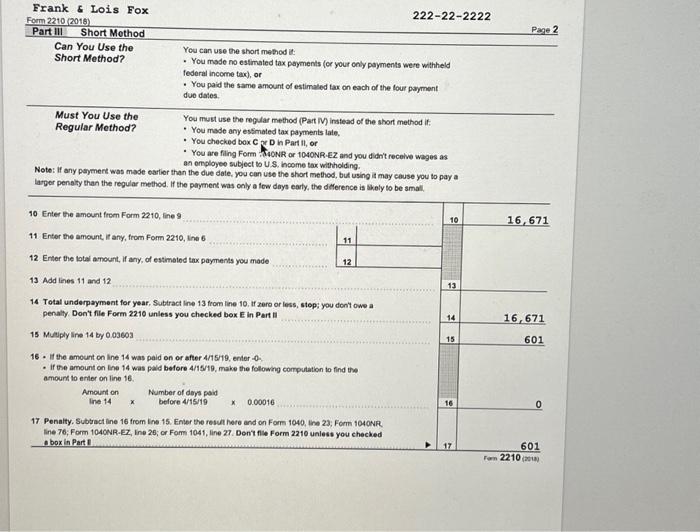

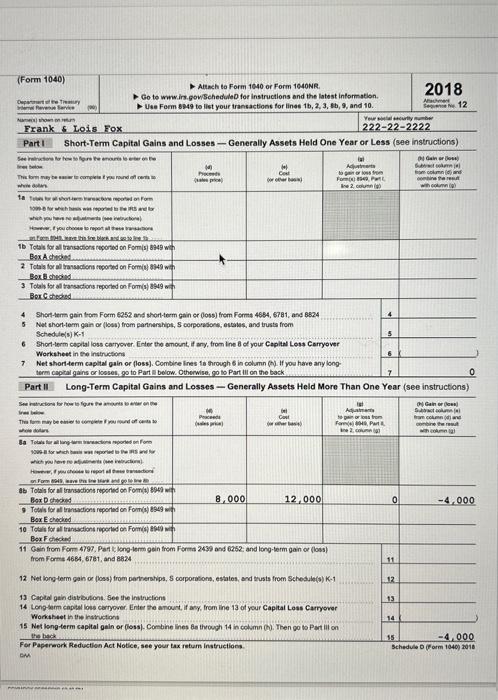

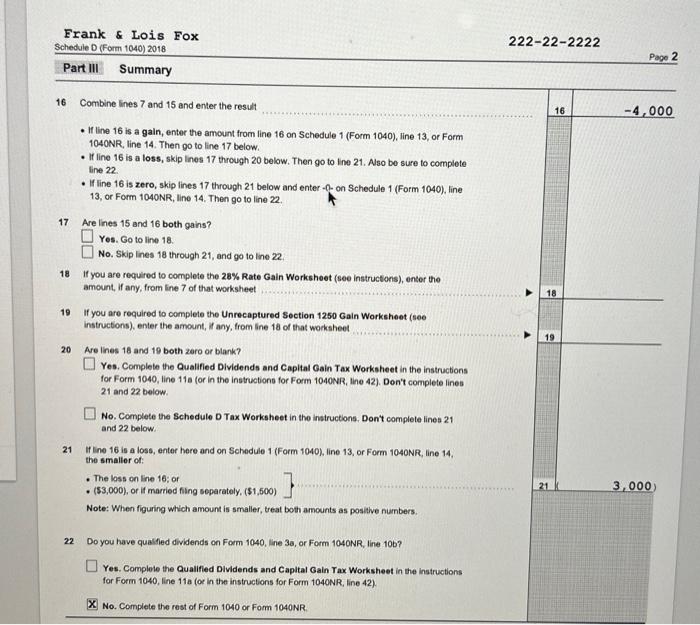

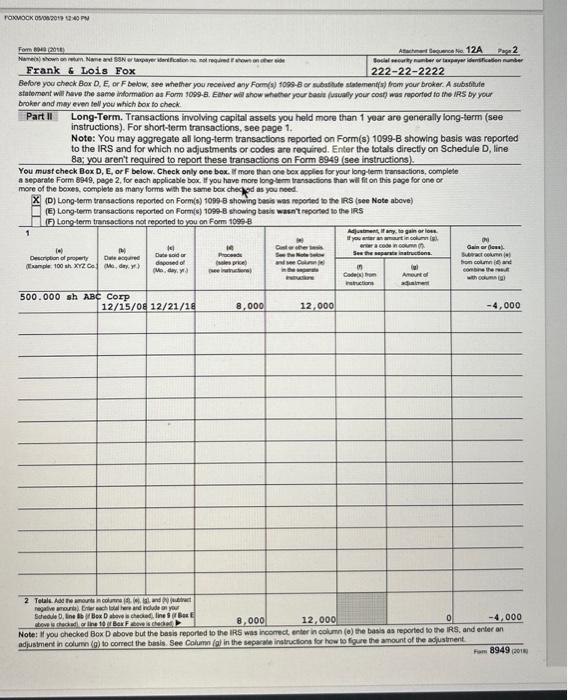

Frank and Lois Fox Balance Sheet December 31, 2018 (Form 1040) Nurnewi thom mints. Frank \& Lois Fox Part I Short-Term Capital Gains and Losses - Generally Assets Held One Year or Less (see instructions) ox Go to www.irs.govischedule D for instructions and the latest information. Use Ferm 8949 to list your transactions for lines 1b,2,3,sb,9, and 10. 2018 222222222 Fom kaea abs: Frank L Lois Fox broker and may even tell you which bor fo check. Part II Long-Term. Transactons involving capital assets you held more than 1 year are generally long-term (see instructions). For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only ene bex. If move than one bex apples for your long-tem transactions, complele a separale Form 8949, page 2, for each applicable box, If you have more longterm transactions than will fit on this poge for one or more of the boxes. complete as many forms with the same beir cheged as you need. X. (D) Long-tem transactions reported on Foem(s) 1095 - showing busis was reperted bo the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1090-8 showing bals wasn't neporned to the IRS (F) Long-term transactions not reported to you on form 1698B Frank and Lois Fox Income Statement For the Year 2018 INCOME Salary Frank Salary tols Interest Income Total Inflow Savings 401(k) Deferrals 403(b) Deferrals Total Savings Avallable for Expenses Expenses Ordinary Living Expenses Food Clothing Private School Tuition Entertainment Utilities Auto Maintenance Alimony Maid Total Ordinary Living Expenses Debt Payments Credit Card Principal Credit Card Interest Mortgage Payment Principal Mortgage Payment interest Auto Loan Principal Auto Loan Interest Total Debt Payments Insurance Premlums Automobile Insurance Premiums Homeowners Insurance Premiums Total Insurance Premiums Taxes Federal Income Tax (W/H) FICA Property Tax Total Taxes Total Expenses Discretionary Cash Flow $91,000$92,000$1,200$184,200 $12,000$11,000 $23,000 $161.200 $68,500 $1,000$2,000$3,000$16,000$5,000$1,000 $10,000$5,000$8,000$24,000$9,000$2,500$4,000$6,000$1,000$2,000$3,000$16,000$5,000$1,000 $91,000$92,000$1,200$184,200 $23,000 $4,000 $1,500 $5,500 $37,000$14,000$5,000 $56,000 $1.58,000 $3,200 Do You Have To File Form 2210? Part I Required Annual Payment 1 Enter your 2018 tax after credits from Form 1040, line 13 (see instructions if not filing Form 1040) 2 Other taxes, including setf-employment tax and, if applicable, Addifonal Medicare Tax andlor Net Investment income Tax (see instructions) 3 Refundable credits, including the premium tax credt (see instructions) 4 Current year tax. Combine lines 1,2, and 3 if less than $1,000 stop: you dont owe a penalty. Dent file Form 2210 5 Multiply line 4 by 90%(0.90) 6 Whalding taxes. Don't include estimated tax payments (see instructions) 7 Subtract ine 6 from line 4. If less than \$1,000, stop; you don't owe a penalty. Dont file Form 2210 - Maximum required annual paymert based on prior year's tax (see instructions) 9 Required annual payment. Enter the smaller of line 5 or line 8 Next: is line 9 more than line 6 ? Ne. You don't owe a penalty. Dent