Question

BASED ON THE SPREAD SHEET 1. Determine the total amount that must be financed 2. Determine which sources will be used and what changes to

BASED ON THE SPREAD SHEET

1. Determine the total amount that must be financed

2. Determine which sources will be used and what changes to those sources must be made (e.g. raising hotel taxes 0.5%).

3. Determine the amount of financing that will be generated from each source. These amounts should sum to the total amount that must be financed.

4. Determine the timing: When money will be collected from each source and when it will be paid back. For instance, if a GOB general obligation bond is used and it is paid for with an increase in hotel taxes, what is the annual payment necessary to pay it off?

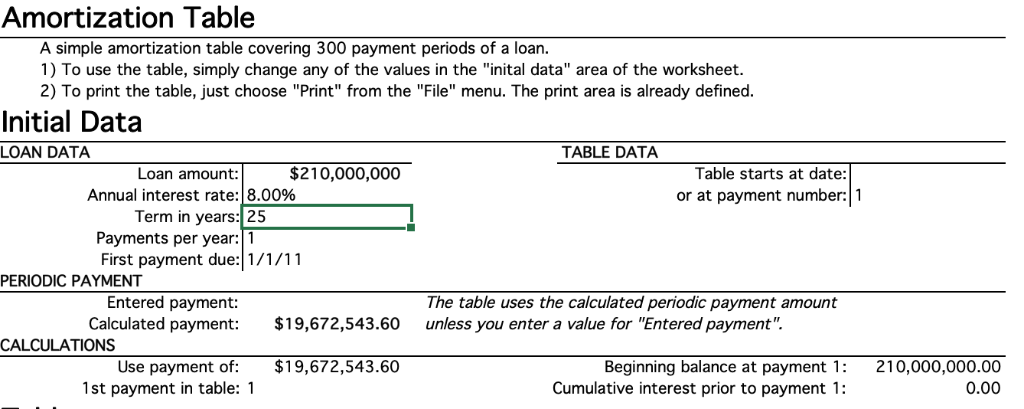

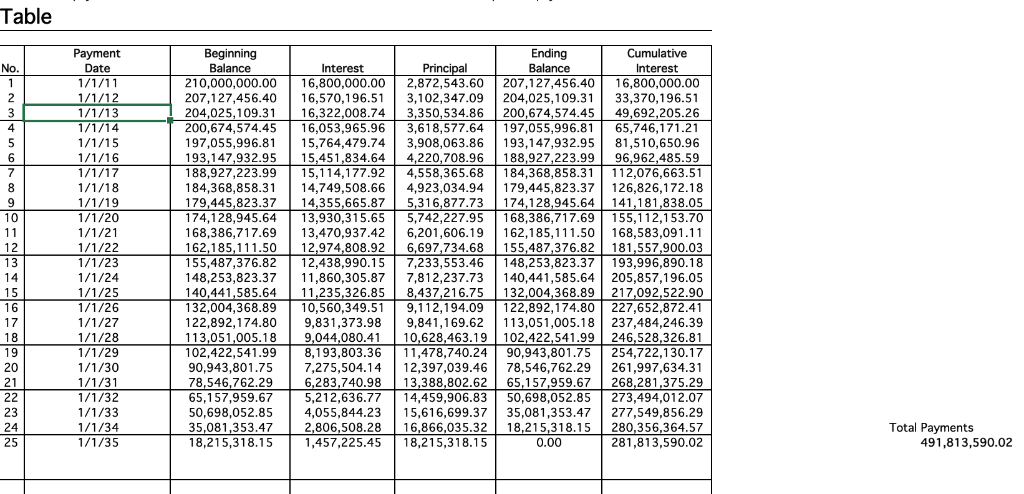

Amortization Table A simple amortization table covering 300 payment periods of a loan. 1) To use the table, simply change any of the values in the "inital data" area of the worksheet. 2) To print the table, just choose "Print" from the "File" menu. The print area is already defined. Initial Data LOAN DATA TABLE DATA Table starts at date: $210,000,000 Loan amount: Annual interest rate: 8.00% Term in years: 25 Payments per year: 1 First payment due: 1/1/11 or at payment number: 1 PERIODIC PAYMENT The table uses the calculated periodic payment amount Entered payment: Calculated payment: $19,672,543.60 unless you enter a value for "Entered payment". CALCULATIONS $19,672,543.60 Use payment of: 1st payment in table: 1 Beginning balance at payment 1: Cumulative interest prior to payment 1: 210,000,000.00 0.00 Table Ending Balance 207,127,456.40 204,025,109.31 Cumulative Payment Beginning Balance No. Date Interest Principal 2,872,543.60 3,102,347.09 Interest 210,000,000.00 16,800,000.00 1 1/1/11 16,800,000.00 16,570,196.51 33,370,196.51 1112 207,127,45b.40 16.053.965.96 1/1/14 200.674.574.45 197,055,996.81 193,147,932.95 188,927,223.99 3,618,577.64 3.908,063.86 4,220,708.96 4,558,365.68 197.055.996.81 193,147,932.95 188,927,223.99 184,368,858.31 65.746.171.21 4 5 1/1/15 1/1/16 1/1/17 15,764,479.74 81,510,650.96 96,962,485.59 112,076,663.51 6 15,451,834.64 15,114,177.92 14,749,508.66 14,355,665.87 13,930,315.65 7 126,826,172.18 141,181,838.05 155.112.153.70 8 1/1/18 184,368,858.31 179,445,823.37 174.128.945.64 4,923.034.94 179,445,823.37 174,128,945.64 168,386,717.69 1/1/19 1/1/20 9 5,316,877.73 5,742,227.95 6,201,606.19 6,697.734.68 12,438,990.15 7,233,553.46 10 162,185,111,50 155,487,376.82 148,253,823.37 140,441,585.64 132,004,368.89 217,092,522.90 122,892,174.80 113,051,005.18 11 1/1/21 168,386,717.69 162,185,111.50 155,487,376.82 13,470,937.42 12,974,808.92 168,583,091.11 181.557,900.03 193,996,890.18 205,857,196.05 12 13 1/1/22 1/1/23 148.253,823.37 140,441,585.64 132,004,368.89 14 1/1/24 11,860,305.87 11,235,326.85 10,560,349.51 9,831,373.98 7,812,237.73 8,437,216.75 9,112,194.09 15 1/1/25 1/1/26 227,652,872.41 237,484,246.39 16 17 1/1/27 122,892,174.80 9,841,169.62 10,628,463.19| 102,422,541.99 ICOOLSO'SU 7,275,504.14 6,283,740.98 5,212,636.77 1/4/29 2FE9926.81 10 12,397,039.46 13,388,802.62 14,459,906.83 20 1/1/30 1/1/31 1/1/32 