based on these financial statements of this company, should we give them the loan of $200,000, this company expects to increase their sales $2.8 million for year ending 2007 and $3.2 millions for year ending 2008.

Need some analysis for these financial statements to decide whether giving the loan for them or not.

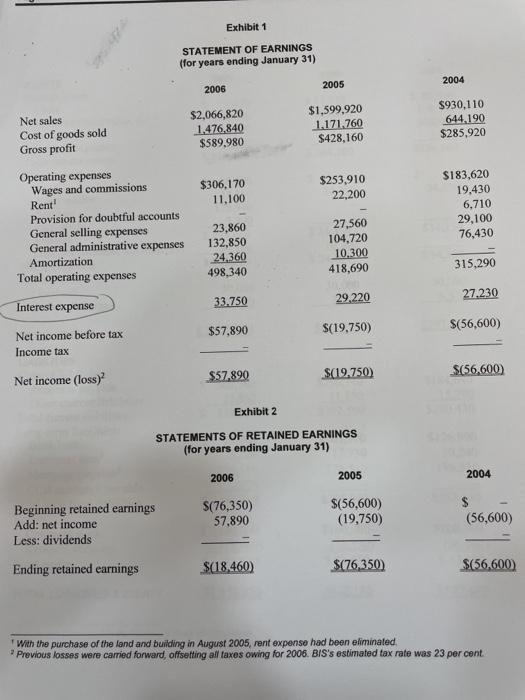

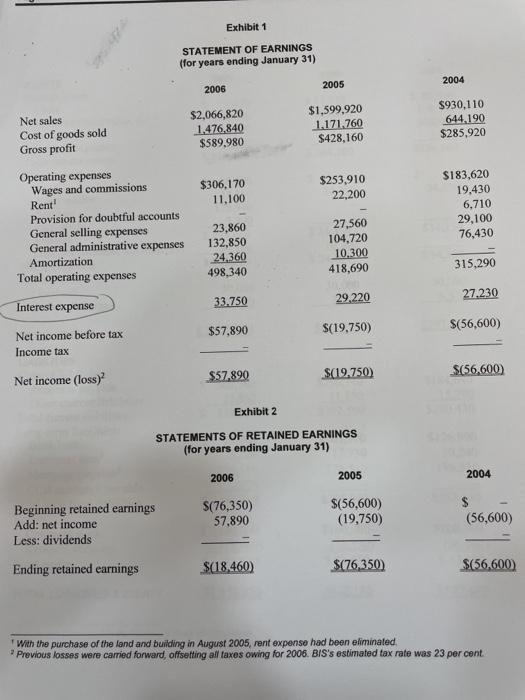

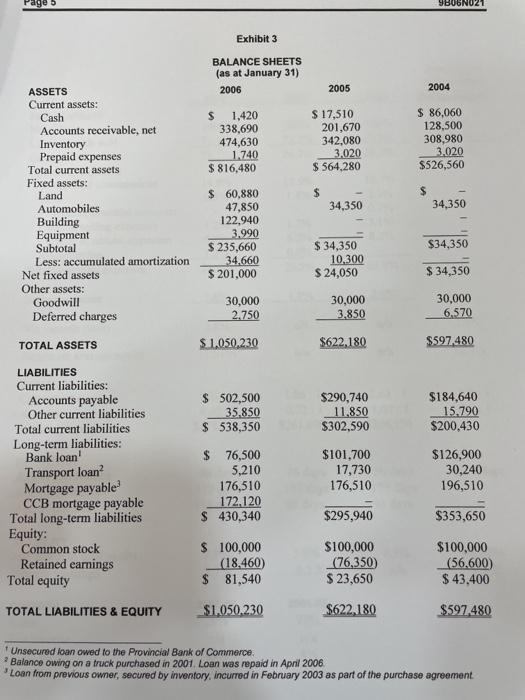

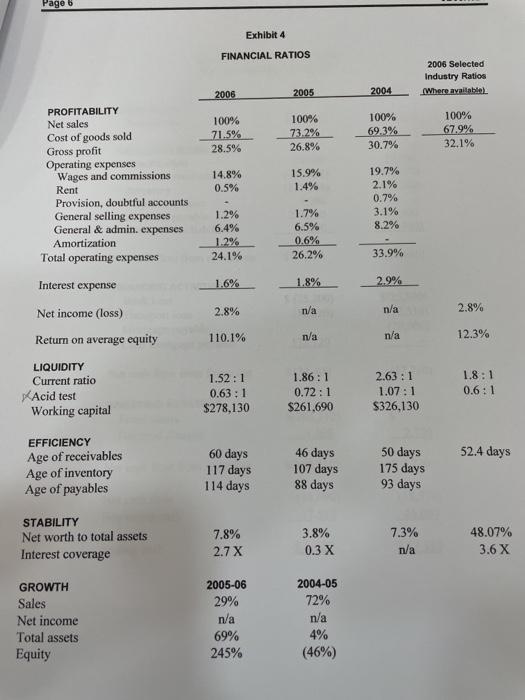

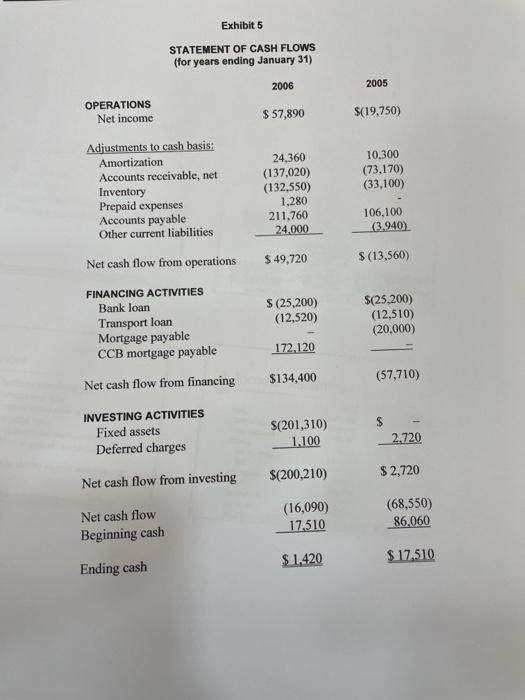

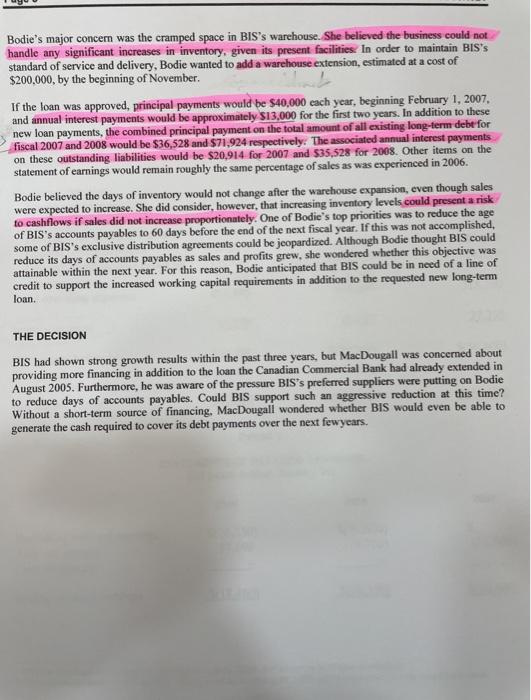

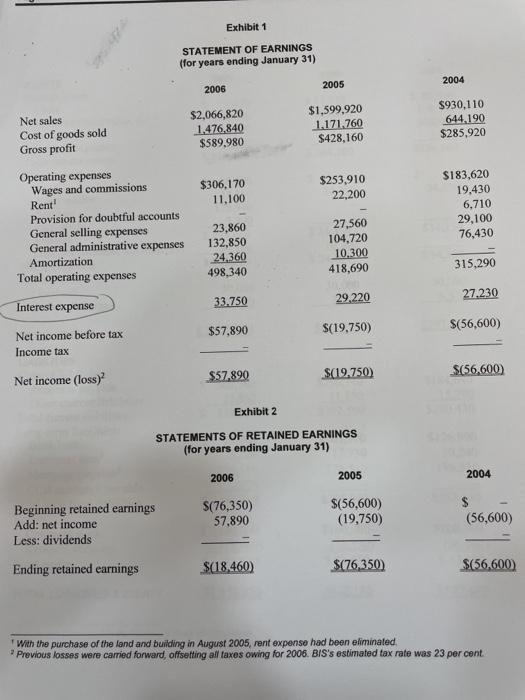

Exhibit 1 STATEMENT OF EARNINGS (for years ending January 31) 2006 2005 2004 $2,066,820 1.476,840 $589,980 $1,599,920 1.171.760 $428,160 $930,110 644.190 $285.920 $306,170 11,100 $253,910 22,200 Net sales Cost of goods sold Gross profit Operating expenses Wages and commissions Rent Provision for doubtful accounts General selling expenses General administrative expenses Amortization Total operating expenses Interest expense Net income before tax Income tax $183,620 19.430 6,710 29,100 76,430 23,860 132,850 24.360 498,340 27,560 104.720 10.300 418,690 315.290 29.220 27.230 33.750 $57,890 $(19,750) $(56,600) $57,890 $(19.750) $(56.600) Net income (loss) Exhibit 2 STATEMENTS OF RETAINED EARNINGS (for years ending January 31) 2006 2005 2004 Beginning retained earnings Add: net income Less: dividends S(76,350) 57.890 $(56,600) (19,750) (56,600) Ending retained earnings $(18,460) $(76,350) $(56,600) With the purchase of the land and building in August 2005, rent expense had been eliminated, Previous losses were carried forward, offsetting all taxes owing for 2006. BIS's estimated tax rate was 23 per cent Page 5 SBOGN021 Exhibit 3 BALANCE SHEETS (as at January 31) 2006 2005 2004 S 1,420 338,690 474,630 1.740 $ 816,480 $ 17,510 201.670 342,080 3.020 $ 564.280 $ 86,060 128,500 308,980 3.020 $526,560 $ ASSETS Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Fixed assets: Land Automobiles Building Equipment Subtotal Less: accumulated amortization Net fixed assets Other assets: Goodwill Deferred charges 34,350 $ 34,350 $ 60,880 47,850 122,940 3.990 $ 235,660 34.660 $ 201,000 $34,350 $ 34,350 10.300 $ 24,050 $ 34,350 30,000 2.750 30,000 3.850 30,000 6.570 TOTAL ASSETS $ 1.050.230 $622,180 $597,480 $ 502,500 35.850 $ 538,350 $290,740 11,850 $302,590 $184,640 15.790 $200.430 LIABILITIES Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term liabilities: Bank loan Transport