Answered step by step

Verified Expert Solution

Question

1 Approved Answer

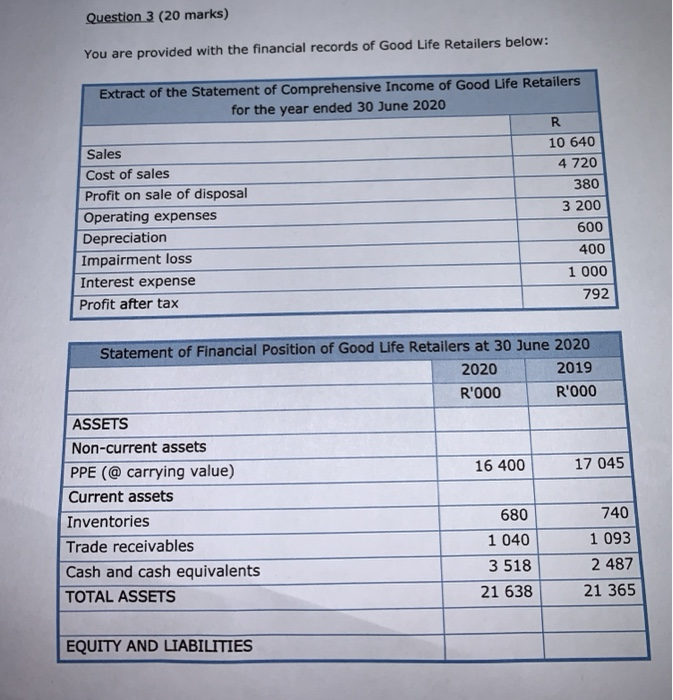

based on the information provided please help me calculate the financial ratios mentioned from letters a-j please forgive i accidentally sent the wrong table for

based on the information provided please help me calculate the financial ratios mentioned from letters a-j

please forgive i accidentally sent the wrong table for the first. please see the corrected below

