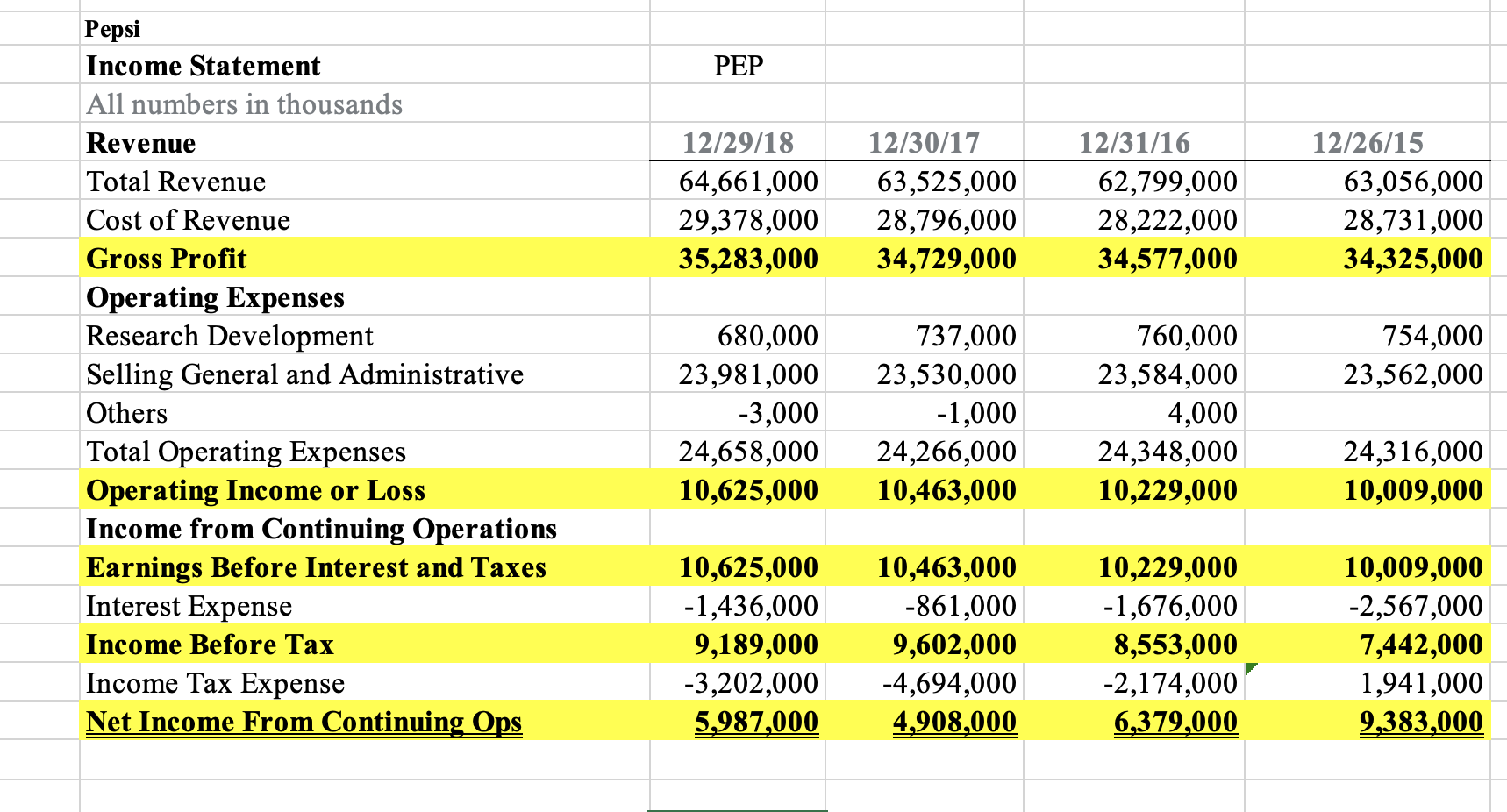

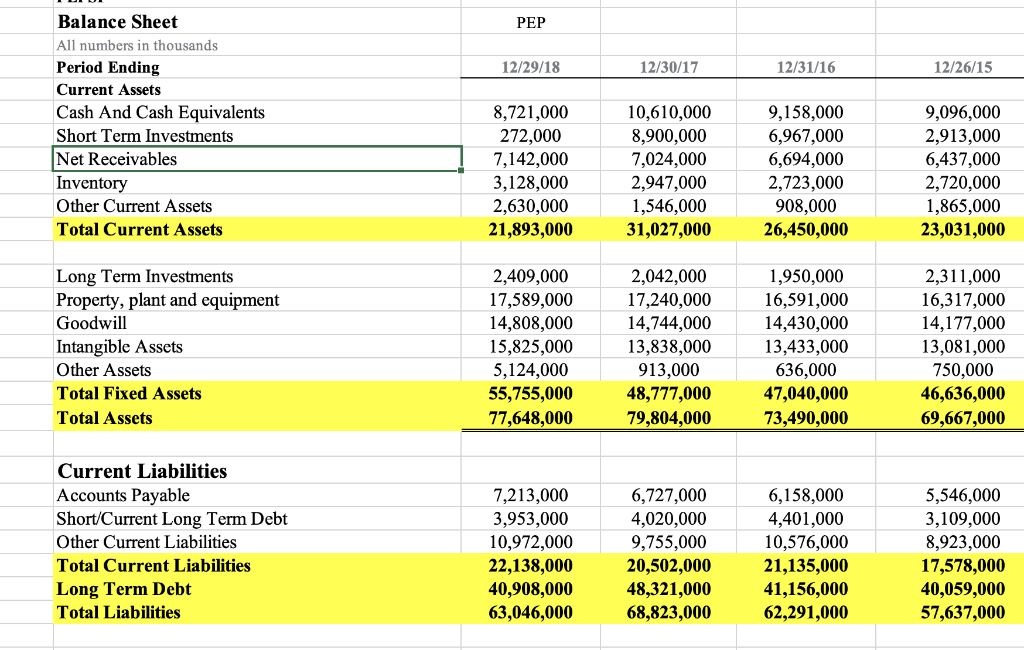

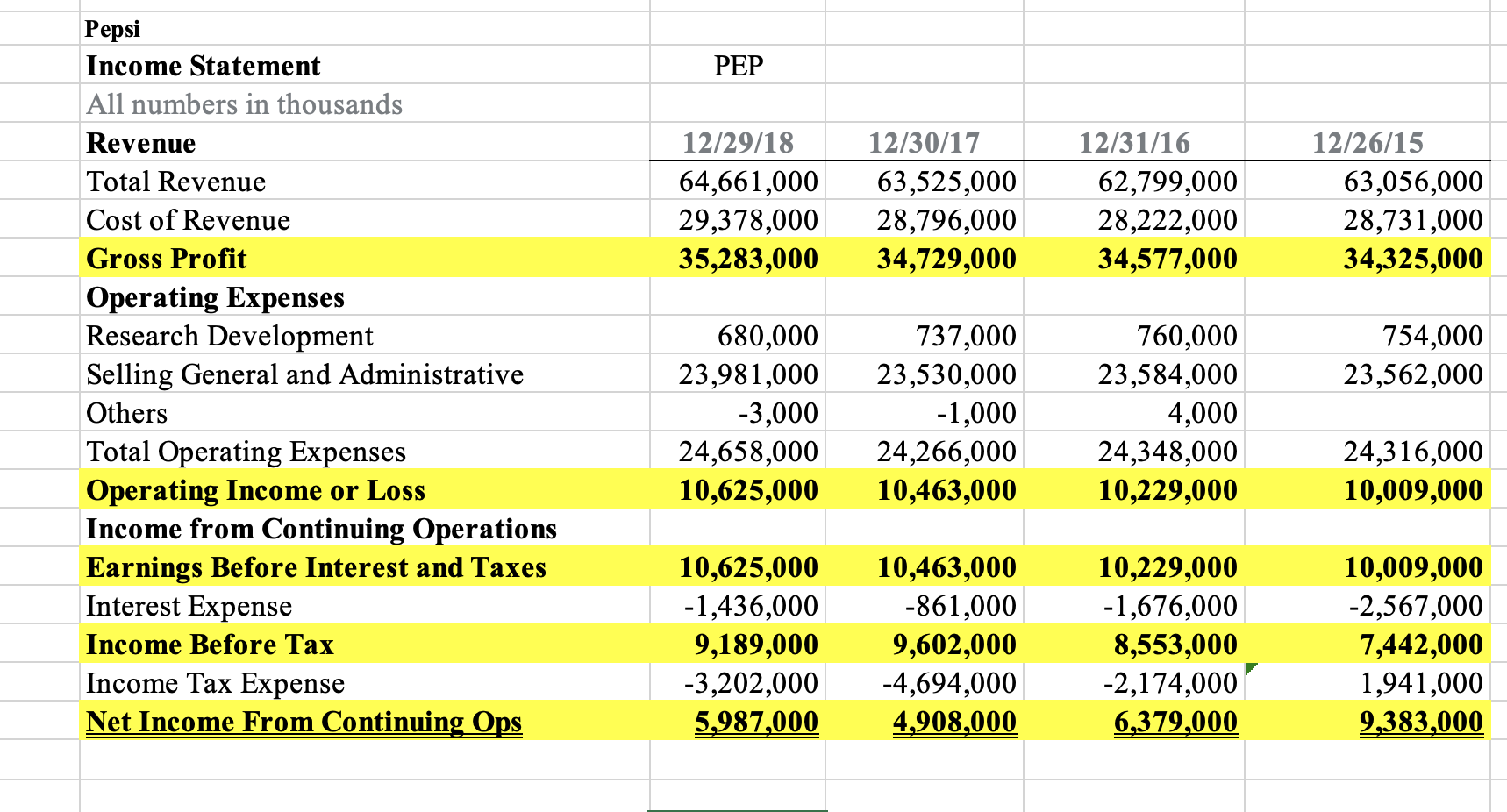

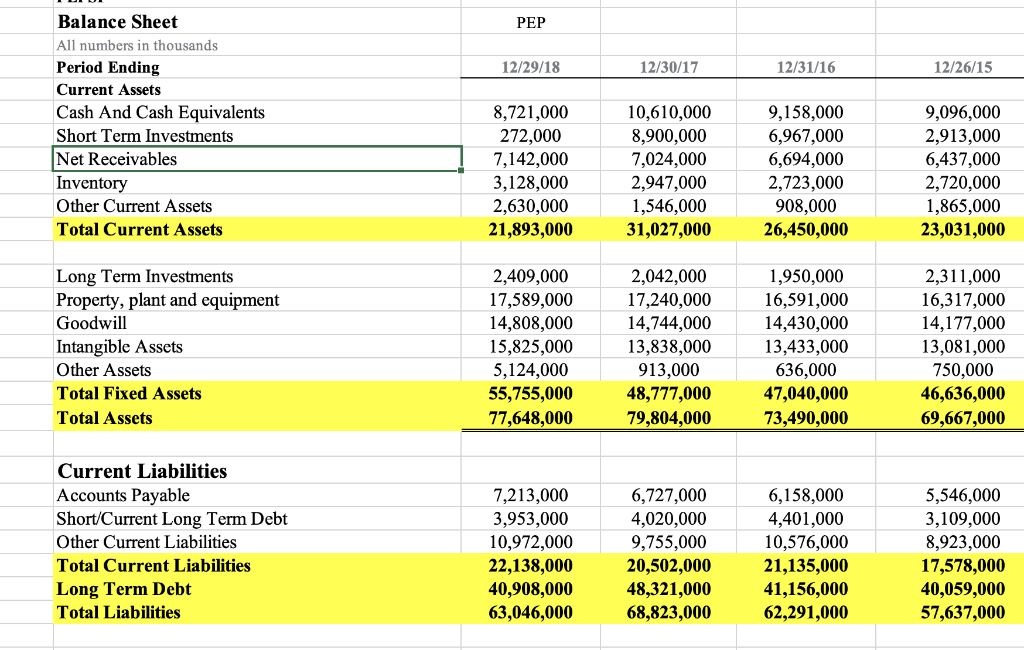

| Based upon the given financial statements for Pepsi, answer the following | | questions concerning the creation of the DuPont Ratio Analysis. | | Use the supplied Dupont Excel Template in the same file. | What is the Equity Multiplier or Financial Leverage for Pepsi for 2018? a- 3.52 b-5.32 c-5.55 d-2.35 |

PEP 12/29/18 64,661,000 29,378,000 35,283,000 12/30/17 63,525,000 28,796,000 34,729,000 12/31/16 62,799,000 28,222,000 34,577,000 12/26/15 63,056,000 28,731,000 34,325,000 Pepsi Income Statement All numbers in thousands Revenue Total Revenue Cost of Revenue Gross Profit Operating Expenses Research Development Selling General and Administrative Others Total