Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the Year 2020 Group account (not Company account) of CBMB and the following information: Due to the expected immunization from the vaccination of

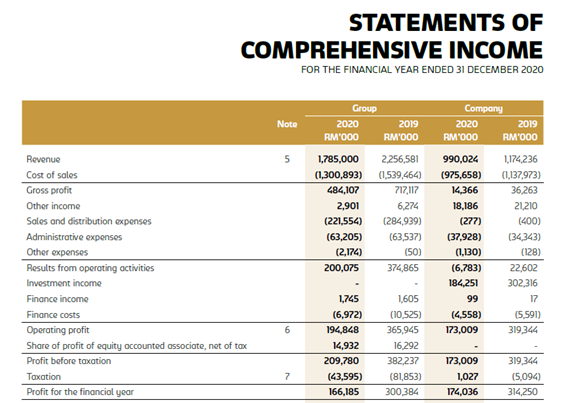

Based on the Year 2020 Group account (not Company account) of CBMB and the following information:

- Due to the expected immunization from the vaccination of COVID-19, assume that CBMB management projects (expects) that its sales in 2021 will grow by 40 percent compared to 2020. Assume that CBMBs corporate tax rate in 2021 is 24% and it is expected to distribute a dividend payout ratio of 90% in 2021.

Under the Income Statements:

- For 2021, assume that its finance costs and finance income will remain unchanged.

- For 2021, assume all types of costs and expenses (except Finance costs) and all types of income (except Finance income) to increase proportionally with the expected increase in sales in 2021 which is 40%.

- Assume that the item Share of profit of equity accounted associate, net of tax will be 5% of the Operating profit in 2021.

