Based on the information below, what is the Total investment cost (including sub-components) using the formula:

The information required is in chronological order with all calculations required.

What is needed:

Question 7:

- calculate the Weighted Average Cost of Capital (mandates located on last photo)

- Definition of Internal Rate of Return + Show calculations

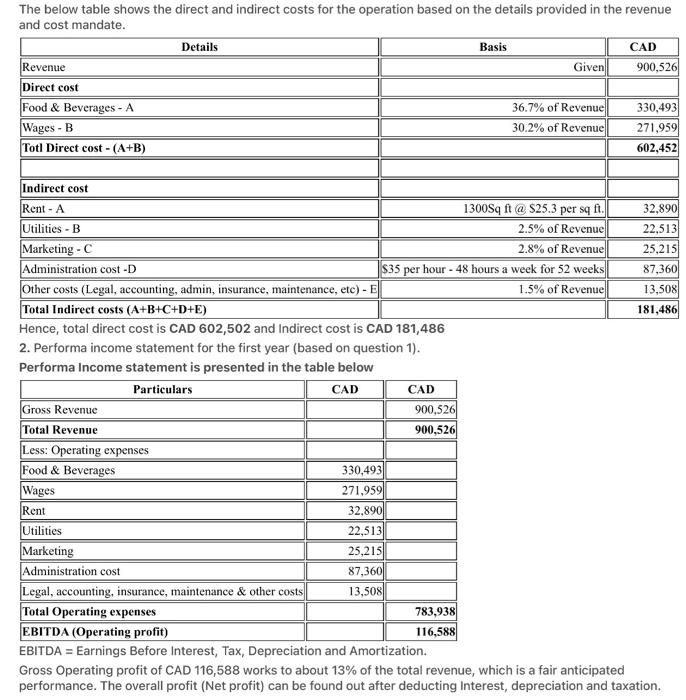

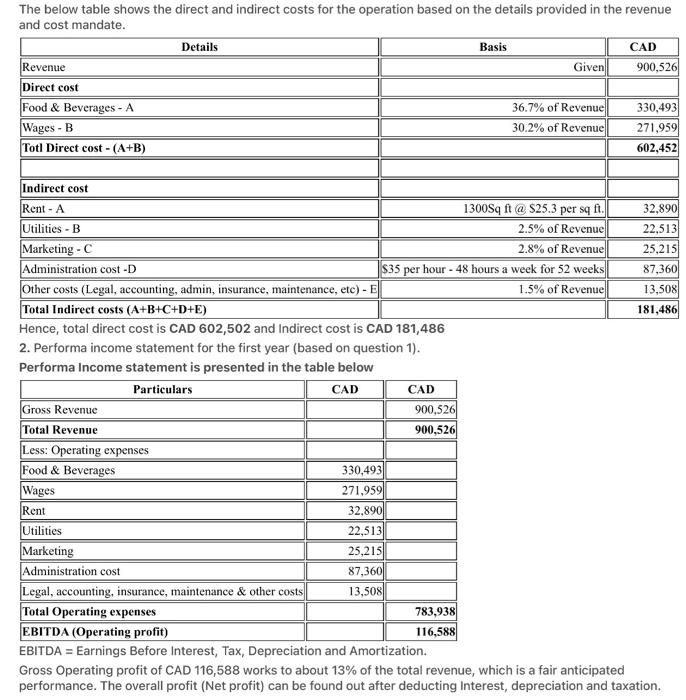

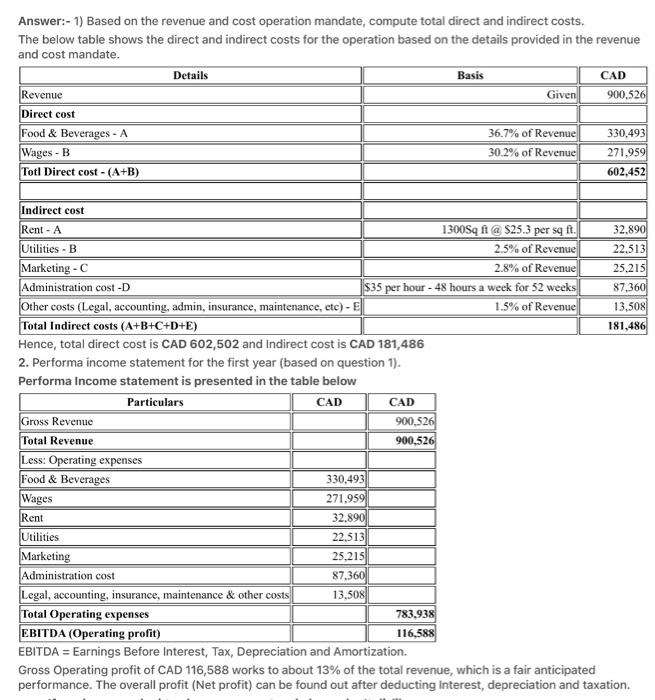

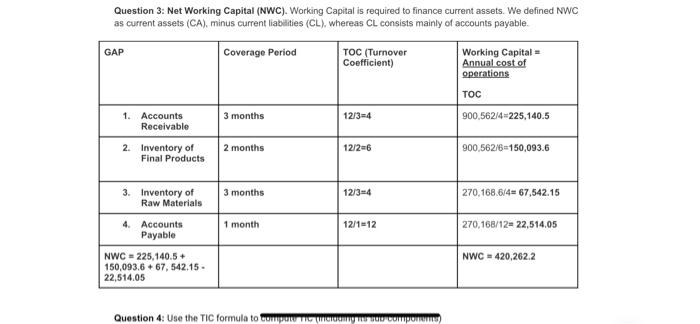

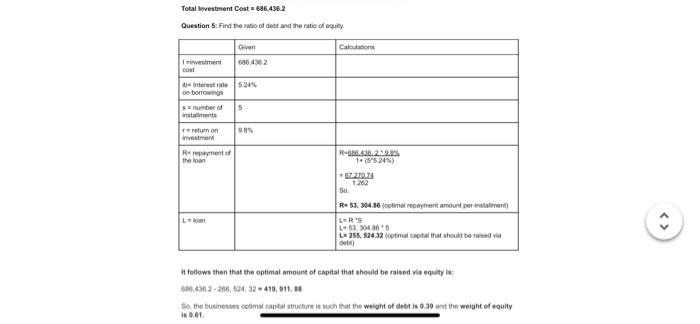

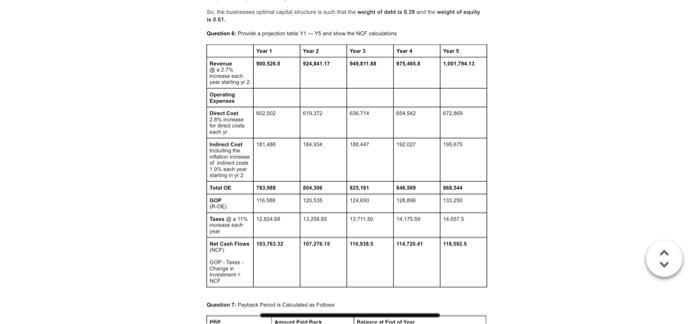

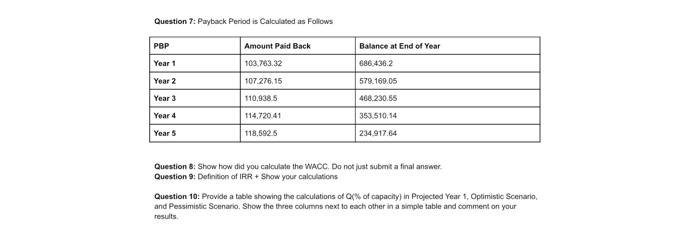

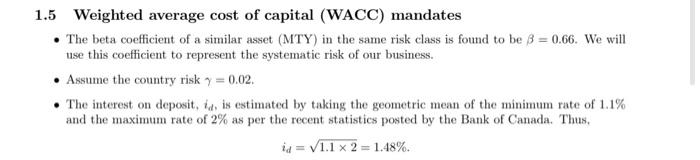

The below table shows the direct and indirect costs for the operation based on the details provided in the revenue and cost mandate. Details Basis CAD Revenue Given 900,526 Direct cost Food & Beverages - A 36.7% of Revenue 330,493 Wages - B 30.2% of Revenue 271,959 Totl Direct cost - (A+B) 602,452 Indirect cost Rent - A 1300Sq ft @ $25.3 per sq ft. 32,890 Utilities - B 2.5% of Revenue 22,513 Marketing - C 2.8% of Revenue 25,215 Administration cost -D $35 per hour - 48 hours a week for 52 weeks 87,360 Other costs (Legal, accounting, admin, insurance, maintenance, etc) - E 1.5% of Revenue 13,508 Total Indirect costs (A+B+C+D+E) 181,486 Hence, total direct cost is CAD 602,502 and Indirect cost is CAD 181,486 2. Performa income statement for the first year (based on question 1). Performa Income statement is presented in the table below Particulars CAD CAD Gross Revenue Total Revenue Less: Operating expenses Food & Beverages 330,493 Wages 271,959 Rent 32,890 Utilities 22,513 Marketing 25,215 Administration cost 87,360 Legal, accounting, insurance, maintenance & other costs 13,508 Total Operating expenses 783,938 116,588 EBITDA (Operating profit) EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization. Gross Operating profit of CAD 116,588 works to about 13% of the total revenue, which is a fair anticipated performance. The overall profit (Net profit) can be found out after deducting Interest, depreciation and taxation. 900,526 900,526 Answer:- 1) Based on the revenue and cost operation mandate, compute total direct and indirect costs. The below table shows the direct and indirect costs for the operation based on the details provided in the revenue and cost mandate. Details Basis CAD Revenue Given 900,526 Direct cost Food & Beverages - A 36.7% of Revenue 330,493 Wages - B 30.2% of Revenue 271,959 Totl Direct cost - (A+B) 602,452 Indirect cost Rent - A 1300Sq ft @ $25.3 per sq ft. 32,890 Utilities - B 2.5% of Revenue 22,513 Marketing - C 2.8% of Revenue 25,215 Administration cost-D $35 per hour - 48 hours a week for 52 weeks 87,360 Other costs (Legal, accounting, admin, insurance, maintenance, etc) - E 1.5% of Revenue 13,508 181,486 Total Indirect costs (A+B+C+D+E) Hence, total direct cost is CAD 602,502 and Indirect cost is CAD 181,486 2. Performa income statement for the first year (based on question 1). Performa Income statement is presented in the table below Particulars CAD CAD Gross Revenue Total Revenue Less: Operating expenses Food & Beverages 330,493 Wages 271,959 Rent 32,890 Utilities 22,513 Marketing 25,215 Administration cost 87,360 Legal, accounting, insurance, maintenance & other costs 13,508 Total Operating expenses 783,938 116,588 EBITDA (Operating profit) EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization. Gross Operating profit of CAD 116,588 works to about 13% of the total revenue, which is a fair anticipated performance. The overall profit (Net profit) can be found out after deducting Interest, depreciation and taxation. 900,526 900,526 Question 3: Net Working Capital (NWC). Working Capital is required to finance current assets. We defined NWC as current assets (CA), minus current liabilities (CL), whereas CL consists mainly of accounts payable. GAP Coverage Period TOC (Turnover Coefficient) Working Capital = Annual cost of operations TOC 3 months 12/3=4 1. Accounts Receivable 900,562/4=225,140.5 2. Inventory of 2 months 12/2=6 900,562/6=150,093.6 3. Inventory of 3 months 12/3=4 270,168.6/4= 67,542.15 Raw Materials 1 month 12/1=12 270,168/12= 22,514.05 4. Accounts Payable NWC = 225,140.5+ NWC = 420,262.2 150,093.6+67, 542.15- 22,514.05 Question 4: Use the TIC formula to companhe tincidding me sad componente Final Products Total Investment Cost = 686,436.2 Question 5: Find the ratio of debt and the ratio of equity Given Calculations investment 686.436.2 cost be interest rate 5.24% on borrowings $= number of 5 installments investment R-006.438.2 9.35 Rrepayment of the loan 1+ (55.24%) -67.270.74 1.262 So. R 53, 304.86 (optimal repayment amount per installment) LR'S L-53, 304 80 5 L255, 524.32 (optimal capital that should be raised i debit) It follows then that the optimal amount of capital that should be raised via equity is: 686.436 2-206, 524. 