loan? Mortgage payable CCB mortgage payable Total long-term liabilities Equity: Common stock Retained earnings Total equity $ 76,500 5,210 176,510 172.120 $ 430,340 $101.700 17,730 176,510 $126,900 30,240 196,510 $295,940 $353,650 $ 100,000 (18,460) $ 81,540 $100,000 (76,350 $ 23,650 $100,000 (56.600) $ 43,400 TOTAL LIABILITIES & EQUITY $1,050.230 $622,180 $597,480 1 Unsecured loan owed to the Provincial Bank of Commerce Balance owing on a truck purchased in 2001 Loan was repaid in April 2006 "Loan from previous owner, secured by inventory, incurred in February 2003 as part of the purchase agreement Page 5 Exhibit 4 FINANCIAL RATIOS 2006 Selected Industry Ratios (Where available) 2006 2005 2004 100% 71.5% 28.5% 100% 73.2% 26.8% 100% 69.3% 30.7% 100% 67.9% 32.1% 14.8% 0.5% 15.9% 1.4% PROFITABILITY Net sales Cost of goods sold Gross profit Operating expenses Wages and commissions Rent Provision, doubtful accounts General selling expenses General & admin. expenses Amortization Total operating expenses Interest expense 19.7% 2.1% 0.7% 3.1% 8.2% 1.2% 6.4% 1.2% 24.1% 1.7% 6.5% 0.6% 26.2% 33.9% 1.6% 1.8% 2.9% 2.8% n/a n/a 2.8% 110.1% n/a 12.3% n/a Net income (loss) Return on average equity LIQUIDITY Current ratio Acid test Working capital 1.52:1 0.63 : 1 $278,130 1.86:1 0.72:1 $261.690 2.63 : 1 1.07:1 $326,130 1.8:1 0.6:1 52.4 days EFFICIENCY Age of receivables Age of inventory Age of payables 60 days 117 days 114 days 46 days 107 days 88 days 50 days 175 days 93 days STABILITY Net worth to total assets Interest coverage 7.8% 2.7 x 3.8% 0.3 X 7.3% n/a 48.07% 3.6 X GROWTH Sales Net income Total assets Equity 2005-06 29% n/a 69% 245% 2004-05 72% n/a 4% (46%) Exhibit 5 STATEMENT OF CASH FLOWS (for years ending January 31) 2006 2005 OPERATIONS Net income $ 57,890 $(19,750) Adjustments to cash basis: Amortization Accounts receivable, net Inventory Prepaid expenses Accounts payable Other current liabilities 10,300 (73.170) (33,100) 24,360 (137,020) (132,550) 1.280 211,760 24,000 106,100 (3.940) Net cash flow from operations $ 49,720 S (13,560) FINANCING ACTIVITIES Bank loan Transport loan Mortgage payable CCB mortgage payable S (25,200) (12,520) $(25,200) (12,510) (20,000) 172.120 $134,400 (57,710) Net cash flow from financing INVESTING ACTIVITIES Fixed assets Deferred charges $(201,310) 1.100 2.720 $(200,210) $ 2,720 Net cash flow from investing Net cash flow Beginning cash (16,090) 17,510 (68,550) 86.060 $ 1.420 $ 17.510 Ending cash Bodie's major concem was the cramped space