Answered step by step

Verified Expert Solution

Question

1 Approved Answer

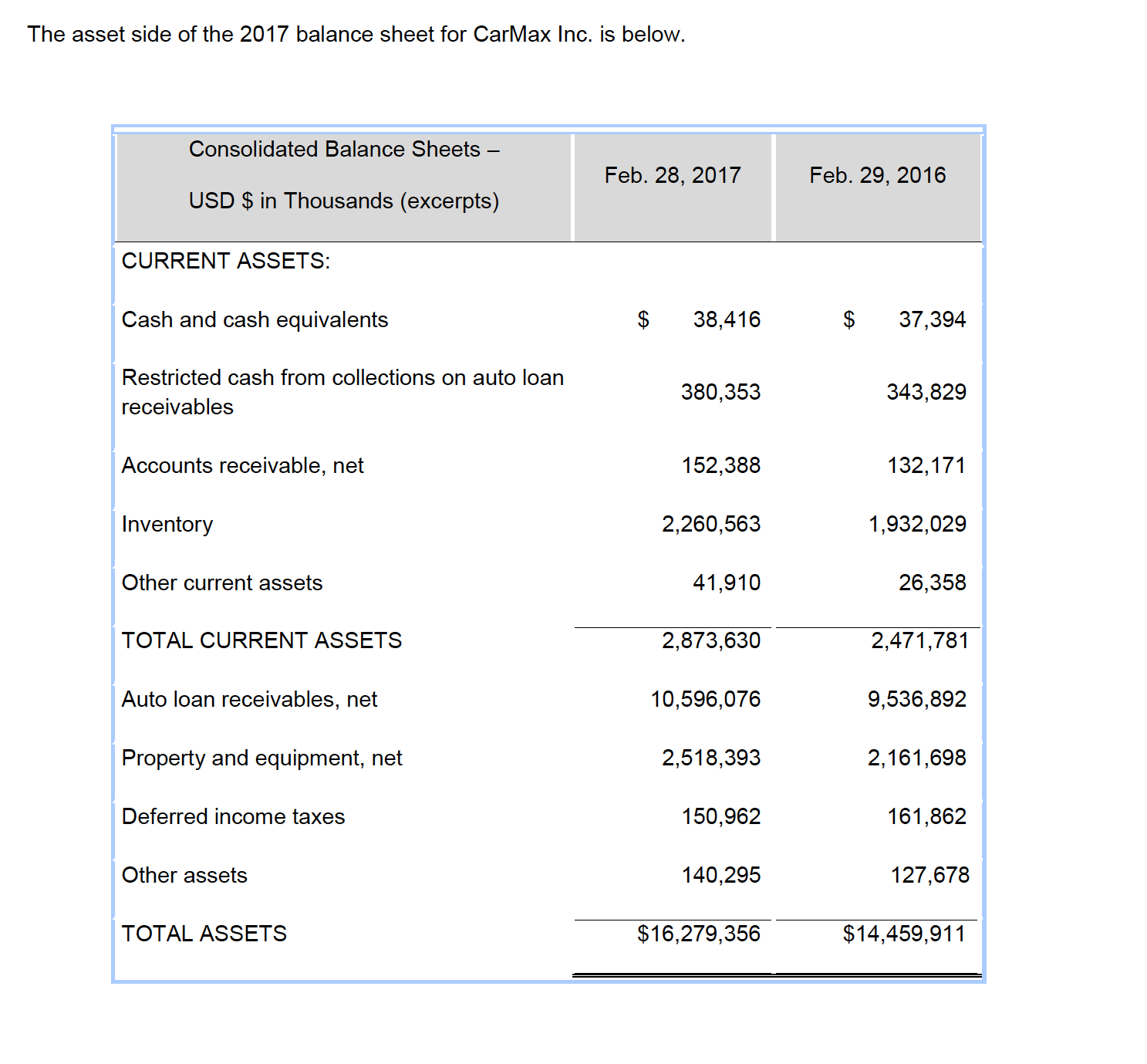

Based on the information on the next page, what inventory costing method does CarMax use? Do you believe this method is appropriate? Explain. b. Calculate

- Based on the information on the next page, what inventory costing method does CarMax use? Do you believe this method is appropriate? Explain.

- b. Calculate the common-size amount for inventories for both years and comment on any differences that you note. Given that the company is an automotive retailer, does this ratio seem appropriate?

- c. At February 28, 2015, Inventory was $2,086,874 thousand. CarMax reports cost of sales of $13,691,824 thousand for the year ended February 28, 2017 and $13,130,915 thousand for the year ended February 29, 2016. Compute the inventory turnover for both years. Interpret the ratio.

- d. CarMax reports revenue of $15,875,118 thousand for the year ended February 28, 2017 and $15,149,675 thousand for the year ended February 29, 2016. Calculate gross profit margins for both years.

Please answer E and F (Part A-D posted here https://www.chegg.com/homework-help/questions-and-answers/based-information-next-page-inventory-costing-method-carmax-use-believe-method-appropriate-q60033409)

e. What is your opinion about the financial health of CarMax? Use the ratios you calculated above to support your opinion.

f. (This question does not pertain to CarMax) In general, discuss how companies can use the lower of cost or market (LCM) rule to manage earnings? Please research and find two companies that have recently written-down th

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started