32-419, 911, 88 So, the businesses optimal capital structure is such that the weight of debt is 0.30 and the weight of equity in 0.01 return on 9.8% So the use optimal capital structure is such that the weight of debt is 0.39 and the weight of equity is 0.61. Question Provide a projection table V-VS and show the NCF calculations Year 1 900.526.0 Year 2 124,841.17 Year 5 1,001,794.13 11. Revenue 0+27 nach Operating Expenses 902 502 619.372 672.000 Direct Co 28% for direct co 1814 184,934 196,475 Indirect Cost houding the nationa of indic 1,9% each year 2 Total Of 781.300 804,304 80544 116.500 120.535 133.250 GOP (ROE) 13,258.85 14.8575 Tanes@1%262468 each 107,276.19 118,5925 Net Cash Flows 183,763.32 (NOF) OOP-T Changin ve NOF Que 7: Packet is Calued in Po PAR 2 636.754 188,447 825,141 124.000 13.711.50 150.300. Year 4 475.466.8 454542 182.027 844.569 120.000 14,175.50 114,720.41 Rate at Fre Question 7: Payback Period is Calculated as Follows PBP Amount Paid Back Balance at End of Year Year 1 103,763.32 686,436.2 Year 2 107.276.15 579.169.05 Year 3 110,938.5 468.230.55 Year 4 114,720.41 353.510,14 Year 5 118.592.5 234.917.64 Question 8: Show how did you calculate the WACC. Do not just submit a final answer. Question 9: Definition of IRR+ Show your calculations Question 10: Provide a table showing the calculations of Q(% of capacity) in Projected Year 1, Optimistic Scenario, and Pessimistic Scenario. Show the three columns next to each other in a simple table and comment on your results. 1.5 Weighted average cost of capital (WACC) mandates The beta coefficient of a similar asset (MTY) in the same risk class is found to be 3 = 0.66. We will use this coefficient to represent the systematic risk of our business. Assume the country risk y = 0.02. The interest on deposit, ia, is estimated by taking the geometric mean of the minimum rate of 1.1% and the maximum rate of 2% as per the recent statistics posted by the Bank of Canada. Thus, id=1.1 x 2 = 1.48%. The below table shows the direct and indirect costs for the operation based on the details provided in the revenue and cost mandate. Details Basis CAD Revenue Given 900,526 Direct cost Food & Beverages - A 36.7% of Revenue 330,493 Wages - B 30.2% of Revenue 271,959 Totl Direct cost - (A+B) 602,452 Indirect cost Rent - A 1300Sq ft @ $25.3 per sq ft. 32,890 Utilities - B 2.5% of Revenue 22,513 Marketing - C 2.8% of Revenue 25,215 Administration cost -D $35 per hour - 48 hours a week for 52 weeks 87,360 Other costs (Legal, accounting, admin, insurance, maintenance, etc) - E 1.5% of Revenue 13,508 Total Indirect costs (A+B+C+D+E) 181,486 Hence, total direct cost is CAD 602,502 and Indirect cost is CAD 181,486 2. Performa income statement for the first year (based on question 1). Performa Income statement is presented in the table below Particulars CAD CAD Gross Revenue Total Revenue Less: Operating expenses Food & Beverages 330,493 Wages 271,959 Rent 32,890 