Answered step by step

Verified Expert Solution

Question

1 Approved Answer

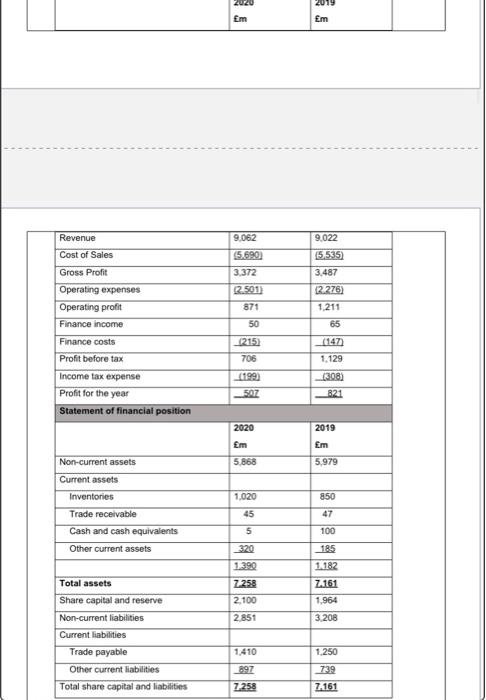

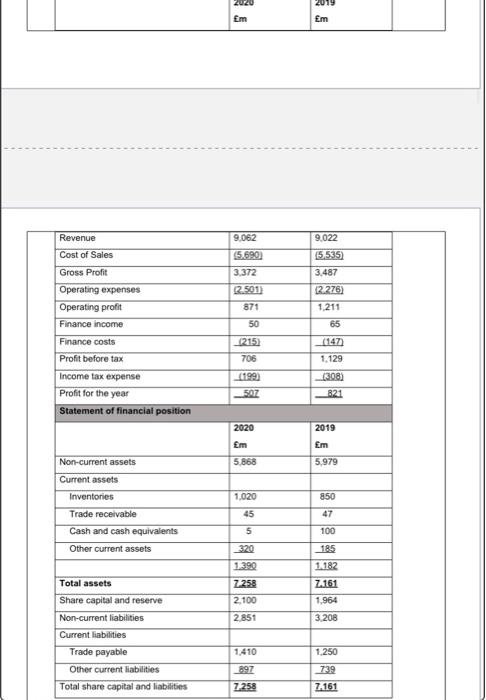

Based solely on the information provided above, analyse the position and performance of Wandy plc in detail 2020 Em 2019 m 9,022 Revenue Cost of

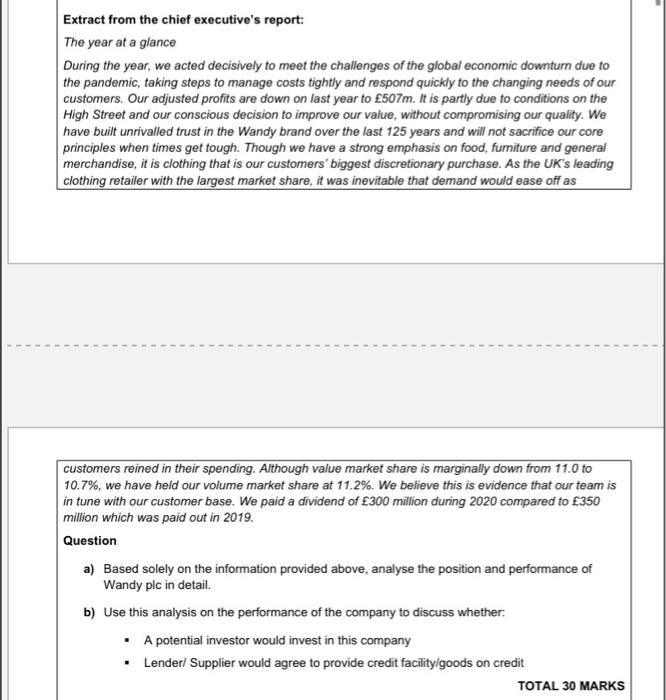

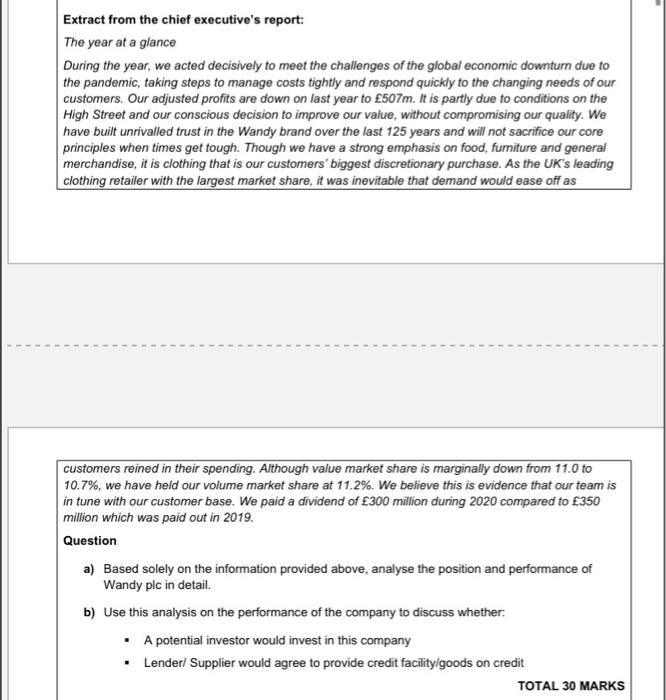

Based solely on the information provided above, analyse the position and performance of Wandy plc in detail

2020 Em 2019 m 9,022 Revenue Cost of Sales Gross Profit Operating expenses Operating profit Finance income Finance costs Profit before tax 9.062 (5.690) 3.372 22.501 871 5535 3.487 2.276) 1.211 65 50 (215) 706 (199) SAZ (147) 1.129 (308) 821 Income tax expense Profit for the year Statement of financial position 2019 2020 Em Em Non-current assets 5.868 5,979 Current assets Inventories Trade receivable 1,020 850 45 47 5 100 Cash and cash equivalents Other current assets 1.390 2.258 2.100 2.851 185 1.182 7161 1.964 3.208 Total assets Share capital and reserve Non-current liabilities Current liabilities Trade payable Other current liabilities Total share capital and liabilities 1.410 897 7.258 1.250 739 7,161 Extract from the chief executive's report: The year at a glance During the year, we acted decisively to meet the challenges of the global economic downturn due to the pandemic, taking steps to manage costs tightly and respond quickly to the changing needs of our customers. Our adjusted profits are down on last year to 507m. It is partly due to conditions on the High Street and our conscious decision to improve our value, without compromising our quality. We have built unrivalled trust in the Wandy brand over the last 125 years and will not sacrifice our core principles when times get tough. Though we have a strong emphasis on food, furniture and general merchandise, it is clothing that is our customers' biggest discretionary purchase. As the UK's leading clothing retailer with the largest market share, it was inevitable that demand would ease off as O customers reined in their spending. Although value market share is marginally down from 11.0 to 10.7%, we have held our volume market share at 11.2%. We believe this is evidence that our team is in tune with our customer base. We paid a dividend of 300 million during 2020 compared to 350 million which was paid out in 2019. Question a) Based solely on the information provided above, analyse the position and performance of Wandy plc in detail. b) Use this analysis on the performance of the company to discuss whether: A potential investor would invest in this company Lenderl Supplier would agree to provide credit facility/goods on credit TOTAL 30 MARKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started