90,943,801.75 78,546,762.29 261,997,634.31 268,281,375.29 273,494,012.07 277,549,856.29 65,157,959.67 50,698,052.85 35,081,353.47 18.215,318.15 21 78,546,762.29 65,157,959.67 22 23 1/1/33 50,698,052.85 35,081,353.47 18,215.318.15 4,055,844.23 2,806,508.28 1,457,225.45 15,616,699.37 16,866,035.32 18,215,318.15 1/1/34 1/1/35 280,356,364.57 Total Payments 24 25 0.00 281,813,590.02 491,813,590.02 Amortization Table A simple amortization table covering 300 payment periods of a loan. 1) To use the table, simply change any of the values in the "inital data" area of the worksheet. 2) To print the table, just choose "Print" from the "File" menu. The print area is already defined. Initial Data LOAN DATA TABLE DATA Table starts at date: $210,000,000 Loan amount: Annual interest rate: 8.00% Term in years: 25 Payments per year: 1 First payment due: 1/1/11 or at payment number: 1 PERIODIC PAYMENT The table uses the calculated periodic payment amount Entered payment: Calculated payment: $19,672,543.60 unless you enter a value for "Entered payment". CALCULATIONS $19,672,543.60 Use payment of: 1st payment in table: 1 Beginning balance at payment 1: Cumulative interest prior to payment 1: 210,000,000.00 0.00 Table Ending Balance 207,127,456.40 204,025,109.31 Cumulative Payment Beginning Balance No. Date Interest Principal 2,872,543.60 3,102,347.09 Interest 210,000,000.00 16,800,000.00 1 1/1/11 16,800,000.00 16,570,196.51 33,370,196.51 1112 207,127,45b.40 16.053.965.96 1/1/14 200.674.574.45 197,055,996.81 193,147,932.95 188,927,223.99 3,618,577.64 3.908,063.86 4,220,708.96 4,558,365.68 197.055.996.81 193,147,932.95 188,927,223.99 184,368,858.31 65.746.171.21 4 5 1/1/15 1/1/16 1/1/17 15,764,479.74 81,510,650.96 96,962,485.59 112,076,663.51 6 15,451,834.64 15,114,177.92 14,749,508.66 14,355,665.87 13,930,315.65 7 126,826,172.18 141,181,838.05 155.112.153.70 8 1/1/18 184,368,858.31 179,445,823.37 174.128.945.64 4,923.034.94 179,445,823.37 174,128,945.64 168,386,717.69 1/1/19 1/1/20 9 5,316,877.73 5,742,227.95 6,201,606.19 6,697.734.68 12,438,990.15 7,233,553.46 10 162,185,111,50 155,487,376.82 148,253,823.37 140,441,585.64 132,004,368.89 217,092,522.90 122,892,174.80 113,051,005.18 11 1/1/21 168,386,717.69 162,185,111.50 155,487,376.82 13,470,937.42 12,974,808.92 168,583,091.11 181.557,900.03 193,996,890.18 205,857,196.05 12 13 1/1/22 1/1/23 148.253,823.37 140,441,585.64 132,004,368.89 14 1/1/24 11,860,305.87 11,235,326.85 10,560,349.51 9,831,373.98 7,812,237.73 8,437,216.75 9,112,194.09 15 1/1/25 1/1/26 227,652,872.41 237,484,246.39 16 17 1/1/27 122,892,174.80 9,841,169.62 10,628,463.19| 102,422,541.99 ICOOLSO'SU 7,275,504.14 6,283,740.98 5,212,636.77 1/4/29 2FE9926.81 10 12,397,039.46 13,388,802.62 14,459,906.83 20 1/1/30 1/1/31 1/1/32 90,943,801.75 78,546,762.29 261,997,634.31 268,281,375.29 273,494,012.07 277,549,856.29 65,157,959.67 50,698,052.85 35,081,353.47 18.215,318.15 21 78,546,762.29 65,157,959.67 22 23 1/1/33 50,698,052.85 35,081,353.47 18,215.318.15 4,055,844.23 2,806,508.28 1,457,225.45 15,616,699.37 16,866,035.32 18,215,318.15 1/1/34 1/1/35 280,356,364.57 Total Payments 24 25 0.00 281,813,590.02 491,813,590.02Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started