fie Form 2210 unless bex E below appliea. X. Yes. You may owe a penally, but don't file Form 2210 unless one or more boxes in Part 11 below applies - If boir B, C, or D applies, you must figure your penalty and nie Form 2210. - If box A or E apples (but not B, C, or D) file only page 1 of Fom 2210. You aren't roquired to figure your perally, the iR-S will figure if and send you a ba for any unpaid amount. If you want to figure your penaly, you may use Part ill or RV as a worksheot and enter your penally on your tax return, but file only page 1 of Form 2210. Part II Reasons for Filing. Check applicable boxes, If none apply, don't file Form 2210. A You request a walver (eee instructions) of your entire penaity due to tax reform or other reasons. You must check this box and file poge 1 of Form 2210 , but you aren't required to flgure your penalty. a You request a waher (see instructions) of part of your penvity, You must figure your penalty snd waiver amount and file Form 2210. cD Your income varied during the yeer and your penaly is reduced or eliminated when figured uaing the annualized income installment method. You must foure the peraty using Schedule Al and file Form 2210 D Your penalty is lower when figured by treating the federal incoms thx witheld from your income as paid on the dates it was actualy witheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Fom 2210. E You filed or are fing a joint return for either 2017 or 2018 , but not for both years, and line a above is smaler than line 5 above You must filo page 1 of Form 2210 , but you aren't required lo foure your penalty (uniess bax B, C, or D apples) For Paperwork. Reduction Act Notice, see separate instructions. Fon 2210 (pota) Frank Lois Fox Schedule D (Form 1040) 2018 222222222 Part III Summary 16 Combine lines 7 and 15 and enter the result Page 2 - Ir line 16 is a galn, enter the amount from line 16 on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 17 below. - If line 16 is a loss, skip lines 17 through 20 below. Then go to ine 21. Aso be sure to complete line 22. - If line 16 is zero, skip lines 17 through 21 below and enter -0- on Schedule 1 (Form 1040), line 13 , or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21 , and go to line 22 . 18 If you are required to complete the 28% Rate Gain Worksheet (see instructens), enter the amount, if any, from line 7 of that worksheet 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, If any, from line 18 of that worksheet 20 Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11s (or in the instructions for Form 1040NR, line 42). Den't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below: 21 If line 16 is a loss, enter here and on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14, the smaller of: - The loss on line 16; or - ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualfed dividends on Form 1040, line 3a, or Form 1040NR, line 10b? Yes. Compleie the Qualified Dividends and Capltal Gain Tax Worksheet in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). X No. Complete the rest of Form 1040 or Form 1040 NR. Frank \& Lois Fox 222222222 Form 2210 (2018) Part III Short Method Page 2 Can You Use the Short Method? You can use the short mebod a: - You made no estimated