Based on the most recent financial report that I distributed to your group in class, perform the following:

Prepare a horizontal analysis of the Income Statement and Balance Sheet comparing the data from the two most recent years.

Prepare a vertical analysis on the Income Statement and Balance Sheet utilizing the two most recent years.

(If you are missing any data needed for averages for years that are not given to you, go find it by pulling up data from a source I suggest Yahoo Finance as demonstrated in class.)

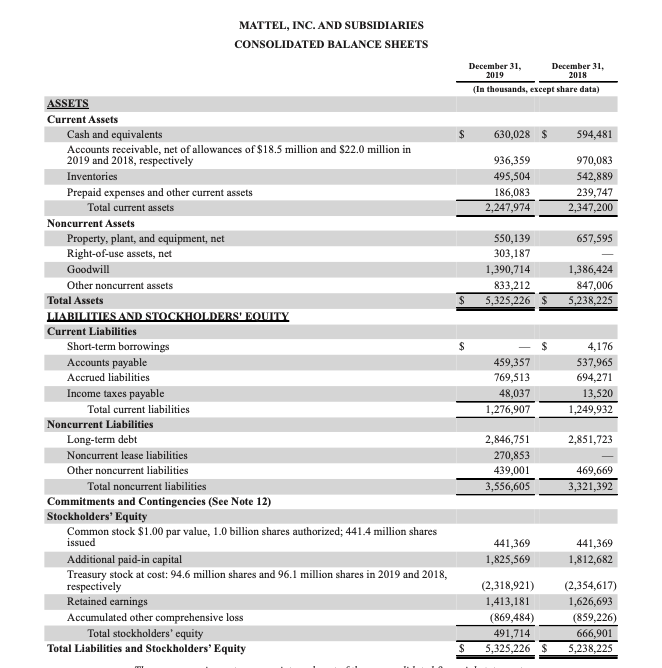

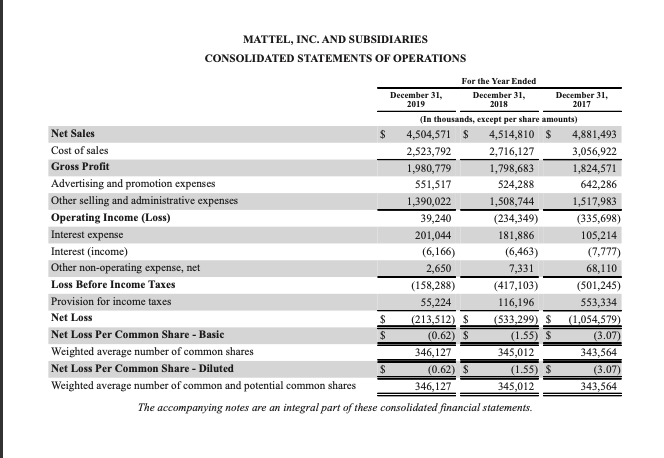

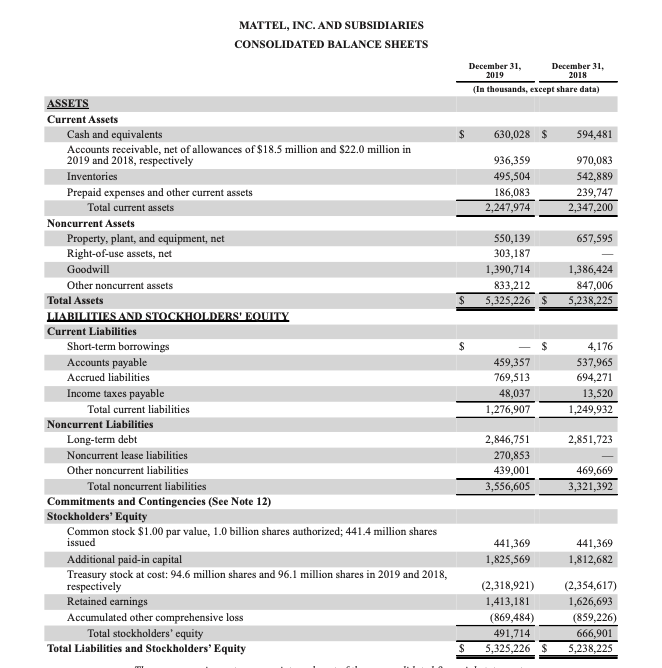

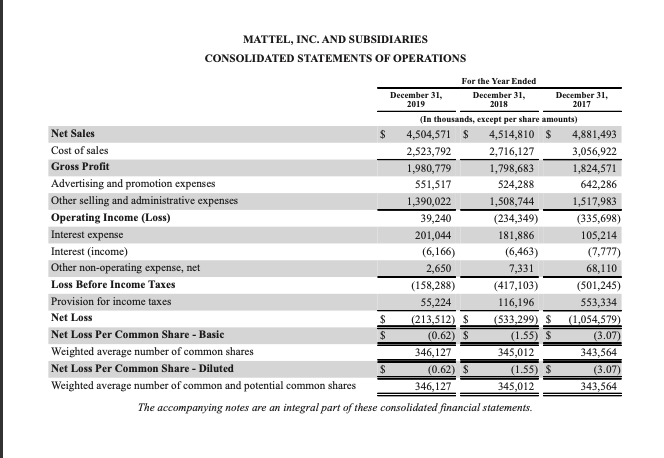

MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, December 31. 2019 2018 (In thousands, except share data) $ 630,028 $ 594,481 936,359 495,504 186,083 2,247,974 970,083 542,889 239,747 2,347,200 657,595 550,139 303,187 1,390,714 833,212 5,325,226 $ 1,386,424 847,006 5,238,225 $ $ ASSETS Current Assets Cash and equivalents Accounts receivable, net of allowances of $18.5 million and $22.0 million in 2019 and 2018, respectively Inventories Prepaid expenses and other current assets Total current assets Noncurrent Assets Property, plant, and equipment, net Right-of-use assets, net Goodwill Other noncurrent assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings Accounts payable Accrued liabilities Income taxes payable Total current liabilities Noncurrent Liabilities Long-term debt Noncurrent lease liabilities Other noncurrent liabilities Total noncurrent liabilities Commitments and Contingencies (See Note 12) Stockholders' Equity Common stock $1.00 par value, 1.0 billion shares authorized; 441.4 million shares issued Additional paid-in capital Treasury stock at cost: 94.6 million shares and 96.1 million shares in 2019 and 2018, respectively Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total Liabilities and Stockholders' Equity 459,357 769,513 48,037 1,276,907 4,176 537,965 694,271 13,520 1,249,932 2,851,723 2,846,751 270,853 439,001 3,556,605 469,669 3,321,392 441,369 1,825,569 441,369 1,812,682 (2,318,921) 1,413,181 (869,484) 491,714 5,325,226 $ (2,354,617) 1,626,693 (859,226) 666,901 5,238,225 $ MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS For the Year Ended December 31, December 31, December 31. 2019 2018 2017 (In thousands, except per share amounts) Net Sales $ 4,504,571 $ 4,514,810 $ 4,881,493 Cost of sales 2,523,792 2,716,127 3,056,922 Gross Profit 1,980,779 1,798,683 1,824,571 Advertising and promotion expenses 551,517 524,288 642,286 Other selling and administrative expenses 1,390,022 1,508,744 1,517,983 Operating Income (Loss) 39,240 (234,349) (335,698) Interest expense 201,044 181,886 105,214 Interest (income) (6,166) (6,463) (7,777) Other non-operating expense, net 2,650 7,331 68,110 Loss Before Income Taxes (158,288) (417,103) (501,245) Provision for income taxes 55,224 116,196 553,334 Net Loss $ (213,512) $ (533,299) $ (1,054,579) Net Loss Per Common Share - Basie $ (0.62) $ (1.55) $ (3.07) Weighted average number of common shares 346,127 345,012 343,564 Net Loss Per Common Share - Diluted (0.62) $ (1.55) $ (3.07) Weighted average number of common and potential common shares 346,127 345,012 343,564 The accompanying notes are an integral part of these consolidated financial statements. MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31, December 31. 