Answered step by step

Verified Expert Solution

Question

1 Approved Answer

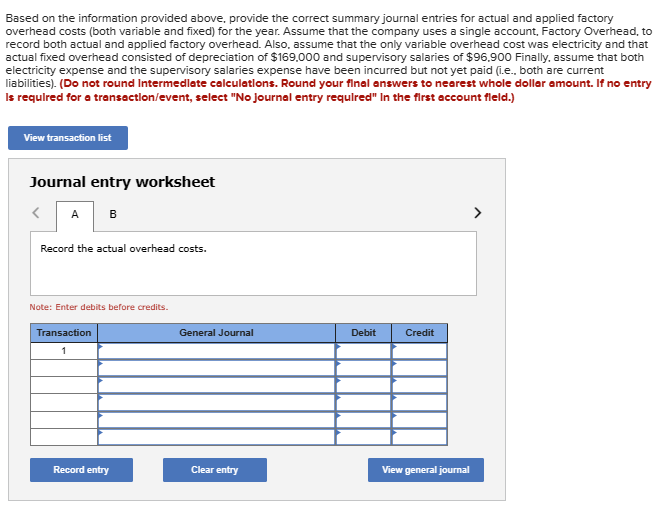

Based on the information provided above, provide the correct summary journal entries for actual and applied factory overhead costs (both variable and fixed) for the

