Question

Based on the information for the Madison Company for the year ending December 31, 2018, compute the following: How much is the firms net working

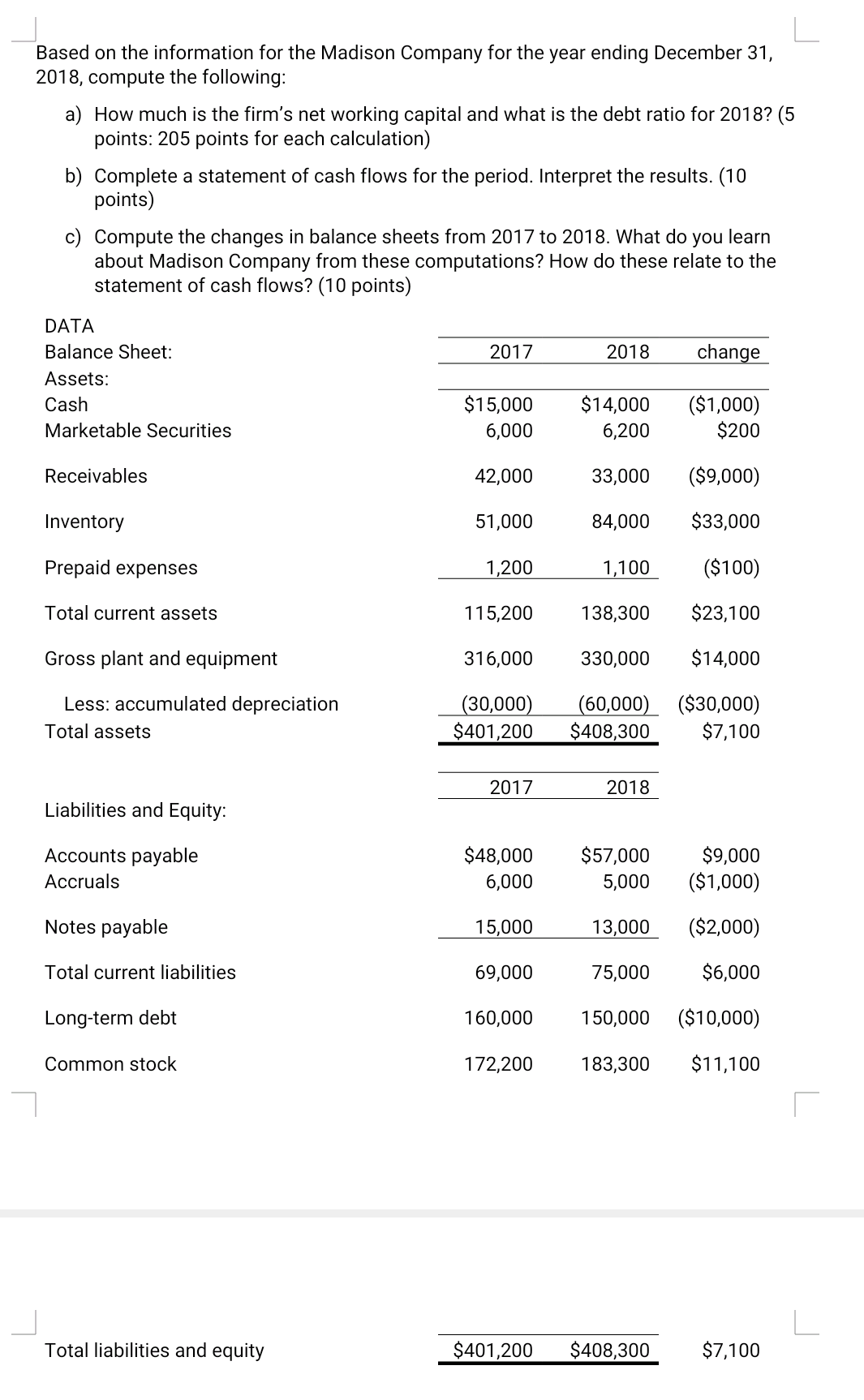

Based on the information for the Madison Company for the year ending December 31, 2018, compute the following: How much is the firms net working capital and what is the debt ratio for 2018? (5 points: 205 points for each calculation) Complete a statement of cash flows for the period. Interpret the results. (10 points) Compute the changes in balance sheets from 2017 to 2018. What do you learn about Madison Company from these computations? How do these relate to the statement of cash flows? (10 points) DATA

Balance Sheet: 2017 2018 change

Assets:

Cash $15,000 $14,000 ($1,000)

Marketable Securities 6,000 6,200 $200

Receivables 42,000 33,000 ($9,000)

Inventory 51,000 84,000 $33,000

Prepaid expenses 1,200 1,100 ($100)

Total current assets 115,200 138,300 $23,100

Gross plant and equipment 316,000 330,000 $14,000

Less: accumulated depreciation (30,000) (60,000) ($30,000)

Total assets $401,200 $408,300 $7,100

2017 2018

Liabilities and Equity:

Accounts payable $48,000 $57,000 $9,000

Accruals 6,000 5,000 ($1,000)

Notes payable 15,000 13,000 ($2,000)

Total current liabilities 69,000 75,000 $6,000

Long-term debt 160,000 150,000 ($10,000)

Common stock 172,200 183,300 $11,100

Total liabilities and equity $401,200 $408,300 $7,100

Income Statement for year-ended December 31, 2018

Sales

$600,000

Cost of goods sold

460,000

Gross profit

140,000

Less: Operating and interest expenses:

General and administration 30,000

Interest 10,000

Depreciation 30,000

Total Operating and interest expenses

70,000

Earnings before taxes

70,000

Less: Taxes

27,100

Net income available to common stockholders

42,900

Less: Cash dividends

31,800

Change in Retained earnings

$11,100

Based on the information for the Madison Company for the year ending December 31, 2018, compute the following: a) How much is the firm's net working capital and what is the debt ratio for 2018? (5 points: 205 points for each calculation) b) Complete a statement of cash flows for the period. Interpret the results. (10 points) c) Compute the changes in balance sheets from 2017 to 2018. What do you learn about Madison Company from these computations? How do these relate to the statement of cash flows? (10 points) 2017 2018 change DATA Balance Sheet: Assets: Cash Marketable Securities $15,000 6,000 $14,000 6,200 ($1,000) $200 Receivables 42,000 33,000 ($9,000) Inventory 51,000 84,000 $33,000 Prepaid expenses 1,200 1,100 ($100) Total current assets 115,200 138,300 $23,100 Gross plant and equipment 316,000 330,000 $14,000 Less: accumulated depreciation Total assets (30,000) $401,200 (60,000) ($30,000) $408,300 $7,100 2017 2018 Liabilities and Equity: Accounts payable Accruals $48,000 6,000 $57,000 5,000 $9,000 ($1,000) Notes payable 15,000 13,000 ($2,000) Total current liabilities 69,000 75,000 $6,000 Long-term debt 160,000 150,000 ($10,000) Common stock 172,200 183,300 $11,100 Total liabilities and equity $401,200 $408,300 $7,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started