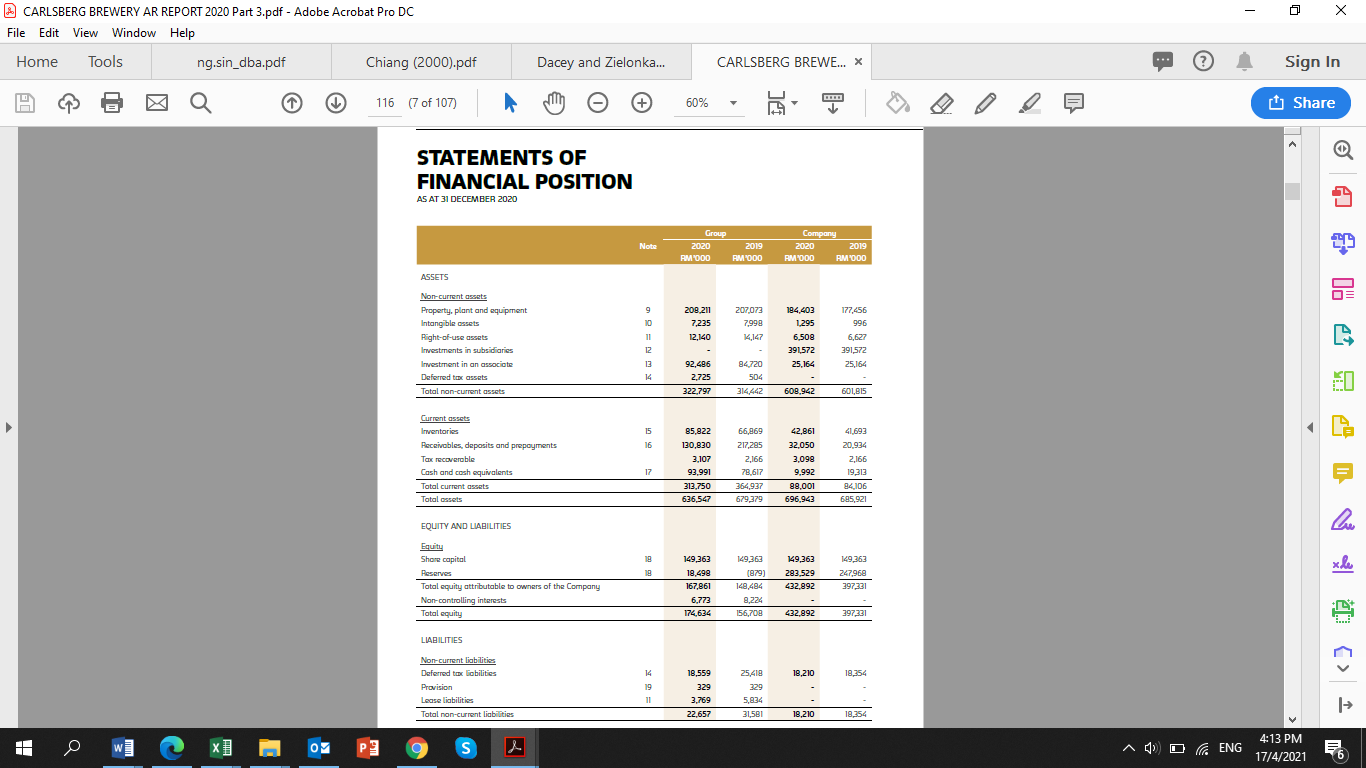

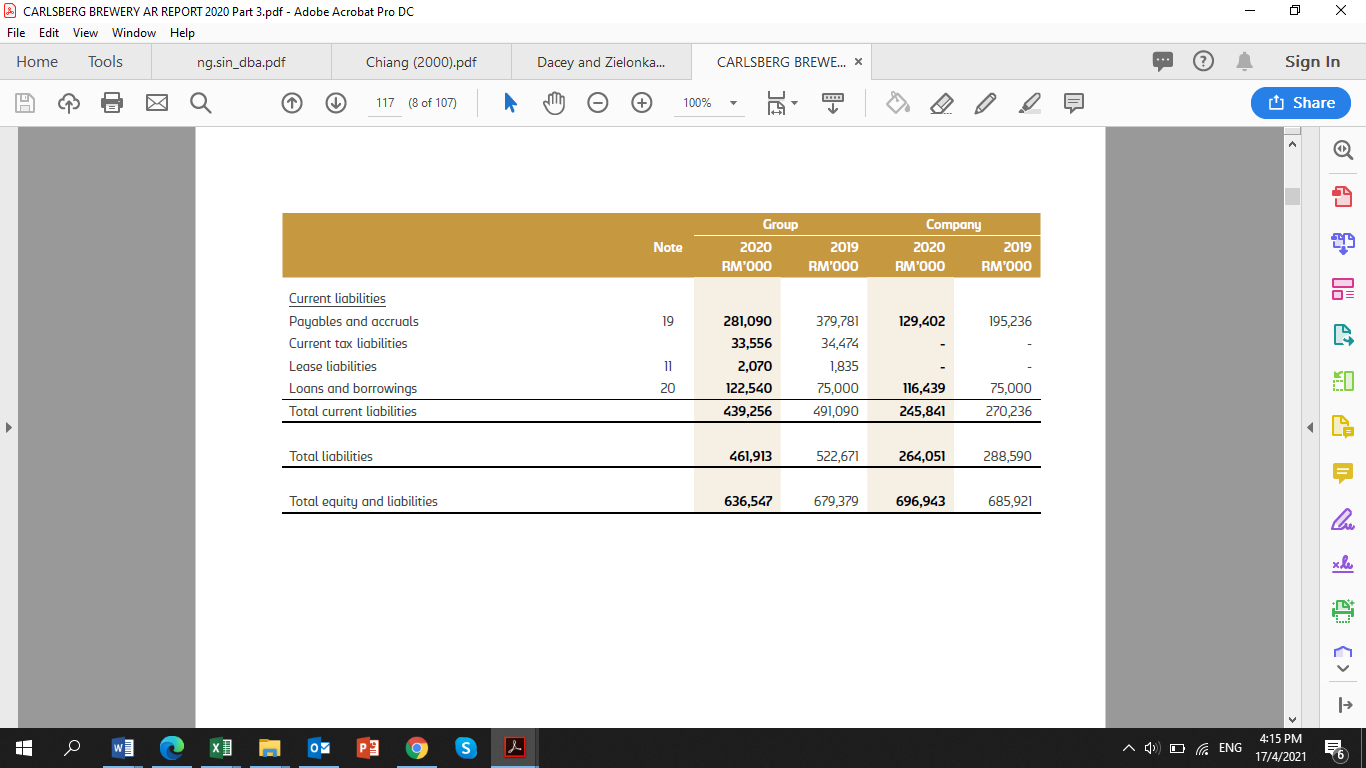

Under the Balance Sheet Statements:

- For 2021, assume that all types of current assets and all types of current liabilities to increase proportionally with the expected increase in sales in 2021 which is 40%.

- For 2021, assume that all types of non-current assets and all types of non-current liabilities to remain and unaffected directly by the expected sales growth.

