Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the given information from PA12-4 (Pp.603-604) in your textbook, complete the following Additional Data: a. Bought equipment for cash. $2 t.0000 b. Paid

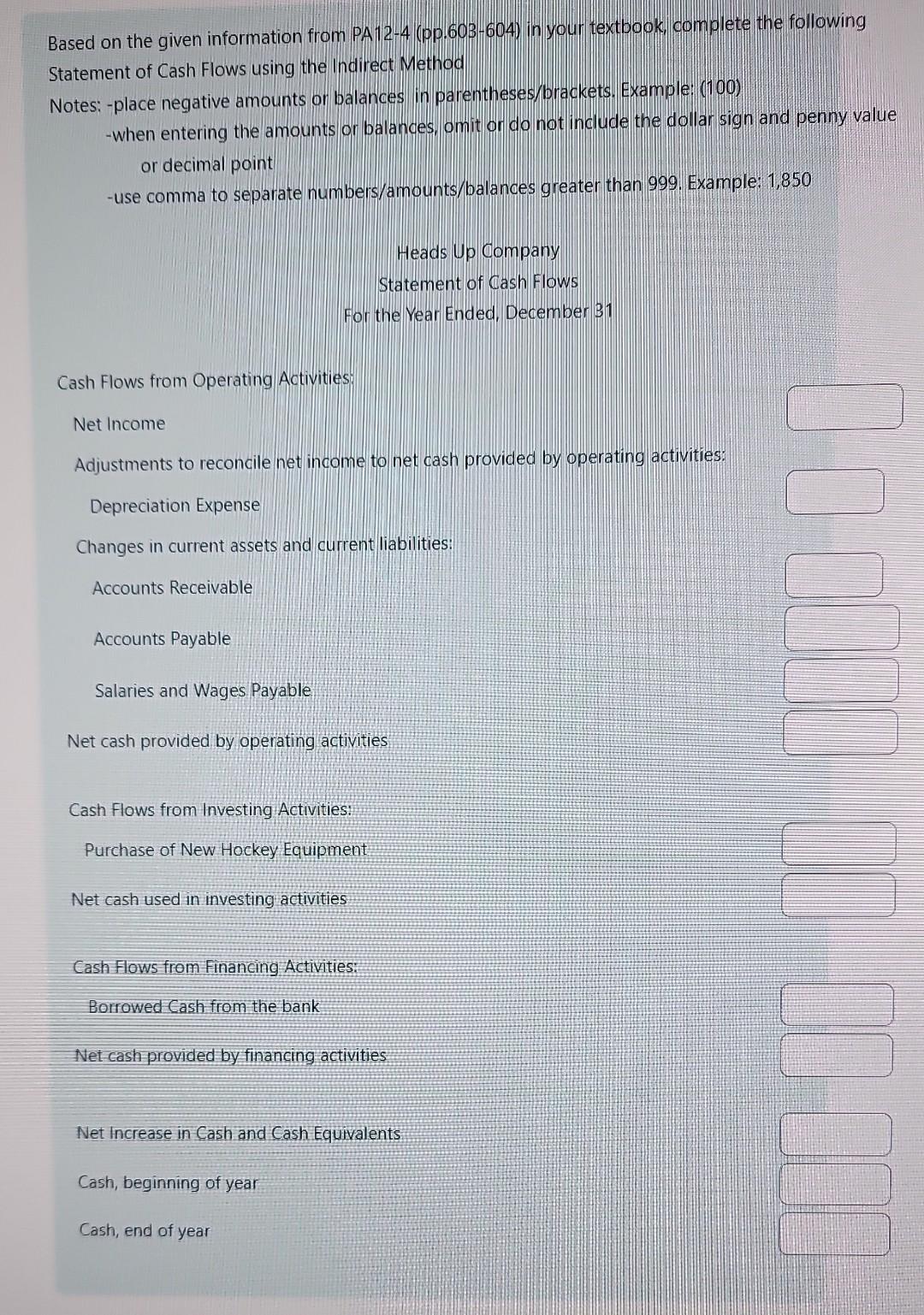

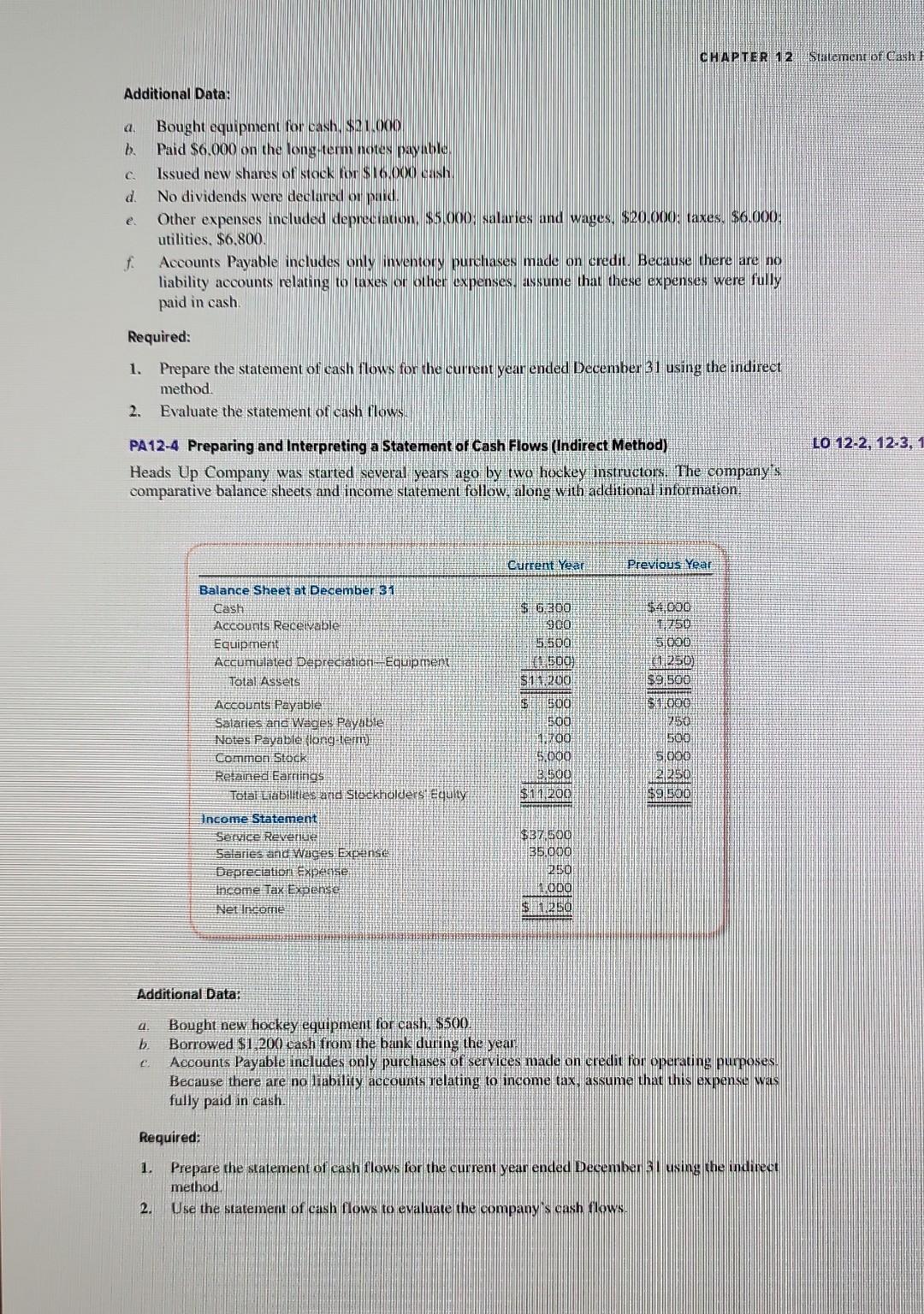

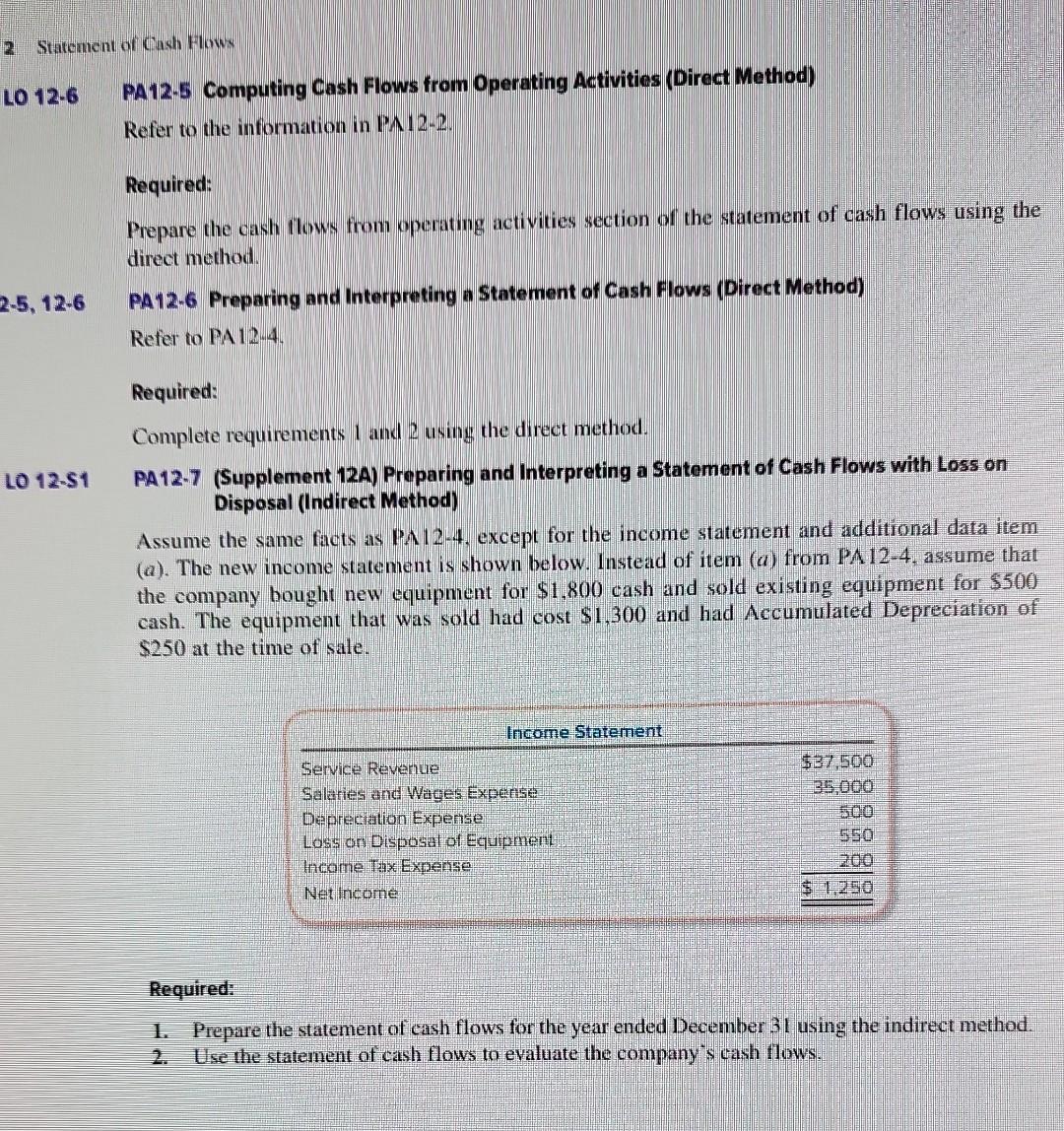

Based on the given information from PA12-4 (Pp.603-604) in your textbook, complete the following Additional Data: a. Bought equipment for cash. $2 t.0000 b. Paid $6.000 on the longterm notes pay ithle. c. Issued new shares of stock tor$(6.000) cash. d. No dividends were declared on paid. e. Other expenses included depneciation, \$5.000: saliries and wages, \$20,000: taxes, \$6.000: utilities, $6,800. f. Accounts Payable includes only inventory purchases made on credit. Because there are no liability accounts relating to taxes or ohther expenses, assume that these expenses were fully paid in cash. Required: 1. Prepare the statement of cash flows for the current year ended Decenber 31 using the indirect method. 