- Based on the information below, and assuming a range of 11-13% WACC and 3-5% terminal value growth rate, what is the range of values for Saito Solar?

- Strategically, do you think Mr. Saito and his partners should sell the firm at this time?

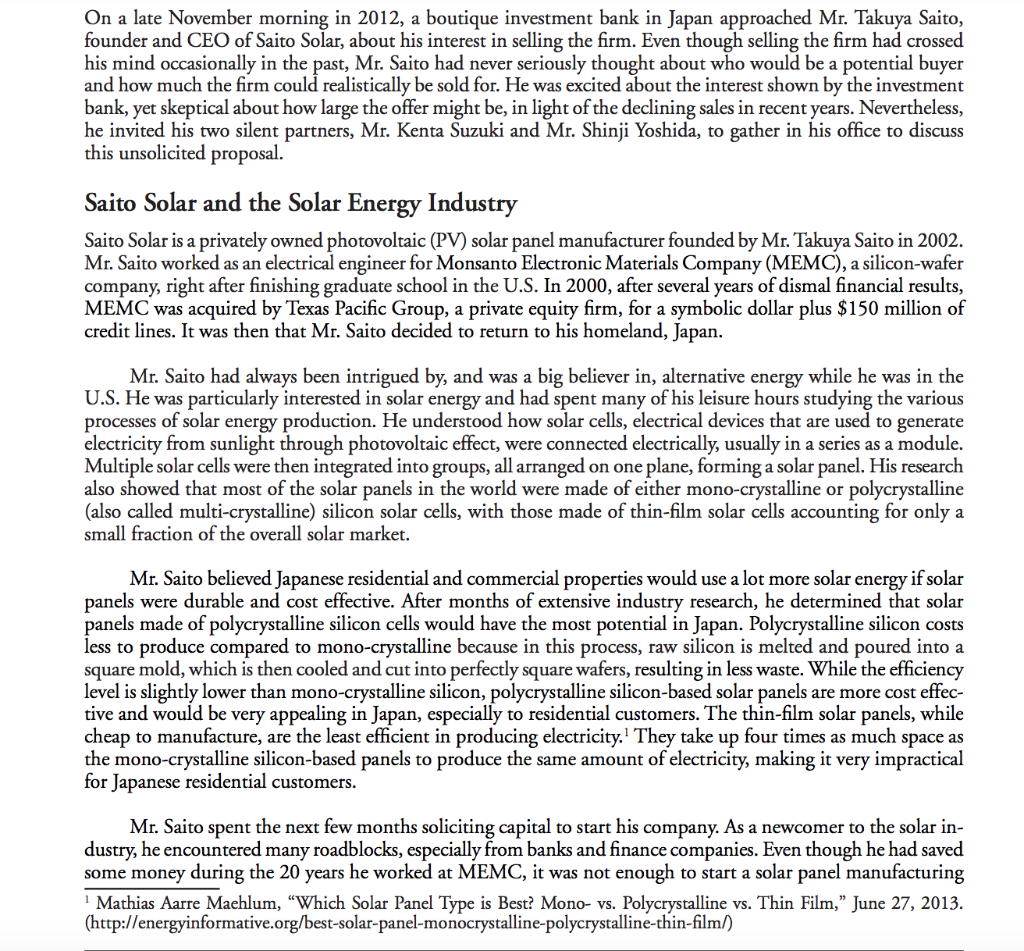

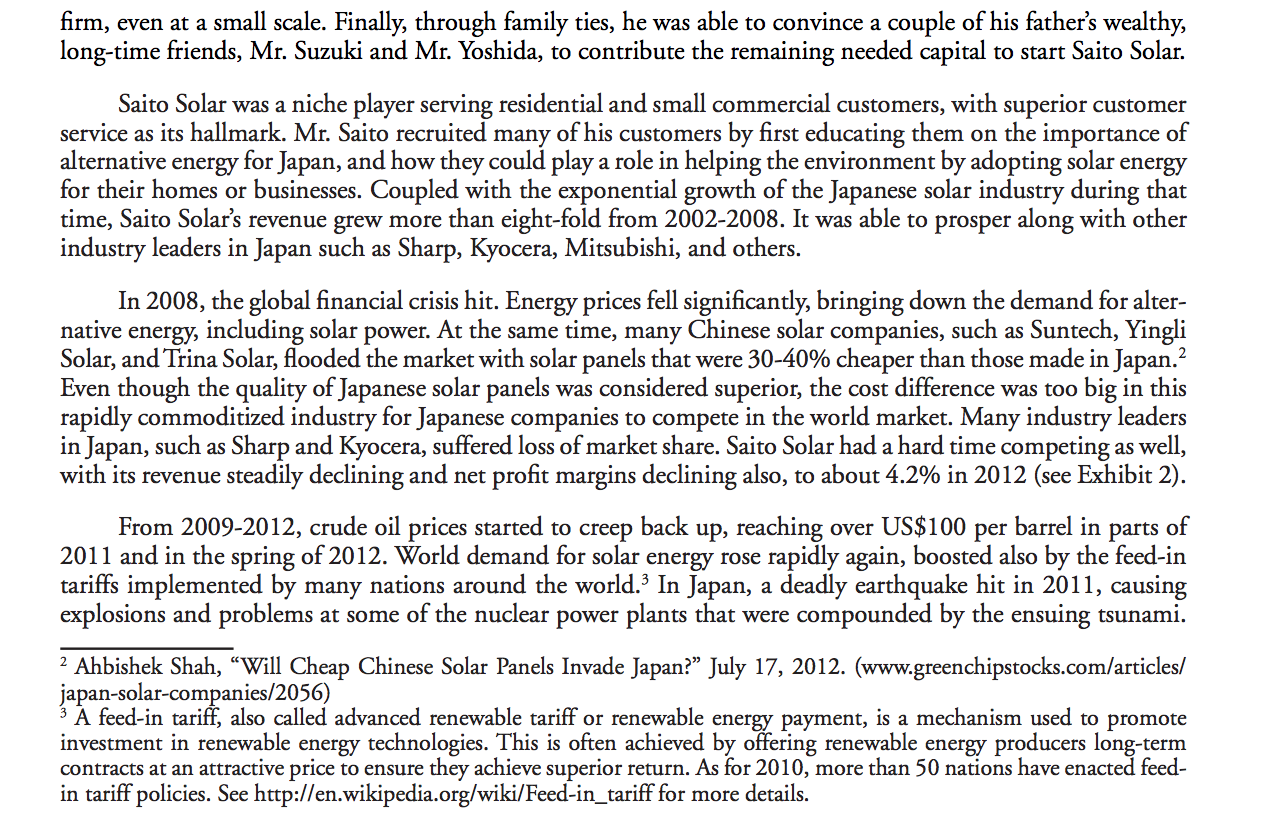

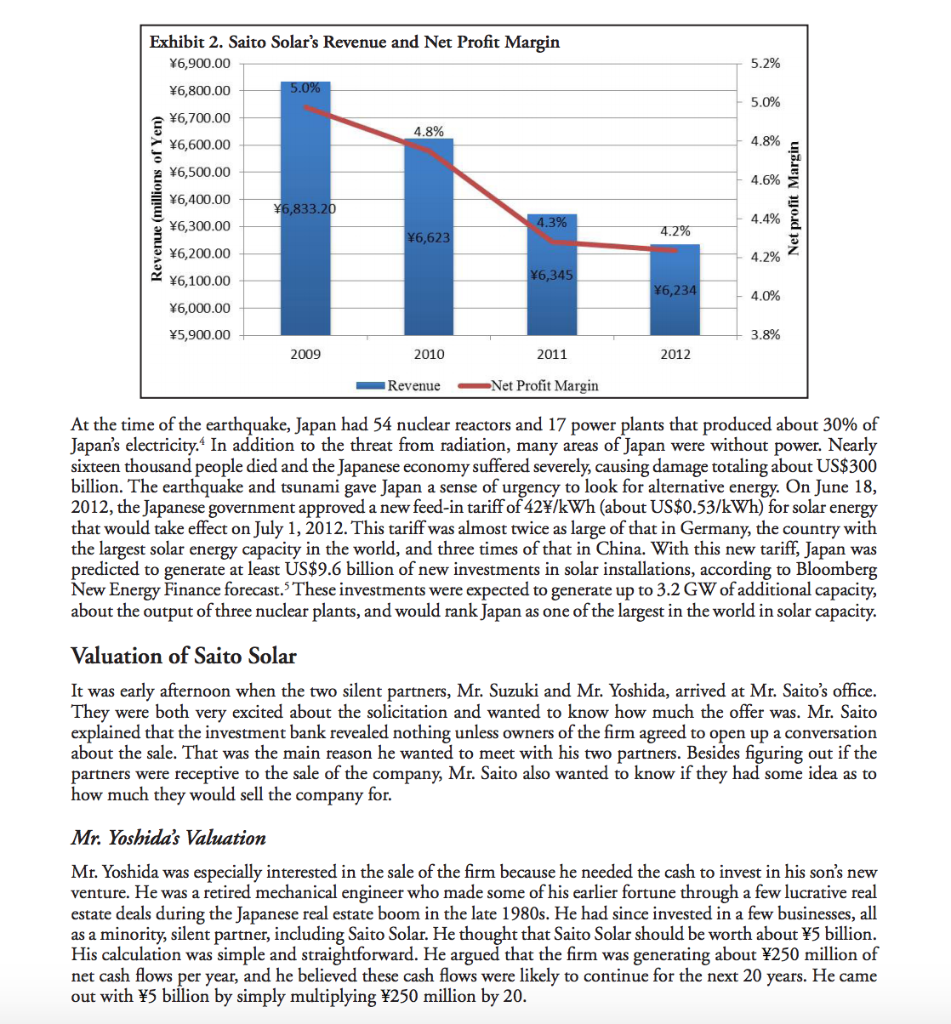

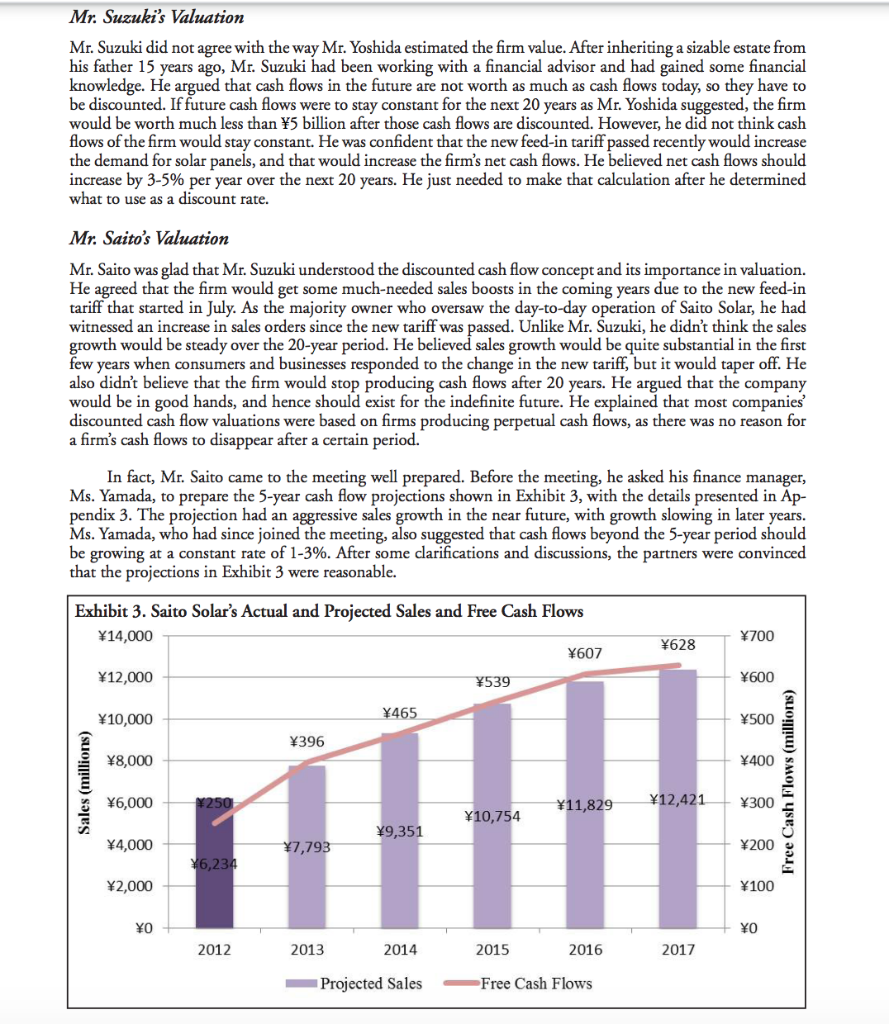

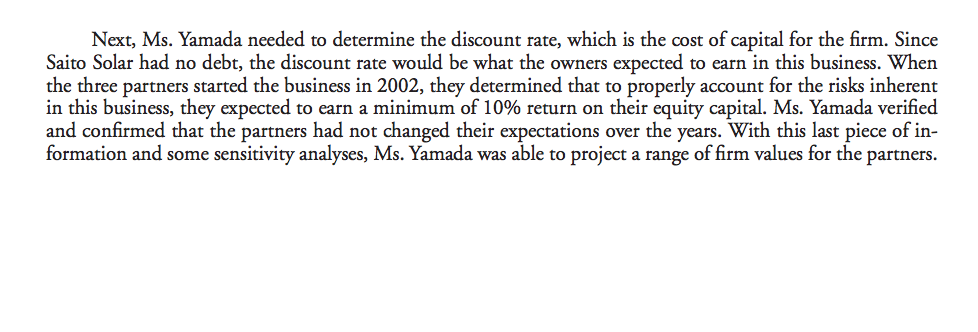

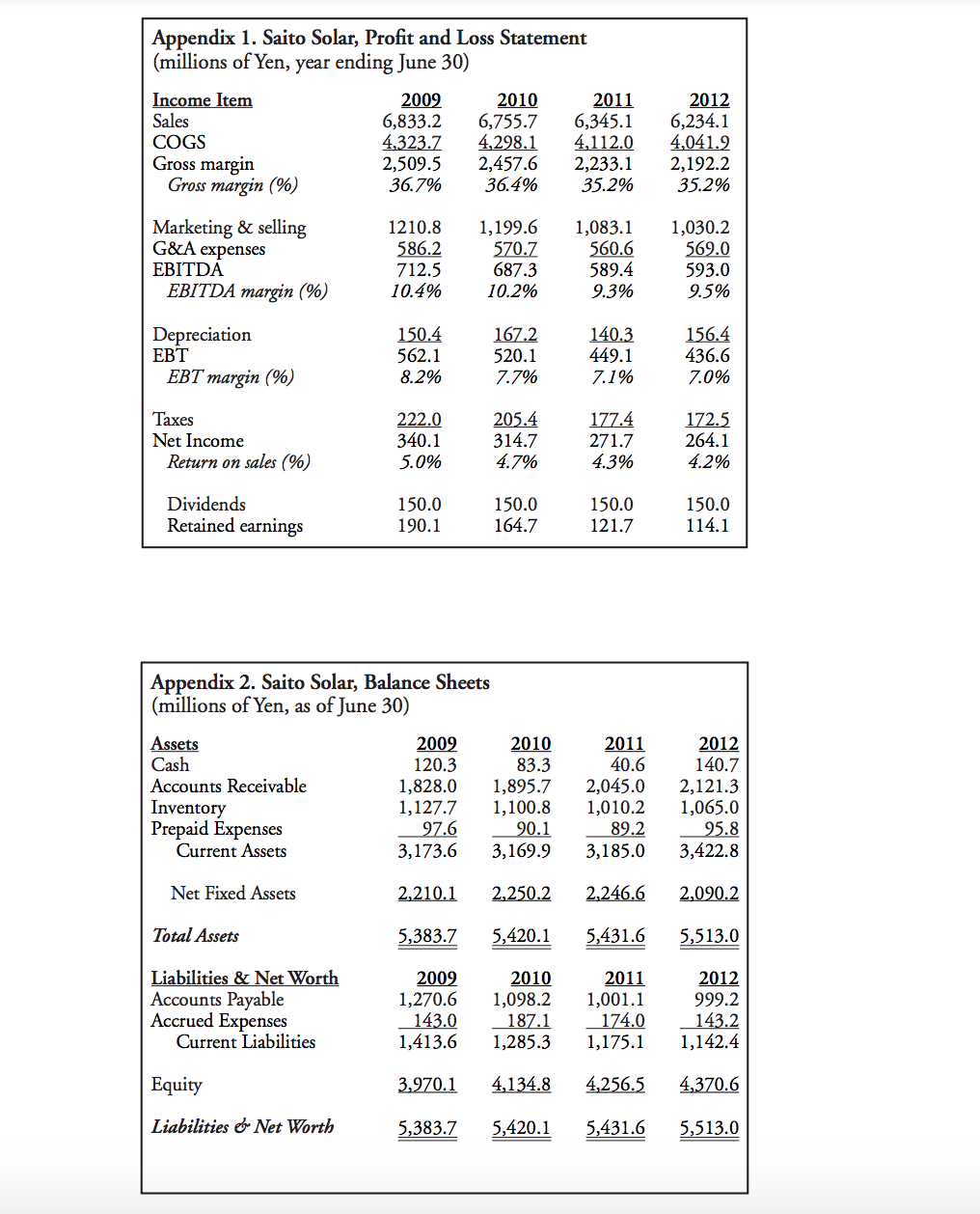

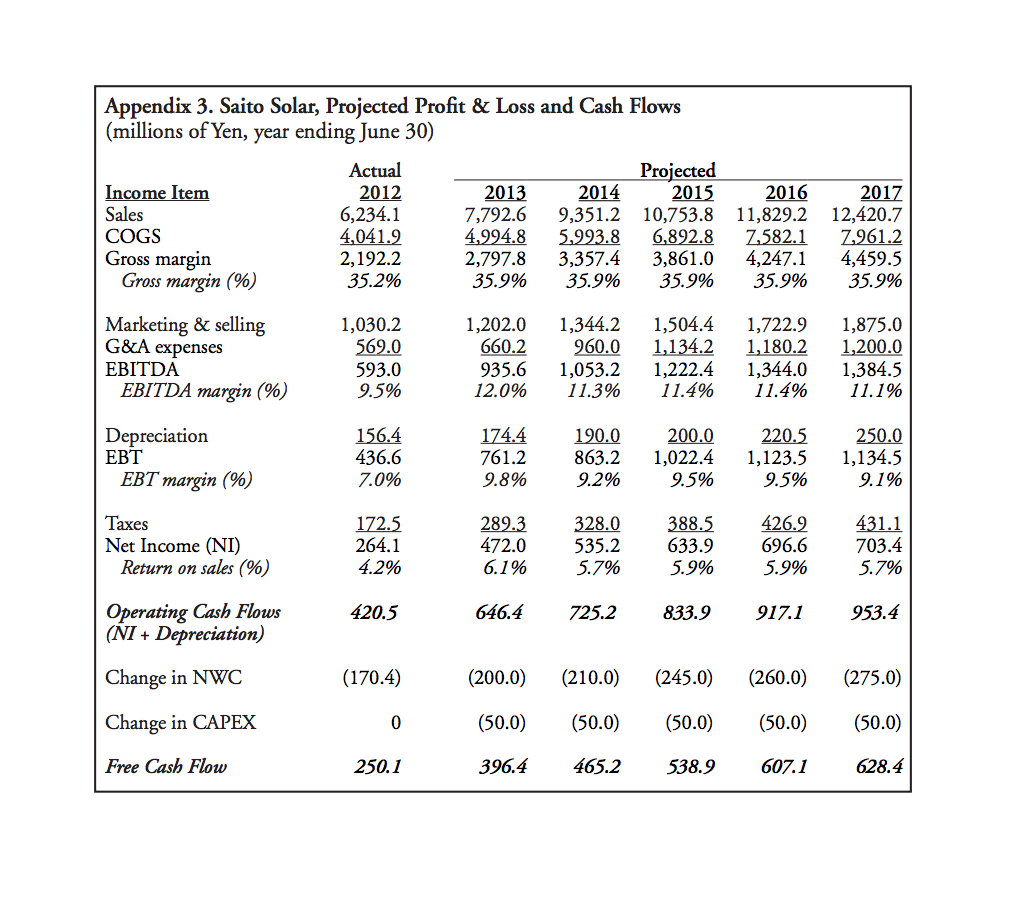

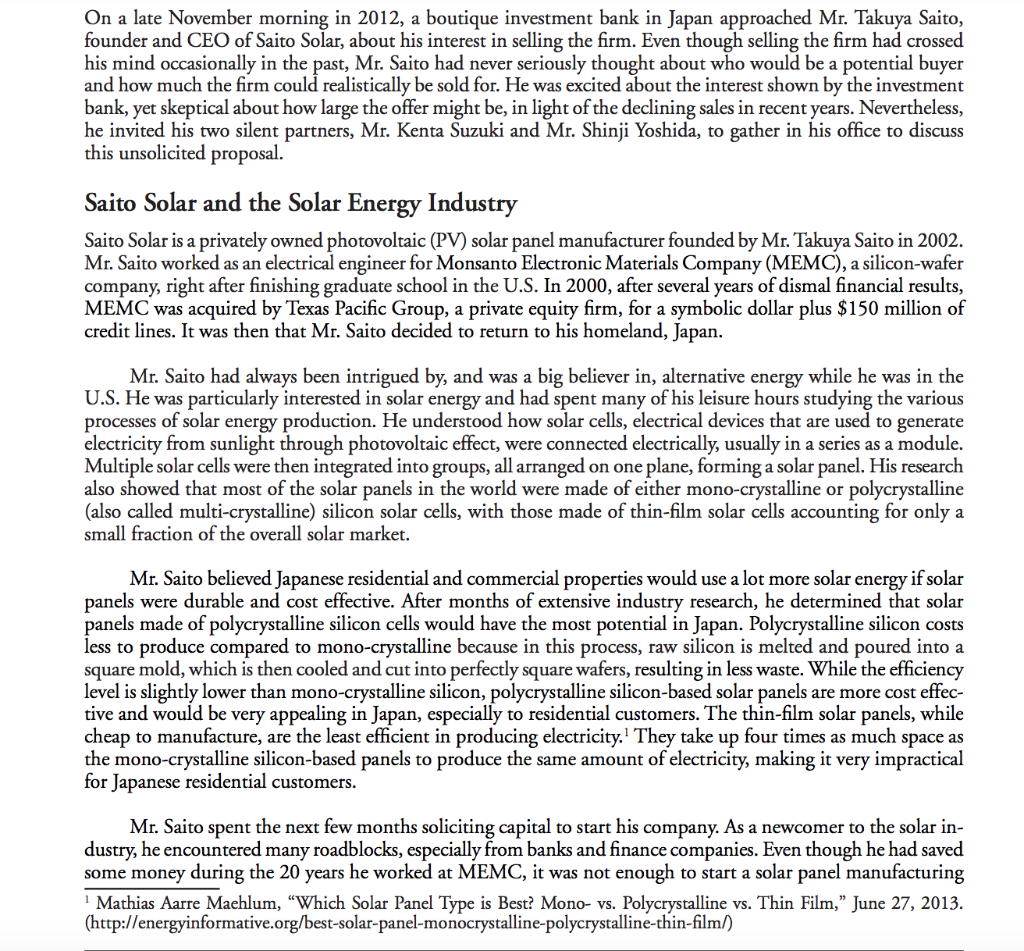

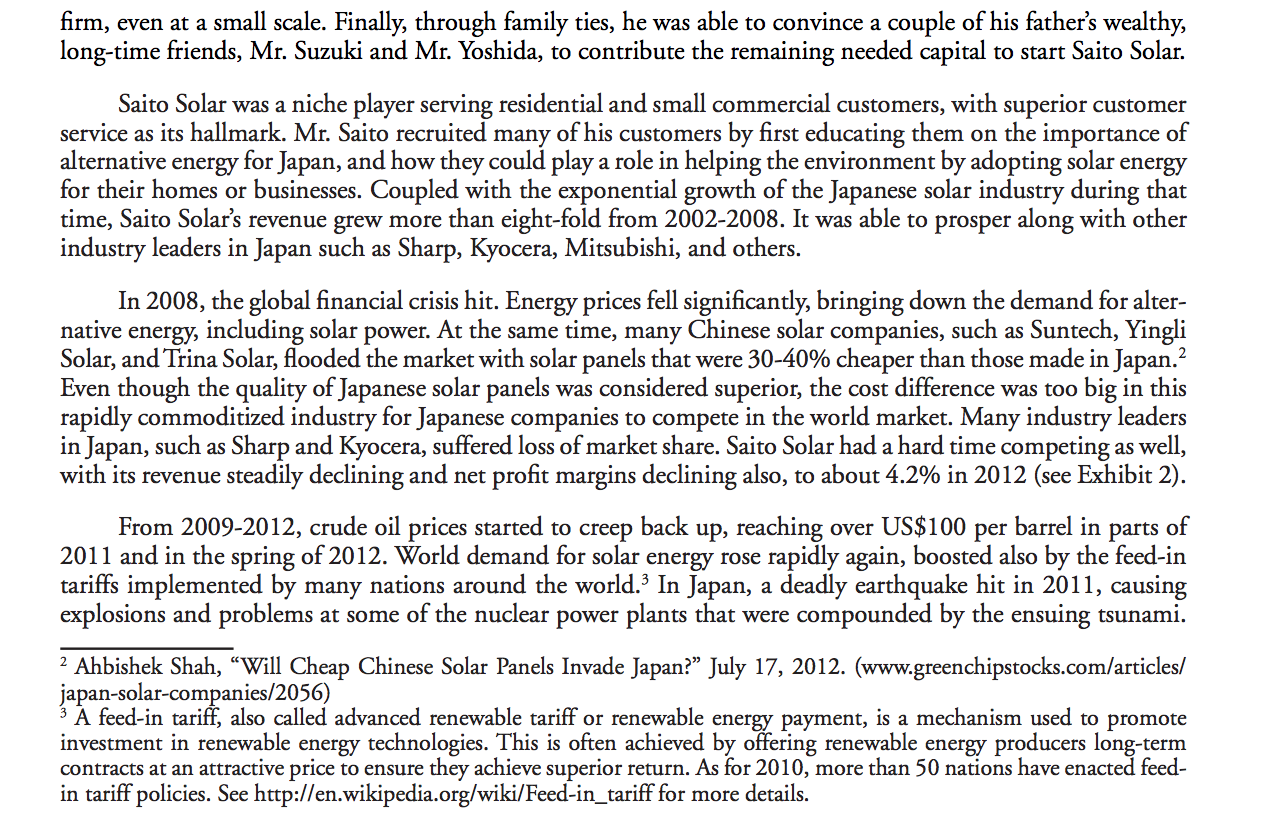

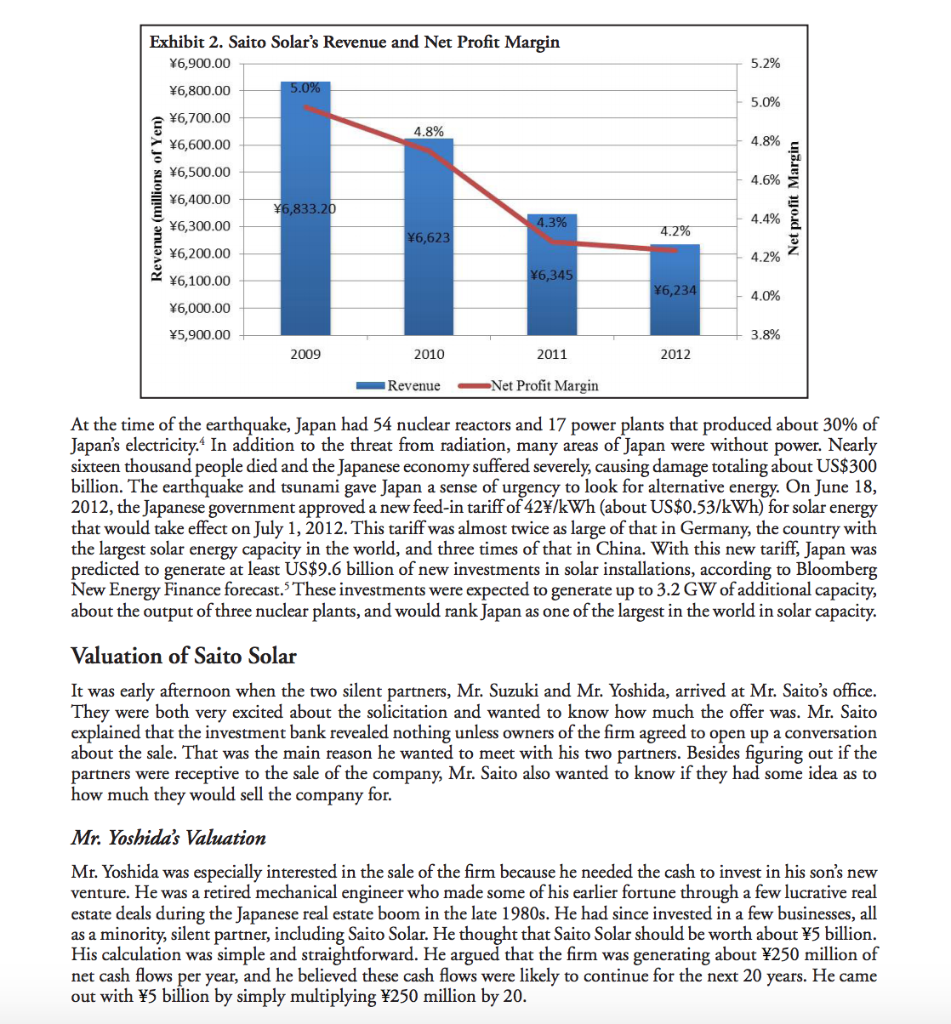

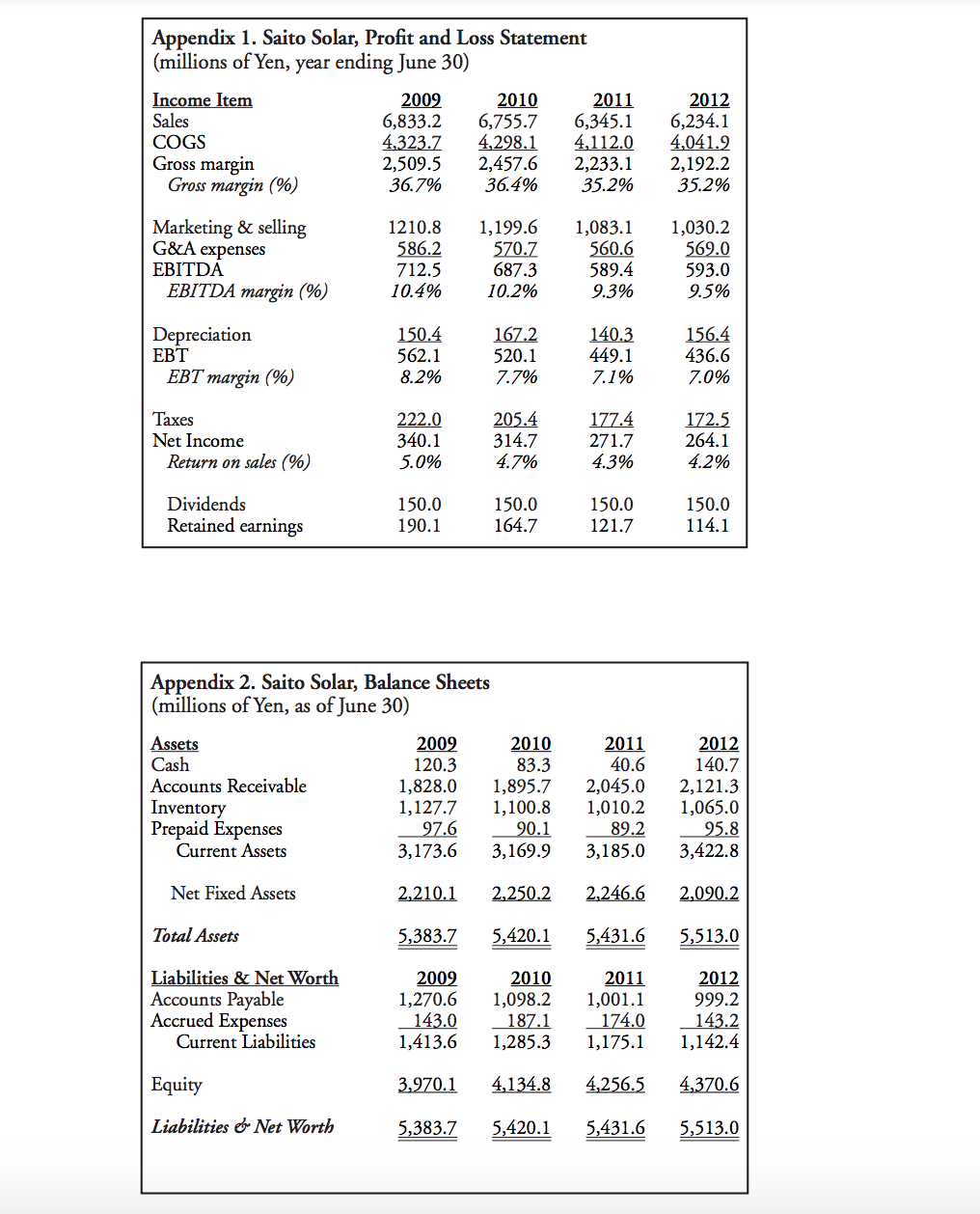

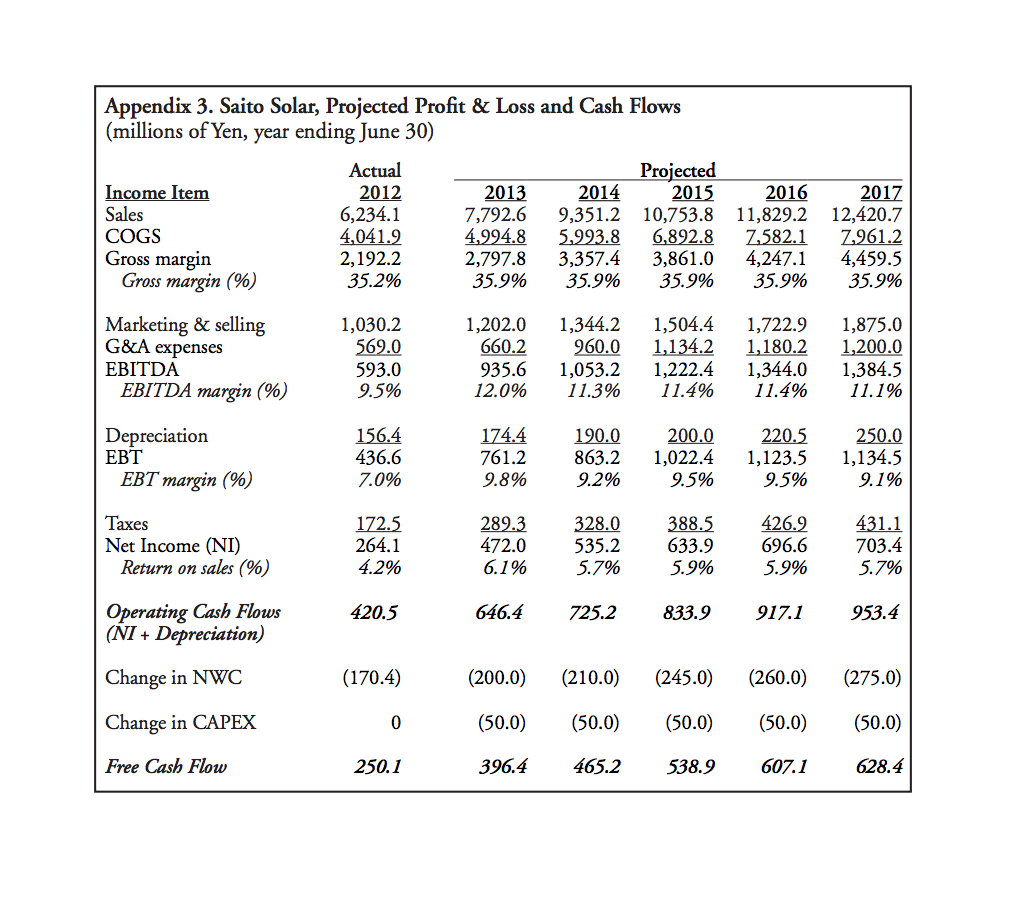

On a late November morning in 2012, a boutique investment bank in Japan approached Mr. Takuya Saito, founder and CEO of Saito Solar, about his interest in selling the firm. Even though selling the firm had crossed his mind occasionally in the past, Mr. Saito had never seriously thought about who would be a potential buyer and how much the firm could realistically be sold for. He was excited about the interest shown by the investment bank, yet skeptical about how large the offer might be, in light of the declining sales in recent years. Nevertheless, he invited his two silent partners, Mr. Kenta Suzuki and Mr. Shinji Yoshida, to gather in his office to discuss this unsolicited proposal. Saito Solar and the Solar Energy Industry Saito Solar is a privately owned photovoltaic (PV) solar panel manufacturer founded by Mr. Takuya Saito in 2002. Mr. Saito worked as an electrical engineer for Monsanto Electronic Materials Company (MEMC), a silicon-wafer company, right after finishing graduate school in the U.S. In 2000, after several years of dismal financial results, MEMC was acquired by Texas Pacific Group, a private equity firm, for a symbolic dollar plus $ 150 million of credit lines. It was then that Mr. Saito decided to return to his homeland, Japan. Mr. Saito had always been intrigued by, and was a big believer in, alternative energy while he was in the U.S. He was particularly interested in solar energy and had spent many of his leisure hours studying the various processes of solar energy production. He understood how solar cells, electrical devices that are used to generate electricity from sunlight through photovoltaic effect, were connected electrically, usually in a series as a module. Multiple solar cells were then integrated into groups, all arranged on one plane, forming a solar panel. His research also showed that most of the solar panels in the world were made of either mono-crystalline or polycrystalline (also called multi-crystalline) silicon solar cells, with those made of thin-film solar cells accounting for only a small fraction of the overall solar market. Mr. Saito believed Japanese residential and commercial properties would use a lot more solar energy if solar panels were durable and cost effective. After months of extensive industry research, he determined that solar panels made of polycrystalline silicon cells would have the most potential in Japan. Polycrystalline silicon costs less to produce compared to mono-crystalline because in this process, raw silicon is melted and poured into a square mold, which is then cooled and cut into perfectly square wafers, resulting in less waste. While the efficiency level is slightly lower than mono-crystalline silicon, polycrystalline silicon-based solar panels are more cost effec- tive and would be very appealing in Japan, especially to residential customers. The thin-film solar panels, while cheap to manufacture, are the least efficient in producing electricity. They take up four times as much space as the mono-crystalline silicon-based panels to produce the same amount of electricity, making it very impractical for Japanese residential customers. Mr. Saito spent the next few months soliciting capital to start his company. As a newcomer to the solar in- dustry, he encountered many roadblocks, especially from banks and finance companies. Even though he had saved some money during the 20 years he worked at MEMC, it was not enough to start a solar panel manufacturing Mathias Aarre Maehlum, Which Solar Panel Type is Best? Mono- vs. Polycrystalline vs. Thin Film, June 27, 