in BIS's warehouse. She believed the business could not handle any significant increases in inventory, given its present facilities. In order to maintain BIS's standard of service and delivery, Bodie wanted to add a warehouse extension, estimated at a cost of $200,000, by the beginning of November If the loan was approved, principal payments would be $40,000 each year, beginning February 1, 2007, and annual interest payments would be approximately $13,000 for the first two years. In addition to these new loan payments, the combined principal payment on the total amount of all existing long-term debe for fiscal 2007 and 2008 would be $36,528 and $71,924 respectively. The associated annual interest payments on these outstanding liabilities would be $20,914. for 2007 and 535,528 for 2008. Other items on the statement of earnings would remain roughly the same percentage of sales as was experienced in 2006. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. THE DECISION BIS had shown strong growth results within the past three years, but MacDougall was concerned about providing more financing in addition to the loan the Canadian Commercial Bank had already extended in August 2005. Furthermore, he was aware of the pressure BIS's preferred suppliers were putting on Bodie to reduce days of accounts payables. Could BIS support such an aggressive reduction at this time? Without a short-term source of financing. MacDougall wondered whether BIS would even be able to generate the cash required to cover its debt payments over the next fewyears. Exhibit 1 STATEMENT OF EARNINGS (for years ending January 31) 2006 2005 2004 $2,066,820 1.476,840 $589,980 $1,599,920 1.171.760 $428,160 $930,110 644.190 $285.920 $306,170 11,100 $253,910 22,200 Net sales Cost of goods sold Gross profit Operating expenses Wages and commissions Rent Provision for doubtful accounts General selling expenses General administrative expenses Amortization Total operating expenses Interest expense Net income before tax Income tax $183,620 19.430 6,710 29,100 76,430 23,860 132,850 24.360 498,340 27,560 104.720 10.300 418,690 315.290 29.220 27.230 33.750 $57,890 $(19,750) $(56,600) $57,890 $(19.750) $(56.600) Net income (loss) Exhibit 2 STATEMENTS OF RETAINED EARNINGS (for years ending January 31) 2006 2005 2004 Beginning retained earnings Add: net income Less: dividends S(76,350) 57.890 $(56,600) (19,750) (56,600) Ending retained earnings $(18,460) $(76,350) $(56,600) With the purchase of the land and building