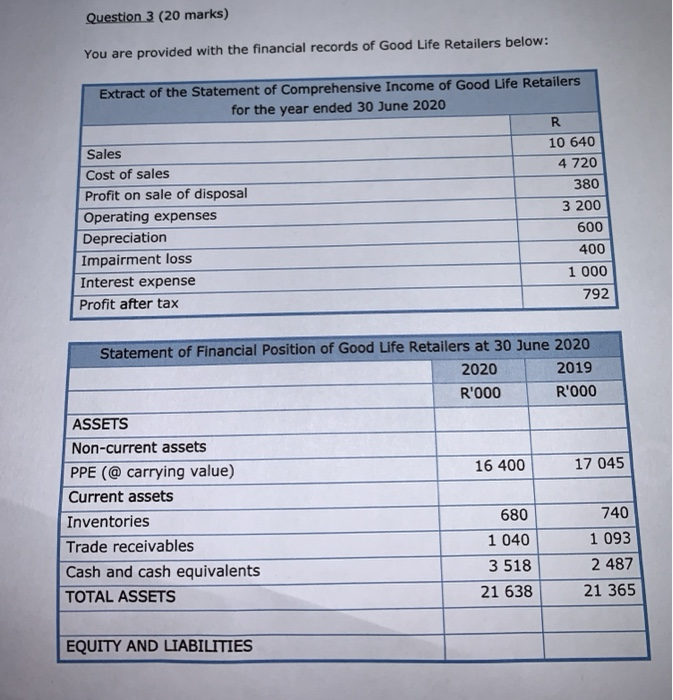

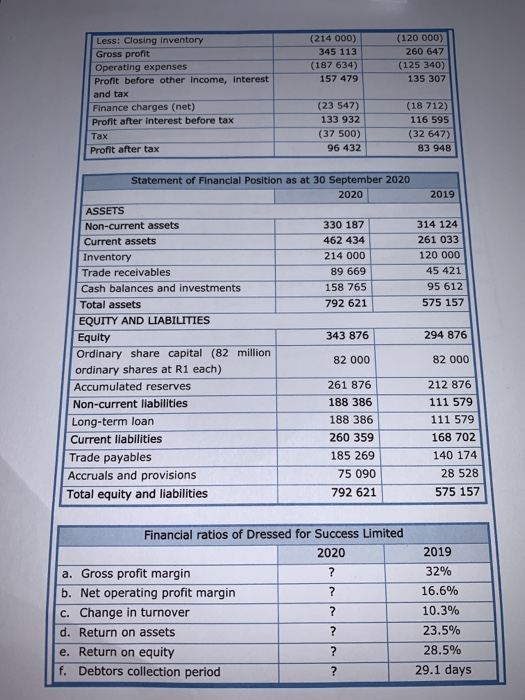

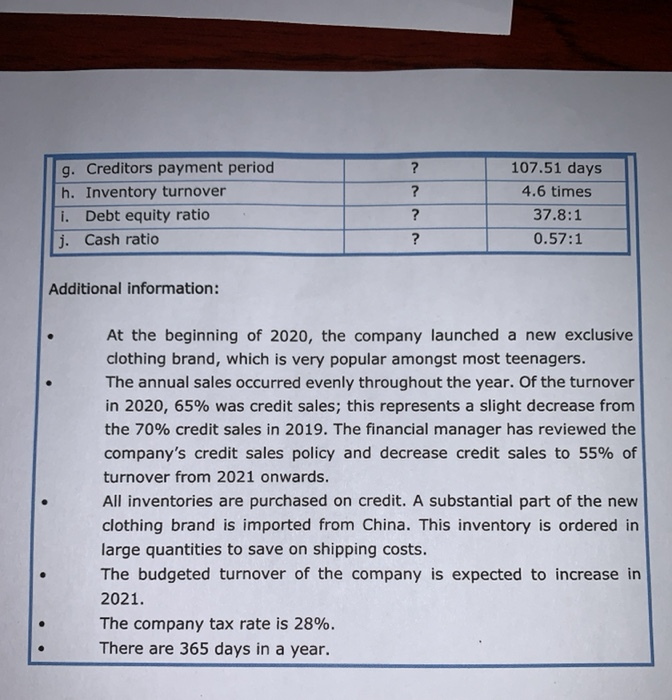

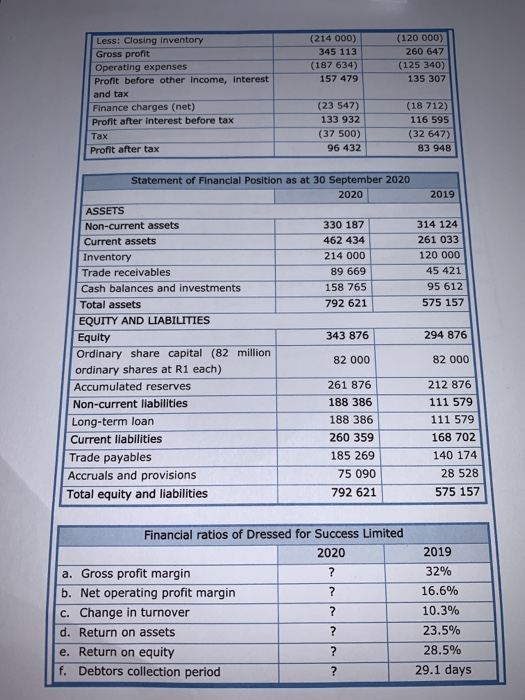

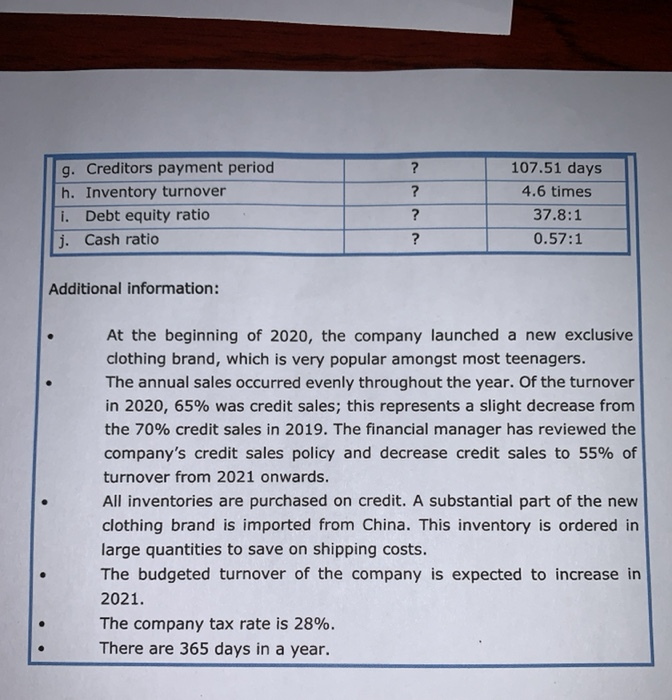

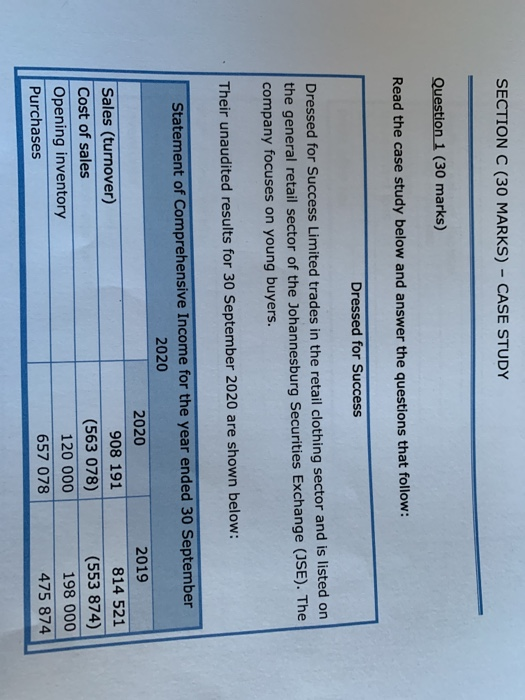

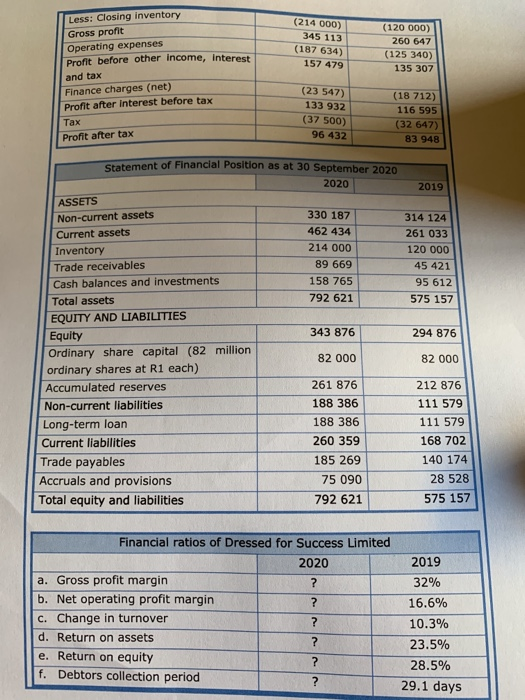

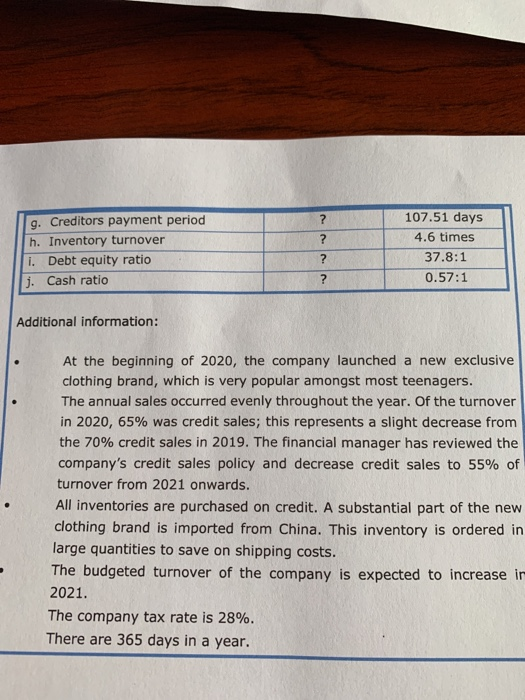

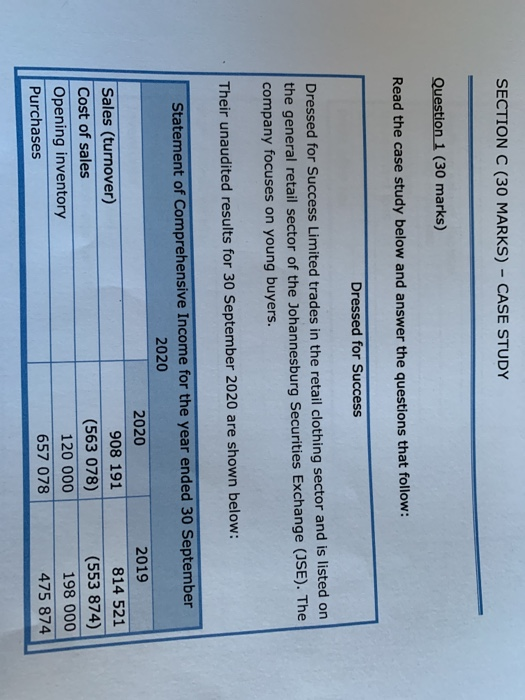

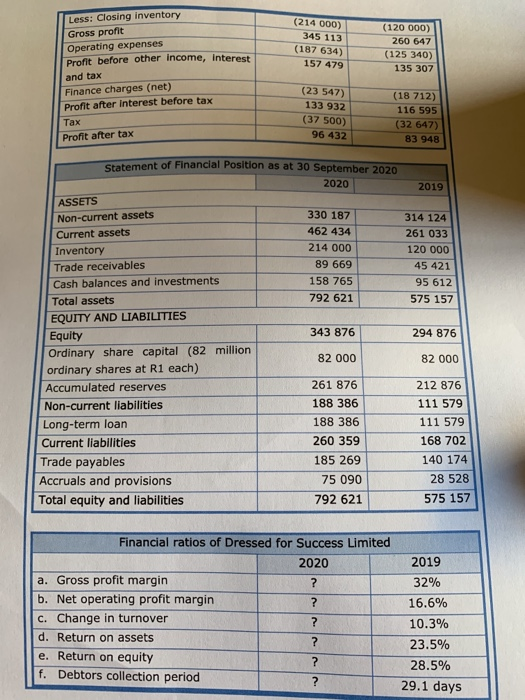

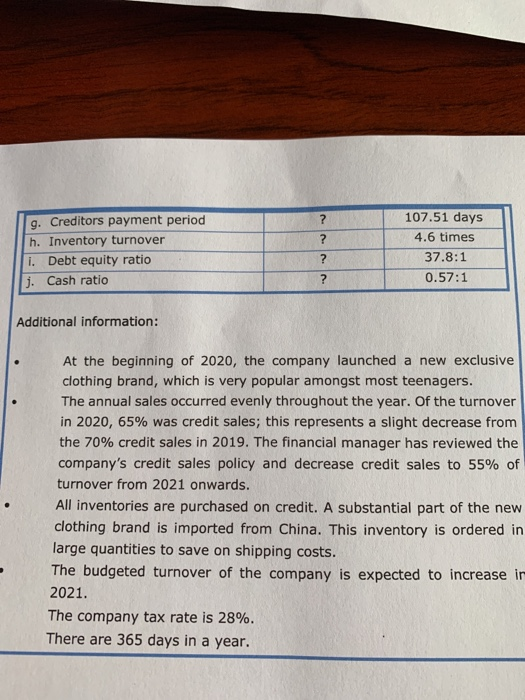

Question 3 (20 marks) You are provided with the financial records of Good Life Retailers below: Extract of the Statement of Comprehensive Income of Good Life Retailers for the year ended 30 June 2020 R Sales 10 640 Cost of sales 4 720 Profit on sale of disposal 380 Operating expenses 3 200 Depreciation 600 Impairment loss 400 Interest expense 1 000 Profit after tax 792 Statement of Financial Position of Good Life Retailers at 30 June 2020 2020 2019 R'000 R'000 ASSETS Non-current assets PPE (@carrying value) 16 400 17 045 Current assets Inventories 680 740 Trade receivables 1 040 1 093 Cash and cash equivalents 3 518 2 487 TOTAL ASSETS 21 638 21 365 EQUITY AND LIABILITIES (214 000) 345 113 (187 634) 157 479 (120 000) 260 647 (125 340) 135 307 Less: Closing inventory Gross profit Operating expenses Profit before other income, interest and tax Finance charges (net) Profit after interest before tax Tax Profit after tax (23 547) 133 932 (37 500) 96 432 (18 712) 116 595 (32 647) 83 948 2019 314 124 261 033 120 000 45 421 95 612 575 157 