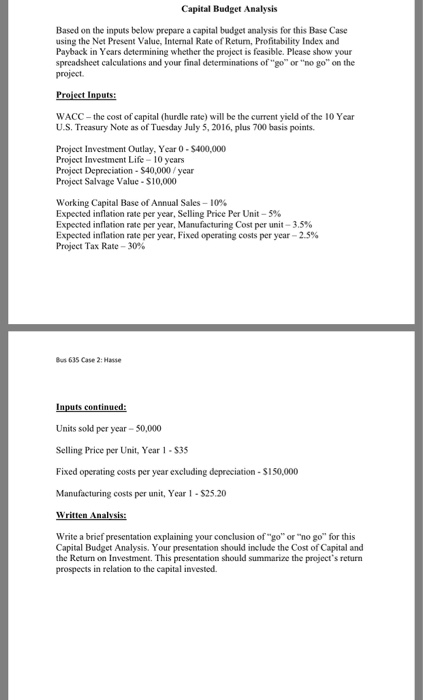

Based on the inputs below prepare a capital budget analysis for this Base Case using the Net Present Value, Internal Rate of Return. Profitability Index and Payback in Years determining whether the project is feasible. Please show your spreadsheet calculations and your final determinations of "go" or "no go" on the project Project Inputs: WACC - the cost of capital (hurdle rate) will be the current yield of the 10 Year U.S. Treasury Note as of Tuesday July 5, 2016, plus 700 basis points. Project Investment Outlay, Year 0 - $400,000 Project Investment Life - 10 years Project Depreciation - $40,000/year Project Salvage Value - $10.000 Working Capital Base of Annual Sales - 10% Expected inflation rate per year, Selling Price Per Unit - 5% Expected inflation rate per year, Manufacturing Cost per unit 3.5% Expected inflation rate per year, Fixed operating costs per year 2.5% Project Tax Rate - 30% Inputs continued: Units sold per year - 50.000 Selling Price per Unit, Year 1 - $35 Fixed operating costs per year excluding depreciation - $150,000 Manufacturing costs per unit, Year 1 - $25, 20 Written Analysis: Write a brief presentation explaining your conclusion of "go" or "no go" for this Capital Budget Analysis. Your presentation should include the Cost of Capital and the Return on Investment. This presentation should summarize the project's return prospects in relation to the capital invested. Based on the inputs below prepare a capital budget analysis for this Base Case using the Net Present Value, Internal Rate of Return. Profitability Index and Payback in Years determining whether the project is feasible. Please show your spreadsheet calculations and your final determinations of "go" or "no go" on the project Project Inputs: WACC - the cost of capital (hurdle rate) will be the current yield of the 10 Year U.S. Treasury Note as of Tuesday July 5, 2016, plus 700 basis points. Project Investment Outlay, Year 0 - $400,000 Project Investment Life - 10 years Project Depreciation - $40,000/year Project Salvage Value - $10.000 Working Capital Base of Annual Sales - 10% Expected inflation rate per year, Selling Price Per Unit - 5% Expected inflation rate per year, Manufacturing Cost per unit 3.5% Expected inflation rate per year, Fixed operating costs per year 2.5% Project Tax Rate - 30% Inputs continued: Units sold per year - 50.000 Selling Price per Unit, Year 1 - $35 Fixed operating costs per year excluding depreciation - $150,000 Manufacturing costs per unit, Year 1 - $25, 20 Written Analysis: Write a brief presentation explaining your conclusion of "go" or "no go" for this Capital Budget Analysis. Your presentation should include the Cost of Capital and the Return on Investment. This presentation should summarize the project's return prospects in relation to the capital invested