2. Evaluate the statement of cash flows. PA12-4 Preparing and Interpreting a Statement of Cash Flows (Indirect Method) Heads Up Company was started several years ago by two hockey instructors. The company"s comparative balance sheets and income statement follow, along with additional information. Additional Data: a. Bought new hockey equipment for cash, $500 b. Borrowed $1,200 eash from the bank during the jeat c. Accounts Payable includes only purchases of services nade on credit for opertating purposes. Because there are no liability accounts ielating to income tax, assume that this expense was fully paid in cash. Required: 1. Prepare the statement of cash flows for the current year ended Decenber 3il using the indineot method. 2. Use the statement of cash flows to evaluate the company s cash flows. PA12-7 (Supplement 12A) Preparing and Interpreting a Statement of Cash Flows with Loss on Disposal (Indirect Method) Assume the same facts as PA124, except for the income statement and additional data item (a). The new income statement is shown below. Instead of item (a) from PA 12-4, assume that the company bought new equipment for $1,800 cash and sold existing equipment for $500 cash. The equipment that was sold had cost $1,300 and had Accumulated Depreciation of $250 at the time of sale. Required: 1. Prepare the statement of cash flows for the year ended December 31 using the indirect method. 2. Use the statement of cash flows to evaluate the company's cash flows. Based on the given information from PA12-4 (Pp.603-604) in your textbook, complete the following Additional Data: a. Bought equipment for cash. $2 t.0000 b. Paid $6.000 on the longterm notes pay ithle. c. Issued new shares of stock tor$(6.000) cash. d. No dividends were declared on paid. e. Other expenses included depneciation, \$5.000: saliries and wages, \$20,000: taxes, \$6.000: utilities, $6,800. f. Accounts Payable includes only inventory purchases made on credit. Because there are no liability accounts relating to taxes or ohther expenses, assume that these expenses were fully paid in cash. Required: 1. Prepare the statement of cash flows for the current year ended Decenber 31 using the indirect method. 2. Evaluate the statement of cash flows. PA12-4 Preparing and Interpreting a Statement of Cash Flows (Indirect Method) Heads Up Company was started several years ago by two hockey instructors. The company"s comparative balance sheets and income statement follow, along with additional information. Additional Data: a. Bought new hockey equipment for cash, $500 b. Borrowed $1,200 eash from the bank during the jeat c. Accounts Payable includes only purchases of services nade on credit for opertating purposes. Because there are no liability accounts ielating to income tax, assume that this expense was fully paid in cash. Required: 1. Prepare the statement of cash flows for the current year ended Decenber 3il using the indineot method. 2. Use the statement of cash flows to evaluate the company s cash flows. PA12-7 (Supplement 12A) Preparing and Interpreting a Statement of Cash Flows with Loss on Disposal (Indirect Method) Assume the same facts as PA124, except for the income statement and additional data item (a). The new income statement is shown below. Instead of item (a) from PA 12-4, assume that the company bought new equipment for $1,800 cash and sold existing equipment for $500 cash. The equipment that was sold had cost $1,300 and had Accumulated Depreciation of $250 at the time of sale. Required: 1. Prepare the statement of cash flows for the year ended December 31 using the indirect method. 2. Use the statement of cash flows to evaluate the company's cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started