Statement of Financial Position as at 30 September 2020 2020 ASSETS Non-current assets 330 187 Current assets 462 434 Inventory 214 000 Trade receivables 89 669 Cash balances and investments 158 765 Total assets 792 621 EQUITY AND LIABILITIES Equity 343 876 Ordinary share capital (82 million 82 000 ordinary shares at R1 each) Accumulated reserves 261 876 Non-current liabilities 188 386 Long-term loan 188 386 Current liabilities 260 359 Trade payables 185 269 Accruals and provisions 75 090 Total equity and liabilities 792 621 294 876 82 000 212 876 111 579 111 579 168 702 140 174 28 528 575 157 2019 32% 16.6% Financial ratios of Dressed for Success Limited 2020 a. Gross profit margin ? b. Net operating profit margin ? c. Change in turnover ? d. Return on assets ? e. Return on equity ? f. Debtors collection period ? 10.3% 23.5% 28.5% 29.1 days ? ? g. Creditors payment period h. Inventory turnover i. Debt equity ratio j. Cash ratio 107.51 days 4.6 times 37.8:1 0.57:1 ? ? Additional information: At the beginning of 2020, the company launched a new exclusive clothing brand, which is very popular amongst most teenagers. The annual sales occurred evenly throughout the year. Of the turnover in 2020, 65% was credit sales; this represents a slight decrease from the 70% credit sales in 2019. The financial manager has reviewed the company's credit sales policy and decrease credit sales to 55% of turnover from 2021 onwards. All inventories are purchased on credit. A substantial part of the new