2019 2018 (In thousands, except share data) $ 630,028 $ 594,481 936,359 495,504 186,083 2,247,974 970,083 542,889 239,747 2,347,200 657,595 550,139 303,187 1,390,714 833,212 5,325,226 $ 1,386,424 847,006 5,238,225 $ $ ASSETS Current Assets Cash and equivalents Accounts receivable, net of allowances of $18.5 million and $22.0 million in 2019 and 2018, respectively Inventories Prepaid expenses and other current assets Total current assets Noncurrent Assets Property, plant, and equipment, net Right-of-use assets, net Goodwill Other noncurrent assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Short-term borrowings Accounts payable Accrued liabilities Income taxes payable Total current liabilities Noncurrent Liabilities Long-term debt Noncurrent lease liabilities Other noncurrent liabilities Total noncurrent liabilities Commitments and Contingencies (See Note 12) Stockholders' Equity Common stock $1.00 par value, 1.0 billion shares authorized; 441.4 million shares issued Additional paid-in capital Treasury stock at cost: 94.6 million shares and 96.1 million shares in 2019 and 2018, respectively Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total Liabilities and Stockholders' Equity 459,357 769,513 48,037 1,276,907 4,176 537,965 694,271 13,520 1,249,932 2,851,723 2,846,751 270,853 439,001 3,556,605 469,669 3,321,392 441,369 1,825,569 441,369 1,812,682 (2,318,921) 1,413,181 (869,484) 491,714 5,325,226 $ (2,354,617) 1,626,693 (859,226) 666,901 5,238,225 $ MATTEL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS For the Year Ended December 31, December 31, December 31. 2019 2018 2017 (In thousands, except per share amounts) Net Sales $ 4,504,571 $ 4,514,810 $ 4,881,493 Cost of sales 2,523,792 2,716,127 3,056,922 Gross Profit 1,980,779 1,798,683 1,824,571 Advertising and promotion expenses 551,517 524,288 642,286 Other selling and administrative expenses 1,390,022 1,508,744 1,517,983 Operating Income (Loss) 39,240 (234,349) (335,698) Interest expense 201,044 181,886 105,214 Interest (income) (6,166) (6,463) (7,777) Other non-operating expense, net 2,650 7,331 68,110 Loss Before Income Taxes (158,288) (417,103) (501,245) Provision for income taxes 55,224 116,196 553,334 Net Loss $ (213,512) $ (533,299) $ (1,054,579) Net Loss Per Common Share - Basie $ (0.62) $ (1.55) $ (3.07) Weighted average number of common shares 346,127 345,012 343,564 Net Loss Per Common Share - Diluted (0.62) $ (1.55) $ (3.07) Weighted average number of common and potential common shares 346,127 345,012 343,564 The accompanying notes are an integral part of these consolidated financial statements