- For 2021, assume that all items under Equity to be unrelated directly to the expected sales growth.

- If CBMBs Property, plant and equipment is currently operating at full capacity, what external financing is needed (EFN) to support the 40 percent expected growth rate in sales in 2021? [you need to prepare a 2021 Pro-forma financial statement for the purpose]

- marks)

- Using an appropriate formula, compute the sustainable growth rate of CBMB.

- marks)

- Comparing the sustainable growth rate in part b) with the projected sales growth of 40% in 2021, what is your advice or recommendation for CBMB management? (100-500 words)

- marks)

- With no clear line of sight yet as to when the COVID pandemic might end, it makes leading a business that much more difficult. Therefore, do you think that projecting a 40% sales growth in 2021 in the corporate financial planning of CBMB by its management is sensible? Explain and justify your opinion (at least 800 words).

(15 marks)

STATEMENTS OF COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020 Group 2020 Company Note 2019 2020 2019 RM'000 RM'000 RM"000 RM'000 Revenue 5 1,785,000 990,024 Cost of sales 2256,581 (1,539,464 717,117 (1,300,893) 484,107 (975,658) 1.174236 (1,137,973) 36,263 Gross profit 14.366 Other income 2,901 18,186 21210 6,274 (284,939) Sales and distribution expenses (221,554) (277) (400) (63,205) (63,537) (37.928) (34,343) (2,174) (50) (1.130) (128) Administrative expenses Other expenses Results from operating activities Investment income 200,075 374,865 (6,783) 22,602 184.251 302,316 Finance income 1,745 1,605 99 17 Finance costs (6,972) (10,525) (4,558) (5.591) 6 194,848 365.945 173,009 319,344 Operating profit Share of profit of equity accounted associate, net of tax 14,932 16,292 Profit before taxation 209,780 382,237 173.009 319,344 Taxation 7 (43,595) (81,853) 1,027 (5,094) Profit for the financial year 166,185 300384 174,036 314,250 - CARLSBERG BREWERY AR REPORT 2020 Part 3.pdf - Adobe Acrobat Pro DC File Edit View Window Help Home Tools ng.sin_dba.pdf Chiang (2000).pdf Dacey and Zielonka... CARLSBERG BREWE... x Sign In 116 (7 of 107) 60% ct Share m STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Group Company Note 2020 2019 2020 2019 RM1000 RM OOO RMOOD RM OOO ASSETS 9 207073 184,402 177,456 Non-current assets Property, plant and equipment Intangible assets Right-of-use assets Investments in subsidiaries 208 211 7,235 7,99 1295 996 11 12,140 6,508 6,627 12 391,572 391,572 Investment in an associate 12 92,486 94720 25,164 25,164 Deferred to assets 14 2.725 504 Total non-current assets 322,797 314442 608.942 601,815 Current assets Inventories 15 85,822 66,869 42,861 41,693 & E F {v h 16 130,830 217,285 32,050 20,934 Receivables, deposits and prepayments Tax recoverable Cash and cosh equivalents 3,107 2,166 3,098 2,166 17 93.991 78.617 9,992 19,313 Total current assets 313.750 364,937 88,001 84.106 Total assets 636,547 679,379 696,943 685,921 EQUITY AND LIABILITIES Equity Shore capital Reserves 19 149,363 149.363 149,363 149.363 xhe 19 18,498 (879) 283,529 247,960 167,861 148,484 432,892 397,331 Total equity attributable to owners of the Company Non-controlling interests Total equity 6.772 8,224 174,634 156,708 432,892 397,331 LIABILITIES Non-current liabilities Deferred tax liabilities 14 18,559 25,418 18,210 18,354 Provision 19 329 329 Lease liabilities 1 3,769 5,834 Total non-current liabilities 22.657 31,581 18,210 19,354 4:13 PM 1 WT x] 07 P S ^ () D ( ENG 17/4/2021 6 - CARLSBERG BREWERY AR REPORT 2020 Part 3.pdf - Adobe Acrobat Pro DC File Edit View Window Help Home Tools ng.sin_dba.pdf Chiang (2000).pdf Dacey and Zielonka... CARLSBERG BREWE... X Sign In 117 (8 of 107) 100% ct Share Group