Utilities 22,513 Marketing 25,215 Administration cost 87,360 Legal, accounting, insurance, maintenance & other costs 13,508 Total Operating expenses 783,938 116,588 EBITDA (Operating profit) EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization. Gross Operating profit of CAD 116,588 works to about 13% of the total revenue, which is a fair anticipated performance. The overall profit (Net profit) can be found out after deducting Interest, depreciation and taxation. 900,526 900,526 Answer:- 1) Based on the revenue and cost operation mandate, compute total direct and indirect costs. The below table shows the direct and indirect costs for the operation based on the details provided in the revenue and cost mandate. Details Basis CAD Revenue Given 900,526 Direct cost Food & Beverages - A 36.7% of Revenue 330,493 Wages - B 30.2% of Revenue 271,959 Totl Direct cost - (A+B) 602,452 Indirect cost Rent - A 1300Sq ft @ $25.3 per sq ft. 32,890 Utilities - B 2.5% of Revenue 22,513 Marketing - C 2.8% of Revenue 25,215 Administration cost-D $35 per hour - 48 hours a week for 52 weeks 87,360 Other costs (Legal, accounting, admin, insurance, maintenance, etc) - E 1.5% of Revenue 13,508 181,486 Total Indirect costs (A+B+C+D+E) Hence, total direct cost is CAD 602,502 and Indirect cost is CAD 181,486 2. Performa income statement for the first year (based on question 1). Performa Income statement is presented in the table below Particulars CAD CAD Gross Revenue Total Revenue Less: Operating expenses Food & Beverages 330,493 Wages 271,959 Rent 32,890 Utilities 22,513 Marketing 25,215 Administration cost 87,360 Legal, accounting, insurance, maintenance & other costs 13,508 Total Operating expenses 783,938 116,588 EBITDA (Operating profit) EBITDA = Earnings Before Interest, Tax, Depreciation and Amortization. Gross Operating profit of CAD 116,588 works to about 13% of the total revenue, which is a fair anticipated performance. The overall profit (Net profit) can be found out after deducting Interest, depreciation and taxation. 900,526 900,526 Question 3: Net Working Capital (NWC). Working Capital is required to finance current assets. We defined NWC as current assets (CA), minus current liabilities (CL), whereas CL consists mainly of accounts payable. GAP Coverage Period TOC (Turnover Coefficient) Working Capital = Annual cost of operations TOC 3 months 12/3=4 1. Accounts Receivable 900,562/4=225,140.5 2. Inventory of 2 months 12/2=6 900,562/6=150,093.6 3. Inventory of 3 months 12/3=4 270,168.6/4= 67,542.15 Raw Materials 1 month 12/1=12 270,168/12= 22,514.05 4. Accounts Payable NWC = 225,140.5+ NWC = 420,262.2 