2013. (http://energyinformative.org/best-solar-panel-monocrystalline-polycrystalline-thin-film/) firm, even at a small scale. Finally, through family ties, he was able to convince a couple of his father's wealthy, long-time friends, Mr. Suzuki and Mr. Yoshida, to contribute the remaining needed capital to start Saito Solar. Saito Solar was a niche player serving residential and small commercial customers, with superior customer service as its hallmark. Mr. Saito recruited many of his customers by first educating them on the importance of alternative energy for Japan, and how they could play a role in helping the environment by adopting solar energy for their homes or businesses. Coupled with the exponential growth of the Japanese solar industry during that time, Saito Solar's revenue grew more than eight-fold from 2002-2008. It was able to prosper along with other industry leaders in Japan such as Sharp, Kyocera, Mitsubishi, and others. In 2008, the global financial crisis hit. Energy prices fell significantly, bringing down the demand for alter- native energy, including solar power. At the same time, many Chinese solar companies, such as Suntech, Yingli Solar, and Trina Solar, flooded the market with solar panels that were 30-40% cheaper than those made in Japan.? Even though the quality of Japanese solar panels was considered superior, the cost difference was too big in this rapidly commoditized industry for Japanese companies to compete in the world market. Many industry leaders in Japan, such as Sharp and Kyocera, suffered loss of market share. Saito Solar had a hard time competing as well, with its revenue steadily declining and net profit margins declining also, to about 4.2% in 2012 (see Exhibit 2). From 2009-2012, crude oil prices started to creep back up, reaching over US$100 per barrel in parts of 2011 and in the spring of 2012. World demand for solar energy rose rapidly again, boosted also by the feed-in tariffs implemented by many nations around the world. In Japan, a deadly earthquake hit in 2011, causing explosions and problems at some of the nuclear power plants that were compounded by the ensuing tsunami. 2 Ahbishek Shah, Will Cheap Chinese Solar Panels Invade Japan? July 17, 2012. (www.greenchipstocks.com/articles/ japan-solar-companies/2056) 3 A feed-in tariff, also called advanced renewable tariff or renewable energy payment, is a mechanism used to promote investment in renewable energy technologies. This is often achieved by offering renewable energy producers long-term contracts at an attractive price to ensure they achieve superior return. As for 2010, more than 50 nations have enacted feed- in tariff policies. See http://en.wikipedia.org/wiki/Feed-in_tariff for more details. 5.2% Exhibit 2. Saito Solar's Revenue and Net Profit Margin 6,900.00 6,800.00 5.0% 6,700.00 4.8% 6,600.00 5.0% 4.8% 4.6% Revenue (millions of Yen) 6,500.00 6,400.00 6,300.00 Net profit Margin 6,833.20 4.3% 4.4% 6,623 4.2% 6,200.00 4.2% 6,100.00 6,345 6,234 4.0% 6,000.00 5,900.00 3.8% 2009 2010 2011 2012 Revenue Net Profit Margin At the time of the earthquake, Japan had 54 nuclear reactors and 17 power plants that produced about 30% of Japan's electricity. In addition to the threat from radiation, many areas of Japan were without power. Nearly sixteen thousand people died and the Japanese economy suffered severely, causing damage totaling about US$300 billion. The earthquake and tsunami gave Japan a sense of urgency to look for alternative energy. On June 18, 2012, the Japanese government approved a new feed-in tariff of 42/kWh (about US$0.53/kWh) for solar energy that would take effect on July 1, 2012. This tariff was almost twice as large of that in Germany, the country with the largest solar energy capacity in the world, and three times of that in China. With this new tariff, Japan was predicted to generate at least US$9.6 billion of new investments in solar installations, according to Bloomberg New Energy Finance forecast. These investments were expected to generate up to 3.2 GW of additional capacity, about the output of three nuclear plants, and would rank Japan as one of the largest in the world in solar capacity. Valuation of Saito Solar It was early afternoon when the two silent partners, Mr. Suzuki and Mr. Yoshida, arrived at Mr. Saito's office. They were both very excited about the solicitation and wanted to know how