Company Note 2020 2019 2020 2019 RM'000 RM'000 RM'000 RM'000 Current liabilities Payables and accruals 19 281,090 379,781 129,402 195,236 Current tax liabilities 33.556 34,474 Lease liabilities 11 2,070 1,835 Loans and borrowings 20 122,540 75,000 116,439 75,000 Total current liabilities 439,256 491,090 245,841 270,236 . Total liabilities 461,913 522,671 264,051 288,590 Total equity and liabilities 636,547 679,379 696,943 685,921 x2 4:15 PM Q S ACD ( ENG 17/4/2021 STATEMENTS OF COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2020 Group 2020 Company Note 2019 2020 2019 RM'000 RM'000 RM"000 RM'000 Revenue 5 1,785,000 990,024 Cost of sales 2256,581 (1,539,464 717,117 (1,300,893) 484,107 (975,658) 1.174236 (1,137,973) 36,263 Gross profit 14.366 Other income 2,901 18,186 21210 6,274 (284,939) Sales and distribution expenses (221,554) (277) (400) (63,205) (63,537) (37.928) (34,343) (2,174) (50) (1.130) (128) Administrative expenses Other expenses Results from operating activities Investment income 200,075 374,865 (6,783) 22,602 184.251 302,316 Finance income 1,745 1,605 99 17 Finance costs (6,972) (10,525) (4,558) (5.591) 6 194,848 365.945 173,009 319,344 Operating profit Share of profit of equity accounted associate, net of tax 14,932 16,292 Profit before taxation 209,780 382,237 173.009 319,344 Taxation 7 (43,595) (81,853) 1,027 (5,094) Profit for the financial year 166,185 300384 174,036 314,250 - CARLSBERG BREWERY AR REPORT 2020 Part 3.pdf - Adobe Acrobat Pro DC File Edit View Window Help Home Tools ng.sin_dba.pdf Chiang (2000).pdf Dacey and Zielonka... CARLSBERG BREWE... x Sign In 116 (7 of 107) 60% ct Share m STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Group Company Note 2020 2019 2020 2019 RM1000 RM OOO RMOOD RM OOO ASSETS 9 207073 184,402 177,456 Non-current assets Property, plant and equipment Intangible assets Right-of-use assets Investments in subsidiaries 208 211 7,235 7,99 1295 996 11 12,140 6,508 6,627 12 391,572 391,572 Investment in an associate 12 92,486 94720 25,164 25,164 Deferred to assets 14 2.725 504 Total non-current assets 322,797 314442 608.942 601,815 Current assets Inventories 15 85,822 66,869 42,861 41,693 & E F {v h 16 130,830 217,285 32,050 20,934 Receivables, deposits and prepayments Tax recoverable Cash and cosh equivalents 3,107 2,166 3,098 2,166 17 93.991 78.617 9,992 19,313 Total current assets 313.750 364,937 88,001 84.106 Total assets 636,547 679,379 696,943 685,921 EQUITY AND LIABILITIES Equity Shore capital Reserves 19 149,363 149.363 149,363 149.363 xhe 19 18,498 (879) 283,529 247,960 167,861 148,484 432,892 397,331 Total equity attributable to owners of the Company Non-controlling interests Total equity 6.772 8,224 174,634 156,708 432,892 397,331 LIABILITIES Non-current liabilities Deferred tax liabilities 14 18,559 25,418 18,210 18,354 Provision 19 329 329 Lease liabilities 1 3,769 5,834 Total non-current liabilities 22.657 31,581 18,210 19,354 4:13 PM 1 WT x] 07 P S ^ () D ( ENG 17/4/2021 6 - CARLSBERG BREWERY AR REPORT 2020 Part 3.pdf - Adobe Acrobat Pro DC File Edit View Window Help Home Tools ng.sin_dba.pdf Chiang (2000).pdf Dacey and Zielonka... CARLSBERG BREWE... X Sign In 117 (8 of 107) 100% ct Share Group Company Note 2020 2019 2020 2019 RM'000 RM'000 RM'000 RM'000 Current liabilities Payables and accruals 19 281,090 379,781 129,402 195,236 Current tax liabilities 33.556 34,474 Lease liabilities 11 2,070 1,835 Loans and borrowings 20 122,540 75,000 116,439 75,000 Total current liabilities 439,256 491,090 245,841 270,236 . Total liabilities 461,913 522,671 264,051 288,590 Total equity and liabilities 636,547 679,379 696,943 685,921 x2 4:15 PM Q S ACD ( ENG 17/4/2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started