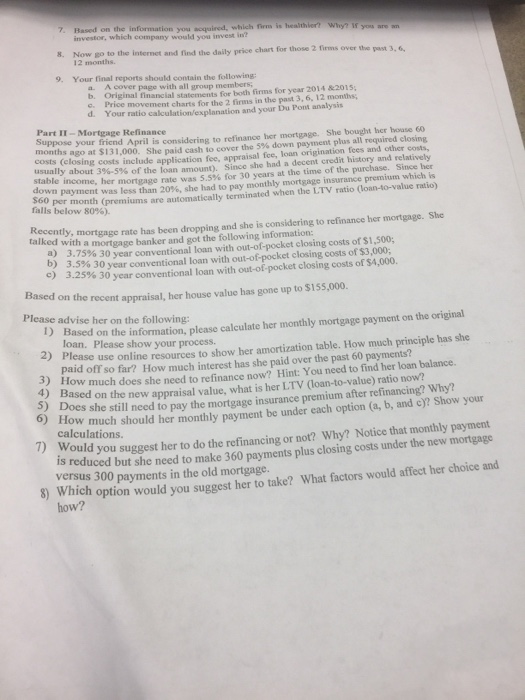

Based on the information you acquired, which firm is healthier? Why If you are an investor, which company would invest in? Now go to the internet and find the daily price chart for those 2 firms over the past 3, 6, 12 months. Your final reports should contain the following: a. A cover page with all group members. b. Original financial statements for both firms for year 2014 & 2015; c. Price movement charts for the 2 firms in the past 3, 6, 12 months; d. Your ratio calculation explanation and your Du Pont analysis Suppose your friend April is considering to refinance her mortgage. She bought her house 60 months ago at $131,000. She paid cash to cover the 5% down payments plus all required closing costs (closing costs include application fee, appraisal fee, loan origination fees and other costs, usually about 3% -5% of the loan amount). Since she had a decent credit history and relatively stable income, her mortgage rate was 5.5% for 30 years at the time of the purchase. Since her down payment was less than 20%, she had to pay monthly mortgage insurance premium which is $60 per month (premium are automatically terminated when the LTV ratio) (loan to value ratio falls below 80%) Recently, mortgage rate has been dropping and she is considering to refinance her mortgage. She talked with a mortgage banker and got the following information: a) 3.75% 30 year conventional loan with out of pocket closing costs of $1, 500; b) 3.5% 30 year conventional loan with out of pocket closing cost of $3,000 c) 3.25% 30 year conventional loan with out of pocket closing costs of $4,000 Based on the recent appraisal, her house value has gone up to $155,000 Please advise her on the following: Based on the information, please calculate- her monthly mortgage payment on the original loan. Please show your process. Please use online resources to show her amortization table. How much principle has she paid off so far? How much interest has she paid over the past 60 payments? How much does she need to refinance now? Based on the new appraisal value, what is her LTV (loan-to-value) ratio now? Does she still need to pay the mortgage insurance premium after refinancing? Why? How much should her monthly payment be under each option (a, b, and c)? Show your calculations. Would you suggest her to do the refinancing or not? Why? Notice that monthly payment is reduced but she need to make 360 payments plus closing costs under the new mortgage versus 300 payments in the old mortgage. Which option would you suggest her to take? What factors would affect her choice and how