Question

It is recommended to start by reviewing the 2019 file as an example to see what was done in the previous year. Similar work should

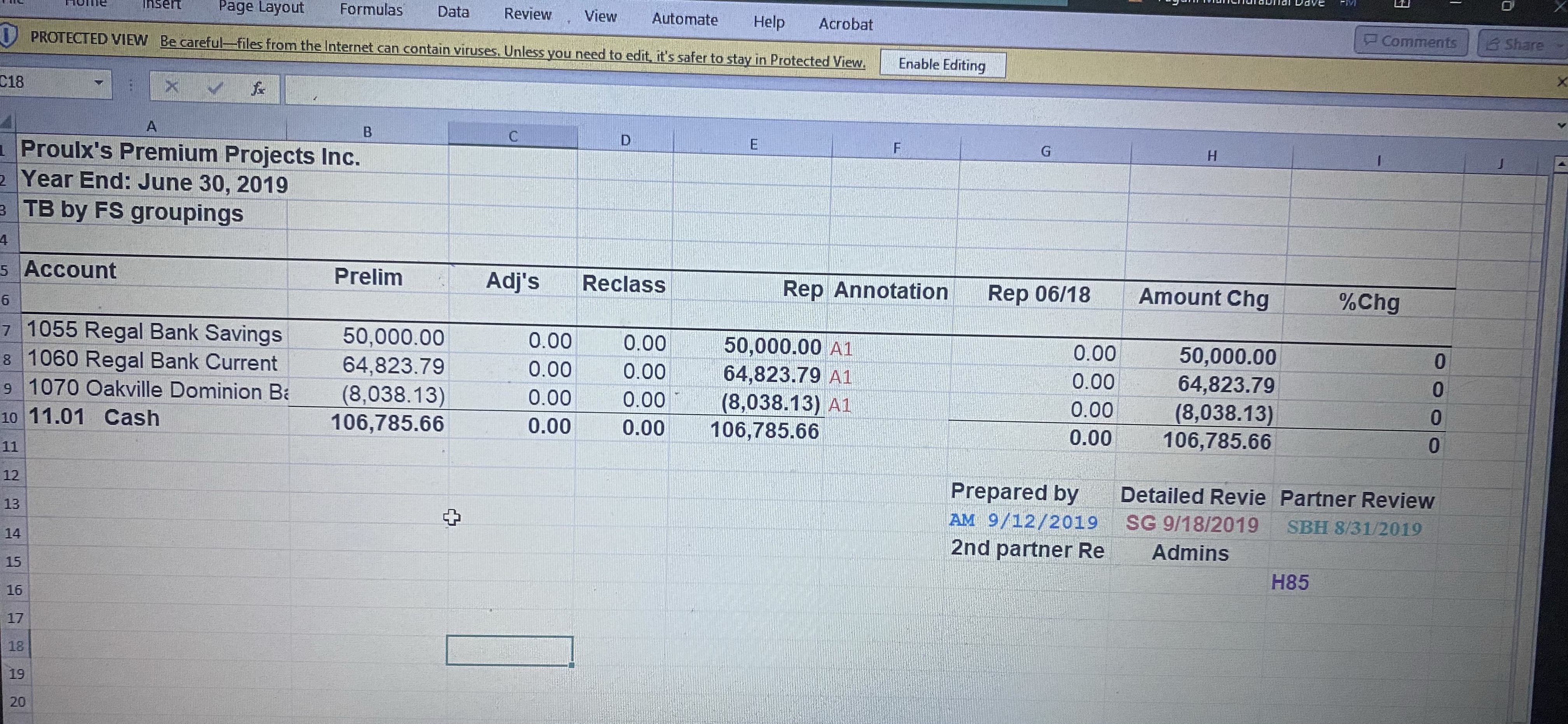

It is recommended to start by reviewing the 2019 file as an example to see what was done in the previous year. Similar work should be completed for 2020. 2. The client was unable to prepare bank reconciliation this year due to an unexpected employee departure in the accounting department. Therefore, you will have to prepare the bank reconciliations. This can be done using a new A1 working paper. You can use the 2019 A1 working paper and select "Save as" and rename it to "A1-2020". Then update it for 2020 information. 3. The only work required is relating to account#1055, 1060, & 1070. 4. When preparing your bank reconciliation, you do not need to calculate all cash receipts and disbursements for the year. Simply state the book ending balance as your starting point. 5. You account transaction details are located in document called ""Proulx's Premium Projects General Ledger Detail Jul 1 2019 - June 30 2020". Look for the detail specific to the bank account numbers that you are working on (titles on the left in the excel). There are a lot of transactions in this document relating to the three bank accounts as the transactions for the entire year have been provided by the client. You do not need the transactions for the entire year, only those that relate to the period in which you are doing the reconciliation. Please copy/past the transactions into a new document for your supporting working paper. 6. Outstanding cheques for the previous month, (May 2020) for account#1060 included Chq#273 for $21,250, Chq#130 for $6,272.70 and Chq#267 for $1,808. There were no outstanding deposits. For account #1070 Cheque # 460 for $1,211.65 and #465 for #1,827.50 were outstanding. No other items were outstanding for the month of May for other accounts. 7. When submitting H85 trial balance for 2020, you only need to include accounts relating to the cash section with relevant markups (please see H85 in in the "2019 Data".

C18 Insert Page Layout Formulas Data Review View Automate Help Acrobat PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. A B Enable Editing D E F G H IVE E Comments Share X Proulx's Premium Projects Inc. 2 Year End: June 30, 2019 3 TB by FS groupings 4 5 Account 6 71055 Regal Bank Savings Prelim Adj's Reclass Rep Annotation Rep 06/18 Amount Chg %Chg 50,000.00 0.00 0.00 50,000.00 A1 0.00 50,000.00 0 8 1060 Regal Bank Current 64,823.79 0.00 0.00 64,823.79 A1 0.00 64,823.79 0 9 1070 Oakville Dominion Ba (8,038.13) 0.00 0.00 (8,038.13) A1 0.00 (8,038.13) 0 10 11.01 Cash 106,785.66 0.00 0.00 106,785.66 0.00 106,785.66 0 11 12 13 14 15 16 17 18 19 20 + Prepared by AM 9/12/2019 2nd partner Re Detailed Revie Partner Review SG 9/18/2019 SBH 8/31/2019 Admins H85

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems like you have provided me with a description of a task related to bank reconciliations for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started