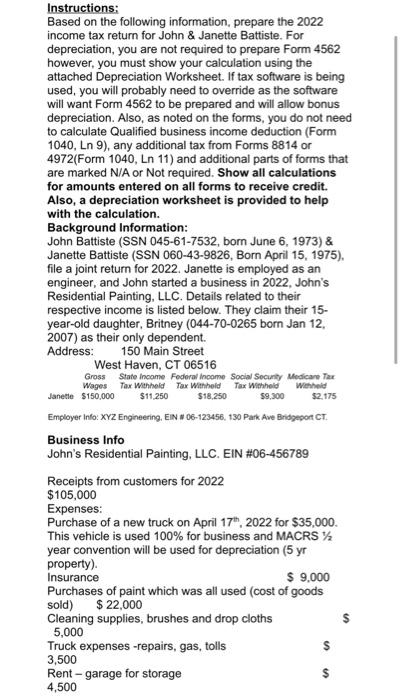

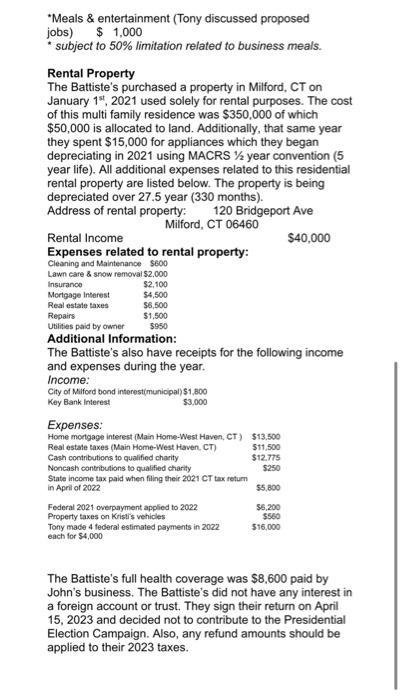

Based on the following information, prepare the 2022 income tax return for John \& Janette Battiste. For depreciation, you are not required to prepare Form 4562 however, you must show your calculation using the attached Depreciation Worksheet. If tax software is being used, you will probably need to override as the software will want Form 4562 to be prepared and will allow bonus depreciation. Also, as noted on the forms, you do not need to calculate Qualified business income deduction (Form 1040, Ln 9), any additional tax from Forms 8814 or 4972(Form 1040, Ln11 ) and additional parts of forms that are marked N/A or Not required. Show all calculations for amounts entered on all forms to receive credit. Also, a depreciation worksheet is provided to help with the calculation. Background Information: John Battiste (SSN 045-61-7532, born June 6, 1973) \& Janette Battiste (SSN 060-43-9826, Born April 15, 1975). file a joint return for 2022. Janette is employed as an engineer, and John started a business in 2022, John's Residential Painting, LLC. Details related to their respective income is listed below. They claim their 15 year-old daughter, Britney (044-70-0265 born Jan 12, 2007) as their only dependent. Address: 150 Main Street West Haven, CT 06516 Grass State income Foderal income Sooial Socunty Medicare Tax \begin{tabular}{|rrrrr} Wages & Tax Wthhold & Tax Withheld & Tax Withheld & Wheheld \\ $150,000 & $11,250 & $18,250 & $9,300 & $2,175 \end{tabular} Employer Info: XYZ Engineering. EIN w 06-123456, 130 Park Ave Bridgeport CT. Business Info John's Residential Painting, LLC. EIN \#06-456789 Receipts from customers for 2022 $105,000 Expenses: Purchase of a new truck on April 17th,2022 for $35,000. This vehicle is used 100% for business and MACRS 1/2 year convention will be used for depreciation ( 5yr property). Insurance $9.000 Purchases of paint which was all used (cost of goods sold) $22,000 Cleaning supplies; brushes and drop cloths 5,000 Truck expenses -repairs, gas, tolls 3,500 Rent - garage for storage "Meals \& entertainment (Tony discussed proposed jobs) \$ $1,000 " subject to 50% limitation related to business meals. Rental Property The Battiste's purchased a property in Milford, CT on January 1st,2021 used solely for rental purposes. The cost of this multi family residence was $350,000 of which $50,000 is allocated to land. Additionally, that same year they spent $15,000 for appliances which they began depreciating in 2021 using MACRS 1/2 year convention ( 5 year life). All additional expenses related to this residential rental property are listed below. The property is being depreciated over 27.5 year ( 330 months). Address of rental property: 120 Bridgeport Ave Milford, CT 06460 Rental Income $40,000 Expenses related to rental property: Cleanina and Mainterance seoo Additional Information: The Battiste's also have receipts for the following income and expenses during the year. Income: City of Miffoed bond interest(munioipal) $1,800 Key Bank interest $3,000 The Battiste's full health coverage was $8,600 paid by John's business. The Battiste's did not have any interest in a foreign account or trust. They sign their return on April 15, 2023 and decided not to contribute to the Presidential Election Campaign. Also, any refund amounts should be applied to their 2023 taxes