clothing brand is imported from China. This inventory is ordered in large quantities to save on shipping costs. The budgeted turnover of the company is expected to increase in 2021. The company tax rate is 28%. There are 365 days in a year. SECTION C (30 MARKS) - CASE STUDY Question 1 (30 marks) Read the case study below and answer the questions that follow: Dressed for Success Dressed for Success Limited trades in the retail clothing sector and is listed on the general retail sector of the Johannesburg Securities Exchange (JSE). The company focuses on young buyers. Their unaudited results for 30 September 2020 are shown below: Statement of Comprehensive Income for the year ended 30 September 2020 2020 2019 Sales (turnover) 908 191 814 521 Cost of sales (563 078) (553 874) Opening inventory 120 000 198 000 Purchases 657 078 475 874 (214 000) 345 113 (187 634) 157 479 (120 000) 260 647 (125 340) 135 307 Less: Closing inventory Gross profit Operating expenses Profit before other income, interest and tax Finance charges (net) Profit after interest before tax Tax Profit after tax (23 547) 133 932 (37 500) 96 432 (18 712) 116 595 (32 647) 83 948 Statement of Financial Position as at 30 September 2020 2020 2019 330 187 462 434 214 000 89 669 158 765 792 621 314 124 261 033 120 000 45 421 95 612 575 157 343 876 294 876 ASSETS Non-current assets Current assets Inventory Trade receivables Cash balances and investments Total assets EQUITY AND LIABILITIES Equity Ordinary share capital (82 million