Based upon the households monthly income, how much can the family afford monthly for a home mortgage? What is the typical percent of total cost for the down payment on a house?

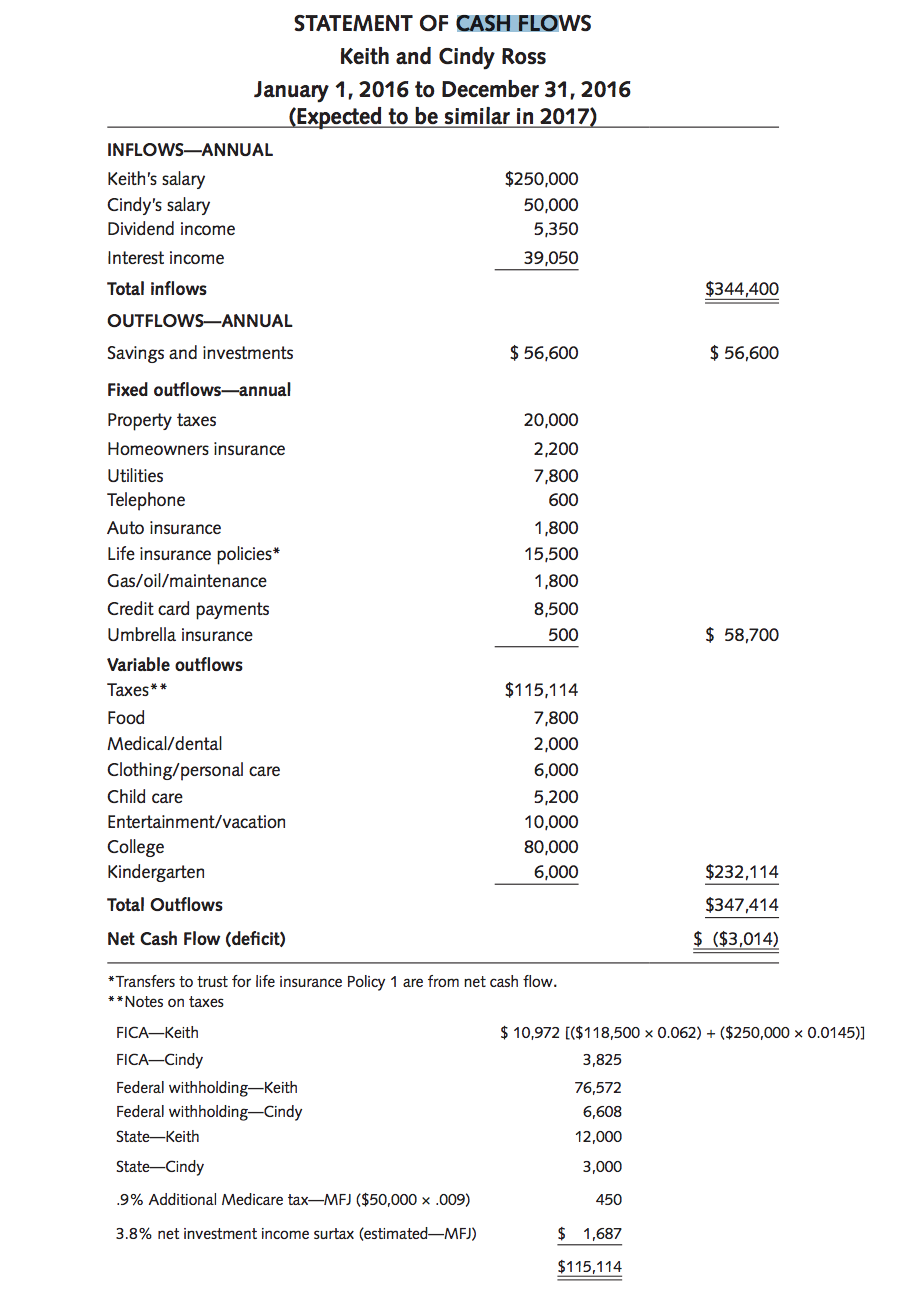

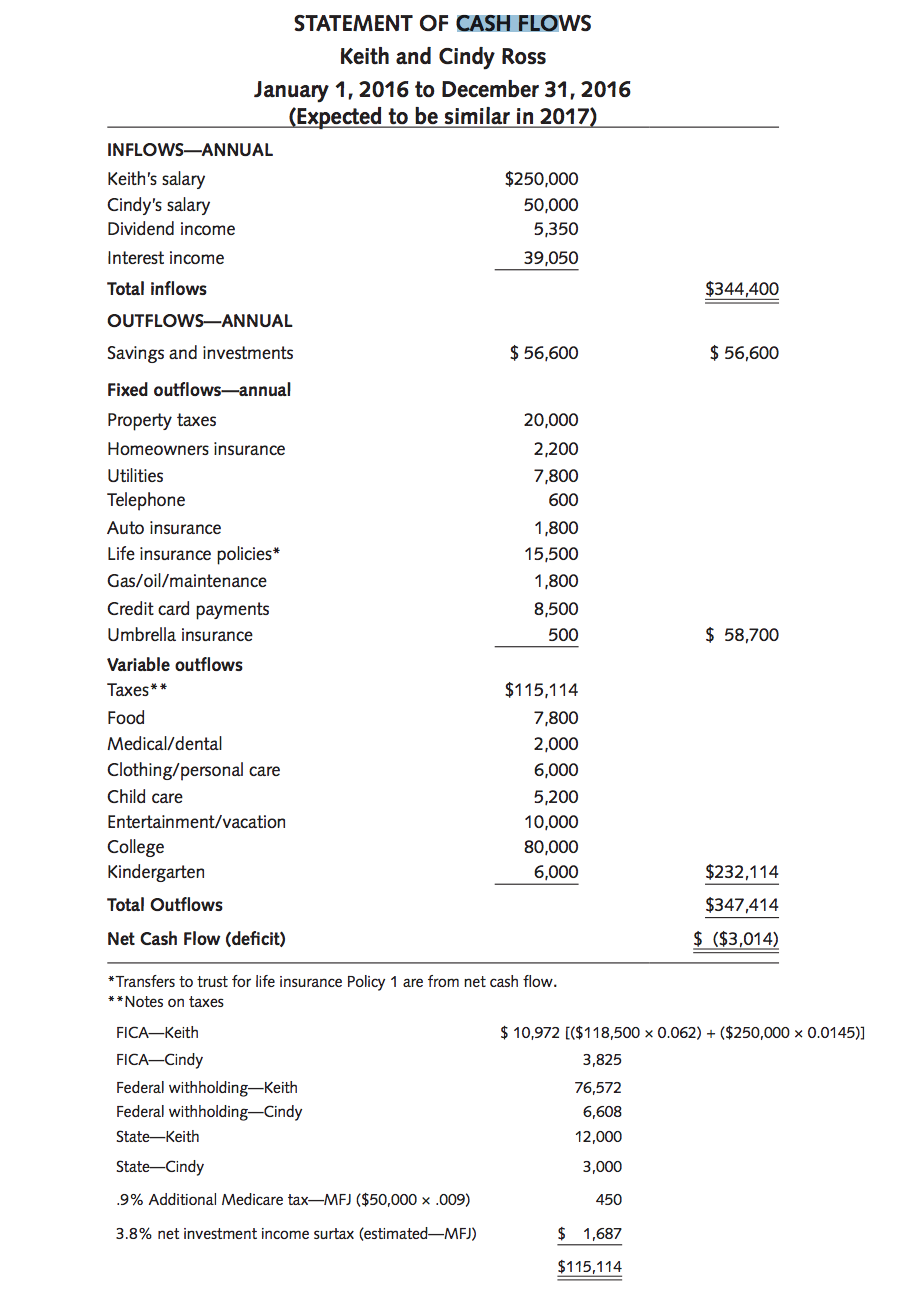

STATEMENT OF CASH FLOWS Keith and Cindy Ross January 1, 2016 to December 31, 2016 (Expected to be similar in 2017) INFLOWS-ANNUAL Keith's salary $250,000 Cindy's salary 50,000 Dividend income 5,350 Interest income 39,050 Total inflows $344,400 OUTFLOWS-ANNUAL Savings and investments $ 56,600 $ 56,600 20,000 2,200 7,800 600 1,800 15,500 1,800 8,500 500 $ 58,700 Fixed outflows-annual Property taxes Homeowners insurance Utilities Telephone Auto insurance Life insurance policies* Gas/oil/maintenance Credit card payments Umbrella insurance Variable outflows Taxes** Food Medical/dental Clothing/personal care Child care Entertainment/vacation College Kindergarten Total Outflows $115,114 7,800 2,000 6,000 5,200 10,000 80,000 6,000 $232,114 $347,414 Net Cash Flow (deficit) $ ($3,014) * Transfers to trust for life insurance Policy 1 are from net cash flow. **Notes on taxes $ 10,972 [($118,500 x 0.062) + ($250,000 0.0145)] 3,825 FICAKeith FICA-Cindy Federal withholding-Keith Federal withholding-Cindy State-Keith 76,572 6,608 12,000 3,000 