Answered step by step

Verified Expert Solution

Question

1 Approved Answer

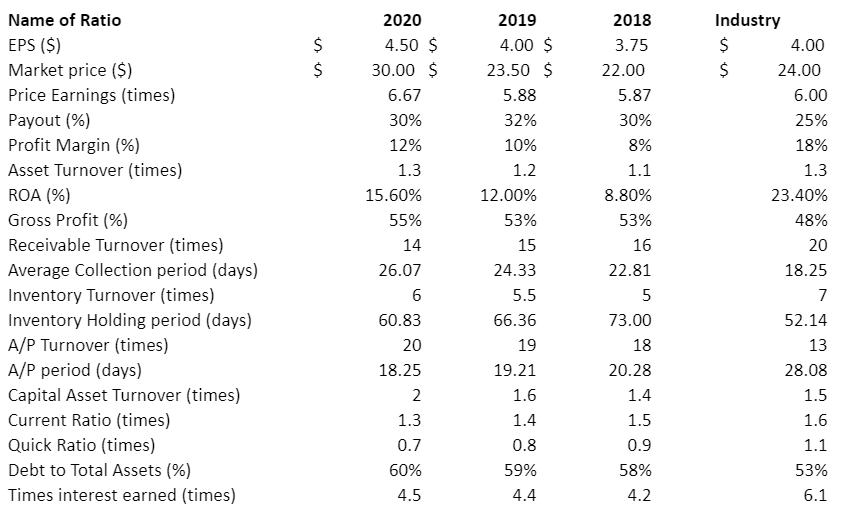

Based on the selected ratios provided below, please comment on the internal trend, comparison to industry and ways they could improve on the ratio. You

Based on the selected ratios provided below, please comment on the internal trend, comparison to industry and ways they could improve on the ratio. You will only select and comment on the following:

Any 2 Profitability ratios

Any 2 Asset Utilization ratios

Any 1 Liquidity ratio

Any 1 Debt Utilization ratio

To recap, you will comment on a total of 6 ratios only. Not all of them. Would you invest in this organization? Explain. Bullet form is fine.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started