tax payments (or your only payments were withheld federal income tax), or - You paid the same amount of estimaled tax on each of the four payment due dates. Must You Use the Regular Method? You must use the regular method (Part M ) instead of the short method it: - You made any essmated tax payments late. - You checked box C Y D h Part II, or - You are filing Form P4ONR or 1040NR.EZ and you didn't recelve wages as an omployeo subject to U.S. hoome tax with alding. Note: If any paymert was made eartier than the due date, you can use the short method, but using it may cause you to pay a larper penaty than the regular method. If the payment was only a fow days early, the difference is skoly to be small. 10 Enter the amount from Form 2210 , line 9 11 Enter the amount, it any, from form 2210, ine 6 12 Enter the lotal anount, if any, of estmatod tax payments you mode 13 Add lines 11 and 12 14 Total underpayment for year, Subtract ine 13 from line 10. If zero or less, stop; you dont owe a penally, Dont file Form 2210 unless you checked box E in Part II 15 Muelply line 14 by 0.03603 16. If the amount on ine 14 was paid on or after 4/15/19, enter -0 - - If the amount on ine 14 was pald bofore 4/15/19, make the following computation to find the amourt to enter on line 16. AmountonIne14Numberofdeyspaidbefore4/15/190.00016 17 Penaity. Subtract ine 16 from ine 15. Enter the resul here and on Form 1040, ine 23; Form 1040NR line 76; Form 1040NR-EZ, Ine 26; or Fom 1041, line 27. Dont flie Form 2210 unless you checked abox in Part 1 Frank and Lois Fox Balance Sheet December 31, 2018 (Form 1040) Nurnewi thom mints. Frank \& Lois Fox Part I Short-Term Capital Gains and Losses - Generally Assets Held One Year or Less (see instructions) ox Go to www.irs.govischedule D for instructions and the latest information. Use Ferm 8949 to list your transactions for lines 1b,2,3,sb,9, and 10. 2018 222222222 Fom kaea abs: Frank L Lois Fox broker and may even tell you which bor fo check. Part II Long-Term. Transactons involving capital assets you held more than 1 year are generally long-term (see instructions). For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D, line 8a; you aren't required to report these transactions on Form 8949 (see instructions). You must check Box D, E, or F below. Check only ene bex. If move than one bex apples for your long-tem transactions, complele a separale Form 8949, page 2, for each applicable box, If you have more longterm transactions than will fit on this poge for one or more of the boxes. complete as many forms with the same beir cheged as you need. X. (D) Long-tem transactions reported on Foem(s) 1095 - showing busis was reperted bo the IRS (see Note above) (E) Long-term transactions reported on Form(s) 1090-8 showing bals wasn't neporned to the IRS (F) Long-term transactions not reported to you on form 1698B Frank and Lois Fox Income Statement For the Year 2018 INCOME Salary Frank Salary tols Interest Income Total Inflow Savings 401(k) Deferrals 403(b) Deferrals Total Savings Avallable for Expenses Expenses Ordinary Living Expenses Food Clothing Private School Tuition Entertainment Utilities Auto Maintenance Alimony Maid Total Ordinary Living Expenses Debt Payments Credit Card Principal Credit Card Interest