Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the two images below, find the journal entries for payroll and employers expense using the tax rates described at the bottom of the

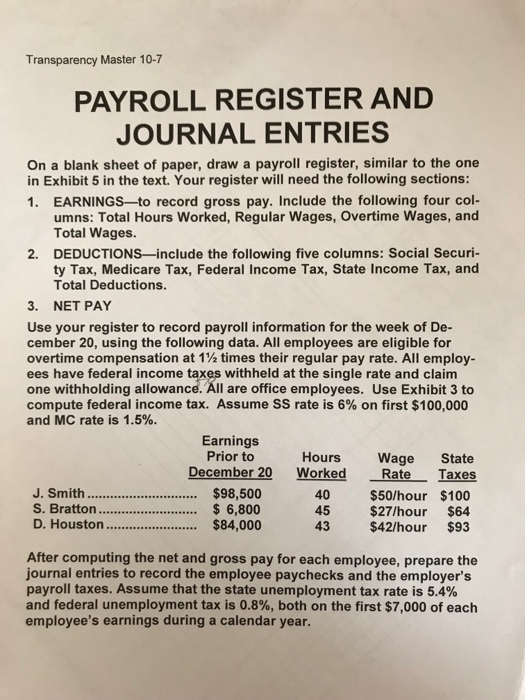

Based on the two images below, find the journal entries for payroll and employers expense using the tax rates described at the bottom of the first picture.

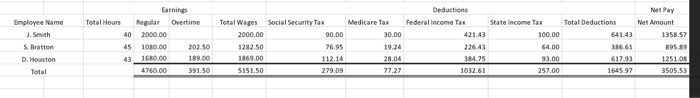

Transparency Master 10-7 PAYROLL REGISTER AND JOURNAL ENTRIES On a blank sheet of paper, draw a payroll register, similar to the one in Exhibit 5 in the text. Your register will need the following sections: 1. EARNINGS-to record gross pay. Include the following four col- umns: Total Hours Worked, Regular Wages, Overtime Wages, and Total Wages 2. DEDUCTIONS-include the following five columns: Social Securi- ty Tax, Medicare Tax, Federal Income Tax, State Income Tax, and Total Deductions. 3. NET PAY Use your register to record payroll information for the week of De- cember 20, using the following data. All employees are eligible for overtime compensation at 1% times their regular pay rate. All employ- ees have federal income taxes with held at the single rate and claim one withholding allowance. All are office employees. Use Exhibit 3 to compute federal income tax. Assume SS rate is 6% on first $100,000 and MC rate is 1.5% Earnings Prior to December 20 Hours Wage Rate State Worked Taxes $98,500 6,800 $84,000 J. Smith 40 45 $50/hour $100 $27/hour $64 $42/hour $93 S. Bratton D. Houston 43 After computing the net and gross pay for each employee, prepare the journal entries to record the employee paychecks and the employer's payroll taxes. Assume that the state unemployment tax rate is 5.4% and federal unemployment tax is 0.8%, both on the first $7,000 of each employee's earnings during a calendar year. Deductions Earnings Net Pay Employee Name Total Hours Total Wages Social Security Tax Federal Income Tax Total Deductions Regular Overtimes Medicare Tax State Income Tax Net Amount: 2000.00 J. Smith 40 2000.00 90.00 30.00 421.43 100.00 64143 1358.57 386.61 89589 S Bratton 45 1080.00 202.50 1282.50 76.95 19.24 226.43 64.00 1680.00 189.00 1869.00 112.14 28.04 384.75 93.00 617.93 1251.08 D. Houston 43 Total 4760.00 391.50 5151.50 279.09 77.27 1032.61 257.00 1645.97 3505.53 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started