much the offer was. Mr. Saito explained that the investment bank revealed nothing unless owners of the firm agreed to open up a conversation about the sale. That was the main reason he wanted to meet with his two partners. Besides figuring out if the partners were receptive to the sale of the company, Mr. Saito also wanted to know if they had some idea as to how much they would sell the company for. Mr. Yoshida's Valuation Mr. Yoshida was especially interested in the sale of the firm because he needed the cash to invest in his son's new venture. He was a retired mechanical engineer who made some of his earlier fortune through a few lucrative real estate deals during the Japanese real estate boom in the late 1980s. He had since invested in a few businesses, all as a minority, silent partner , including Saito Solar. He thought that Saito Solar should be worth about 5 billion. His calculation was simple and straightforward. He argued that the firm was generating about 250 million of net cash flows per year, and he believed these cash flows were likely to continue for the next 20 years. He came out with 5 bilion by simply multiplying 250 million by 20. Mr. Suzuki's Valuation Mr. Suzuki did not agree with the way Mr. Yoshida estimated the firm value. After inheriting a sizable estate from his father 15 years ago, Mr. Suzuki had been working with a financial advisor and had gained some financial knowledge. He argued that cash flows in the future are not worth as much as cash flows today, so they have to be discounted. If future cash flows were to stay constant for the next 20 years as Mr. Yoshida suggested, the firm would be worth much less than 5 billion after those cash flows are discounted. However, he did not think cash flows of the firm would stay constant. He was confident that the new feed-in tariff passed recently would increase the demand for solar panels, and that would increase the firm's net cash flows. He believed net cash flows should increase by 3-5% per year over the next 20 years. He just needed to make that calculation after he determined what to use as a discount rate. Mr. Saito's Valuation Mr. Saito was glad that Mr. Suzuki understood the discounted cash flow concept and its importance in valuation. He agreed that the firm would get some much-needed sales boosts in the coming years due to the new feed-in tariff that started in July. As the majority owner who oversaw the day-to-day operation of Saito Solar, he had witnessed an increase in sales orders since the new tariff was passed. Unlike Mr. Suzuki, he didn't think the sales growth would be steady over the 20-year period. He believed sales growth would be quite substantial in the first few years when consumers and businesses responded to the change in the new tariff, but it would taper off. He also didn't believe that the firm would stop producing cash flows after 20 years. He argued that the company would be in good hands, and hence should exist for the indefinite future. He explained that most companies discounted cash flow valuations were based on firms producing perpetual cash flows, as there was no reason for a firm's cash flows to disappear after a certain period. In fact, Mr. Saito came to the meeting well prepared. Before the meeting, he asked his finance manager, Ms. Yamada, to prepare the 5-year cash flow projections shown in Exhibit 3, with the details presented in Ap- pendix 3. The projection had an aggressive sales growth in the near future, with growth slowing in later years. Ms. Yamada, who had since joined the meeting, also suggested that cash flows beyond the 5-year period should be growing at a constant rate of 1-3%. After some clarifications and discussions, the partners were convinced that the projections in Exhibit 3 were reasonable. 