Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the information provided create a general journal for the months of April through September as it impacts expense, liabilities and equity. As the

Based on the information provided create a general journal for the months of April through September as it impacts expense, liabilities and equity.

As the first half of 2012 came to a close?the compay was in position to be a leader in the sale of high end computer networking equipment for broadcast media companies. As demand was forecasted to increase to 12,500 units per year over the next 7 years the company invested $600,000 in new equipment to increase the capacity of its manufacturing facility. It financed this new equipment purchase through a combination of debt and equity. In April, CNE received a $300,000 loan from a commercial bank at 7% interest. Starting on May 1st principal and interest payments of 3,500 are to be paid on a monthly basis over 10 years. Also in April, the company issued $300,000 of common stock to a private venture capital firm. 50,000 shares were issued at a par value of $3 per share.

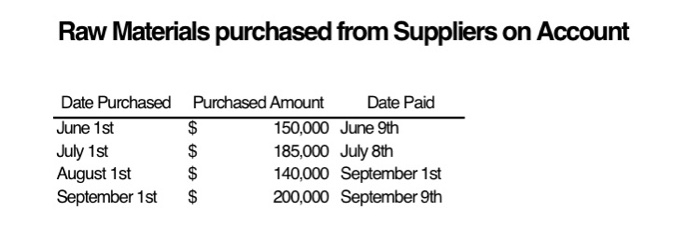

To support sales growth, the company extended generous accounts receivable terms to its customers. As a result, the companys cash cycle lengthen where inventory and A/R days outstanding reached a combined 90 days in the first half of 2012. To generate more operating cash flow, the company decided to rely more heavily on accounts payable. In June of 2012 all purchases for raw materials were switched from a cash basis to A/P with 2/10, n/30 terms. Based on early payment discounts from its suppliers the company adopted a policy of paying within the 10 day window. Figure 1 on the following page shows the schedule of the companys raw material purchases by month and when the company paid for each purchase.

As the second quarter of 2012 came to a close profits were at a record high. The company declared a cash and stock dividend at the end of June. The cash dividend was set at $.25 cents per share and the stock dividend was set at 10% of total outstanding stock with a par value of $3 per share. Total outstanding stock at the end of June was 100,000 shares. The dividends were distributed in September. The stock was trading at $6 per share at the time the dividends were declared and distributed.

Assumptions:

1. Do not worry about journalizing accounting entries for revenue, fixed assets, account

receivables, or depreciation expense on fixed assets. You will need to account for Cash and Inventory as it relates to expenses, liabilities, and equity.

2. For this exercise ignore calculating and journalizing the current portion of long term debt.

3. When computing interest, make sure you document the assumptions (i.e., assumed 365 days or 360 days in a year) and show your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started