Question

Based on your financial analysis, prepare a paragraph or so of a summary from the stand point of a consultant. In this summary, provide your

Based on your financial analysis, prepare a paragraph or so of a summary from the stand point of a consultant. In this summary, provide your ideas about this project and what you think would be the best course of action for the company to follow and why. Remember to justify your answers with facts from your calculations as well as provide meaningful insight for the company.

Based on your financial analysis, prepare a paragraph or so of a summary from the stand point of a consultant. In this summary, provide your ideas about this project and what you think would be the best course of action for the company to follow and why. Remember to justify your answers with facts from your calculations as well as provide meaningful insight for the company.

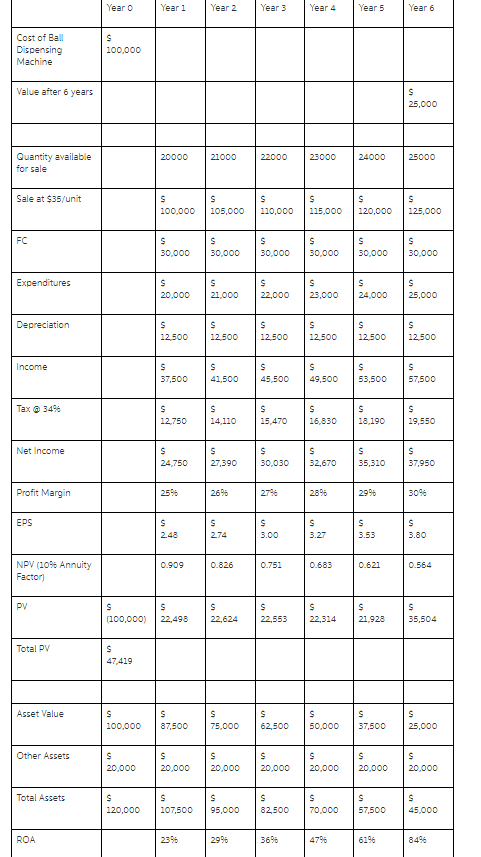

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Cost of Ball Dispensing Machine $ 100,000 Value after 6 years $ 25,000 Quantity available for sale 20000 21000 22000 23000 24000 25000 Sale at $35/unit $ 100,000 $ 105,000 $ 110,000 $ 115,000 $ 120,000 $ 125,000 FC $ 30,000 $ 30,000 $ 30,000 $ 30,000 $ 30,000 $ 30,000 Expenditures $ 20,000 $ 21,000 $ 22,000 $ 23,000 $ 24,000 $ 25,000 Depreciation $ 12,500 $ 12,500 $ 12,500 $ 12,500 $ 12,500 $ 12,500 Income $ 37,500 $ 41,500 $ 45,500 $ 49,500 $ 53,500 $ 57,500 Tax @ 34% $ 12,750 $ 14,110 $ 15,470 $ 16,830 $ 18,190 $ 19,550 Net Income $ 24,750 $ 27,390 $ 30,030 $ 32,670 $ 35,310 $ 37,950 Profit Margin 25% 26% 27% 28% 29% 30% EPS $ 2.48 $ 2.74 $ 3.00 $ 3.27 $ 3.53 $ 3.80 NPV (10% Annuity Factor) 0.909 0.826 0.751 0.683 0.621 0.564 PV $ (100,000) $ 22,498 $ 22,624 $ 22,553 $ 22,314 $ 21,928 $ 35,504 Total PV $ 47,419 Asset Value $ 100,000 $ 87,500 $ 75,000 $ 62,500 $ 50,000 $ 37,500 $ 25,000 Other Assets $ 20,000 $ 20,000 $ 20,000 $ 20,000 $ 20,000 $ 20,000 $ 20,000 Total Assets $ 120,000 $ 107,500 $ 95,000 $ 82,500 $ 70,000 $ 57,500 $ 45,000 ROA 23% 29% 36% 47% 61% 84% ROE 38% 48% 61% 78% 102% 141%

ear o ear 1 ear 2 Year 3 Year 4Year 5 Year 6 Cost of Bal 100,000 Machine alue after 6 years 25,000 20000 21000 Quantity available for sale 22000 23000 24000 25000O Sale at $35/unit 100,000 | 105,000 | 110,000 | 115,000 | 120,000 | 125,000 FC 50,000 30,000 30,000 30,000 30,00030,000 20,000 21,000 22,000 23,000 24,00025,00O Depreciation 12500 12 500 12500 12500 12500 12500 57,500 41500 45,500 49,500 53,50057,500 Tax @ 34% 12,750 14,110 15,470 16,830 18,190 19,550 Net Income 24,750 27,390 50,030 32,670 35,31037,950 Profit Margin 2696 2736 2896 296 30% EPS 248 274 3.00 3.53 3.80 NPV (10% Annuity Factor) 0.909 0.826 0.751 0.683 0.621 0.564 100,000) 22,498 22,624 22,553 22,314 21,928 35,504 Total PV 47419 Asset Value 100,000 87,500 75,000 62,500 50,000 37,500 25,000 Other Assets 20,000 20,000 20,000 20,000 20,000 20,00020,000 Total Assets 120,000 107,500 95,000 82500 70,000 57,500 45,000 ROA 2996 36% 47 6 6196 84 ear o ear 1 ear 2 Year 3 Year 4Year 5 Year 6 Cost of Bal 100,000 Machine alue after 6 years 25,000 20000 21000 Quantity available for sale 22000 23000 24000 25000O Sale at $35/unit 100,000 | 105,000 | 110,000 | 115,000 | 120,000 | 125,000 FC 50,000 30,000 30,000 30,000 30,00030,000 20,000 21,000 22,000 23,000 24,00025,00O Depreciation 12500 12 500 12500 12500 12500 12500 57,500 41500 45,500 49,500 53,50057,500 Tax @ 34% 12,750 14,110 15,470 16,830 18,190 19,550 Net Income 24,750 27,390 50,030 32,670 35,31037,950 Profit Margin 2696 2736 2896 296 30% EPS 248 274 3.00 3.53 3.80 NPV (10% Annuity Factor) 0.909 0.826 0.751 0.683 0.621 0.564 100,000) 22,498 22,624 22,553 22,314 21,928 35,504 Total PV 47419 Asset Value 100,000 87,500 75,000 62,500 50,000 37,500 25,000 Other Assets 20,000 20,000 20,000 20,000 20,000 20,00020,000 Total Assets 120,000 107,500 95,000 82500 70,000 57,500 45,000 ROA 2996 36% 47 6 6196 84Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started