State--Cindy .9% Additional Medicare tax-MFJ ($50,000 x .009) 450 3.8% net investment income surtax (estimatedMF) $ 1,687 $115,114 STATEMENT OF CASH FLOWS Keith and Cindy Ross January 1, 2016 to December 31, 2016 (Expected to be similar in 2017) INFLOWS-ANNUAL Keith's salary $250,000 Cindy's salary 50,000 Dividend income 5,350 Interest income 39,050 Total inflows $344,400 OUTFLOWS-ANNUAL Savings and investments $ 56,600 $ 56,600 20,000 2,200 7,800 600 1,800 15,500 1,800 8,500 500 $ 58,700 Fixed outflows-annual Property taxes Homeowners insurance Utilities Telephone Auto insurance Life insurance policies* Gas/oil/maintenance Credit card payments Umbrella insurance Variable outflows Taxes** Food Medical/dental Clothing/personal care Child care Entertainment/vacation College Kindergarten Total Outflows $115,114 7,800 2,000 6,000 5,200 10,000 80,000 6,000 $232,114 $347,414 Net Cash Flow (deficit) $ ($3,014) * Transfers to trust for life insurance Policy 1 are from net cash flow. **Notes on taxes $ 10,972 [($118,500 x 0.062) + ($250,000 0.0145)] 3,825 FICAKeith FICA-Cindy Federal withholding-Keith Federal withholding-Cindy State-Keith 76,572 6,608 12,000 3,000 State--Cindy .9% Additional Medicare tax-MFJ ($50,000 x .009) 450 3.8% net investment income surtax (estimatedMF) $ 1,687 $115,114