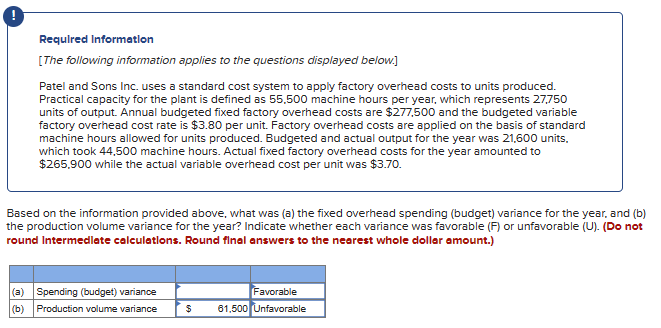

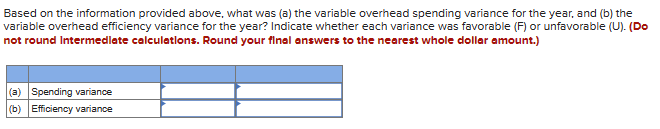

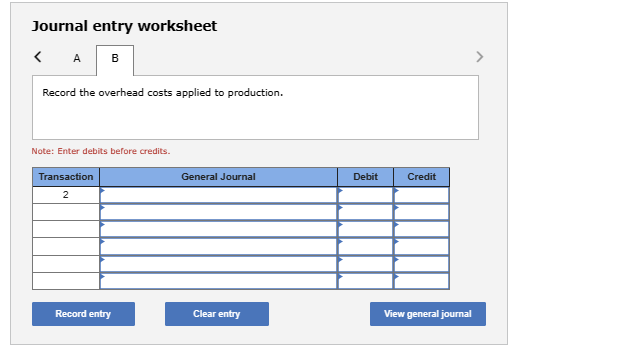

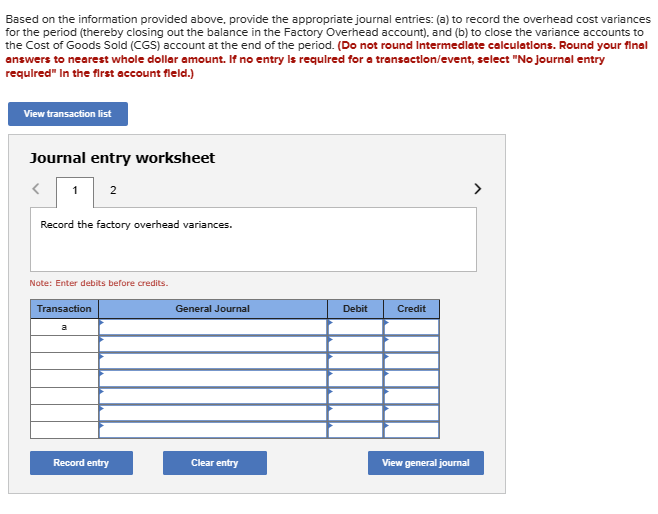

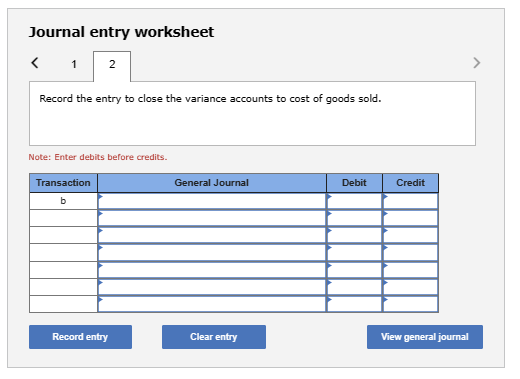

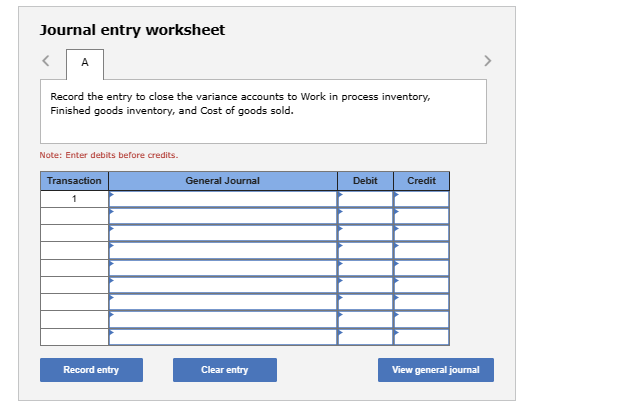

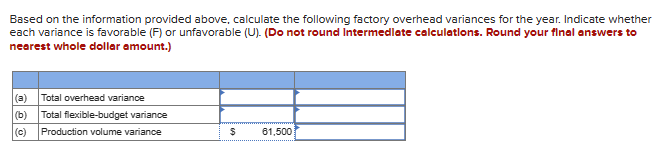

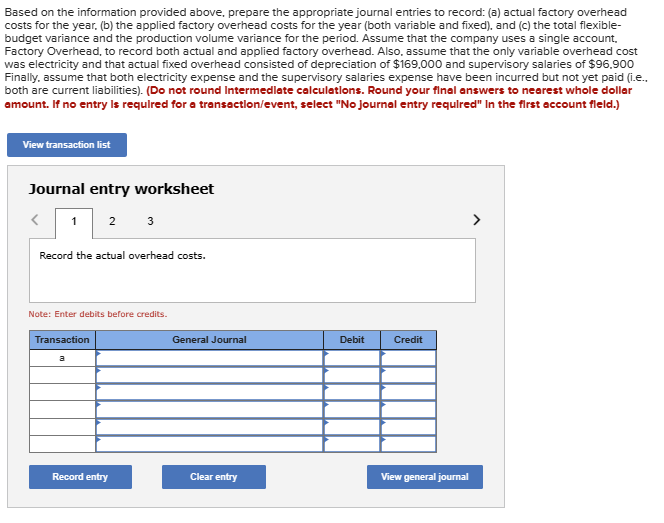

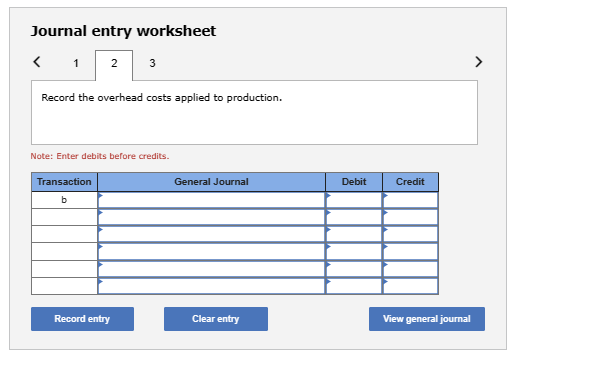

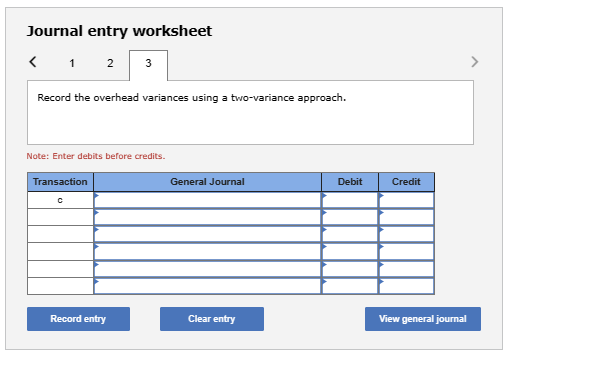

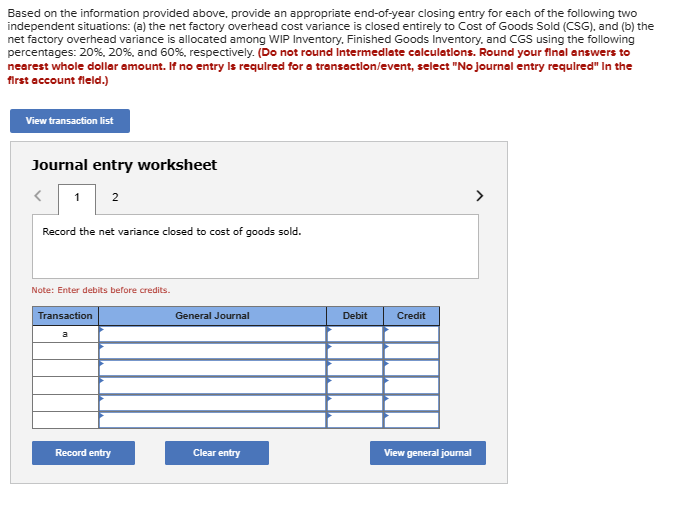

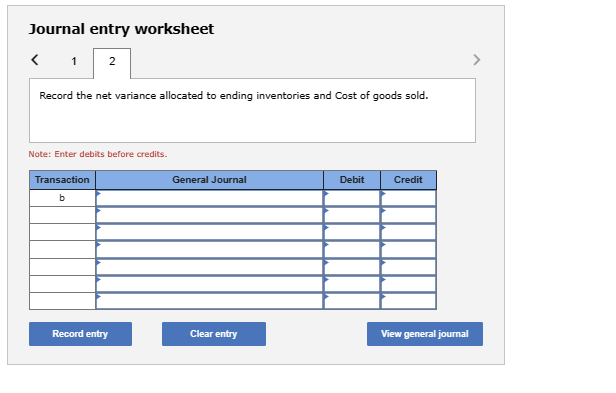

Based on the information provided above, provide the correct summary journal entries for actual and applied factory overhead costs (both variable and fixed) for the year. Assume that the company uses a single account, Factory Overhead, to record both actual and applied factory overhead. Also, assume that the only variable overhead cost was electricity and that actual fixed overhead consisted of depreciation of $169,000 and supervisory salaries of $96,900 Finally, assume that both electricity expense and the supervisory salaries expense have been incurred but not yet paid (i.e., both are current liabilities). (Do not round Intermedlete calculatlons. Round your final answers to nearest whole doller emount. If no entry Is required for a transoction/event, select "No journal entry requlred" In the first account fleld.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the overhead costs applied to production. Note: Enter debits before credits. Based on the information provided above, provide the appropriate journal entries: (a) to record the overhead cost variances for the period (thereby closing out the balance in the Factory Overhead account). and (b) to close the variance accounts to the Cost of Goods Sold (CGS) account at the end of the period. (Do not round Intermedlete calculatlons. Round your flnal answers to nearest whole dollar amount. If no entry ls requlred for a transectlon/event, select "No journal entry requlred" In the flrst account fleld.