Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on these re-leasing assumptions, complete the NPV table below and determine the discounted cash flows the Company should receive assuming you sell the Property

Based on these re-leasing assumptions, complete the NPV table below and determine the discounted cash flows the Company should receive assuming you sell the Property 5 years from today. Choose an appropriate discount rate and exit cap rate as well.

Given the current scenario of re-leasing the property after a period of vacancy and selling it 5 years from today, what are some strategies you can imploy to increase cash flow and thereby the net present value of the Property?

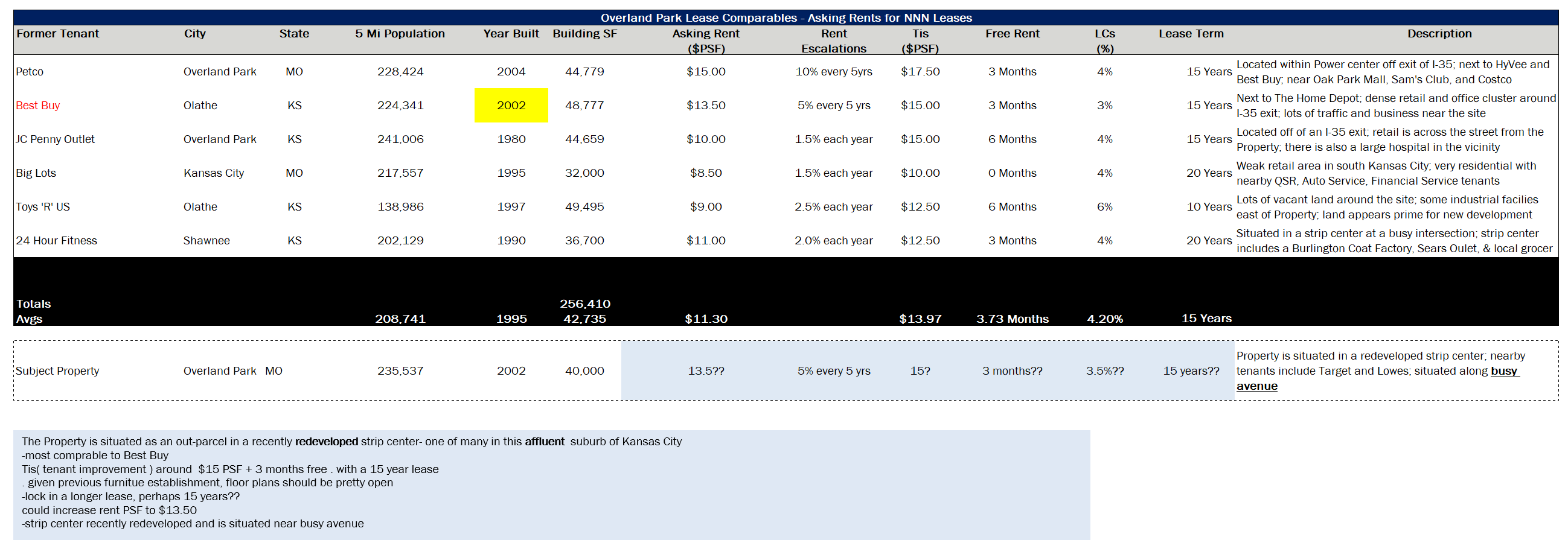

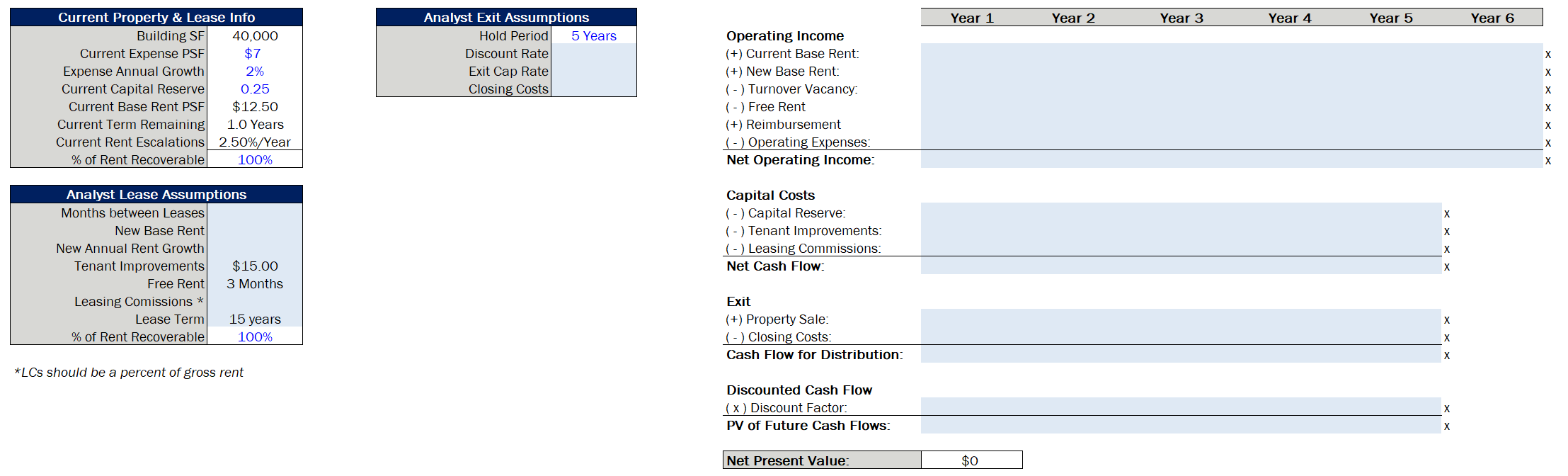

Former Tenant City State 5 Mi Population Overland Park Lease Comparables - Asking Rents for NNN Leases Year Built Building SF Asking Rent Rent Tis ($PSF) Escalations ($PSF) Free Rent Lease Term Description LCs (%) Petco Overland Park MO 228,424 2004 44,779 $15.00 10% every 5yrs $17.50 3 Months 4% Best Buy Olathe KS 224,341 2002 48,777 $13.50 5% every 5 yrs $15.00 3 Months 3% JC Penny Outlet Overland Park KS 241,006 1980 44,659 $10.00 1.5% each year $15.00 6 Months 4% Located within Power center off exit of 1-35; next to HyVee and 15 Years Best Buy, near Oak Park Mall, Sam's Club, and Costco Next to The Home Depot; dense retail and office cluster around 15 Years 1-35 exit; lots of traffic and business near the site Located off of an 1-35 exit; retail is across the street from the 15 Years Property, there is also a large hospital in the vicinity Weak retail area in south Kansas City, very residential with 20 Years nearby QSR, Auto Service, Financial Service tenants Lots of vacant land around the site, some industrial facilies 10 Years east of Property, land appears prime for new development Situated in a strip center at a busy intersection; strip center 20 Years includes a Burlington Coat Factory, Sears Oulet, & local grocer Big Lots Kansas City MO 217,557 1995 32,000 $8.50 1.5% each year $10.00 O Months 4% Toys 'R' US Olathe KS 138,986 1997 49,495 $9.00 2.5% each year $12.50 6 Months 6% 24 Hour Fitness Shawnee KS 202,129 1990 36,700 $11.00 2.0% each year $12.50 3 Months 4% Totals Avgs 256,410 42,735 208,741 1995 $11.30 $13.97 3.73 Months 4.20% 15 Years Subject Property Overland Park MO 235,537 2002 40,000 13.5?? 5% every 5 yrs 15? 3 months?? 3.5%?? 