700 Exhibit 3. Saito Solar's Actual and Projected Sales and Free Cash Flows 14,000 607 12,000 539 628 600 465 10,000 500 396 8,000 400 Sales (millions) Free Cash Flows (millions) 6,000 250 11,829 12,421 300 10,754 9,351 4,000 7,793 200 6,234 2,000 100 0 0 2012 2013 2014 2015 2016 2017 Projected Sales Free Cash Flows Next, Ms. Yamada needed to determine the discount rate, which is the cost of capital for the firm. Since Saito Solar had no debt, the discount rate would be what the owners expected to earn in this business. When the three partners started the business in 2002, they determined that to properly account for the risks inherent in this business, they expected to earn a minimum of 10% return on their equity capital. Ms. Yamada verified and confirmed that the partners had not changed their expectations over the years. With this last piece of in- formation and some sensitivity analyses, Ms. Yamada was able to project a range of firm values for the partners. Appendix 1. Saito Solar, Profit and Loss Statement (millions of Yen, year ending June 30) Income Item 2009 2010 2011 Sales 6,833.2 6,755.7 6,345.1 COGS 4,323.7 4,298.1 4,112.0 Gross margin 2,509.5 2,457.6 2,233.1 Gross margin (%) 36.7% 36.4% 35.2% 2012 6,234.1 4,041.9 2,192.2 35.2% Marketing & selling G&A expenses EBITDA EBITDA margin (%) 1210.8 586.2 712.5 10.4% 1,199.6 570.7 687.3 10.2% 1,083.1 560.6 589.4 9.3% 1,030.2 569.0 593.0 9.5% Depreciation EBT EBT margin (%) 150.4 562.1 8.2% 167.2 520.1 7.7% 140.3 449.1 7.1% 156.4 436.6 7.0% Taxes Net Income Return on sales (%) 222.0 340.1 5.0% 205.4 314.7 4.7% 177.4 271.7 4.3% 172.5 264.1 4.2% Dividends Retained earnings 150.0 190.1 150.0 164.7 150.0 121.7 150.0 114.1 Appendix 2. Saito Solar, Balance Sheets (millions of Yen, as of June 30) Assets Cash Accounts Receivable Inventory Prepaid Expenses Current Assets 2009 120.3 1,828.0 1,127.7 97.6 3,173.6 2010 83.3 1,895.7 1,100.8 90.1 3,169.9 2011 40.6 2,045.0 1,010.2 89.2 3,185.0 2012 140.7 2,121.3 1,065.0 95.8 3,422.8 Net Fixed Assets 2,210.1 2,250.2 2.246.6 2,090.2 Total Assets 5,383.7 5,420.1 5,431.6 5,513.0 2012 Liabilities & Net Worth Accounts Payable Accrued Expenses Current Liabilities 2009 1,270.6 143.0 1,413.6 2010 1,098.2 187.1 1,285.3 2011 1,001.1 174.0 1,175.1 999.2 143.2 1,142.4 Equity 3,970.1 4,134.8 4,256.5 4,370.6 Liabilities & Net Worth 5,383.7 5,420.1 5,431.6 5,513.0 Appendix 3. Saito Solar, Projected Profit & Loss and Cash Flows (millions of Yen, year ending June 30) Actual Projected Income Item 2012 2013 2014 2015 Sales 6,234.1 7,792.6 9,351.2 10,753.8 COGS 4,041.9 4,994.8 5.993.8 6,892.8 Gross margin 2,192.2 2,797.8 3,357.4 3,861.0 Gross margin (%) 35.2% 35.9% 35.9% 35.9% 2016 11,829.2 7.582.1 4,247.1 35.9% 2017 12,420.7 7,961.2 4,459.5 35.9% Marketing & selling G&A expenses EBITDA EBITDA margin (%) 1,030.2 569.0 593.0 9.5% 1,202.0 660.2 935.6 12.0% 1,344.2 960.0 1,053.2 11.3% 1,504.4 1,134.2 1,222.4 11.4% 1,722.9 1,180.2 1,344.0 11.4% 1,875.0 1,200.0 1,384.5 11.1% Depreciation EBT EBT margin (%) 156.4 436.6 7.0% 174.4 761.2 9.8% 190.0 863.2 9.2% 200.0 1,022.4 9.5% 220.5 1,123.5 9.5% 250.0 1,134.5 9.1% Taxes Net Income (NI) Return on sales (%) 172.5 264.1 289.3 472.0 6.1% 328.0 535.2 5.7% 388.5 633.9 5.9% 426.2 696.6 431.1 703.4 5.7% 4.2% 5.9% 420.5 646.4 725.2 833.9 917.1 953.4 Operating Cash Flows (NI + Depreciation) Change in NWC (170.4) (200.0) (210.0) (245.0) (260.0) (275.0) Change in CAPEX 0 (50.0) (50.0) (50.0) (50.0) (50.0) Free Cash Flow 250.1 396.4 465.2 538.9 607.1 628.4 Appendix 4. Discounting Future Cash Flows with Formulas A firm's free cash flows can be in a variety of patterns, ranging from a simple single future cash flow to a complex mixed stream of projected cash flows. Most, if not all, can be handled by one of the formulas below. Generic DCF Formula CF PV = *(1+r) PV = the present value of the cash flow stream CFt - the cash flow which occurs at the end of year t . 1 = the discount rate assumed to be constant over the project horizon) . t= the year, which ranges from one to n n = the last year in which a cash flow occurs denotes summation of the cash flows as t goes from 1 ton Note that discount rate, opportunity rate, required rate of return, interest rate, capitalization rate, and weighted average cost of capital (WACC) are terms used interchangeably by authors and practitioners. Fortunately, simpler versions (shortcuts) of the above formula exist, including: No Growth Perpetuity CF PV = where CF is the constant perpetual cash flow and r = the discount rate. Growing Perpetuity CF PV = r-g where CF, is the cash flow at the end of year one, r = the discount rate, and g = the growth rate. Regular Annuity 1 PV = CFC r r(1+r)' where CF represents the steady end-of-year cash flow, r = the discount rate, and T = the number of constant cash flows. The term in brackets is defined as an annuity factor, and facilitates more tedious algebraic computation. Growing Annuity PV = C r-g 