Question

Based on the following lease amortization schedule for a lessor, answer the following questions. The lease meets at least one condition for it to be

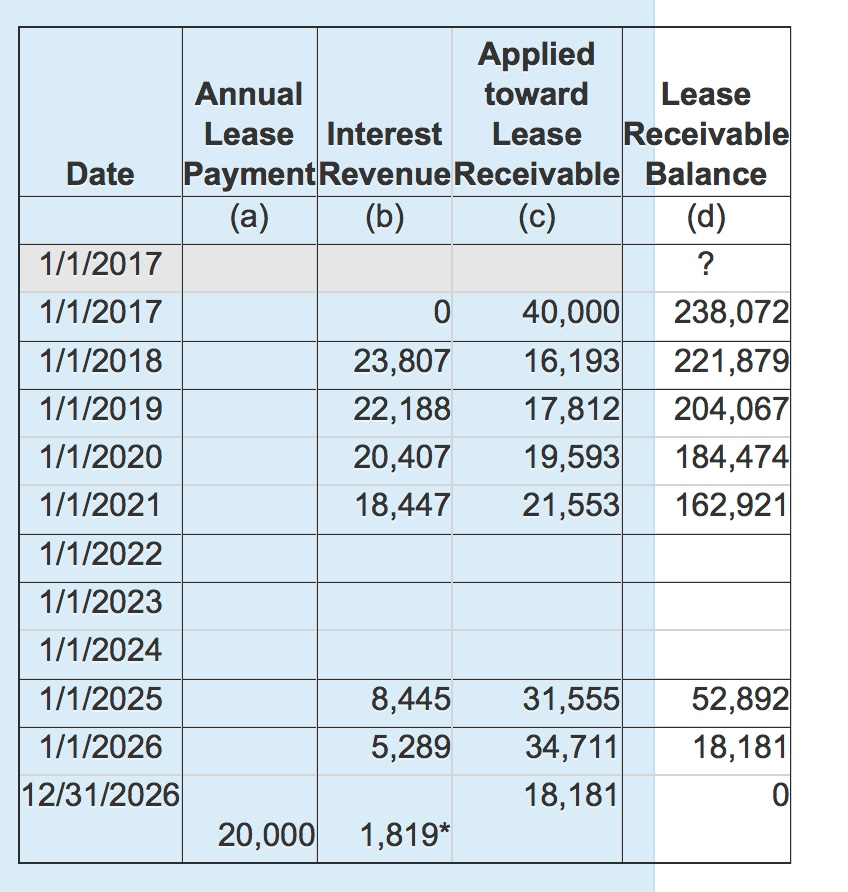

Based on the following lease amortization schedule for a lessor, answer the following questions. The lease meets at least one condition for it to be recorded as a capital lease for the lessor. The lessor purchased this asset from its manufacturer for 250,000 before leasing it to the lessee. The lessee did not guarantee the residual value of the leased asset. PV of minimum payments = fair value of the leased asset.

1. What was the fair value of the asset being leased out in this situation? Show work.

2. What was the effective interest rate implicit in the situation? Show work.

3. What was the annual lease payment?

4. What was the balance of Lease Receivable after the seventh annual lease payment? Show work.

5. What was the most likely reason for the $20,000 payment at the end of 2026?

6. Is this a "sales-type" lease or a direct financing lease for the lessor? Explain briefly.

7. What is the total amount of lease payments received by the lessor from this lease? Show work.

8. What total amount of interest revenue would be recognized by the lessor from this lease? Show work.

Applied toward Annual LeaseInterest Lease Receivable Lease Date Payment RevenueReceivable Balance 1/1/2017 1/1/2017 1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022 1/1/2023 1/1/2024 1/1/2025 1/1/2026 12/31/2026 23,807 16,19 22,188 20,407 18,447 21,553 0 40,000238,072 3221,879 17,812204,067 19,593184,474 ,447 21,553 162,921 8,445 31,555 52,892 5,28934,71118,181 0 18,181 20,0001,819*Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started