Question

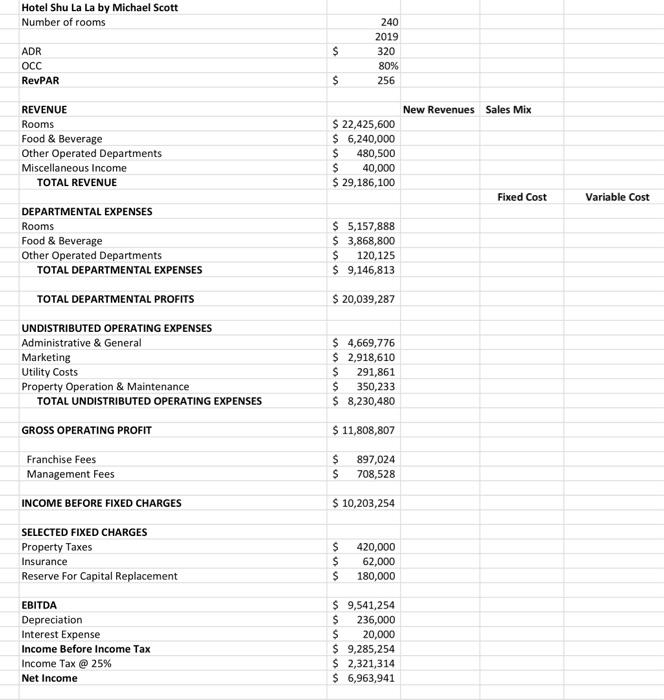

Based on the income statement and the information below: The income tax rate is 25%. Number of rooms is 240, and hotel operates at 80%

Based on the income statement and the information below:

The income tax rate is 25%. Number of rooms is 240, and hotel operates at 80% occupancy.

Room, Food & Beverage, and Other Operated Department expenses are directly variable with total sales revenue.

Administrative & General: $2,400,000 is fixed, the remainder is variable with total revenue.

Marketing $1,240,000 is fixed, the remainder is variable with total revenue.

Utilities cost: $180,000 is fixed, the remainder is variable with total revenue.

Property Operations & Maintenance: $188,000 is fixed, the remainder is variable with total revenue.

Assume both franchise fees and management fees to be fixed.

Answer the following questions.

- What is the revenue at breakeven point?

- At breakeven point, what would the room revenues be?

- At breakeven point, what is the occupancy at $320 ADR?

- What revenue is required to achieve desired operating income (income before income tax) of $12,000,000?

- If the operating income (income before income tax) of $12,000,000 achieved, how much would the food and beverage revenue be?

- If rooms and food & beverage revenues increase by 10% and 15%, respectively, through price increases, what would the new breakeven be?

- If fixed cost increases by $2,400,000, how much addtional revenues is needed to cover the additional fixed expenses?

- What would the required revenue be if a net income of $9,000.000 is desired?

- What would the occupancy rate be if a net income of $9,000,000 is achieved at $320 ADR?

- If the depreciation expense decreases by 100,000, what would the breakeven point be?

- If the hotel reduces all departmental expenses by 10%. what would the new breakeven be?

- What would the required revenue be if a net income of $10.000,000 is desired and at the same time the fixed expenses incease by $1.200.000?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started