Mortgage Payment Principal Mortgage Payment interest Auto Loan Principal Auto Loan Interest Total Debt Payments Insurance Premlums Automobile Insurance Premiums Homeowners Insurance Premiums Total Insurance Premiums Taxes Federal Income Tax (W/H) FICA Property Tax Total Taxes Total Expenses Discretionary Cash Flow $91,000$92,000$1,200$184,200 $12,000$11,000 $23,000 $161.200 $68,500 $1,000$2,000$3,000$16,000$5,000$1,000 $10,000$5,000$8,000$24,000$9,000$2,500$4,000$6,000$1,000$2,000$3,000$16,000$5,000$1,000 $91,000$92,000$1,200$184,200 $23,000 $4,000 $1,500 $5,500 $37,000$14,000$5,000 $56,000 $1.58,000 $3,200 Do You Have To File Form 2210? Part I Required Annual Payment 1 Enter your 2018 tax after credits from Form 1040, line 13 (see instructions if not filing Form 1040) 2 Other taxes, including setf-employment tax and, if applicable, Addifonal Medicare Tax andlor Net Investment income Tax (see instructions) 3 Refundable credits, including the premium tax credt (see instructions) 4 Current year tax. Combine lines 1,2, and 3 if less than $1,000 stop: you dont owe a penalty. Dent file Form 2210 5 Multiply line 4 by 90%(0.90) 6 Whalding taxes. Don't include estimated tax payments (see instructions) 7 Subtract ine 6 from line 4. If less than \$1,000, stop; you don't owe a penalty. Dont file Form 2210 - Maximum required annual paymert based on prior year's tax (see instructions) 9 Required annual payment. Enter the smaller of line 5 or line 8 Next: is line 9 more than line 6 ? Ne. You don't owe a penalty. Dent fie Form 2210 unless bex E below appliea. X. Yes. You may owe a penally, but don't file Form 2210 unless one or more boxes in Part 11 below applies - If boir B, C, or D applies, you must figure your penalty and nie Form 2210. - If box A or E apples (but not B, C, or D) file only page 1 of Fom 2210. You aren't roquired to figure your perally, the iR-S will figure if and send you a ba for any unpaid amount. If you want to figure your penaly, you may use Part ill or RV as a worksheot and enter your penally on your tax return, but file only page 1 of Form 2210. Part II Reasons for Filing. Check applicable boxes, If none apply, don't file Form 2210. A You request a walver (eee instructions) of your entire penaity due to tax reform or other reasons. You must check this box and file poge 1 of Form 2210 , but you aren't required to flgure your penalty. a You request a waher (see instructions) of part of your penvity, You must figure your penalty snd waiver amount and file Form 2210. cD Your income varied during the yeer and your penaly is reduced or eliminated when figured uaing the annualized income installment method. You must foure the peraty using Schedule Al and file Form 2210 D Your penalty is lower when figured by treating the federal incoms thx witheld from your income as paid on the dates it was actualy witheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Fom 2210. E You filed or are fing a joint return for either 2017 or 2018 , but not for both years, and line a above is smaler than line 5 above You must filo page 1 of Form 2210 , but you aren't required lo foure your penalty (uniess bax B, C, or D apples) For Paperwork. Reduction Act Notice, see separate instructions. Fon 2210 (pota) Frank Lois Fox