Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the NPV and IRR investment criteria, should your company introduce a new candy flavor? 1) Should the cost of a marketing survey

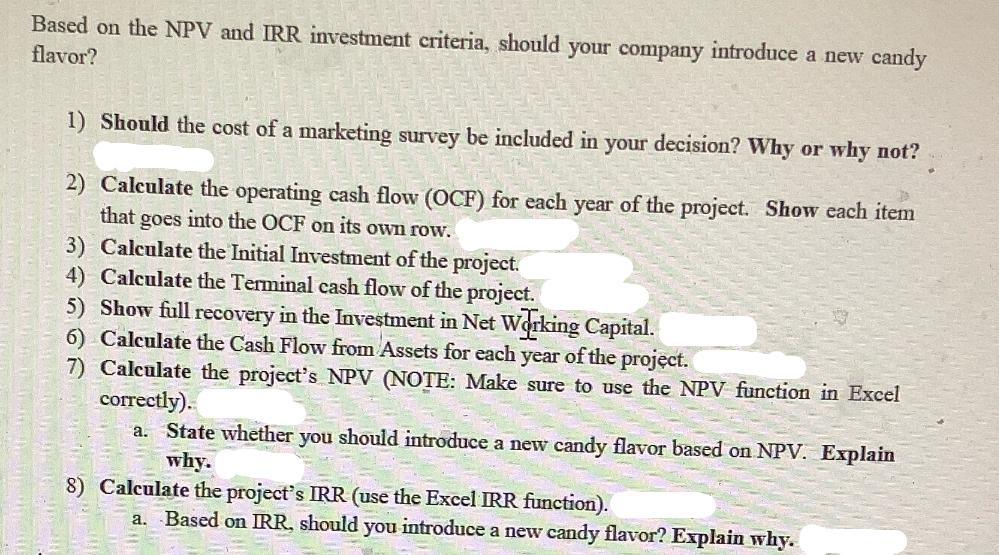

Based on the NPV and IRR investment criteria, should your company introduce a new candy flavor? 1) Should the cost of a marketing survey be included in your decision? Why or why not? 2) Calculate the operating cash flow (OCF) for each year of the project. Show each item that goes into the OCF on its own row. 3) Calculate the Initial Investment of the project. 4) Calculate the Terminal cash flow of the project. 5) Show full recovery in the Investment in Net Working Capital. 6) Calculate the Cash Flow from Assets for each year of the project. 7) Calculate the project's NPV (NOTE: Make sure to use the NPV function in Excel correctly). a. State whether you should introduce a new candy flavor based on NPV. Explain why. 8) Calculate the project's IRR (use the Excel IRR function). a. Based on IRR, should you introduce a new candy flavor? Explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

New Candy Flavor Investment Analysis Unfortunately I cannot provide specific calculations without actual data However I can guide you through the proc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started