Answered step by step

Verified Expert Solution

Question

1 Approved Answer

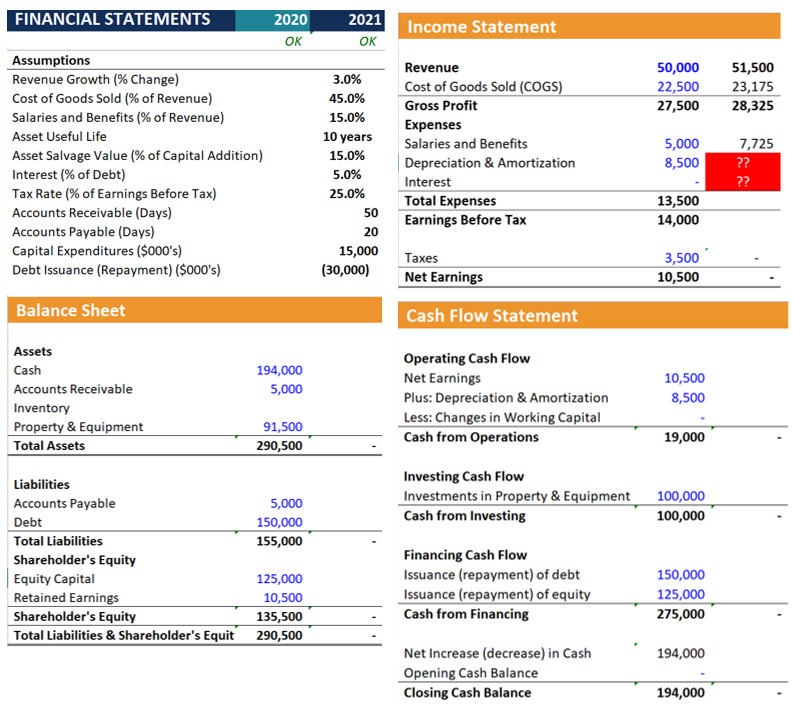

Based on the module above, what is the forecasted amount of Depreciation & Amortization as well of Interest for 2021? FINANCIAL STATEMENTS 2021 2020 OK

Based on the module above, what is the forecasted amount of Depreciation & Amortization as well of Interest for 2021?

FINANCIAL STATEMENTS 2021 2020 OK Income Statement OK 50,000 22,500 27,500 51,500 23,175 28,325 Assumptions Revenue Growth (% Change) Cost of Goods Sold (% of Revenue) Salaries and Benefits (% of Revenue) Asset Useful Life Asset Salvage Value % of Capital Addition) Interest (% of Debt) Tax Rate (% of Earnings Before Tax) Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures ($000's) Debt Issuance (Repayment) ($000's) Revenue Cost of Goods Sold (COGS) Gross Profit Expenses Salaries and Benefits Depreciation & Amortization Interest Total Expenses Earnings Before Tax 3.0% 45.0% 15.0% 10 years 15.0% 5.0% 25.0% 50 20 15,000 (30,000) 5,000 8,500 7,725 ?? ?? 13,500 14,000 Taxes Net Earnings 3,500 10,500 Balance Sheet Cash Flow Statement 194,000 5,000 Assets Cash Accounts Receivable Inventory Property & Equipment Total Assets Operating Cash Flow Net Earnings Plus: Depreciation & Amortization Less: Changes in Working Capital Cash from Operations 10,500 8,500 91,500 290,500 19,000 5,000 150,000 155,000 Investing Cash Flow Investments in Property & Equipment Cash from Investing 100,000 100,000 Liabilities Accounts Payable Debt Total Liabilities Shareholder's Equity Equity Capital Retained Earnings Shareholder's Equity Total Liabilities & Shareholder's Equit 125,000 10,500 135,500 290,500 Financing Cash Flow Issuance (repayment) of debt Issuance (repayment) of equity Cash from Financing 150,000 125,000 275,000 194,000 Net Increase (decrease) in Cash Opening Cash Balance Closing Cash Balance 194,000 FINANCIAL STATEMENTS 2021 2020 OK Income Statement OK 50,000 22,500 27,500 51,500 23,175 28,325 Assumptions Revenue Growth (% Change) Cost of Goods Sold (% of Revenue) Salaries and Benefits (% of Revenue) Asset Useful Life Asset Salvage Value % of Capital Addition) Interest (% of Debt) Tax Rate (% of Earnings Before Tax) Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures ($000's) Debt Issuance (Repayment) ($000's) Revenue Cost of Goods Sold (COGS) Gross Profit Expenses Salaries and Benefits Depreciation & Amortization Interest Total Expenses Earnings Before Tax 3.0% 45.0% 15.0% 10 years 15.0% 5.0% 25.0% 50 20 15,000 (30,000) 5,000 8,500 7,725 ?? ?? 13,500 14,000 Taxes Net Earnings 3,500 10,500 Balance Sheet Cash Flow Statement 194,000 5,000 Assets Cash Accounts Receivable Inventory Property & Equipment Total Assets Operating Cash Flow Net Earnings Plus: Depreciation & Amortization Less: Changes in Working Capital Cash from Operations 10,500 8,500 91,500 290,500 19,000 5,000 150,000 155,000 Investing Cash Flow Investments in Property & Equipment Cash from Investing 100,000 100,000 Liabilities Accounts Payable Debt Total Liabilities Shareholder's Equity Equity Capital Retained Earnings Shareholder's Equity Total Liabilities & Shareholder's Equit 125,000 10,500 135,500 290,500 Financing Cash Flow Issuance (repayment) of debt Issuance (repayment) of equity Cash from Financing 150,000 125,000 275,000 194,000 Net Increase (decrease) in Cash Opening Cash Balance Closing Cash Balance 194,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started