ordinary shares at R1 each) Accumulated reserves Non-current liabilities Long-term loan Current liabilities Trade payables Accruals and provisions Total equity and liabilities 82 000 82 000 261 876 188 386 188 386 260 359 185 269 75 090 792 621 212 876 111 579 111 579 168 702 140 174 28 528 575 157 Financial ratios of Dressed for Success Limited 2020 a. Gross profit margin ? b. Net operating profit margin ? c. Change in turnover ? d. Return on assets ? e. Return on equity ? f. Debtors collection period ? 2019 32% 16.6% 10.3% 23.5% 28.5% 29.1 days ? g. Creditors payment period h. Inventory turnover i. Debt equity ratio j. Cash ratio ? ? 107.51 days 4.6 times 37.8:1 0.57:1 ? Additional information: At the beginning of 2020, the company launched a new exclusive clothing brand, which is very popular amongst most teenagers. The annual sales occurred evenly throughout the year. Of the turnover in 2020, 65% was credit sales; this represents a slight decrease from the 70% credit sales in 2019. The financial manager has reviewed the company's credit sales policy and decrease credit sales to 55% of turnover from 2021 onwards. All inventories are purchased on credit. A substantial part of the new clothing brand is imported from China. This inventory is ordered in large quantities to save on shipping costs. The budgeted turnover of the company is expected to increase in 2021. The company tax rate is 28%. There are 365 days in a year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started