1- 1+g 1+1 where r = the discount rate, g = the growth rate, and T = the number of cash flows. Note that the formula above is simply the PV of a growing perpetuity penalized by cash flows foregone. In all of these cases, cash flows are assumed to occur at the end of the year, and the formulas throughout represent discrete (vs. continuous) time versions of these cash flows. On a late November morning in 2012, a boutique investment bank in Japan approached Mr. Takuya Saito, founder and CEO of Saito Solar, about his interest in selling the firm. Even though selling the firm had crossed his mind occasionally in the past, Mr. Saito had never seriously thought about who would be a potential buyer and how much the firm could realistically be sold for. He was excited about the interest shown by the investment bank, yet skeptical about how large the offer might be, in light of the declining sales in recent years. Nevertheless, he invited his two silent partners, Mr. Kenta Suzuki and Mr. Shinji Yoshida, to gather in his office to discuss this unsolicited proposal. Saito Solar and the Solar Energy Industry Saito Solar is a privately owned photovoltaic (PV) solar panel manufacturer founded by Mr. Takuya Saito in 2002. Mr. Saito worked as an electrical engineer for Monsanto Electronic Materials Company (MEMC), a silicon-wafer company, right after finishing graduate school in the U.S. In 2000, after several years of dismal financial results, MEMC was acquired by Texas Pacific Group, a private equity firm, for a symbolic dollar plus $ 150 million of credit lines. It was then that Mr. Saito decided to return to his homeland, Japan. Mr. Saito had always been intrigued by, and was a big believer in, alternative energy while he was in the U.S. He was particularly interested in solar energy and had spent many of his leisure hours studying the various processes of solar energy production. He understood how solar cells, electrical devices that are used to generate electricity from sunlight through photovoltaic effect, were connected electrically, usually in a series as a module. Multiple solar cells were then integrated into groups, all arranged on one plane, forming a solar panel. His research also showed that most of the solar panels in the world were made of either mono-crystalline or polycrystalline (also called multi-crystalline) silicon solar cells, with those made of thin-film solar cells accounting for only a small fraction of the overall solar market. Mr. Saito believed Japanese residential and commercial properties would use a lot more solar energy if solar panels were durable and cost effective. After months of extensive industry research, he determined that solar panels made of polycrystalline silicon cells would have the most potential in Japan. Polycrystalline silicon costs less to produce compared to mono-crystalline because in this process, raw silicon is melted and poured into a square mold, which is then cooled and cut into perfectly square wafers, resulting in less waste. While the efficiency level is slightly lower than mono-crystalline silicon, polycrystalline silicon-based solar panels are more cost effec- tive and would be very appealing in Japan, especially to residential customers. The thin-film solar panels, while cheap to manufacture, are the least efficient in producing electricity. They take up four times as much space as the mono-crystalline silicon-based panels to produce the same amount of electricity, making it very impractical for Japanese residential customers. Mr. Saito spent the next few months soliciting capital to start his company. As a newcomer to the solar in- dustry, he encountered many roadblocks, especially from banks and finance companies. Even though he had saved some money during the 20 years he worked at MEMC, it was not enough to start a solar panel manufacturing Mathias Aarre Maehlum, Which Solar Panel Type is Best? Mono- vs. Polycrystalline vs. Thin Film, June 27, 2013. (http://energyinformative.org/best-solar-panel-monocrystalline-polycrystalline-thin-film/) firm, even at a small scale. Finally, through family ties, he was able to convince a couple of his father's wealthy, long-time friends, Mr. Suzuki and Mr. Yoshida, to contribute the remaining needed capital to start Saito Solar. Saito Solar was a niche player serving residential and small commercial