Answered step by step

Verified Expert Solution

Question

1 Approved Answer

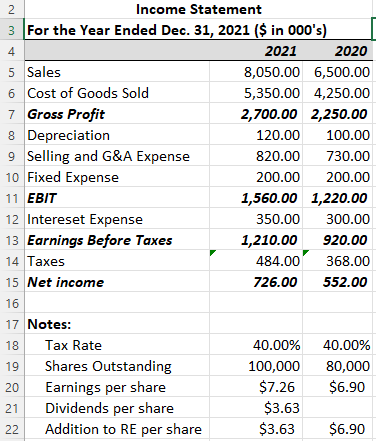

Based on the income statements created in Questions 1, create a forecasted income statement on the worksheet Q2_Pro-forma IS for 2022. Assume that: 1) Each

Based on the income statements created in Questions 1, create a forecasted income statement on the worksheet Q2_Pro-forma IS for 2022.

Assume that: 1) Each income statement item remains in the same proportion as in 2021.

2) The forecasted sales for 2022 are $9,000,000.

3) Fixed expenses and interest expense will not change for 2022.

4) Changes in depreciation expenses are proportional to changes in sales for 2022.

5) The tax rate and the number of shares outstanding for 2022 are the same as those in 2021

Income statement created in Question one:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started