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the entry to close the variance accounts to Work in process inventory, Finished goods inventory, and Cost of goods sold. Note: Enter debits before credits. Based on the information provided above, calculate the following factory overhead variances for the year. Indicate whether each variance is favorable (F) or unfavorable (U). (Do not round Intermedlete colculatlons. Round your flnal onswers to nearest whole dollar amount.) Based on the information provided above, prepare the appropriate journal entries to record: (a) actual factory overhead costs for the year, (b) the applied factory overhead costs for the year (both variable and fixed), and (c) the total flexiblebudget variance and the production volume variance for the period. Assume that the company uses a single account, Factory Overhead, to record both actual and applied factory overhead. Also, assume that the only variable overhead cost was electricity and that actual fixed overhead consisted of depreciation of $169.000 and supervisory salaries of $96.900 Finally, assume that both electricity expense and the supervisory salaries expense have been incurred but not yet paid (i.e., both are current liabilities). (Do not round Intermedlate calculatlons. Round your flnal answers to nearest whole dollar amount. If no entry ls required for a transaction/event, select "No journal entry requlred" In the first account fleld.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the overhead variances using a two-variance approach. Note: Enter debits before credits. Based on the information provided above, provide an appropriate end-of-year closing entry for each of the following two independent situations: (a) the net factory overhead cost variance is closed entirely to Cost of Goods Sold (CSG), and (b) the net factory overhead variance is allocated among WIP Inventory. Finished Goods Inventory, and CGS using the following percentages: 20%,20%, and 60%, respectively. (Do not round Intermedlete calculations. Round your final answers to nearest whole dollar amount. If no entry is required for a trensactlon/event, select "No journal entry required" In the flrst occount fleld.) Journal entry worksheet Record the net variance closed to cost of goods sold. Note: Enter debits before credits. Journal entry worksheet Record the net variance allocated to ending inventories and Cost of goods sold. Note: Enter debits before credits