15 years?? Property is situated in a redeveloped strip center, nearby tenants include Target and Lowes, situated along busy avenue The Property is situated as an out-parcel in a recently redeveloped strip center- one of many in this affluent suburb of Kansas City -most comprable to Best Buy Tis( tenant improvement ) around $15 PSF + 3 months free with a 15 year lease given previous furnitue establishment, floor plans should be pretty open -lock in a longer lease, perhaps 15 years?? could increase rent PSF to $13.50 -strip center recently redeveloped and is situated near busy avenue Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Analyst Exit Assumptions Hold Period 5 Years Discount Rate Exit Cap Rate Closing Costs X Current Property & Lease Info Building SF 40,000 Current Expense PSF $7 Expense Annual Growth 2% Current Capital Reserve 0.25 Current Base Rent PSF $12.50 Current Term Remaining 1.0 Years Current Rent Escalations 2.50%/Year % of Rent Recoverable 100% X Operating Income (+) Current Base Rent: (+) New Base Rent: (-) Turnover Vacancy: (-) Free Rent (+) Reimbursement ( - ) Operating Expenses: Net Operating Income: X X Capital Costs (-) Capital Reserve: ( - ) Tenant Improvements: (-) Leasing Commissions: Net Cash Flow: X Analyst Lease Assumptions Months between Leases New Base Rent New Annual Rent Growth Tenant Improvements $15.00 Free Rent 3 Months Leasing Comissions * Lease Term 15 years % of Rent Recoverable 100% X X Exit (+) Property Sale: ( - ) Closing Costs: Cash Flow for Distribution: X X *LCs should be a percent of gross rent Discounted Cash Flow (x) Discount Factor: PV of Future Cash Flows: X Net Present Value: $0 Former Tenant City State 5 Mi Population Overland Park Lease Comparables - Asking Rents for NNN Leases Year Built Building SF Asking Rent Rent Tis ($PSF) Escalations ($PSF) Free Rent Lease Term Description LCs (%) Petco Overland Park MO 228,424 2004 44,779 $15.00 10% every 5yrs $17.50 3 Months 4% Best Buy Olathe KS 224,341 2002 48,777 $13.50 5% every 5 yrs $15.00 3 Months 3% JC Penny Outlet Overland Park KS 241,006 1980 44,659 $10.00 1.5% each year $15.00 6 Months 4% Located within Power center off exit of 1-35; next to HyVee and 15 Years Best Buy, near Oak Park Mall, Sam's Club, and Costco Next to The Home Depot; dense retail and office cluster around 15 Years 1-35 exit; lots of traffic and business near the site Located off of an 1-35 exit; retail is across the street from the 15 Years Property, there is also a large hospital in the vicinity Weak retail area in south Kansas