Answered step by step

Verified Expert Solution

Question

1 Approved Answer

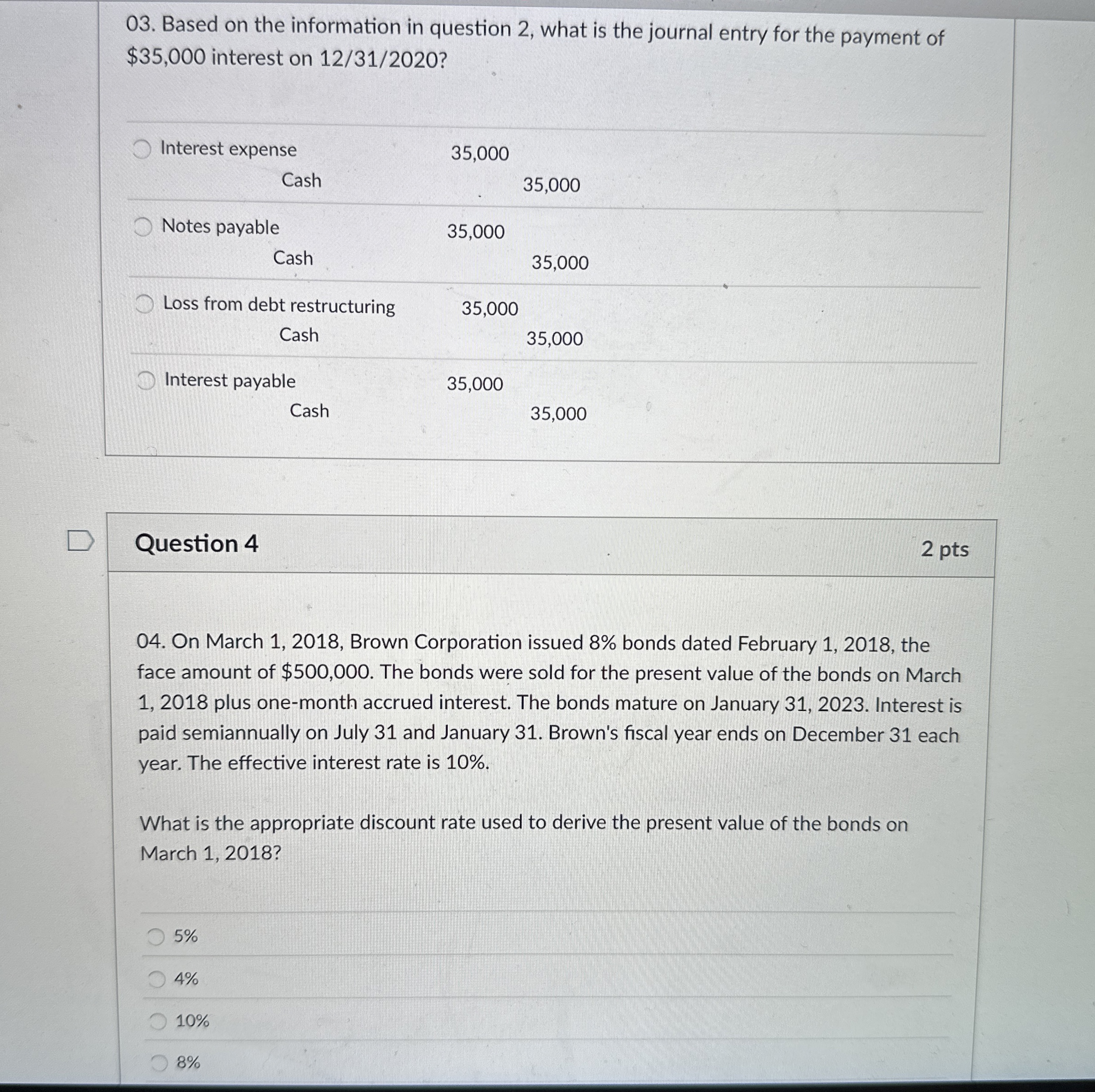

Based on the information in question 2 , what is the journal entry for the payment of $ 3 5 , 0 0 0 interest

Based on the information in question what is the journal entry for the payment of

$ interest on

Interest expense

Cash

Notes payable

Loss from debt restructuring

Cash

Interest payable

Cash

Cash

Question

On March Brown Corporation issued bonds dated February the

face amount of $ The bonds were sold for the present value of the bonds on March

plus onemonth accrued interest. The bonds mature on January Interest is

paid semiannually on July and January Brown's fiscal year ends on December each

year. The effective interest rate is

What is the appropriate discount rate used to derive the present value of the bonds on

March

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started