customers, with superior customer service as its hallmark. Mr. Saito recruited many of his customers by first educating them on the importance of alternative energy for Japan, and how they could play a role in helping the environment by adopting solar energy for their homes or businesses. Coupled with the exponential growth of the Japanese solar industry during that time, Saito Solar's revenue grew more than eight-fold from 2002-2008. It was able to prosper along with other industry leaders in Japan such as Sharp, Kyocera, Mitsubishi, and others. In 2008, the global financial crisis hit. Energy prices fell significantly, bringing down the demand for alter- native energy, including solar power. At the same time, many Chinese solar companies, such as Suntech, Yingli Solar, and Trina Solar, flooded the market with solar panels that were 30-40% cheaper than those made in Japan.? Even though the quality of Japanese solar panels was considered superior, the cost difference was too big in this rapidly commoditized industry for Japanese companies to compete in the world market. Many industry leaders in Japan, such as Sharp and Kyocera, suffered loss of market share. Saito Solar had a hard time competing as well, with its revenue steadily declining and net profit margins declining also, to about 4.2% in 2012 (see Exhibit 2). From 2009-2012, crude oil prices started to creep back up, reaching over US$100 per barrel in parts of 2011 and in the spring of 2012. World demand for solar energy rose rapidly again, boosted also by the feed-in tariffs implemented by many nations around the world. In Japan, a deadly earthquake hit in 2011, causing explosions and problems at some of the nuclear power plants that were compounded by the ensuing tsunami. 2 Ahbishek Shah, Will Cheap Chinese Solar Panels Invade Japan? July 17, 2012. (www.greenchipstocks.com/articles/ japan-solar-companies/2056) 3 A feed-in tariff, also called advanced renewable tariff or renewable energy payment, is a mechanism used to promote investment in renewable energy technologies. This is often achieved by offering renewable energy producers long-term contracts at an attractive price to ensure they achieve superior return. As for 2010, more than 50 nations have enacted feed- in tariff policies. See http://en.wikipedia.org/wiki/Feed-in_tariff for more details. 5.2% Exhibit 2. Saito Solar's Revenue and Net Profit Margin 6,900.00 6,800.00 5.0% 6,700.00 4.8% 6,600.00 5.0% 4.8% 4.6% Revenue (millions of Yen) 6,500.00 6,400.00 6,300.00 Net profit Margin 6,833.20 4.3% 4.4% 6,623 4.2% 6,200.00 4.2% 6,100.00 6,345 6,234 4.0% 6,000.00 5,900.00 3.8% 2009 2010 2011 2012 Revenue Net Profit Margin At the time of the earthquake, Japan had 54 nuclear reactors and 17 power plants that produced about 30% of Japan's electricity. In addition to the threat from radiation, many areas of Japan were without power. Nearly sixteen thousand people died and the Japanese economy suffered severely, causing damage totaling about US$300 billion. The earthquake and tsunami gave Japan a sense of urgency to look for alternative energy. On June 18, 2012, the Japanese government approved a new feed-in tariff of 42/kWh (about US$0.53/kWh) for solar energy that would take effect on July 1, 2012. This tariff was almost twice as large of that in Germany, the country with the largest solar energy capacity in the world, and three times of that in China. With this new tariff, Japan was predicted to generate at least US$9.6 billion of new investments in solar installations, according to Bloomberg New Energy Finance forecast. These investments were expected to generate up to 3.2 GW of additional capacity, about the output of three nuclear plants, and would rank Japan as one of the largest in the world in solar capacity. Valuation of Saito Solar It was early afternoon when the two silent partners, Mr. Suzuki and Mr. Yoshida, arrived at Mr. Saito's office. They were both very excited about the solicitation and wanted to know how much the offer was. Mr. Saito explained that the investment bank revealed nothing unless owners of the firm agreed to open up a conversation about the sale. That was the main reason he wanted to meet with his two partners. Besides figuring out if the partners were receptive to the sale of the company, Mr. Saito also wanted to know if they had some idea as to how much they