Answered step by step

Verified Expert Solution

Question

1 Approved Answer

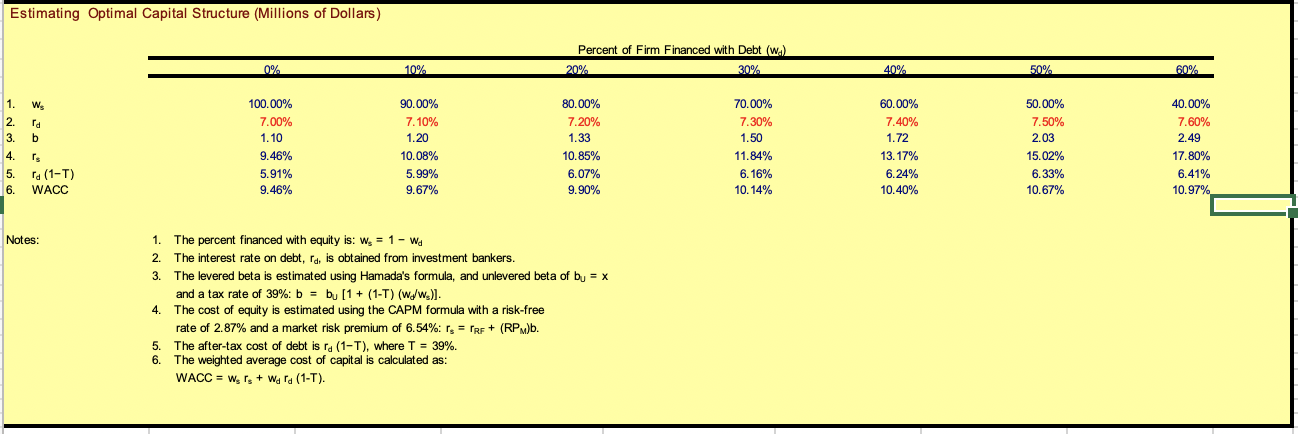

Based on the results below, Should the company take on more debt, repurchase stock, have a seasoned equity offering? Justify your answers. Estimating Optimal Capital

Based on the results below, Should the company take on more debt, repurchase stock, have a seasoned equity offering? Justify your answers.

Estimating Optimal Capital Structure (Millions of Dollars) 1. Ws 2. rd 3. b 4. rs 5. rd (1-T) 6. WACC Notes: Percent of Firm Financed with Debt (wa) 0% 10% 20% 30% 40% 50% 60% 100.00% 90.00% 80.00% 70.00% 60.00% 50.00% 40.00% 7.00% 7.10% 7.20% 7.30% 7.40% 7.50% 7.60% 1.10 1.20 1.33 1.50 1.72 2.03 2.49 9.46% 10.08% 10.85% 11.84% 13.17% 15.02% 17.80% 5.91% 9.46% 5.99% 6.07% 6.16% 6.24% 6.33% 6.41% 9.67% 9.90% 10.14% 10.40% 10.67% 10.97% 1. The percent financed with equity is: W = 1 Wd 2. The interest rate on debt, rd, is obtained from investment bankers. 3. The levered beta is estimated using Hamada's formula, and unlevered beta of b = x and a tax rate of 39%: b = by [1 + (1-T) (W/W)]. 4. The cost of equity is estimated using the CAPM formula with a risk-free rate of 2.87% and a market risk premium of 6.54%: rs = RF + (RPM)b. 5. The after-tax cost of debt is rd (1-T), where T = 39%. 6. The weighted average cost of capital is calculated as: WACC = Wrs + Ward (1-T).

Step by Step Solution

★★★★★

3.24 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing Capital Structure Options based on WACC The provided table shows the Weighted Average Cost of Capital WACC for different percentages of debt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started