Based on the given info and answers for 1-3,

| Write a short report (at least 75 words) that identifies factors that explain why the two product-costing systems result in differing costs. |

| Which system do you recommend? Why? Include in your recommendation an analysis of the activities being used. | |

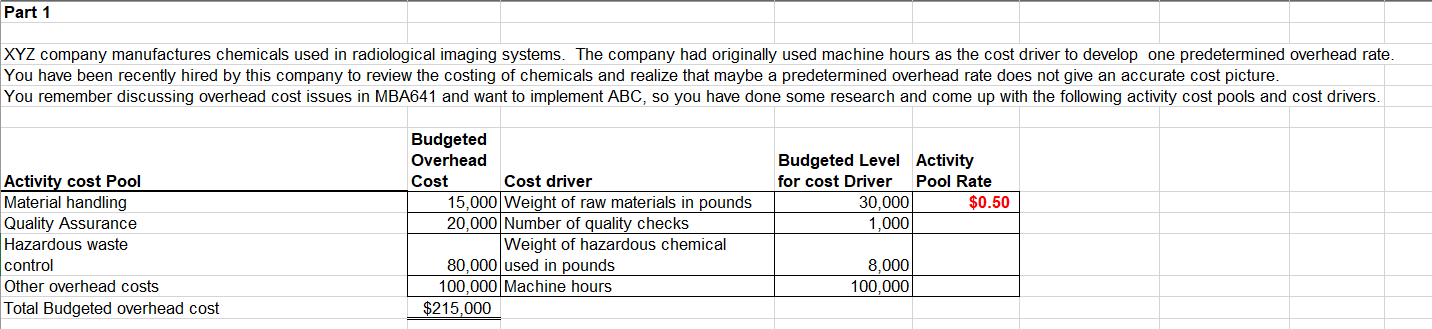

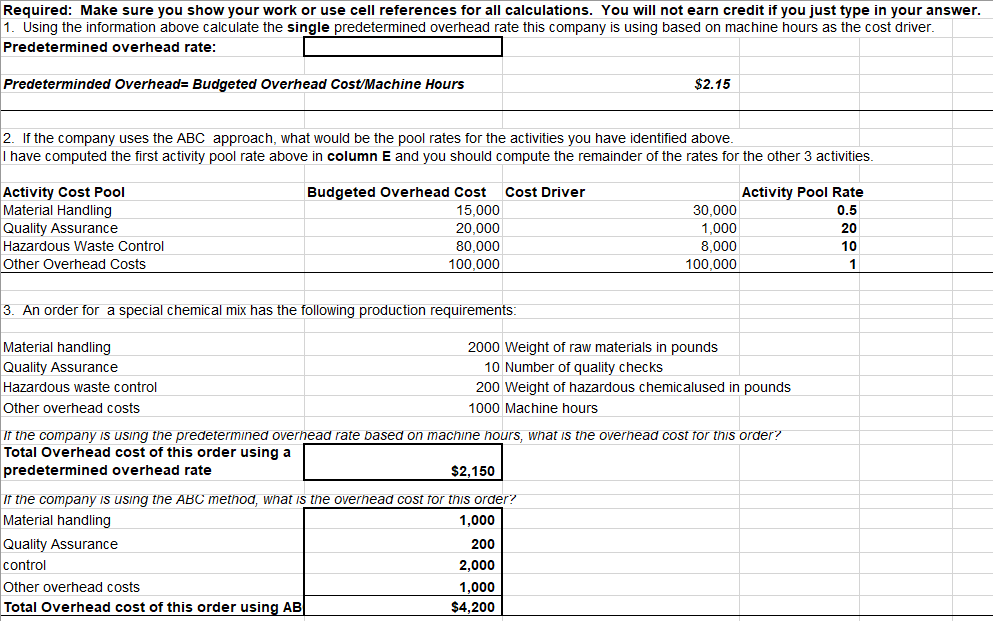

Part 1 XYZ company manufactures chemicals used in radiological imaging systems. The company had originally used machine hours as the cost driver to develop one predetermined overhead rate. You have been recently hired by this company to review the costing of chemicals and realize that maybe a predetermined overhead rate does not give an accurate cost picture. You remember discussing overhead cost issues in MBA641 and want to implement ABC, so you have done some research and come up with the following activity cost pools and cost drivers. Budgeted Level Activity for cost Driver Pool Rate 30,000 $0.50 1,000 Activity cost Pool Material handling Quality Assurance Hazardous waste control Other overhead costs Total Budgeted overhead cost Budgeted Overhead Cost Cost driver 15,000 Weight of raw materials in pounds 20,000 Number of quality checks Weight of hazardous chemical 80,000 used in pounds 100,000 Machine hours $215,000 8,000 100,000 Required: Make sure you show your work or use cell references for all calculations. You will not earn credit if you just type in your answer. 1. Using the information above calculate the single predetermined overhead rate this company is using based on machine hours as the cost driver. Predetermined overhead rate: Predeterminded Overhead= Budgeted Overhead Cost/Machine Hours $2.15 2. If the company uses the ABC approach, what would be the pool rates for the activities you have identified above. I have computed the first activity pool rate above in column E and you should compute the remainder of the rates for the other 3 activities. Activity Cost Pool Material Handling Quality Assurance Hazardous Waste Control Other Overhead Costs Budgeted Overhead Cost Cost Driver 15,000 20,000 80,000 100,000 Activity Pool Rate 30,000 0.5 1,000 8,000 10 100,000 20 3. An order for a special chemical mix has the following production requirements: Material handling Quality Assurance Hazardous waste control Other overhead costs 2000 Weight of raw materials in pounds 10 Number of quality checks 200 Weight of hazardous chemicalused in pounds 1000 Machine hours If the company is using the predetermined overhead rate based on machine hours, what is the overhead cost for this order? Total Overhead cost of this order using a predetermined overhead rate $2,150 if the company is using the ABC method, what is the overhead cost for this order? Material handling 1,000 Quality Assurance 200 control 2,000 Other overhead costs 1,000 Total Overhead cost of this order using AB $4,200