would sell the company for. Mr. Yoshida's Valuation Mr. Yoshida was especially interested in the sale of the firm because he needed the cash to invest in his son's new venture. He was a retired mechanical engineer who made some of his earlier fortune through a few lucrative real estate deals during the Japanese real estate boom in the late 1980s. He had since invested in a few businesses, all as a minority, silent partner , including Saito Solar. He thought that Saito Solar should be worth about 5 billion. His calculation was simple and straightforward. He argued that the firm was generating about 250 million of net cash flows per year, and he believed these cash flows were likely to continue for the next 20 years. He came out with 5 bilion by simply multiplying 250 million by 20. Mr. Suzuki's Valuation Mr. Suzuki did not agree with the way Mr. Yoshida estimated the firm value. After inheriting a sizable estate from his father 15 years ago, Mr. Suzuki had been working with a financial advisor and had gained some financial knowledge. He argued that cash flows in the future are not worth as much as cash flows today, so they have to be discounted. If future cash flows were to stay constant for the next 20 years as Mr. Yoshida suggested, the firm would be worth much less than 5 billion after those cash flows are discounted. However, he did not think cash flows of the firm would stay constant. He was confident that the new feed-in tariff passed recently would increase the demand for solar panels, and that would increase the firm's net cash flows. He believed net cash flows should increase by 3-5% per year over the next 20 years. He just needed to make that calculation after he determined what to use as a discount rate. Mr. Saito's Valuation Mr. Saito was glad that Mr. Suzuki understood the discounted cash flow concept and its importance in valuation. He agreed that the firm would get some much-needed sales boosts in the coming years due to the new feed-in tariff that started in July. As the majority owner who oversaw the day-to-day operation of Saito Solar, he had witnessed an increase in sales orders since the new tariff was passed. Unlike Mr. Suzuki, he didn't think the sales growth would be steady over the 20-year period. He believed sales growth would be quite substantial in the first few years when consumers and businesses responded to the change in the new tariff, but it would taper off. He also didn't believe that the firm would stop producing cash flows after 20 years. He argued that the company would be in good hands, and hence should exist for the indefinite future. He explained that most companies discounted cash flow valuations were based on firms producing perpetual cash flows, as there was no reason for a firm's cash flows to disappear after a certain period. In fact, Mr. Saito came to the meeting well prepared. Before the meeting, he asked his finance manager, Ms. Yamada, to prepare the 5-year cash flow projections shown in Exhibit 3, with the details presented in Ap- pendix 3. The projection had an aggressive sales growth in the near future, with growth slowing in later years. Ms. Yamada, who had since joined the meeting, also suggested that cash flows beyond the 5-year period should be growing at a constant rate of 1-3%. After some clarifications and discussions, the partners were convinced that the projections in Exhibit 3 were reasonable. 700 Exhibit 3. Saito Solar's Actual and Projected Sales and Free Cash Flows 14,000 607 12,000 539 628 600 465 10,000 500 396 8,000 400 Sales (millions) Free Cash Flows (millions) 6,000 250 11,829 12,421 300 10,754 9,351 4,000 7,793 200 6,234 2,000 100 0 0 2012 2013 2014 2015 2016 2017 Projected Sales Free Cash Flows Next, Ms. Yamada needed to determine the discount rate, which is the cost of capital for the firm. Since Saito Solar had no debt, the discount rate would be what the owners expected to earn in this business. When the three partners started the business in 2002, they determined that to properly account for the risks inherent in this business, they expected to earn a minimum of 10% return on their equity capital. Ms. Yamada verified and confirmed that the partners had not changed their expectations over the years. With this last piece of in- formation and some sensitivity analyses, Ms. Yamada was able to project a range of firm values