Answered step by step

Verified Expert Solution

Question

1 Approved Answer

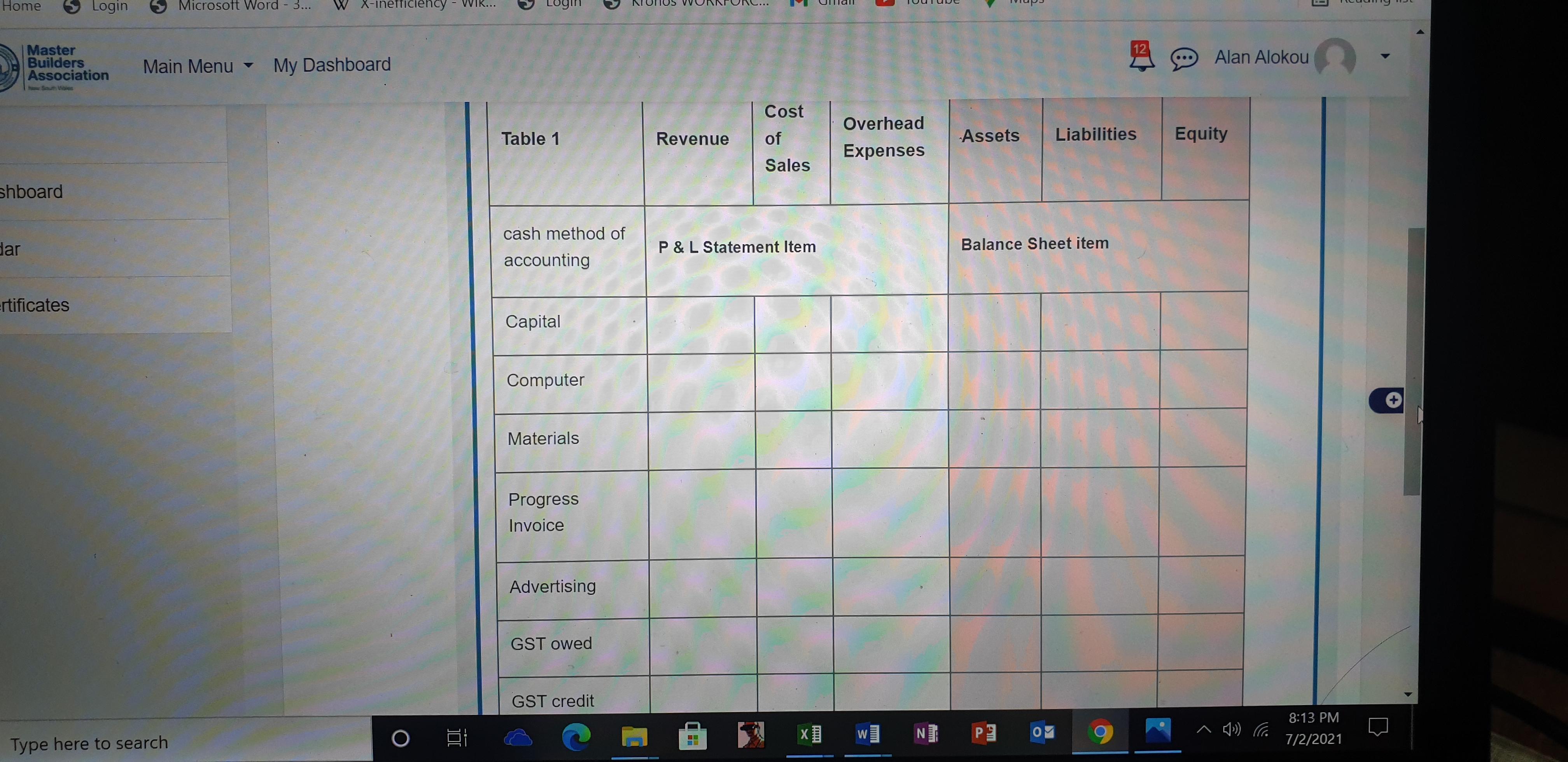

Based on the series of activities below, classify and record the following financial information in the table provided: ECO commenced business on 1 July. A

Based on the series of activities below, classify and record the following financial information in the table provided:

ECO commenced business on 1 July. A summary of transactions for the month of July are set out below:

- Owner injects capital of $20,000 to ECO on 1 July.

- ECO purchases a computer with cash for $5,500 (including GST) on 1 July.

- ECO purchases materials on 15 July for $11,000 (including GST). The materials are not paid for until August (the following month).

- ECO issues a customer progress invoice for $27,500 (including GST) on 31 July. The customer does not pay until August (the following month).

- ECO pays $1,100 (including GST) to Google advertising with cash on 15 July.

Follow through the above transactions. As at 31 July, Identify:

- Assets

- Liabilities

- Capital

- Revenue

- Direct Costs (i.e. materials and labour)

- Overhead Expenses

b) What is the assumption being made regarding the method of accounting used for ECO in the table

Home shboard dar Master Builders Association Login rtificates Microsoft Word - 3... Type here to search inefficiency Main Menu My Dashboard O 100 Table 1 cash method of accounting Capital Computer Materials Progress Invoice Advertising GST owed GST credit Revenue Cost of Sales P & L Statement Item 4 Overhead Expenses W N www Assets Liabilities Balance Sheet item P OM 12 O ... Alan Alokou Equity ^)) ( 8:13 PM 7/2/2021

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Based on the series of activities provided we can classify and record the financial informati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started