Answered step by step

Verified Expert Solution

Question

1 Approved Answer

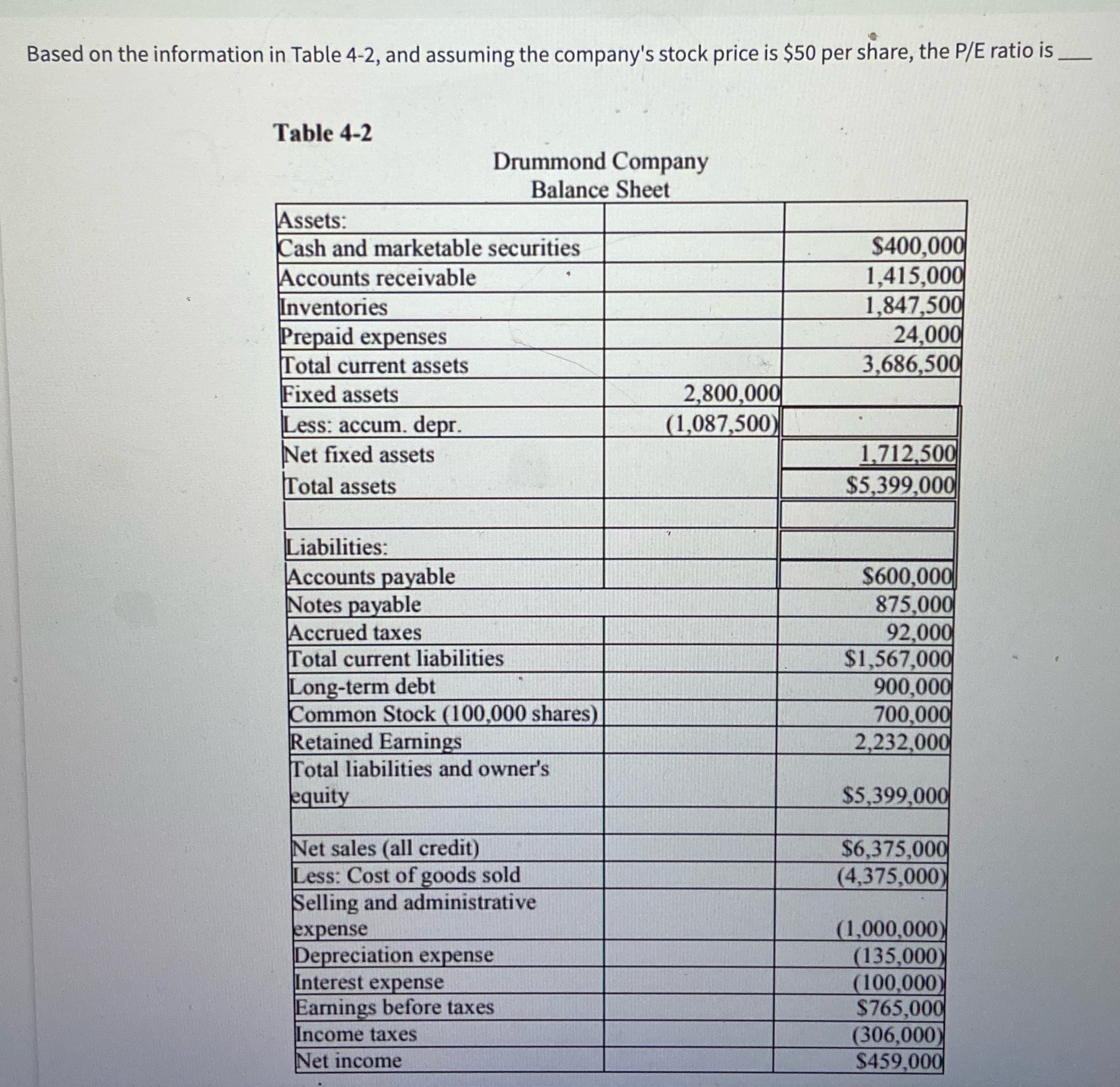

Based on the information in Table 4-2, and assuming the company's stock price is $50 per share, the P/E ratio is Table 4-2 Drummond

Based on the information in Table 4-2, and assuming the company's stock price is $50 per share, the P/E ratio is Table 4-2 Drummond Company Balance Sheet Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Common Stock (100,000 shares) Retained Earnings Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 2,800,000 (1,087,500) $400,000 1,415,000 1,847,500 24,000 3,686,500 1,712,500 $5,399,000 $600,000 875,000 92,000 $1,567,000 900,000 700,000 2,232,000 $5,399,000 $6,375,000 (4,375,000) (1,000,000) (135,000) (100,000) $765,000 (306,000) $459,000 Based on the information in Table 4-2, and assuming the company's stock price is $50 per share, the P/E ratio is Table 4-2 Drummond Company Balance Sheet Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Common Stock (100,000 shares) Retained Earnings Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 2,800,000 (1,087,500) $400,000 1,415,000 1,847,500 24,000 3,686,500 1,712,500 $5,399,000 $600,000 875,000 92,000 $1,567,000 900,000 700,000 2,232,000 $5,399,000 $6,375,000 (4,375,000) (1,000,000) (135,000) (100,000) $765,000 (306,000) $459,000

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started