for the partners. Appendix 1. Saito Solar, Profit and Loss Statement (millions of Yen, year ending June 30) Income Item 2009 2010 2011 Sales 6,833.2 6,755.7 6,345.1 COGS 4,323.7 4,298.1 4,112.0 Gross margin 2,509.5 2,457.6 2,233.1 Gross margin (%) 36.7% 36.4% 35.2% 2012 6,234.1 4,041.9 2,192.2 35.2% Marketing & selling G&A expenses EBITDA EBITDA margin (%) 1210.8 586.2 712.5 10.4% 1,199.6 570.7 687.3 10.2% 1,083.1 560.6 589.4 9.3% 1,030.2 569.0 593.0 9.5% Depreciation EBT EBT margin (%) 150.4 562.1 8.2% 167.2 520.1 7.7% 140.3 449.1 7.1% 156.4 436.6 7.0% Taxes Net Income Return on sales (%) 222.0 340.1 5.0% 205.4 314.7 4.7% 177.4 271.7 4.3% 172.5 264.1 4.2% Dividends Retained earnings 150.0 190.1 150.0 164.7 150.0 121.7 150.0 114.1 Appendix 2. Saito Solar, Balance Sheets (millions of Yen, as of June 30) Assets Cash Accounts Receivable Inventory Prepaid Expenses Current Assets 2009 120.3 1,828.0 1,127.7 97.6 3,173.6 2010 83.3 1,895.7 1,100.8 90.1 3,169.9 2011 40.6 2,045.0 1,010.2 89.2 3,185.0 2012 140.7 2,121.3 1,065.0 95.8 3,422.8 Net Fixed Assets 2,210.1 2,250.2 2.246.6 2,090.2 Total Assets 5,383.7 5,420.1 5,431.6 5,513.0 2012 Liabilities & Net Worth Accounts Payable Accrued Expenses Current Liabilities 2009 1,270.6 143.0 1,413.6 2010 1,098.2 187.1 1,285.3 2011 1,001.1 174.0 1,175.1 999.2 143.2 1,142.4 Equity 3,970.1 4,134.8 4,256.5 4,370.6 Liabilities & Net Worth 5,383.7 5,420.1 5,431.6 5,513.0 Appendix 3. Saito Solar, Projected Profit & Loss and Cash Flows (millions of Yen, year ending June 30) Actual Projected Income Item 2012 2013 2014 2015 Sales 6,234.1 7,792.6 9,351.2 10,753.8 COGS 4,041.9 4,994.8 5.993.8 6,892.8 Gross margin 2,192.2 2,797.8 3,357.4 3,861.0 Gross margin (%) 35.2% 35.9% 35.9% 35.9% 2016 11,829.2 7.582.1 4,247.1 35.9% 2017 12,420.7 7,961.2 4,459.5 35.9% Marketing & selling G&A expenses EBITDA EBITDA margin (%) 1,030.2 569.0 593.0 9.5% 1,202.0 660.2 935.6 12.0% 1,344.2 960.0 1,053.2 11.3% 1,504.4 1,134.2 1,222.4 11.4% 1,722.9 1,180.2 1,344.0 11.4% 1,875.0 1,200.0 1,384.5 11.1% Depreciation EBT EBT margin (%) 156.4 436.6 7.0% 174.4 761.2 9.8% 190.0 863.2 9.2% 200.0 1,022.4 9.5% 220.5 1,123.5 9.5% 250.0 1,134.5 9.1% Taxes Net Income (NI) Return on sales (%) 172.5 264.1 289.3 472.0 6.1% 328.0 535.2 5.7% 388.5 633.9 5.9% 426.2 696.6 431.1 703.4 5.7% 4.2% 5.9% 420.5 646.4 725.2 833.9 917.1 953.4 Operating Cash Flows (NI + Depreciation) Change in NWC (170.4) (200.0) (210.0) (245.0) (260.0) (275.0) Change in CAPEX 0 (50.0) (50.0) (50.0) (50.0) (50.0) Free Cash Flow 250.1 396.4 465.2 538.9 607.1 628.4 Appendix 4. Discounting Future Cash Flows with Formulas A firm's free cash flows can be in a variety of patterns, ranging from a simple single future cash flow to a complex mixed stream of projected cash flows. Most, if not all, can be handled by one of the formulas below. Generic DCF Formula CF PV = *(1+r) PV = the present value of the cash flow stream CFt - the cash flow which occurs at the end of year t . 1 = the discount rate assumed to be constant over the project horizon) . t= the year, which ranges from one to n n = the last year in which a cash flow occurs denotes summation of the cash flows as t goes from 1 ton Note that discount rate, opportunity rate, required rate of return, interest rate, capitalization rate, and weighted average cost of capital (WACC) are terms used interchangeably by authors and practitioners. Fortunately, simpler versions (shortcuts) of the above formula exist, including: No Growth Perpetuity CF PV = where CF is the constant perpetual cash flow and r = the discount rate. Growing Perpetuity CF PV = r-g where CF, is the cash flow at the end of year one, r = the discount rate, and g = the growth rate. Regular Annuity 1 PV = CFC r r(1+r)' where CF represents the steady end-of-year cash flow, r = the discount rate, and T = the number of constant cash flows. The term in brackets is defined as an annuity factor, and facilitates more tedious algebraic computation. Growing Annuity PV = C r-g 1- 1+g 1+1 where r = the discount rate, g = the growth rate, and T = the number of cash flows. Note that the formula above is simply the PV of a growing perpetuity penalized by cash flows foregone. In all of these cases, cash flows are assumed to occur at the end of the year, and the formulas throughout represent discrete (vs. continuous) time versions of these cash flows