Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on this information, how was the annuity factor (2.9906) calculated? Thank you. Now that we know how to find the accounting break-even, it is

Based on this information, how was the annuity factor (2.9906) calculated? Thank you.

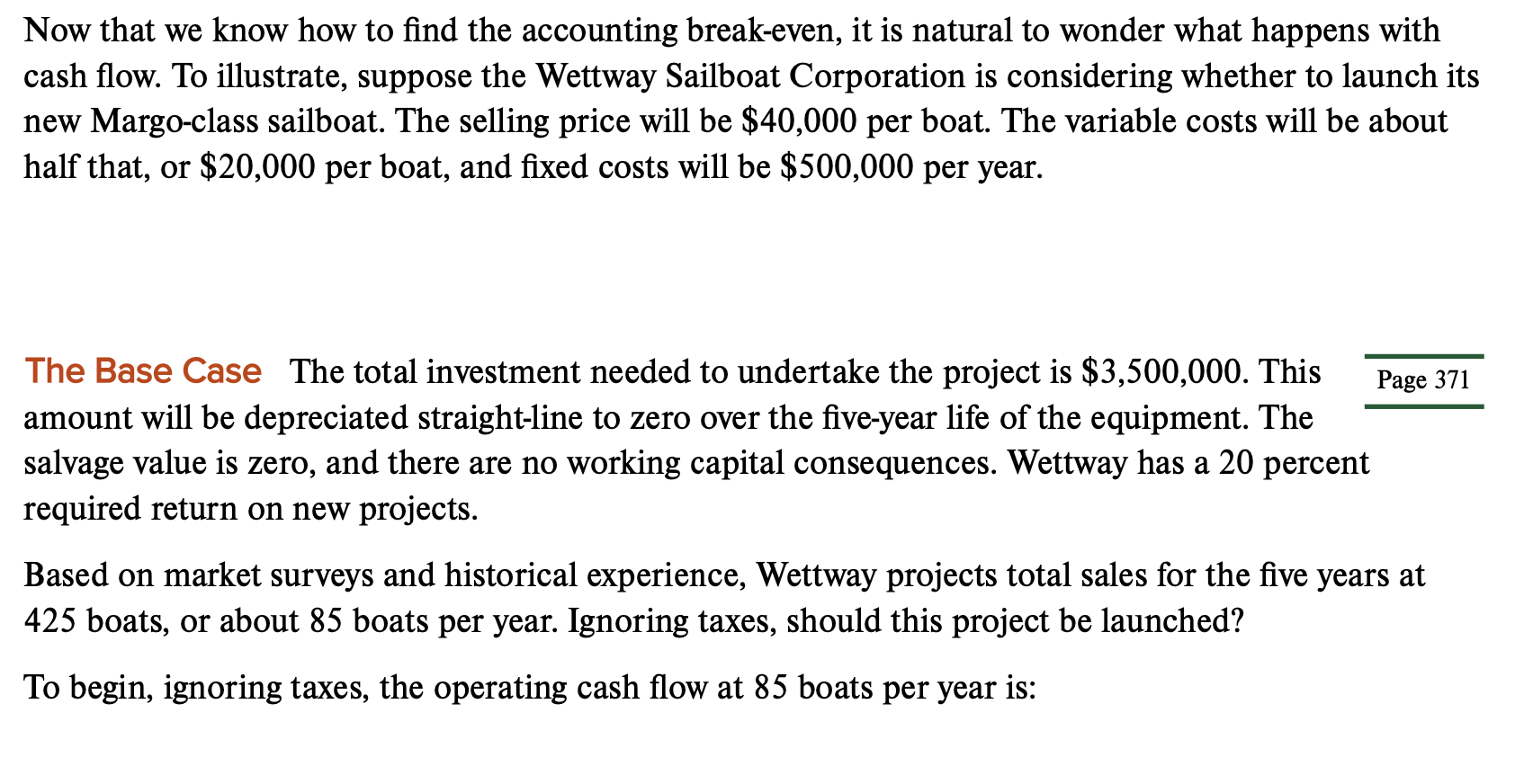

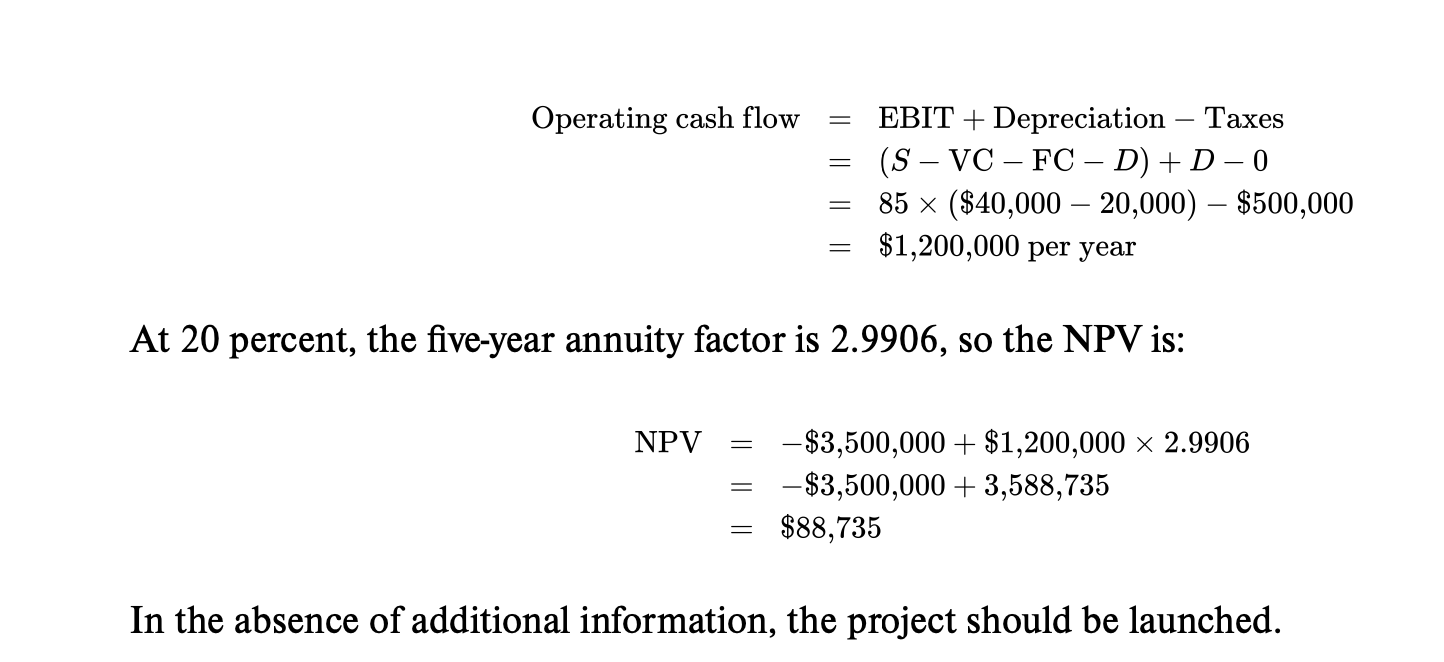

Now that we know how to find the accounting break-even, it is natural to wonder what happens with cash flow. To illustrate, suppose the Wettway Sailboat Corporation is considering whether to launch its new Margo-class sailboat. The selling price will be $40,000 per boat. The variable costs will be about half that, or $20,000 per boat, and fixed costs will be $500,000 per year. The Base Case The total investment needed to undertake the project is $3,500,000. This Page 371 amount will be depreciated straight-line to zero over the five-year life of the equipment. The salvage value is zero, and there are no working capital consequences. Wettway has a 20 percent required return on new projects. Based on market surveys and historical experience, Wettway projects total sales for the five years at 425 boats, or about 85 boats per year. Ignoring taxes, should this project be launched? To begin, ignoring taxes, the operating cash flow at 85 boats per year is: Operatingcashflow=EBIT+DepreciationTaxes=(SVCFCD)+D0=85($40,00020,000)$500,000=$1,200,000peryear At 20 percent, the five-year annuity factor is 2.9906 , so the NPV is: NPV=$3,500,000+$1,200,0002.9906=$3,500,000+3,588,735=$88,735 In the absence of additional information, the project should be launchedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started