Schedule D (Form 1040) 2018 222222222 Part III Summary 16 Combine lines 7 and 15 and enter the result Page 2 - Ir line 16 is a galn, enter the amount from line 16 on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 17 below. - If line 16 is a loss, skip lines 17 through 20 below. Then go to ine 21. Aso be sure to complete line 22. - If line 16 is zero, skip lines 17 through 21 below and enter -0- on Schedule 1 (Form 1040), line 13 , or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21 , and go to line 22 . 18 If you are required to complete the 28% Rate Gain Worksheet (see instructens), enter the amount, if any, from line 7 of that worksheet 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, If any, from line 18 of that worksheet 20 Are lines 18 and 19 both zero or blank? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11s (or in the instructions for Form 1040NR, line 42). Den't complete lines 21 and 22 below. No. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below: 21 If line 16 is a loss, enter here and on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14, the smaller of: - The loss on line 16; or - ($3,000), or if married filing separately, ($1,500) Note: When figuring which amount is smaller, treat both amounts as positive numbers. 22 Do you have qualfed dividends on Form 1040, line 3a, or Form 1040NR, line 10b? Yes. Compleie the Qualified Dividends and Capltal Gain Tax Worksheet in the instructions for Form 1040, line 11a (or in the instructions for Form 1040NR, line 42). X No. Complete the rest of Form 1040 or Form 1040 NR. Frank \& Lois Fox 222222222 Form 2210 (2018) Part III Short Method Page 2 Can You Use the Short Method? You can use the short mebod a: - You made no estimated tax payments (or your only payments were withheld federal income tax), or - You paid the same amount of estimaled tax on each of the four payment due dates. Must You Use the Regular Method? You must use the regular method (Part M ) instead of the short method it: - You made any essmated tax payments late. - You checked box C Y D h Part II, or - You are filing Form P4ONR or 1040NR.EZ and you didn't recelve wages as an omployeo subject to U.S. hoome tax with alding. Note: If any paymert was made eartier than the due date, you can use the short method, but using it may cause you to pay a larper penaty than the regular method. If the payment was only a fow days early, the difference is skoly to be small. 10 Enter the amount from Form 2210 , line 9 11 Enter the amount, it any, from form 2210, ine 6 12 Enter the lotal anount, if any, of estmatod tax payments you mode 13 Add lines 11 and 12 14 Total underpayment for year, Subtract ine 13 from line 10. If zero or less, stop; you dont owe a penally, Dont file Form 2210 unless you checked box E in Part II 15 Muelply line 14 by 0.03603 16. If the amount on ine 14 was paid on or after 4/15/19, enter -0 - - If the amount on ine 14 was pald bofore 4/15/19, make the following computation to find the amourt to enter on line 16. AmountonIne14Numberofdeyspaidbefore4/15/190.00016 17 Penaity. Subtract ine 16 from ine 15. Enter the resul here and on Form 1040, ine 23; Form 1040NR line 76; Form 1040NR-EZ, Ine 26; or Fom 1041, line 27. Dont flie Form 2210 unless you checked abox in