Answered step by step

Verified Expert Solution

Question

1 Approved Answer

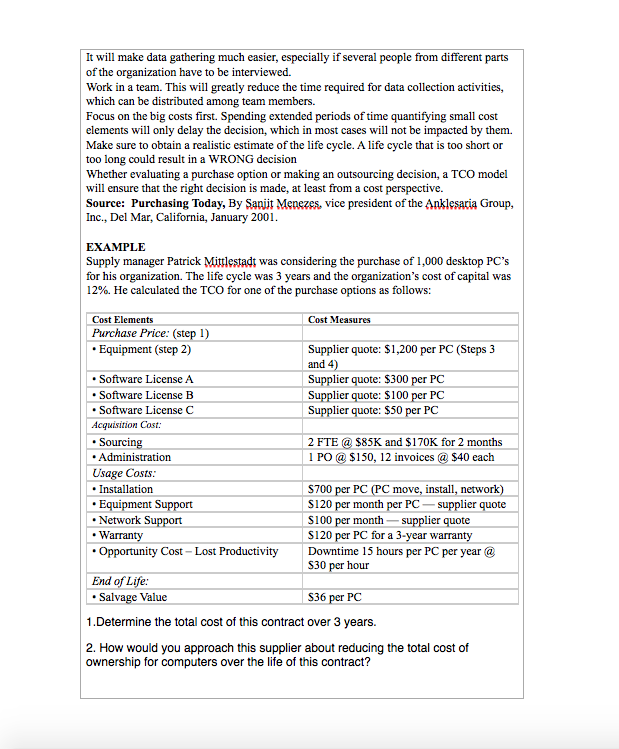

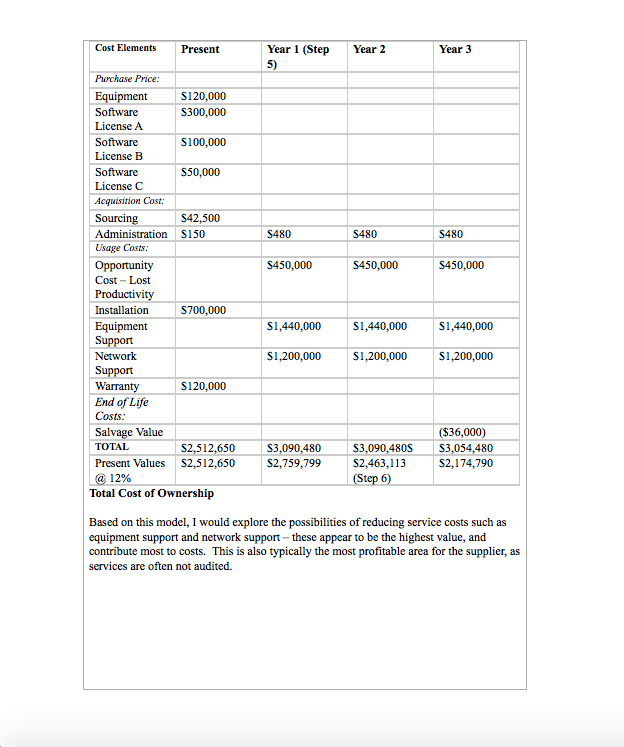

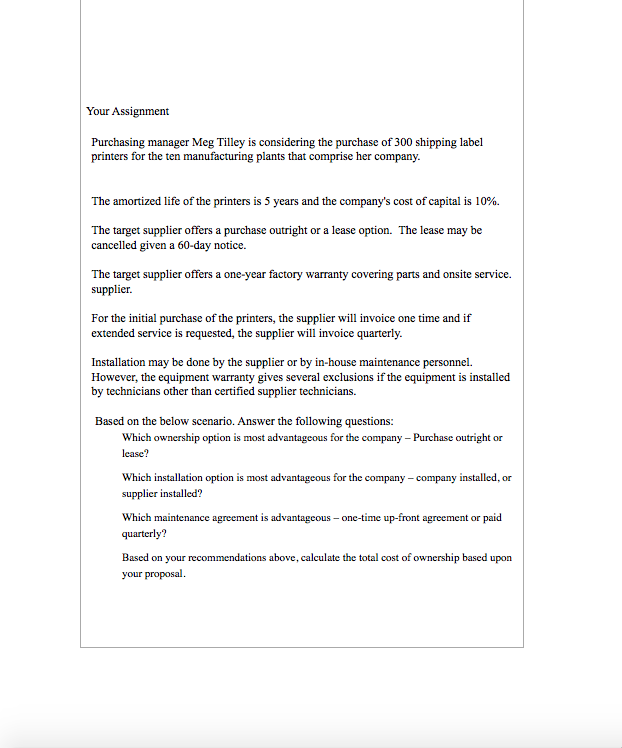

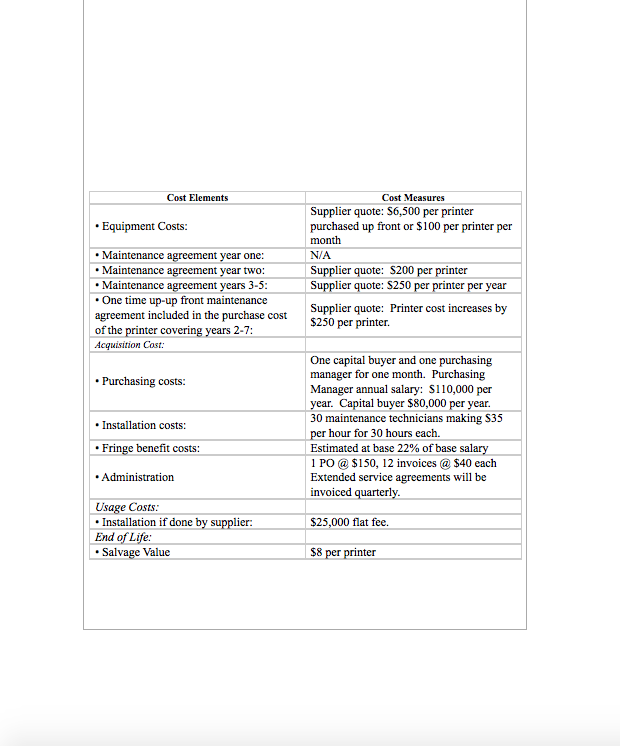

Based on this Case Study, I need a MS Excel spreadhseet showing your analysis to determine whether the product is most profitable to make

Based on this Case Study, I need a " MS Excel spreadhseet showing your analysis to determine whether the product is most profitable to make or buy " If you could help me outline and calculate this spreadsheet, that would be amazing. Doesn't even have to be perfect!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started