Operating Expenses Operating Income or Loss Income from Continuing Operations Earnings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income From Continuing Ops 754,000 23,562,000 680,000 23,981,000 -3,000 24,658,000 10,625,000 737,000 23,530,000 -1,000 24,266,000 10,463,000 760,000 23,584,000 4,000 24,348,000 10,229,000 24,316,000 10,009,000 10,625,000 -1,436,000 9,189,000 -3,202,000 5,987,000 10,463,000 -861,000 9,602,000 -4,694,000 4,908,000 10,229,000 -1,676,000 8,553,000 -2,174,000 6,379,000 10,009,000 -2,567,000 7,442,000 1,941,000 9,383,000 PEP 12/29/18 12/30/17 12/31/16 12/26/15 Balance Sheet All numbers in thousands Period Ending Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets 8,721,000 272,000 7,142,000 3,128,000 2,630,000 21,893,000 10,610,000 8,900,000 7,024,000 2,947,000 1,546,000 31,027,000 9,158,000 6,967,000 6,694,000 2,723,000 908,000 26,450,000 9,096,000 2,913,000 6,437,000 2,720,000 1,865,000 23,031,000 Long Term Investments Property, plant and equipment Goodwill Intangible Assets Other Assets Total Fixed Assets Total Assets 2,409,000 17,589,000 14,808,000 15,825,000 5,124,000 55,755,000 77,648,000 2,042,000 17,240,000 14,744,000 13,838,000 913,000 48,777,000 79,804,000 1,950,000 16,591,000 14,430,000 13,433,000 636,000 47,040,000 73,490,000 2,311,000 16,317,000 14,177,000 13,081,000 750,000 46,636,000 69,667,000 Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Total Liabilities 7,213,000 3,953,000 10,972,000 22,138,000 40,908,000 63,046,000 6,727,000 4,020,000 9,755,000 20,502,000 48,321,000 68,823,000 6,158,000 4,401,000 10,576,000 21,135,000 41,156,000 62,291,000 5,546,000 3,109,000 8,923,000 17,578,000 40,059,000 57,637,000