Based on the information provided above, provide the correct summary journal entries for actual and applied factory overhead costs (both variable and fixed) for the year. Assume that the company uses a single account, Factory Overhead, to record both actual and applied factory overhead. Also, assume that the only variable overhead cost was electricity and that actual fixed overhead consisted of depreciation of $169,000 and supervisory salaries of $96,900 Finally, assume that both electricity expense and the supervisory salaries expense have been incurred but not yet paid (i.e., both are current liabilities). (Do not round Intermedlete calculatlons. Round your final answers to nearest whole doller emount. If no entry Is required for a transoction/event, select "No journal entry requlred" In the first account fleld.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the overhead costs applied to production. Note: Enter debits before credits. Based on the information provided above, provide the appropriate journal entries: (a) to record the overhead cost variances for the period (thereby closing out the balance in the Factory Overhead account). and (b) to close the variance accounts to the Cost of Goods Sold (CGS) account at the end of the period. (Do not round Intermedlete calculatlons. Round your flnal answers to nearest whole dollar amount. If no entry ls requlred for a transectlon/event, select "No journal entry requlred" In the flrst account fleld.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the entry to close the variance accounts to Work in process inventory, Finished goods inventory, and Cost of goods sold. Note: Enter debits before credits. Based on the information provided above, calculate the following factory overhead variances for the year. Indicate whether each variance is favorable (F) or unfavorable (U). (Do not round Intermedlete colculatlons. Round your flnal onswers to nearest whole dollar amount.) Based on the information provided above, prepare the appropriate journal entries to record: (a) actual factory overhead costs for the year, (b) the applied factory overhead costs for the year (both variable and fixed), and (c) the total flexiblebudget variance and the production volume variance for the period. Assume that the company uses a single account, Factory Overhead, to record both actual and applied factory overhead. Also, assume that the only variable overhead cost was electricity and that actual fixed overhead consisted of depreciation of $169.000 and supervisory salaries of $96.900 Finally, assume that both electricity expense and the supervisory salaries expense have been incurred but not yet paid (i.e., both are current liabilities). (Do not round Intermedlate calculatlons. Round your flnal answers to nearest whole dollar amount. If no entry ls required for a transaction/event, select "No journal entry requlred" In the first account fleld.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the overhead variances using a two-variance approach. Note: Enter debits before credits. Based on the information provided above, provide an appropriate end-of-year closing entry for each of the following two independent situations: (a) the net factory overhead cost variance is closed entirely to Cost of Goods Sold (CSG), and (b) the net factory overhead variance is allocated among WIP Inventory. Finished Goods Inventory, and CGS using the following percentages: 20%,20%, and 60%, respectively. (Do not round Intermedlete calculations. Round your final answers to nearest whole dollar amount. If no entry is required for a trensactlon/event, select "No journal entry required" In the flrst occount fleld.) Journal entry worksheet Record the net variance closed to cost of goods sold. Note: Enter debits before credits. Journal entry worksheet Record the net variance allocated to ending inventories and Cost of goods sold. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started