Answered step by step

Verified Expert Solution

Question

1 Approved Answer

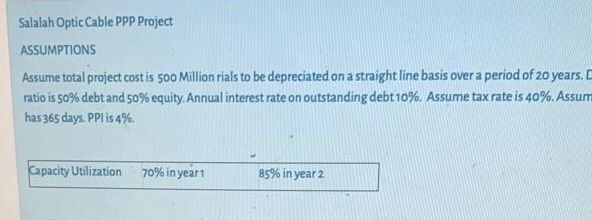

based on those informations, solve the three questions below: Salalah Optic Cable PPP Project ASSUMPTIONS Assume total project cost is 500 Million rials to be

based on those informations, solve the three questions below:

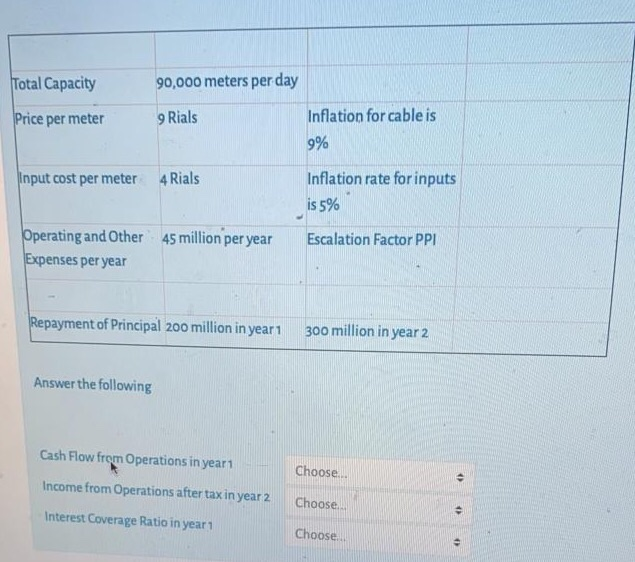

Salalah Optic Cable PPP Project ASSUMPTIONS Assume total project cost is 500 Million rials to be depreciated on a straight line basis over a period of 20 years. O ratio is 50% debt and 50% equity. Annual interest rate on outstanding debt 10%. Assume tax rate is 40%. Assum has 365 days. PPl is 4% Capacity Utilization 70% in year 1 85% in year 2 Total Capacity 90,000 meters per day Price per meter 9 Rials Inflation for cable is 9% input cost per meter 4 Rials Inflation rate for inputs is 5% Escalation Factor PPI Operating and Other 45 million per year Expenses per year Repayment of Principal 200 million in year 1 300 million in year 2 Answer the following Cash Flow from Operations in year1 Choose... . Income from Operations after tax in year 2 Choose Interest Coverage Ratio in year 1 Choose . Cash Flow from Operations in year Choose... 0 Income from Operations after tax in year 2 Choose. Interest Coverage Ratio in year Choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started