Question

Based on your knowledge of management accounting you are exploring the idea of using Activity Based costing for applying overhead costs to products instead of

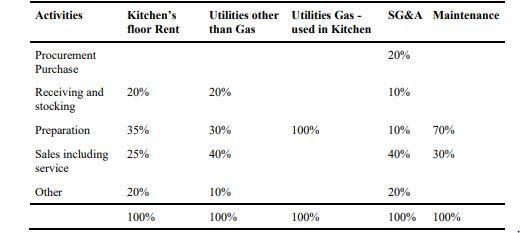

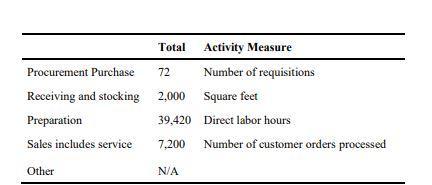

Based on your knowledge of management accounting you are exploring the idea of using Activity Based costing for applying overhead costs to products instead of traditional absorption costing method. You explain the concept behind ABC and Sophia has identified the following activity cost pools and activity measures:

Maintenance includes all costs incurred for the smooth operations of the café. (HINT: Think of all the manufacturing and non-manufacturing overheads that are utilized in regular operations of the café.) Total activity for each activity pool is as follows:

Sophia has asked for your help in formalizing business processes in a document form, so it will help owners monitor staff members and train new employees. You have been conducting interviews with the staff members at the cafe to document the processes for the owners. The following are your findings for the procurement process: Mr. Sheikh is responsible for procuring the raw materials from the wholesale market vendors on a bimonthly basis and the other vendors 2-3 times a week. The procurement of material is based on requirements generated by Mr. Sheikh based on the sales of the cafe. As the wholesale market dealings are usually in cash Mr. Sheikh draws the money from the cafe’s bank account and procures the material. To avoid sales tax the wholesalers don’t always provide a printed receipt for the materials purchased. Mr. Sheikh on his return from the market provides the receipts to the accountant.

Required:

1. Using first stage allocation, determine the amount of overheads assigned to each cost pool identified by Sophia.

2. Determining activity rates for each cost pool for second stage allocation using the ABC method.

Activities Procurement Purchase Receiving and stocking Preparation Kitchen's floor Rent 20% 35% Sales including 25% service Other 20% 100% Utilities other than Gas 20% 30% 40% 10% 100% Utilities Gas- used in Kitchen 100% 100% SG&A Maintenance 20% 10% 70% 40% 30% 10% 20% 100% 100%

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Using First Stage Allocation Utilities 20 of total overhead 20 x 39...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started