City, very residential with 20 Years nearby QSR, Auto Service, Financial Service tenants Lots of vacant land around the site, some industrial facilies 10 Years east of Property, land appears prime for new development Situated in a strip center at a busy intersection; strip center 20 Years includes a Burlington Coat Factory, Sears Oulet, & local grocer Big Lots Kansas City MO 217,557 1995 32,000 $8.50 1.5% each year $10.00 O Months 4% Toys 'R' US Olathe KS 138,986 1997 49,495 $9.00 2.5% each year $12.50 6 Months 6% 24 Hour Fitness Shawnee KS 202,129 1990 36,700 $11.00 2.0% each year $12.50 3 Months 4% Totals Avgs 256,410 42,735 208,741 1995 $11.30 $13.97 3.73 Months 4.20% 15 Years Subject Property Overland Park MO 235,537 2002 40,000 13.5?? 5% every 5 yrs 15? 3 months?? 3.5%?? 15 years?? Property is situated in a redeveloped strip center, nearby tenants include Target and Lowes, situated along busy avenue The Property is situated as an out-parcel in a recently redeveloped strip center- one of many in this affluent suburb of Kansas City -most comprable to Best Buy Tis( tenant improvement ) around $15 PSF + 3 months free with a 15 year lease given previous furnitue establishment, floor plans should be pretty open -lock in a longer lease, perhaps 15 years?? could increase rent PSF to $13.50 -strip center recently redeveloped and is situated near busy avenue Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Analyst Exit Assumptions Hold Period 5 Years Discount Rate Exit Cap Rate Closing Costs X Current Property & Lease Info Building SF 40,000 Current Expense PSF $7 Expense Annual Growth 2% Current Capital Reserve 0.25 Current Base Rent PSF $12.50 Current Term Remaining 1.0 Years Current Rent Escalations 2.50%/Year % of Rent Recoverable 100% X Operating Income (+) Current Base Rent: (+) New Base Rent: (-) Turnover Vacancy: (-) Free Rent (+) Reimbursement ( - ) Operating Expenses: Net Operating Income: X X Capital Costs (-) Capital Reserve: ( - ) Tenant Improvements: (-) Leasing Commissions: Net Cash Flow: X Analyst Lease Assumptions Months between Leases New Base Rent New Annual Rent Growth Tenant Improvements $15.00 Free Rent 3 Months Leasing Comissions * Lease Term 15 years % of Rent Recoverable 100% X X Exit (+) Property Sale: ( - ) Closing Costs: Cash Flow for Distribution: X X *LCs should be a percent of gross rent Discounted Cash Flow (x) Discount Factor: PV of Future Cash Flows: X Net Present Value: $0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started