Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the supplied information for Home Depot and Lowes, along with the calculated ratios, which corporation would you choose to invest in? Why? Explain

Based on the supplied information for Home Depot and Lowes, along with the calculated ratios, which corporation would you choose to invest in? Why? Explain your reasoning with financial and nonfinancial information. Did your personal experience with the entity play a role in your decision? Do you feel that the company represents a long-term investment? Why or why not?

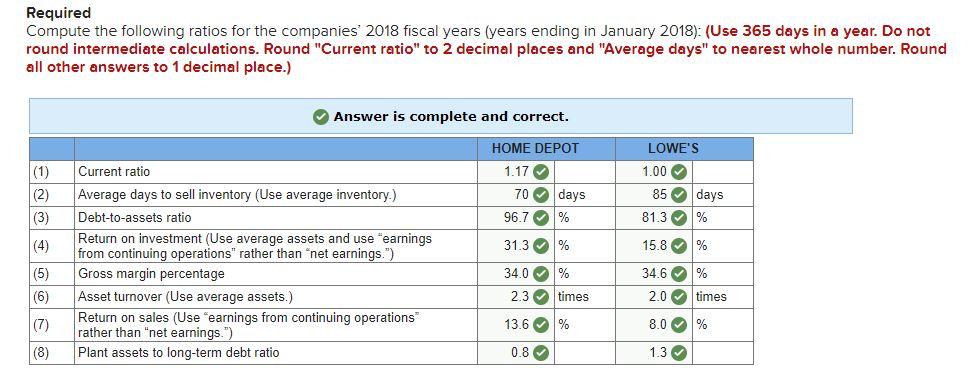

Required Compute the following ratios for the companies' 2018 fiscal years (years ending in January 2018): (Use 365 days in a year. Do not round intermediate calculations. Round "Current ratio" to 2 decimal places and "Average days" to nearest whole number. Round all other answers to 1 decimal place.) Answer is complete and correct. HOME DEPOT 1.17 (1) (2) (3) LOWE'S 1.00 85 days 81.3% 70 days 96.7 % 31.3% 15.8% Current ratio Average days to sell inventory (Use average inventory.) Debt-to-assets ratio Return on investment (Use average assets and use "earnings from continuing operations" rather than "net earnings.") Gross margin percentage Asset turnover (Use average assets.) Return on sales (Use earnings from continuing operations rather than "net earnings.") Plant assets to long-term debt ratio (5) (6) (7) 34.0% 23 times 13.6% 34.6% 2.0 times 8.0 % (8) 0.8 1.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started