Answered step by step

Verified Expert Solution

Question

1 Approved Answer

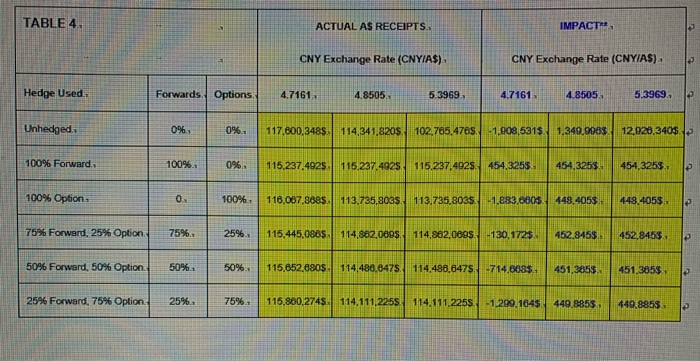

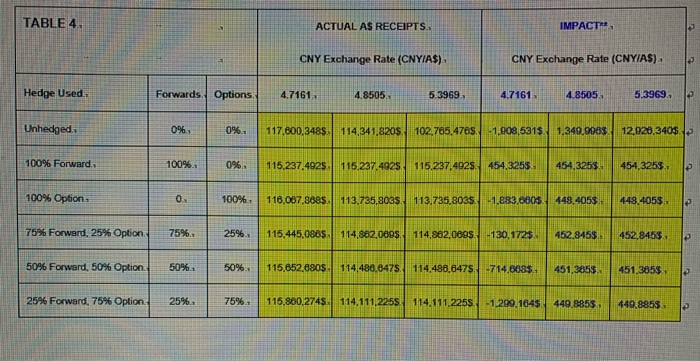

Based on the table, which hedging strategy would you prefer and why? (Impact = benchmark $ receipt - actual $ receipt) benchmark assumes no change

Based on the table, which hedging strategy would you prefer and why?

TABLE4 ACTUAL AS RECEIPTS. IMPACT CNY Exchange Rate (CNYIAS). CNY Exchange Rate (CNYIAS). Hedge Used Forwards Options 4.7161 4 .8505 5 .3969, 4.7161 4.8505. 5.3969 Unhedged 0% 0%. 117.600.3485, 114,341.8200 102.765.476. 1.008,53151,340.000 12.020,340$ 100% Forward 100% 0%. 115.237.492$ 115237.492 115.237.402 54.325 454 325 454,325$ 100% Option 100% 110,007.8685. 113.735.803. 113.735,8035 -1,883.6008448,405$ 449,4053. 75% Forward, 25% Option 75%. 25% 116,445.0805 114.862,0895. 114,882,0805 -130, 1725 452,845$. 452,845$ 50% Forward, 50% Option 50%. 50% 116.662.8805 114,486,6478 114.486.8475714,0035 451,385$ 451,385$ 25% Forward. 75% Option 25% 75% 116,800.274.114.111.2255114.111.225 -1200,1645440.8855. 440,8859 (Impact = benchmark $ receipt - actual $ receipt)

benchmark assumes no change from initial exhange rate of 4.7939/A$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started