Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Percentages need to be entered in decimal format, for instance 3% would be entered as .03.) Stock A and Stock B produced the returns shown

Percentages need to be entered in decimal format, for instance 3% would be entered as .03.)

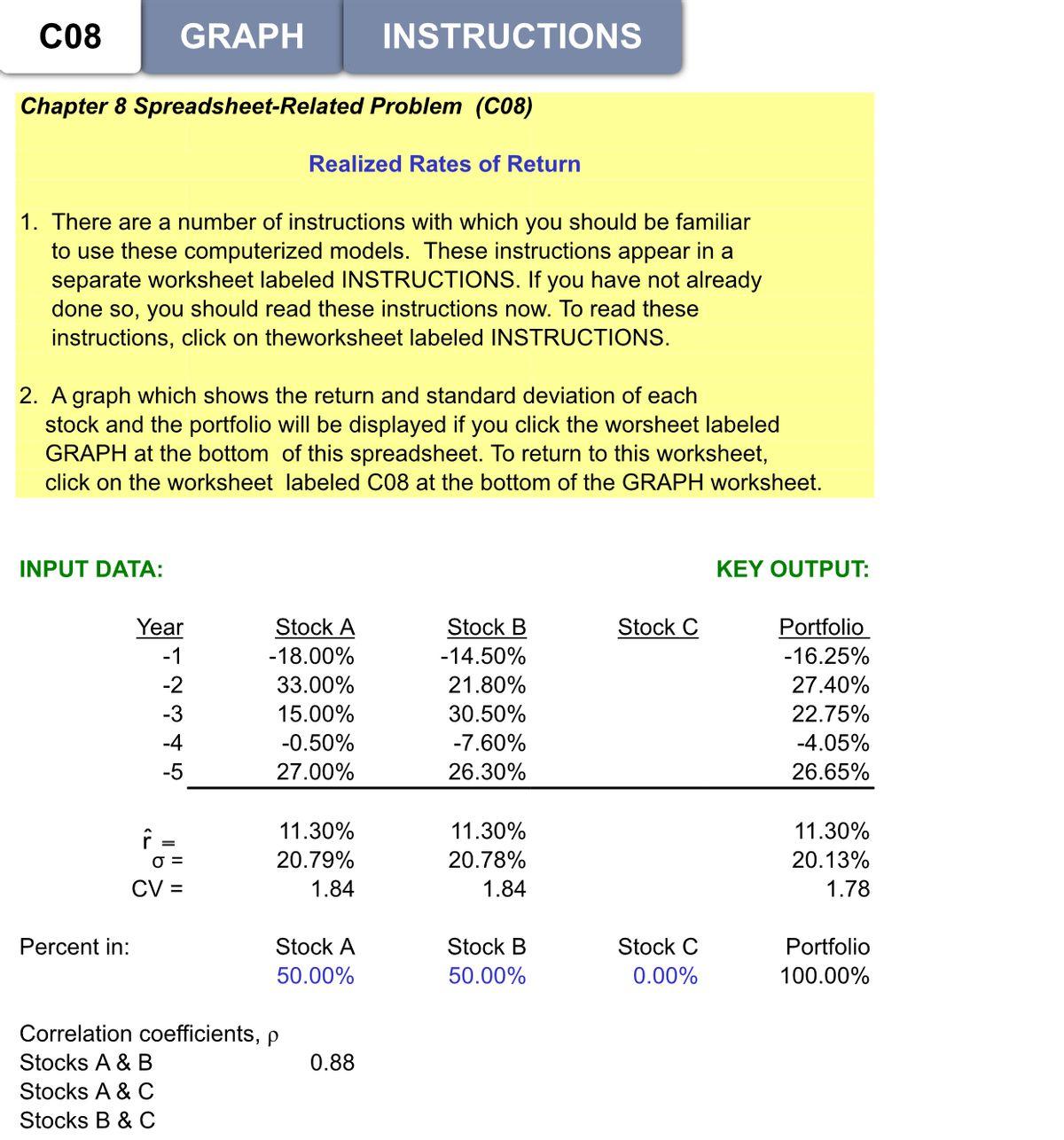

- Stock A and Stock B produced the returns shown on the spreadsheet during the past five years (Year -1 is one year ago, Year -2 is two years ago, and so forth). According to the spreadsheet, what is the average rate of return for each stock during the past five years? (Refer to Row 26 for average rate of return.)

- Based on the information in the spreadsheet, what is the coefficient of variation for each stock and for the portfolio? (Refer to Row 28 for the coefficient of variation.) If you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? Why?

- Consider a third stock, Stock C, that is available for inclusion in the portfolio. Stock C produced the returns shown in the table during the past five years (add this to column D under Stock C). What is the average return, standard deviation, and coefficient of variation for Stock C? (Refer to Row 27 for standard deviation.)

Year Stock C's Return -1 32.00% -2 -11.75% -3 10.75% -4 32.25% -5 -6.75% - Adjust the portfolio to consist of 33.33% Stock A, 33.33% Stock B, and 33.33% Stock C (row 31). How does this change affect the portfolio average rate of return, standard deviation, and coefficient of variation versus when 50% was invested in Stock A and 50% in Stock B?

- Make some other changes in the percentage of stocks in the portfolio (Row 31), making sure that the percentages add up to 100%. For example, you could enter 25% for Stock A, 25% for Stock B, and 50% for Stock C. Notice that the average rate of return for the portfolio remains constant for each scenario, but the standard deviation changes. Would you prefer to hold a portfolio consisting only of Stocks A and B or a portfolio that also includes Stock C? Why or why not?

C08 GRAPH Chapter 8 Spreadsheet-Related Problem (C08) Realized Rates of Return 1. There are a number of instructions with which you should be familiar to use these computerized models. These instructions appear in a separate worksheet labeled INSTRUCTIONS. If you have not already done so, you should read these instructions now. To read these instructions, click on theworksheet labeled INSTRUCTIONS. 2. A graph which shows the return and standard deviation of each stock and the portfolio will be displayed if you click the worsheet labeled GRAPH at the bottom of this spreadsheet. To return to this worksheet, click on the worksheet labeled C08 at the bottom of the GRAPH worksheet. INPUT DATA: KEY OUTPUT: Stock A Stock B Stock C Portfolio -18.00% -14.50% -16.25% 33.00% 21.80% 27.40% 15.00% 30.50% 22.75% -0.50% -7.60% -4.05% 27.00% 26.30% 26.65% 11.30% 11.30% 11.30% 20.79% 20.78% 20.13% 1.84 1.84 1.78 Stock A Stock B Portfolio 50.00% 50.00% 100.00% 0.88 Year -1 -2 -3 -5 = O= CV = INSTRUCTIONS Percent in: Correlation coefficients, p Stocks A & B Stocks A & C Stocks B & C Stock C 0.00%

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started