Answered step by step

Verified Expert Solution

Question

1 Approved Answer

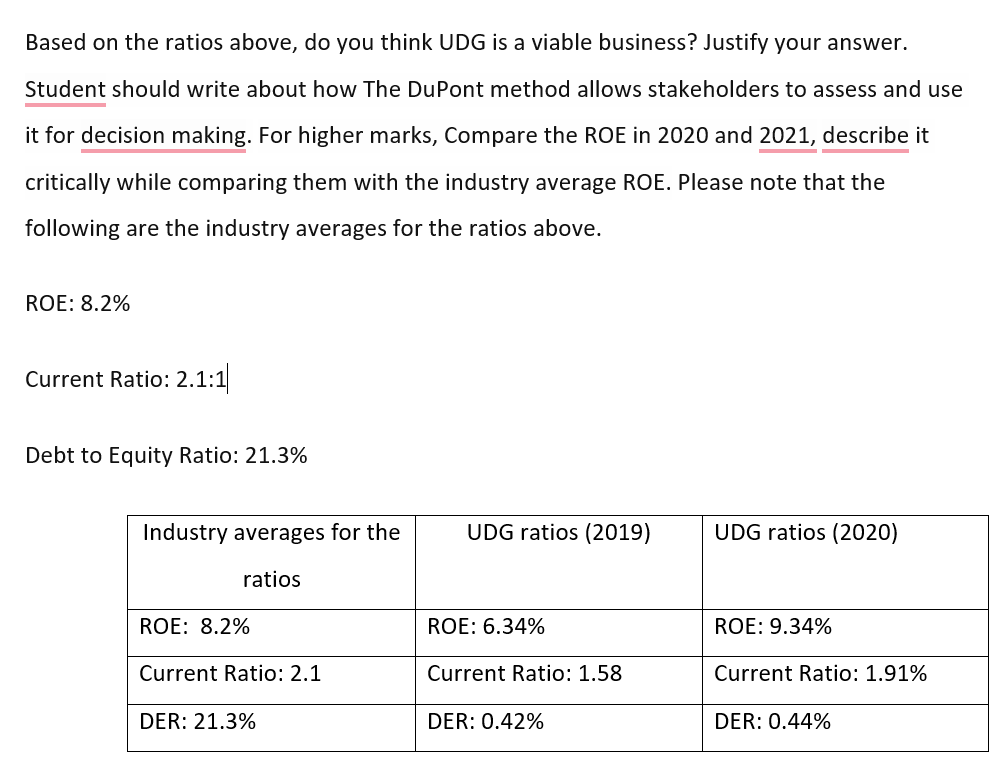

Based on the ratios above, do you think UDG is a viable business? Justify your answer. Student should write about how The DuPont method allows

Based on the ratios above, do you think UDG is a viable business? Justify your answer.

Student should write about how The DuPont method allows stakeholders to assess and use

it for decision making. For higher marks, Compare the ROE in and describe it

critically while comparing them with the industry average ROE. Please note that the

following are the industry averages for the ratios above.

ROE:

Current Ratio: :

Debt to Equity Ratio:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started