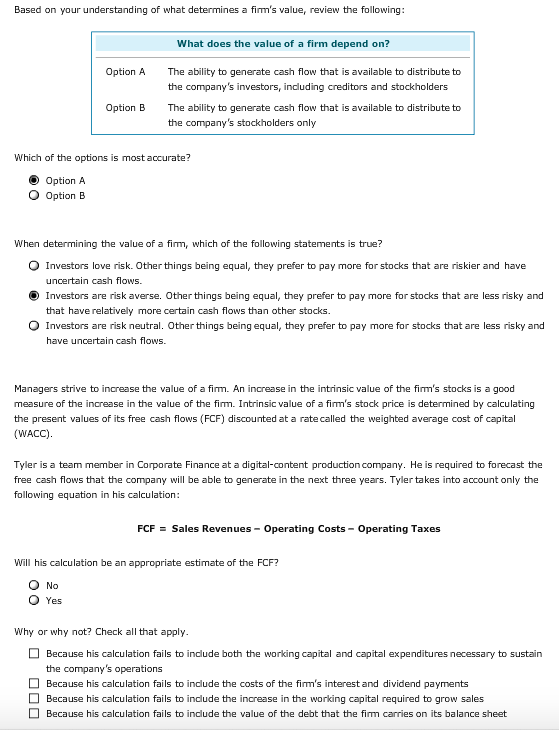

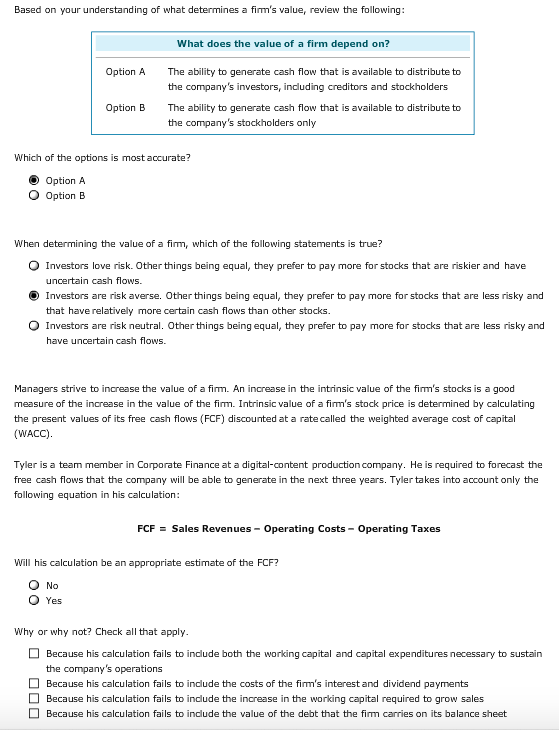

Based on your understanding of what determines a firm's value, review the following What does the value of a firm depend on? Option A The ability to generate cash flow that is available to distribute to the company's investors, including creditors and stockholders The ability to generate cash flow that is available to distribute to the company's stockholders only Option B Which of the options is most accurate? Option A O Option B When determining the value of a firm, which of the following statements is true? O Investors love risk. Other things being equal, they prefer to pay more for stocks that are riskier and have uncertain cash flows. Investors are risk averse. Other things being equal, they prefer to pay more for stocks that are less risky and that have relatively more certain cash flows than other stocks. O Investors are risk neutral. Other things being equal, they prefer to pay more for stocks that are less risky and have uncertain cash flows. Managers strive to increase the value of a firm. An increase in the intrinsic value of the firm's stocks is a good measure of the increase in the value of the firm. Intrinsic value of a firm's stock price is determined by calculating the present values of its free cash flows (FCF) discounted at a rate called the weighted average cost of capital (WACC) Tyler is a team member in Corporate Finance at a digital-content production company. He is required to forecast the free cash flows that the company will be able to generate in the next three years. Tyler takes into account only the following equation in his calculation FCF = Sales Revenues-Operating Costs-Operating Taxes Will his calculation be an appropriate estimate of the FCF? No Why or why not? Check all that apply Because his calculation fails to include both the working capital and capital expenditures necessary to sustain the company's operations Because his calculation fails to include the costs of the firm's interest and dividend payments Because his calculation fails to include the increase in the working capital required to grow sales Because his calculation fails to include the value of the debt that the firm carries on its balance sheet