Answered step by step

Verified Expert Solution

Question

1 Approved Answer

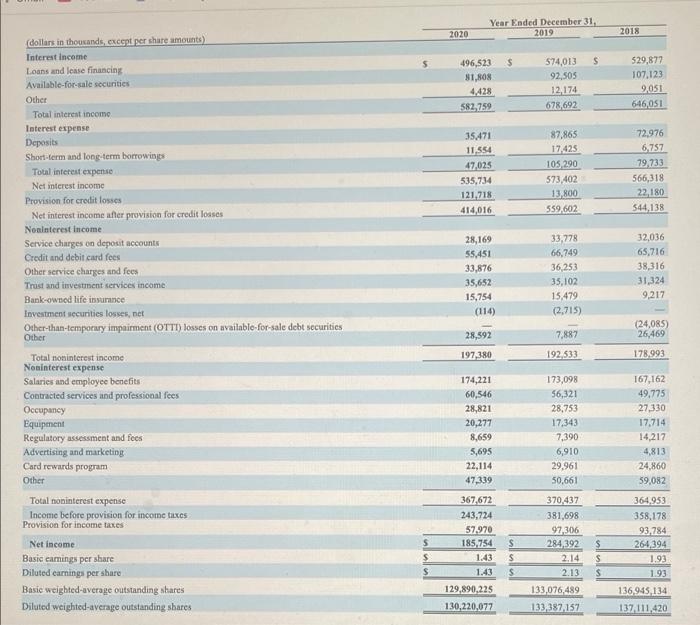

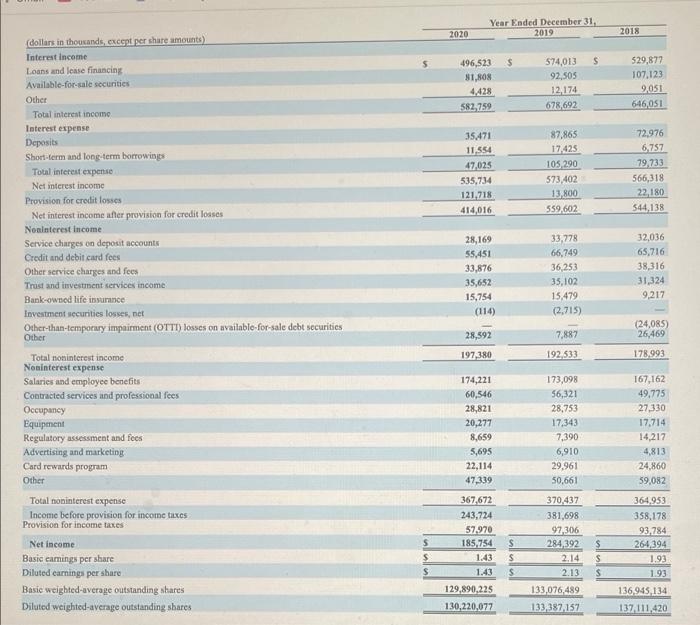

based on this, how do you assess credit risk analysis? Year Ended December 31 2019 2020 2018 $ S 496,523 81,808 4,428 582.759 574,013 92,505

based on this, how do you assess credit risk analysis?

Year Ended December 31 2019 2020 2018 $ S 496,523 81,808 4,428 582.759 574,013 92,505 12 174 678,692 529,877 107,123 9,051 646051 35,471 11,554 47,025 535,734 121,718 414,016 87,865 17425 105,290 573.402 13,800 559.602 72,976 6 757 79,733 566,318 22,180 544,138 28,169 55,451 33,876 35,652 15,754 (114) 33,778 66,749 36,253 35,102 15,479 (2.715) 32,036 65,716 38,316 31,324 9,217 dollars in thousands, except per share amounts) Interest income Loans and losse financing Available for sale securities Other Total interest income Interest expense Deposits Short-term and long-term borrowings Total interest expense Net interest income Provision for credit losses Net interest income after provision for credit losses Noninterest income Service charges on deposit accounts Credit and debit card fees Other service charges and foes Trust and investment services income Bank-owned life insurance Investment securities losses, net Other-than-temporary impairment (OTTI) losses on available-for-sale debt securities Other Total noninterest income Noninterest expense Salaries and employee benefits Contracted services and professional fees Occupancy Equipment Regulatory assessment and focs Advertising and marketing Card rewards program Other Total noninterest expense Income before provision for income taxes Provision for income taxes Net income Basic camings per share Diluted carnings per share Basic weighted average outstanding shares Diluted weighted average outstanding shares 28,592 7,887 (24.085) 26,469 178,993 197,380 192,533 174,221 60,546 28,821 20,277 8,659 5,695 22,114 47,339 367,672 243,724 57,970 185.754 1.43 1.43 129,890,225 130,220.077 173,098 56,321 28,753 17.343 7,390 6,910 29,961 50,661 370,437 381,698 97 306 284,392 2.14 2.13 167,162 49.775 27,330 17,714 14,217 4,813 24,860 59,082 364,953 358,178 93.784 264,394 1.93 1.93 $ s $ $ S $ 133,076,489 136,945,134 137,111,420 133,387,157 Year Ended December 31 2019 2020 2018 $ S 496,523 81,808 4,428 582.759 574,013 92,505 12 174 678,692 529,877 107,123 9,051 646051 35,471 11,554 47,025 535,734 121,718 414,016 87,865 17425 105,290 573.402 13,800 559.602 72,976 6 757 79,733 566,318 22,180 544,138 28,169 55,451 33,876 35,652 15,754 (114) 33,778 66,749 36,253 35,102 15,479 (2.715) 32,036 65,716 38,316 31,324 9,217 dollars in thousands, except per share amounts) Interest income Loans and losse financing Available for sale securities Other Total interest income Interest expense Deposits Short-term and long-term borrowings Total interest expense Net interest income Provision for credit losses Net interest income after provision for credit losses Noninterest income Service charges on deposit accounts Credit and debit card fees Other service charges and foes Trust and investment services income Bank-owned life insurance Investment securities losses, net Other-than-temporary impairment (OTTI) losses on available-for-sale debt securities Other Total noninterest income Noninterest expense Salaries and employee benefits Contracted services and professional fees Occupancy Equipment Regulatory assessment and focs Advertising and marketing Card rewards program Other Total noninterest expense Income before provision for income taxes Provision for income taxes Net income Basic camings per share Diluted carnings per share Basic weighted average outstanding shares Diluted weighted average outstanding shares 28,592 7,887 (24.085) 26,469 178,993 197,380 192,533 174,221 60,546 28,821 20,277 8,659 5,695 22,114 47,339 367,672 243,724 57,970 185.754 1.43 1.43 129,890,225 130,220.077 173,098 56,321 28,753 17.343 7,390 6,910 29,961 50,661 370,437 381,698 97 306 284,392 2.14 2.13 167,162 49.775 27,330 17,714 14,217 4,813 24,860 59,082 364,953 358,178 93.784 264,394 1.93 1.93 $ s $ $ S $ 133,076,489 136,945,134 137,111,420 133,387,157

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started