in August 2005, rent expense had been eliminated, Previous losses were carried forward, offsetting all taxes owing for 2006. BIS's estimated tax rate was 23 per cent Page 5 SBOGN021 Exhibit 3 BALANCE SHEETS (as at January 31) 2006 2005 2004 S 1,420 338,690 474,630 1.740 $ 816,480 $ 17,510 201.670 342,080 3.020 $ 564.280 $ 86,060 128,500 308,980 3.020 $526,560 $ ASSETS Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Fixed assets: Land Automobiles Building Equipment Subtotal Less: accumulated amortization Net fixed assets Other assets: Goodwill Deferred charges 34,350 $ 34,350 $ 60,880 47,850 122,940 3.990 $ 235,660 34.660 $ 201,000 $34,350 $ 34,350 10.300 $ 24,050 $ 34,350 30,000 2.750 30,000 3.850 30,000 6.570 TOTAL ASSETS $ 1.050.230 $622,180 $597,480 $ 502,500 35.850 $ 538,350 $290,740 11,850 $302,590 $184,640 15.790 $200.430 LIABILITIES Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term liabilities: Bank loan Transport loan? Mortgage payable CCB mortgage payable Total long-term liabilities Equity: Common stock Retained earnings Total equity $ 76,500 5,210 176,510 172.120 $ 430,340 $101.700 17,730 176,510 $126,900 30,240 196,510 $295,940 $353,650 $ 100,000 (18,460) $ 81,540 $100,000 (76,350 $ 23,650 $100,000 (56.600) $ 43,400 TOTAL LIABILITIES & EQUITY $1,050.230 $622,180 $597,480 1 Unsecured loan owed to the Provincial Bank of Commerce Balance owing on a truck purchased in 2001 Loan was repaid in April 2006 "Loan from previous owner, secured by inventory, incurred in February 2003 as part of the purchase agreement Page 5 Exhibit 4 FINANCIAL RATIOS 2006 Selected Industry Ratios (Where available) 2006 2005 2004 100% 71.5% 28.5% 100% 73.2% 26.8% 100% 69.3% 30.7% 100% 67.9% 32.1% 14.8% 0.5% 15.9% 1.4% PROFITABILITY Net sales Cost of goods sold Gross profit Operating expenses Wages and commissions Rent Provision, doubtful accounts General selling expenses General & admin. expenses Amortization Total operating expenses Interest expense 19.7% 2.1% 0.7% 3.1% 8.2% 1.2% 6.4% 1.2% 24.1% 1.7% 6.5% 0.6% 26.2% 33.9% 1.6% 1.8% 2.9% 2.8% n/a n/a 2.8% 110.1% n/a 12.3% n/a Net income (loss) Return on average equity LIQUIDITY Current ratio Acid test Working capital 1.52:1 0.63 : 1 $278,130 1.86:1 0.72:1 $261.690 2.63 : 1 1.07:1 $326,130 1.8:1 0.6:1 52.4 days EFFICIENCY Age of receivables Age of inventory Age of payables 60 days 117 days 114 days 46 days 107 days 88 days 50 days 175 days 93 days STABILITY Net worth to total assets Interest coverage 7.8% 2.7 x 3.8% 0.3 