Answered step by step

Verified Expert Solution

Question

1 Approved Answer

based on the four methods we have learned so far, how would you group the pros and cons of each? methods are: discounted cash flow,

based on the four methods we have learned so far, how would you group the pros and cons of each?

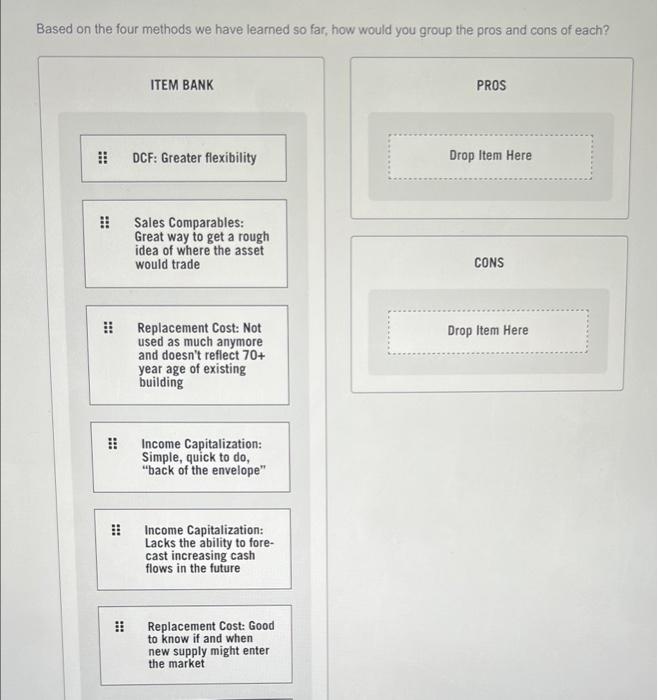

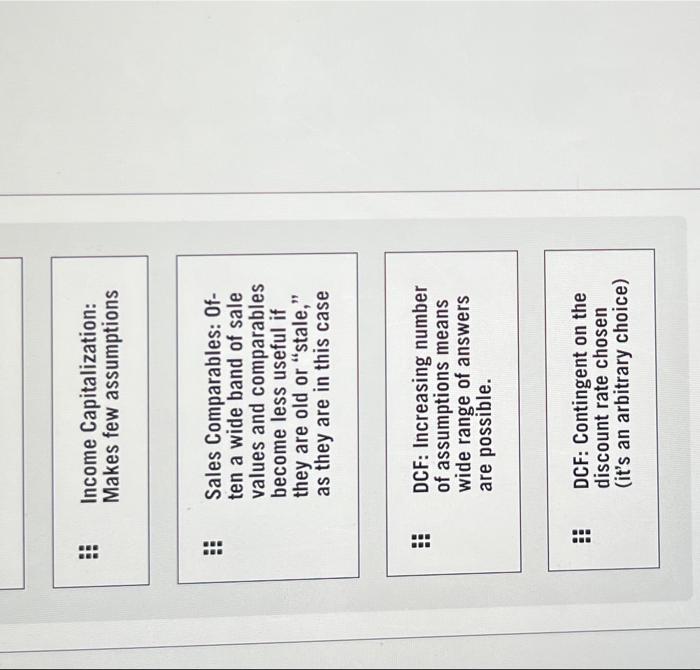

Based on the four methods we have learned so far, how would you group the pros and cons of each? ** *** ITEM BANK DCF: Greater flexibility Sales Comparables: Great way to get a rough idea of where the asset would trade Replacement Cost: Not used as much anymore and doesn't reflect 70+ year age of existing building Income Capitalization: Simple, quick to do, "back of the envelope" Income Capitalization: Lacks the ability to fore- cast increasing cash flows in the future Replacement Cost: Good to know if and when new supply might enter the market PROS Drop Item Here CONS Drop Item Here ww www # Income Capitalization: Makes few assumptions Sales Comparables: Of- ten a wide band of sale values and comparables become less useful if they are old or "stale," as they are in this case DCF: Increasing number of assumptions means wide range of answers are possible. DCF: Contingent on the discount rate chosen (it's an arbitrary choice) methods are: discounted cash flow, sales comparables, income capitalization, replacement cost

items banks will be sent in photos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started