Answered step by step

Verified Expert Solution

Question

1 Approved Answer

based on what you studied in the course investment management on Walter Model, you are required to calculate the fair value of the stock of

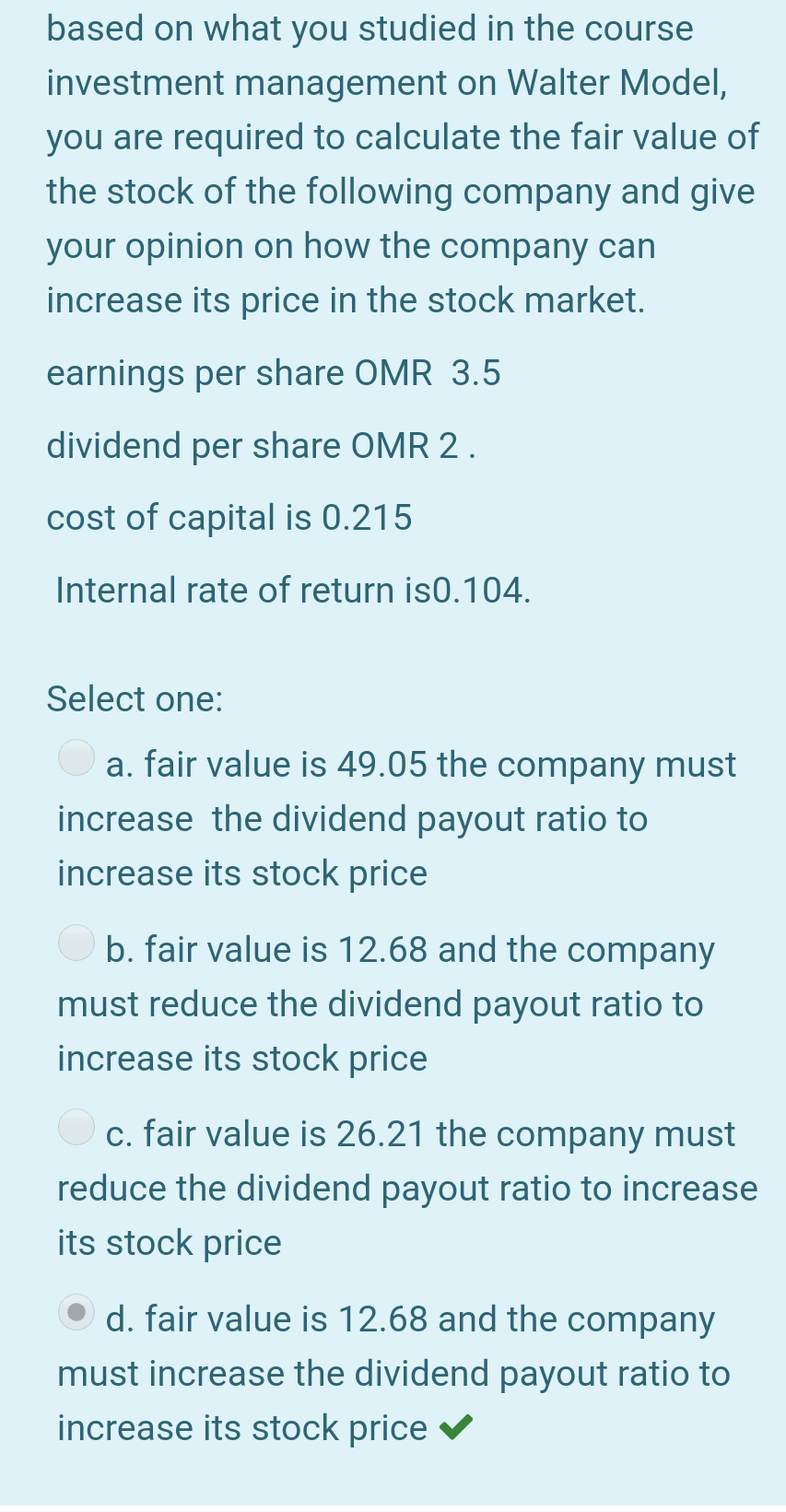

based on what you studied in the course investment management on Walter Model, you are required to calculate the fair value of the stock of the following company and give your opinion on how the company can increase its price in the stock market. earnings per share OMR 3.5 dividend per share OMR 2. cost of capital is 0.215 Internal rate of return is0.104. Select one: a. fair value is 49.05 the company must increase the dividend payout ratio to increase its stock price b. fair value is 12.68 and the company must reduce the dividend payout ratio to increase its stock price c. fair value is 26.21 the company must reduce the dividend payout ratio to increase its stock price d. fair value is 12.68 and the company must increase the dividend payout ratio to increase its stock price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started