150,093.6+67, 542.15- 22,514.05 Question 4: Use the TIC formula to companhe tincidding me sad componente Final Products Total Investment Cost = 686,436.2 Question 5: Find the ratio of debt and the ratio of equity Given Calculations investment 686.436.2 cost be interest rate 5.24% on borrowings $= number of 5 installments investment R-006.438.2 9.35 Rrepayment of the loan 1+ (55.24%) -67.270.74 1.262 So. R 53, 304.86 (optimal repayment amount per installment) LR'S L-53, 304 80 5 L255, 524.32 (optimal capital that should be raised i debit) It follows then that the optimal amount of capital that should be raised via equity is: 686.436 2-206, 524. 32-419, 911, 88 So, the businesses optimal capital structure is such that the weight of debt is 0.30 and the weight of equity in 0.01 return on 9.8% So the use optimal capital structure is such that the weight of debt is 0.39 and the weight of equity is 0.61. Question Provide a projection table V-VS and show the NCF calculations Year 1 900.526.0 Year 2 124,841.17 Year 5 1,001,794.13 11. Revenue 0+27 nach Operating Expenses 902 502 619.372 672.000 Direct Co 28% for direct co 1814 184,934 196,475 Indirect Cost houding the nationa of indic 1,9% each year 2 Total Of 781.300 804,304 80544 116.500 120.535 133.250 GOP (ROE) 13,258.85 14.8575 Tanes@1%262468 each 107,276.19 118,5925 Net Cash Flows 183,763.32 (NOF) OOP-T Changin ve NOF Que 7: Packet is Calued in Po PAR 2 636.754 188,447 825,141 124.000 13.711.50 150.300. Year 4 475.466.8 454542 182.027 844.569 120.000 14,175.50 114,720.41 Rate at Fre Question 7: Payback Period is Calculated as Follows PBP Amount Paid Back Balance at End of Year Year 1 103,763.32 686,436.2 Year 2 107.276.15 579.169.05 Year 3 110,938.5 468.230.55 Year 4 114,720.41 353.510,14 Year 5 118.592.5 234.917.64 Question 8: Show how did you calculate the WACC. Do not just submit a final answer. Question 9: Definition of IRR+ Show your calculations Question 10: Provide a table showing the calculations of Q(% of capacity) in Projected Year 1, Optimistic Scenario, and Pessimistic Scenario. Show the three columns next to each other in a simple table and comment on your results. 1.5 Weighted average cost of capital (WACC) mandates The beta coefficient of a similar asset (MTY) in the same risk class is found to be 3 = 0.66. We will use this coefficient to represent the systematic risk of our business. Assume the country risk y = 0.02. The interest on deposit, ia, is estimated by taking the geometric mean of the minimum rate of 1.1% and the maximum rate of 2% as per the recent statistics posted by the Bank of Canada. Thus, id=1.1 x 2 = 1.48%