X 7.3% n/a 48.07% 3.6 X GROWTH Sales Net income Total assets Equity 2005-06 29% n/a 69% 245% 2004-05 72% n/a 4% (46%) Exhibit 5 STATEMENT OF CASH FLOWS (for years ending January 31) 2006 2005 OPERATIONS Net income $ 57,890 $(19,750) Adjustments to cash basis: Amortization Accounts receivable, net Inventory Prepaid expenses Accounts payable Other current liabilities 10,300 (73.170) (33,100) 24,360 (137,020) (132,550) 1.280 211,760 24,000 106,100 (3.940) Net cash flow from operations $ 49,720 S (13,560) FINANCING ACTIVITIES Bank loan Transport loan Mortgage payable CCB mortgage payable S (25,200) (12,520) $(25,200) (12,510) (20,000) 172.120 $134,400 (57,710) Net cash flow from financing INVESTING ACTIVITIES Fixed assets Deferred charges $(201,310) 1.100 2.720 $(200,210) $ 2,720 Net cash flow from investing Net cash flow Beginning cash (16,090) 17,510 (68,550) 86.060 $ 1.420 $ 17.510 Ending cash Bodie's major concem was the cramped space in BIS's warehouse. She believed the business could not handle any significant increases in inventory, given its present facilities. In order to maintain BIS's standard of service and delivery, Bodie wanted to add a warehouse extension, estimated at a cost of $200,000, by the beginning of November If the loan was approved, principal payments would be $40,000 each year, beginning February 1, 2007, and annual interest payments would be approximately $13,000 for the first two years. In addition to these new loan payments, the combined principal payment on the total amount of all existing long-term debe for fiscal 2007 and 2008 would be $36,528 and $71,924 respectively. The associated annual interest payments on these outstanding liabilities would be $20,914. for 2007 and 535,528 for 2008. Other items on the statement of earnings would remain roughly the same percentage of sales as was experienced in 2006. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. THE DECISION BIS had shown strong growth results within the past three years, but MacDougall was concerned about providing more financing in addition to the loan the Canadian Commercial Bank had already extended in August 2005. Furthermore, he was aware of the pressure BIS's preferred suppliers were putting on Bodie to reduce days of accounts payables. Could BIS support such an aggressive reduction at this time? Without a short-term source of financing. MacDougall wondered whether BIS would even be able to generate the cash required to cover its debt payments over the next fewyears