A property was purchased on 1 January 20X0 for $2m. The estimated depreciable amount, excluding the land, was $1m and it had an estimated

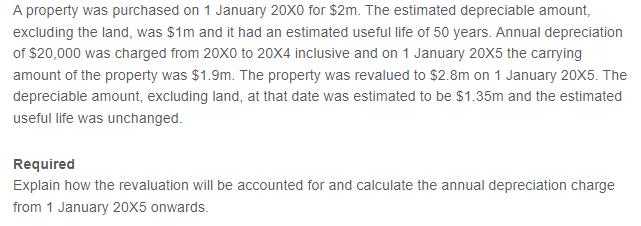

A property was purchased on 1 January 20X0 for $2m. The estimated depreciable amount, excluding the land, was $1m and it had an estimated useful life of 50 years. Annual depreciation of $20,000 was charged from 20X0 to 20X4 inclusive and on 1 January 20X5 the carrying amount of the property was $1.9m. The property was revalued to $2.8m on 1 January 20X5. The depreciable amount, excluding land, at that date was estimated to be $1.35m and the estimated useful life was unchanged. Required Explain how the revaluation will be accounted for and calculate the annual depreciation charge from 1 January 20X5 onwards.

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The revaluation surplus of 900000 28m 19m is recognized in the statement of changes in equ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started